Dear Steemians,

This is now the 3rd Update on the Collaborative #SteemFund to help new CryptoInvestors making good choices.

How does it work ?

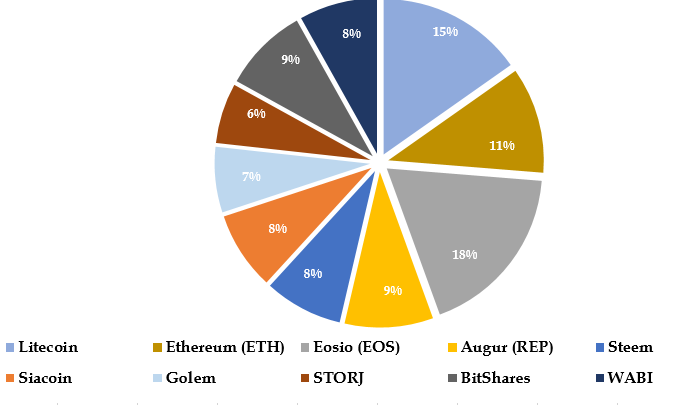

I started by making a quite diversified Crypto Investment Fund with cryptos I like and I believe have great underlying projects.

Every week, depending on the comments I receive on this post or on my Twitter account, I will make a survey asking if we should integrate a new "Crypto".

The one receiving the most votes will then be integrated in the Portfolio.

We will track the Portfolio Performance on a Weekly Basis.

This initiative can ONLY work if Steemians gather to discuss Crypto Projects and come together.

Portfolio as of Wednesday March 7th

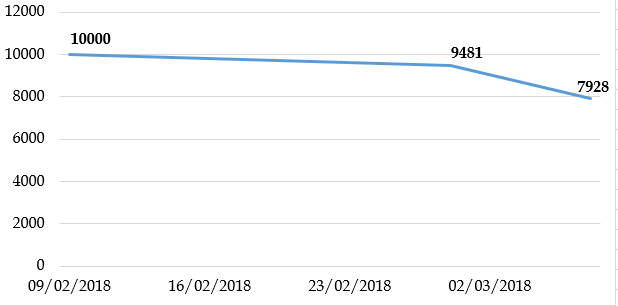

Performance of #SteemFund

Performance has been very volatile and today is just a Blodd Bath...

Our Portfolio Value is currently standing at $7928 (-20,72% over this period).

- Steem: If you read this, you know why. I am still mad that I did not buy more at <1$

- Eosio (EOS): I believe in Dan Larimer; he already developped 2 great projects (Steem and Bitshares) and as the Co-founder of Steemit on @SGTReport said about Dan larimer and its EOS ICO: “The people who say that there is no product yet, Dan has built 2 of them if they think he’s not gonna build the 3rd one, they’re crazy. This is the one he always wanted. The other 2 were just helping him get there”. EOS Meet-up in NY taking place today, AirDrop in 2 weeks of their first partner.

- Ethereum (ETH): In my opinion, it has been the most exciting project in cryptos so far. This project has been copied or inspire many other hot cryptos (NEO, EOS...). Devon3 gathering brought a lot of visibility on Ethereum's next improvements especially on the scalability issue.

- Siacoin (SC): Siacoin is a solution that allow companies to use storage in a decentralize on Siacoin network. “Miners” are renting their storage capacity. It is 5-10x less expensive than with traditional companies as Amazon Web Services, Google, etc…

- STORJ: Same business plan as Siacoin, smaller Market Capitalisation and recently the company announced that it “froze” some of its tokens as they will not need it in the next 6months+ to finance the development of the platform. This is a good sign as it tells us the team is feeling confident to have “all it needs” to deliver what the market expects.

- Golem (GNT): It is a cryptocurrency allowing you to use the calculating power of the computers connected to its blockchain network. This is useful for companies looking to rent some calculating power for a project, etc…

- Augur (REP): I just like the prediction market project. They have a good team of developers and seem to work very hard on this project. And last but not least but they keep you updated on a weekly basis.

Transaction Prices

- 1.175 Ethereum at 852 USD

- 220 EOS at 9.1 USD

- 18.5 Augur at 54.9 USD

- 235 Steem at 4.25 USD

- 42000 Siacoin at 0.02387

- 1450 Golem at 0.342

- 500 STORJ at 1.01 USD

- 4000 BitShares 0.25 USD

- 625 WABI at 1,61 USD

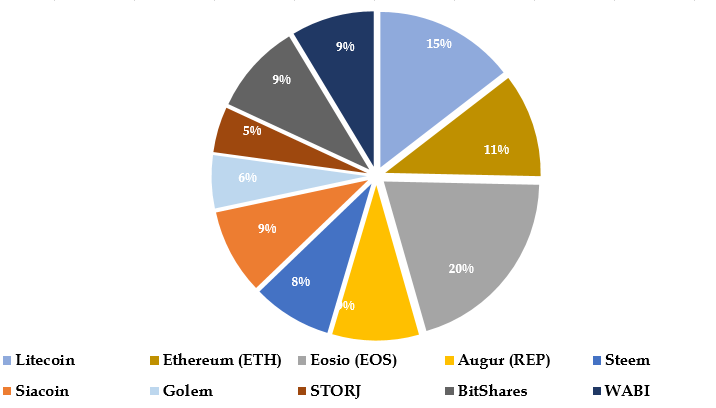

What should we do?

I made a 4 choices Survey on Twitter that you can find here concerning the Cryptos we should sell at the moment.

- Not Sell anything and stick with this Portfolio

- Sell 5% of EOS as it performed badly during the past week

- Sell 5% of Augur as it is a low Market Cap Altcoin and vulnerable to Bear Market

- Cut STORJ as it is a small crypto vulnerable to Bear Market

In which Cryptos Should we invest the previous sell (if any)?

Please find the other survey here

- Bitcoin, Resisting very nicely to this Bear Market

- Monero, best performer last week

- NEO,

- Ripple

Portfolio as of Wednesday March 7th

What do you think of this initiative? I am so excited to read your comments!

Related Articles:

You don't want to miss a Crypto news?

Follow me on Twitter and Facebook