Leap of Faith

About six weeks ago I discovered Steemit. Straight away I got it. It was easy for me to get it. I've been passionate about people getting rewarded for their social engagement for the longest time. So much so that, with next to no programming experience, I taught myself enough Nodejs, Angular, Meteor, Python, Pymongo and Mongdb to create a prototype of a site that looked to reward people for their twitter engagement.

The site was called Popboolr. I still have the box up at that url (slow box, so takes a while to load up). I started work on Popboolr about this time last year but had neither the time nor expertise to finish it. I therefore appreciate the work that the Steemit team have done to get this site to where it is, because I've spent a few months living under the hood of something similar. I see the massive potential in Steemit. I saw it from day one.

So I threw myself into Steemit with as much gusto as a full-time job, pregnant wife and two kids would allow. Today that leap of faith has been partial vindicated. Steem dollars and Steem Power have arrived in my wallet. The current market value of those assets is pleasing. However I understand crypto enough not to get too carried away.

Leap again

Now a second leap of faith is required. I now require faith that the financial eco-system of Steem will hold together.

There are only two reasons for me to look to cash out Steem Power or Steem Dollars for BTC or fiat:

- Pressing 'real world' finanical need (e.g. bailiffs at the door)

- Fear that Steem will collapse (e.g. “squeaky-bum time” aka 'get out while the going is good')

Fortunately I can stave off the bailiffs for a few months at least, so I'm not worried about the first reason just yet. I also do not see a reason to fear a Steem collapse. In fact, collectively I believe that there is "nothing to fear but fear itself." The biggest threat to the price is if people like me fear it will collapse and start panicking. So the best course of action for me is be calm. I’ve been in crypto long enough to know that provided the fundamentals are sound, a collapse in the market is as much as an opportunity as anything else. It’s an opportunity for savvy trader to earn some money whilst others are spilling their own blood on the floor.

My strategy for Steem is quite simple. Grow my share of Steem Power to 0.1% of Steemit’s market cap. If Steemit reaches a $1billon dollar market cap, my share will be worth $1m. At that point, I’ll consider cashing out some of my investment. Right now my share is around 0.05% if I powered up today. Only half way to where I need to be. I’ll need to work to maintain my current share, let alone double it. For me, the grind continues.

Things for Authors unaccustomed to Risk and Trading to consider

I’ve been trading crypto for a couple of years now so I’m use to adding new coins (and value) to my portfolio. I’ve watched my portfolio rise and fall dramatically over night and I’ve learned to treat each ‘imposer’ the same. My focus is always on the general trajectory of my portfolio overall, over a period of time. Is it going up? Am I making the right decision about my assets based on fundamental analysis?

However I've invited a few people onto Steemit. All have done well (relative to expectations) in the first payout. None of these friends have any background in crypto or trading. Their instinct is to make hay while the sun shines and "cash out" to fiat.

"Why risk it?" Is the attitude.

Ultimately the decision on what to do now is theirs. I’ll arm them with as much information as I can. But ultimately one of the key tenants to cryptocurrency is personal financial responsibility. They have the power (and burden) of controlling their own finances. Here are the things I’m going to invite them (and you) to consider before cashing out:

1.Everything is a risk and a trade-off

In my view there is no risk free option in life. Everything is a risk and a trade-off. Stick or twist. We all took the risk of potentially ‘wasting our time’ by posting to Steemit. Now we’re seeing that the rewards are really being allocated. I bet, like me, you wish you put in a bit more time and effort. But that’s the trade-off for not over-committing, we don’t get all the spoils.

“Cashing out” now holds a risk. “Holding” holds a risk. “Powering up your Steem Dollars” holds a risk. The only question is how much risk you apportion to each option. The fallacy is in believing there is no risk in cashing out.

2. Conversion loss

One of the tangible risks of cashing out now is the risk of losing the value of your Steem Dollars due to conversion. The difference between a dollar and a dollar value is nuanced. In a liquid market 1 Steem Dollar would be worth at least 1US Dollar. I say at least because it could be worth slightly more as holding a Steem Dollar has the potential of earning 10% interest.

Unfortunately right now the markets Steem Dollar/ Steem markets are relatively illiquid. You need to convert Steem Dollars into Steem, then convert Steem into BTC. Then convert BTC into fiat. There are then extra hurdles to get the BTC into Pound Sterling for us guys in the UK.

It is certainly doable. And I'm happy to explain all the steps and options to the people I invited here. However if they're (or I) am not careful $1000 worth of Steem dollars can easily convert to 40-50% less that if we do not ensure that the market conditions are ripe for conversion. The last time I looked the Bittrex wallet was still under maintenance. By the time trading opens who knows what will happen. Why gamble when you know that when the dust settles your Steem Dollar should still be worth a dollar?

