Today we are summarizing the changes we have implemented and are prepared to release on Tuesday and hardfork the following Tuesday. If there are any issues discovered this could be postponed. Change is always controversial, but we feel the changes we have implemented reflect the wishes of the wider community.

Changes:

- Power Down in 13 weeks instead of 104

- Inflate at 9.5% APR narrowing to 0.95% APR by 0.01% every 250,000 blocks (Roughly 0.5% per year).

- Steem Dollar conversion takes 3.5 days (down from 7)

- Witnesses receive 10% of inflation, runner up witnesses get paid 5 times the top 19 per block produced.

- Miners get paid the same as the top 19 per block produced

- Witnesses / Miners will continue to be paid in Steem Power

- 75% of inflation goes to authors and curators

- 15% of inflation is allocated to Steem Power

- Switch to Equihash Proof of Work algorithm.

- Remove rewards for including Proof of Work transactions

Equihash Proof of Work

By changing to Equihash we hope to make ordinary computers more competitive relative to high end GPUs with optimized algorithms. Over the past couple of months one or two people have dominated the Steem mining queue. They have either identified a computational shortcut or implemented a private GPU algorithm. The Equihash algorithm was adopted by the creators of Zcash, a recently hyped privacy-oriented crypto-currency. This algorithm is designed to make heavy use of randomly accessed memory. The computations are very simple, but they require 128 MB of ram accessed in a manner that should saturate the memory bus.

The nature of this Proof of Work algorithm is that solving a single instance can take over 2 blocks (validating is instant). We have updated the Proof of Work to allow them to build on top of any block after the last irreversible block. In practice this means miners have about 30 seconds to solve the Proof of Work.

Steem Dollar Conversion

The moving average of STEEM / DOLLAR price has changed to 3.5 days to match the conversion delay. This should dramatically reduce the price volatility risk of converting Steem Dollars to STEEM which in turn should strengthen the peg. 3.5 day median should still give 1.75 days to detect and correct any bogus price feeds before they can have a negative impact on the protocol.

Paying Witnesses in Steem Power

Witnesses have always been paid in Steem Power. In our last post on proposed changes, we suggested paying them in STEEM. After talking with prominent witnesses, we decided to keep it in Steem Power. The 3 month power down significantly improves witness liquidity and paying as Steem Power will prevent the need to manually power-up after every block as we believe most Witnesses will/should choose to do.

Paying Runner Up Witnesses (Time Shared Witness Slot)

We have increased the amount paid per block to the runner up witnesses. These witnesses produce blocks a couple of times per hour instead of every single minute. Even though they get paid 5 times the other witnesses for their block, on average they will still earn less per day than the top 19. By increasing the pay-per-block we enable more people to be runner up witnesses which helps keep a healthy supply of standby witnesses.

Miner Pay

Miners will make the same per block as the top 19 witnesses. After watching the miner queue be dominated by one or two individuals, some people were rightly concerned that a mining monopoly could consume a disproportionate amount of the block rewards. By paying the miners (collectively) the same as the top 19 witnesses, we are assured that even if mining is fully dominated by a single individual that said individual would have no more power or income than the top 19. After factoring in the cost of mining, their profits would be less than the elected witnesses.

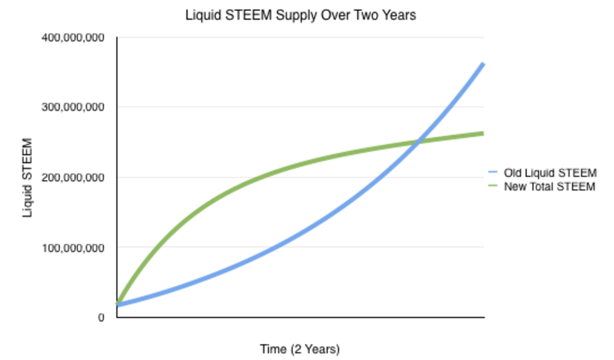

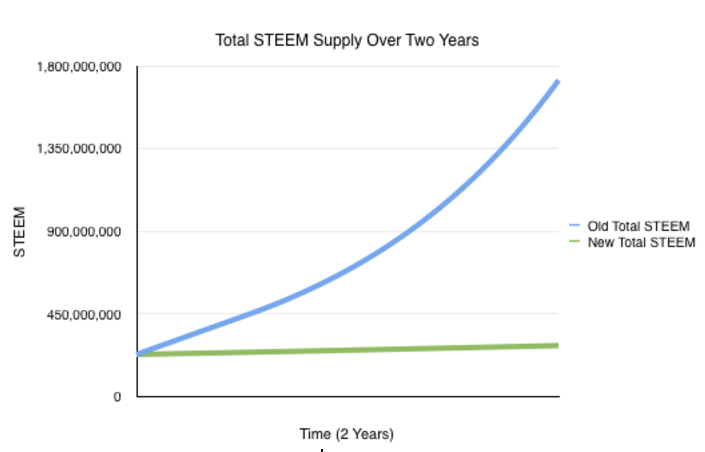

Modeling Difference in Steem Supply

The above chart shows the difference between the old and new model by comparing the current Liquid Steem vs the new Total Steem ( Liquid and Vesting). What this shows us is that within 18 months there will be a net reduction in supply. This assumes the worst-case that everyone but Steemit powers down at the maximum rate.

We would like to caution speculators that these charts do not tell the whole story when it comes to projecting future price. Supply is only one side of the equation and there is no easy way to measure how the market currently perceives Steem held as Steem Power relative to the liquid STEEM. The other side of the equation is demand. Small changes in demand can have dramatic impact on price. There are too many variables to make any projection on where the price will move in the short term.

Witness Pay

One of the great services that our witnesses have been providing our community is the funding of development from their witness pay. The Witness role was not intended for this at genesis, however, it seems the delegated project funding has been very valuable, and these witnesses should be appreciated for their hard work and dedication. While the budget for witness pay, less the POW inclusion reward (.55% inflation currently), is increasing from 0.75% to 0.95% inflation. Effectively, witness pay decreases in the short run and increases in the long run.

Long View

These changes are intended to open doors for Steem as a currency and provide greater synergy between the currency, social and content aspects of the network. We look forward to comments. We will consider comments before setting a date for offering the potential upgrade to the network’s witnesses.