Steem Basic Income

Steem Basic Income is a social experiment to bring a basic income to as many Steemians as possible. Members join by sponsoring others into the program. Steem Basic Income is delivered through providing regular upvotes to member content.

Introduction

Where does the value of your vote come from in Steem Basic Income? The purpose of this series is to break things down with as little math as possible. To make it easy for everyone to better understand how value moves within the SBI system. To let everyone make the best decisions about how to use SBI to help you reach your Steem goals.

As a subscription upvote service that utilizes Steem blockchain to deliver a sustainable basic income, we are completely dependent on Steem blockchain reward mechanism.

Series Roadmap

In this post we will explore what drives value on Steem.

In the rest of the series, we will explore each of the factors that determine how we allcoate value within the SBI system. After explaining the four factors in brief, we will talk about how those four factors are handled under both our current system and in the new system.

After showing how those factors are managed in both our current system and in the new system that will be released soon, we will recap the changes. We don't want you to make big financial decisions to maximize your reward under the old system, only to have your value outcome dramatically change when the new system is released.

Steem Rewards - It Starts With Inflation

The Steem reward pool is funded by inflation. There is an existing asset base (STEEM) and new rewards are created by gradually inflating the asset base. The inflation rate gradually decreases over time. That means that while the rewards pool will keep growing (as the base grows) the rate at which the rewards pool grows will gradually decrease.

This inflation is allocated separately to witnesses, to interest for SP/SBD holders, and to the rewards pool. According to the white paper, the rewards pool receives 75% of the newly created tokens.

What does this mean for value?

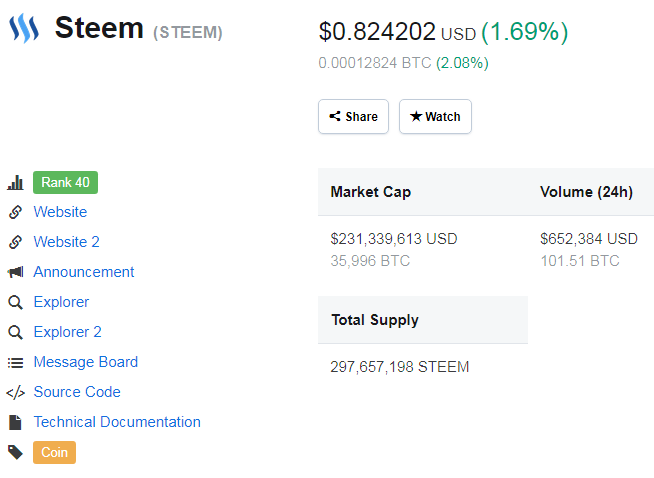

The most significant factor determining upvote values on Steem is the STEEM price. Since the inflation is calculated as a % of the asset base, the outstanding value of the asset base (Steem Market Cap) is a huge factor in upvote values. Sure, price changes impact the value of your holdings, but they also affect the value of your rewards.

If the Steem Market Cap is $500 million, then the annual rewards pool might be $20 million. If the Steem Market Cap rises to $1 billion, then the annual rewards pool would rise to $40 million.

(For numbers nerds, I did not look up the current inflation rate or use the actual current market cap for this example. And for developers, this value factor is captured in the reward estimation calculation as sbd_median_price).)

The Rewards Pool Distribution - Who Gets How Much?

As inflation fills the reward pool, rewards are allocated based on stake-weighted upvotes. That means that the portion of the asset base that you control determines the portion of the rewards that you allocate. But something interesting happens here. Not everybody regularly upvotes, and there are some pretty big whales that don't upvote at all. So actually, the portion of the voting asset base that you control determines the portion of the rewards that you allocate.

What does this mean for value?

Continuing the above example, imagine that you hold $50 million worth of SP, and only half (50%) of the total $500 million base actually votes regularly ($250 million). Instead of your account controlling $2 million of rewards each year, your account would control $4 million worth of rewards. That's a nice big upvote!

But if the STEEM price doubles, then many inactive accounts will start voting again. If the voted amount rises from half to two-thirds (66.67%), then instead of controlling 20% of the reward pool, you would only control 15% of the reward pool! Instead of your upvote rising from $1000 to $2000, it would only rise to $1500.