3. Opportunity cost

The biggest risk around cashing out now is the opportunity cost. Steemit’s market cap is around $20m, it has room to grow. Steemit also rewards loyalty and engagement. There is an opportunity for non-crypto enthusiasts to maintain and increase their share unlike any coin I know. You can negate the risks of any potential slip in market cap by increasing your activity on Steemit, more than this you can increase your share. Like most things, what you put in is what you get out. Steemit is asking for your time, your passion, your creativity. Most over coins require your money. Cashing out Steem Power is a huge opportunity cost. It will be like gold dust for authors if Steemit is successful.

Even holding Steem Dollars accrues interest, so cash out now, pay later.

4. Just write!

When you get a windfall it’s easy to lose perspective and forget how you got the windfall. As an author of posts, you got rewarded for writing posts. My key advice is do not think about money too much, just write! Go back and visit the posts that gave you the biggest rewards. Look for what they have in common. Cultivate that. Nurture that. Write for a month. See where that leads you. Steemit is still in its infancy and badly needs content. YOU still have first mover advantage. If another 100,000 users joined, we would all still be earlier adopters, should Steemit go mainstream.

My advice is “work the room” while you can. Not only will it benefit you in the short-term, in the long term the effort you put in now could be worth its weight in gold.

5. If you must cash out, cash out a little, first

If you’re the kind of person that needs tangible rewards as motivation, cash out a little first. If you have $1000 Steem Dollars, cash out say $100. See what that converts to. Did you get $100 (or £75) in your bank account? Or was it a lot less? Was the conversation loss bearable? Ultimately though, if cashing out will inspire you to write more, cash out a little but write more! Write/ post much more.

6. Promote

Use the cash you’ve made and the money in your Steem wallet to promote the site. Promoting the site to people you know will not only get you more followers (and potential upvoters) but will also increase the market value of Steemit (and your holdings). Social media sites can earn huge market caps based on user adoption alone, with no clear path for monetisation. Steemit has many potential and actual monetisation models. With the right level of user adoption it will be huge.

Word of mouth is the biggest way to promote, so if your friends ask what you’ve been doing recently, ‘cashing cheques for blog posts’ should figure high in the conversation piece! IF you do promote, use your referral link https//www.steemit.com/?r=nanzo-scoop is mine. Replace my user name with yours. I don’t think there are referral rewards now, but there may be in the future, you (and whoever you sign up) may benefit retrospectively.

7. And Vote!

As a successful author (any author that gets paid to write is successful in my book) you now have Steem Power. Voting, curating and commenting can earn you extra income. You only need to spend ten minutes to an hour a day checking the site and voting on good content. It’s well worth investing a bit of time in working out a voting strategy to maximise rewards. As an author, reading is probably second nature. Treat time on Steemit as research, focus on stuff you’re interested in, but also take a bit of time to learn how the site that is rewarding you works. Get involved. Broaden your horizons. Get more rewards.

Conclusion

I was watching Reggie Yates – The Insider on BBC3 yesterday. It’s a documentary where a British presenter spent a few days as an inmate in a Texan jail. Getting crypto rewards is a bit like going to prison. A lot of the ‘money problems’ are in people’s head. Is it real? How long it last? It is going to get dumped? Is it safe to pick up the soap? The first sign of trouble, a lot of people crack. They crack mentally and not based on any fundamental analysis. They buy high, sell low because they fear failure and accept smaller rewards or a small loss at the first sign of trouble. Then FOMO kicks in once the coin “recovers.”

But I appreciate everyone’s situation is different.

I’m fortunate enough to be a position where a few thousand dollars profit is not going to be life-changing. A few hundred thousand dollar profit would be life-changing for me. So that’s what I’m shooting for. I’m going to “go big or go home”. I can live with ‘being wrong’ and missing out on a few thousand dollars. Getting it wrong and missing out on a few hundred thousand dollar would be a bitter pill for me to swallow. Particularly when I would be betting against something I’m passionate about. This isn’t like missing out on something like Ethereum, which while interesting, doesn’t keep me up at night or get my juices flowing. Sometimes in life, if you find something good you have to go for it. Commit to it. Live for it. If you fall on your face, you’ll get up stronger. At least you tried to live the dream.

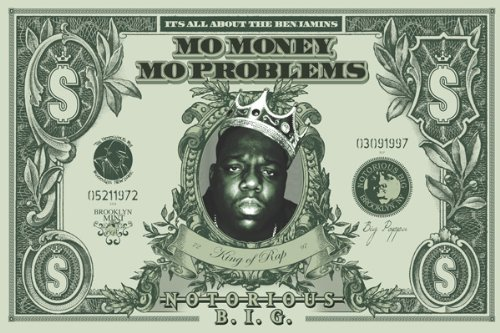

More money is not necessarily more problems. More money is more opportunity to go bigger, to make a difference. A difference to my life and those that I come into connect with. That’s what I plan to do.