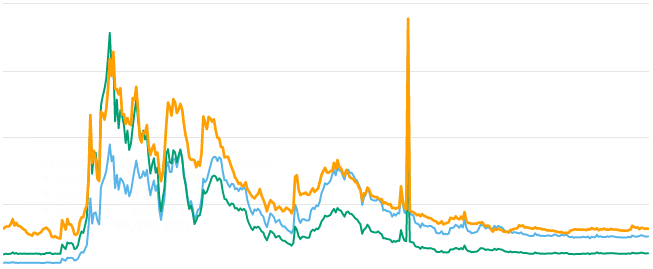

This catches people by surprise whenever STEEM goes up. The value of your upvote will never rise as fast as the STEEM price, but it may fall more slowly than the STEEM price.

SBD Premiums - Say What Now?

As if things aren't complicated enough already, you get half of your author rewards in SBD. The reward mechanism assumes that SBD is worth $1 when rewarded. This is why many people started talking about rewards as STU's. If SBD is $1 (right now, yay!) then 1 STU equals $1. The curator gets $0.25 and the author gets $0.75. Simple enough, right?

But what about when SBD does not equal $1? Imagine that SBD is at $2. This SBD premium means that 1 STU is now worth some amount more. The 0.375 that is paid to the author in SBD is now worth $0.75, which means 1 STU is worth $1.375.

What does this mean for value?

If you think about value in STU's it means nothing. If you have to value every transaction in USD and pay taxes next year, it means a lot. If you pay for upvotes using SBD, it means even more. (If a program does not factor SBD premium into their reference prices, then a 'guaranteed profit' upvote may actually be a guaranteed loss. If they factor SBD premiums in but SBD or STEEM (or both) are dropping in value quickly, then most 'guaranteed profit' upvotes can become guaranteed losses until prices stabilize.

@josephsavage has previously written about this on his own page. If there is interest I will dig up the actual post links.

When SBD dropped from $12 to $1 and STEEM dropped from $8 to $0.80, the value of an STU fell from above $4 to $1 and the number of STU's that people got on each post decreased by 70-80%. Many paid upvote services closed, and total SBD being sent to bid-bots decreased by more than 50%. Over that same time period, Steem Basic Income expanded its active member base significantly.

SBD premiums as a value factor are one reason that Steem Basic Income was designed to be a lifetime upvote program instead of having a more narrow time reference. A difficult period for STEEM lowers everyone's profitability, but SBI is much more resilient.

Let's talk Steem Basic Income

The factors that we've discussed already have major impact on Steem Basic Income. I think by now most people have figured out that the value of your SBI votes depends on the value of STEEM, and there isn't much we can do about that. We are equally powerless in the face of changes to SBD premium or to changes in the proportion of the reward pool that is voted.

When STEEM goes up, the proportion of the reward pool that we distribute will go down. The value of your SBI upvotes will not rise as quickly as the STEEM price. On the flip side, if SBD rises faster than STEEM like it did in 4th quarter 2017, then the value of your SBI upvotes could rise faster than STEEM because of the SBD premium. With any luck, that will help SBI upvote values to track STEEM, but don't expect it. I still expect long-term equilibrium for SBD to be $1, even if STEEM eventually reaches $100.

A Silver Lining?

On the plus side, the ROI somebody gets for self-voting is impacted by the same factors. A rising STEEM price may draw all the bloodsuckers out of the woodwork, but their returns relative to their investment will be worse.

It got really bad during the last run-up because of the SBD premiums. When upvotes get the benefit of SBD premiums but downvotes don't, it raises the opportunity cost of downvotes significantly and shifts the balance of power. If the SBD premium stays low next time STEEM rises, then there won't be as much abuse during the next big STEEM bull market as there was during the last one.

What Do You Think?

Did we knock these factors out of the park, or did we strike out and then round the bases anyway? Please let us know your thoughts, and share what you think the key internal factors might be. Some are covered in depth in the below resources, but you can identify all of them?

Frequently Asked Questions

A Complete Overview

Managing Voting Power

Pulling Back the Screen

Enrollment

If you want to get involved, or to increase the share of basic income that you receive, enrollment is pretty straightforward:

Just send 1 STEEM to @steembasicincome. Include the name of a Steemian to sponsor in the transaction memo (preceded by @). You and the person you sponsor will each receive 1 share in the program. You can sponsor any active Steemian, it does not have to be a current member.

If you're unclear, please check out our full transaction memo guidelines and then let us know if you have any questions.

@steembasicincome/steem-basic-income-updated-transaction-memo-guidelines

The official currency for enrollment is STEEM. Please allow up to 7 days for your enrollment to be processed.

Questions?

Please read our recently published FAQ. Most questions are addressed in our FAQ or in the additional resources that it suggests. If you still have questions, ask in the comments section or join us in our discord channel. To review your share counts, we recently introduced our new SBI Member Lookup Tool.