The most frequent question raised in Steemit maybe "Where does the money come from?" In this post, I will provide a simple explanation about this topic with comparison to Bitcoin's reward mechanism.

Highlights

- Steem's rewards majorly come from STEEM holders by diluting their shares

- In some conditions, Steem Power holders also pay for the rewards via dilution, but the magnitude is much smaller than STEEM's

- Bitcoin also has the similar mechanism but all rewards go to miners, while Steem's rewards go to diverse agents, such as content providers, curators, validators, miners, and liquidity providers.

Introduction

Do you think that Steemit is a ponzi? If you answer yes, you also have to admit that Bitcoin is a ponzi because they have the same reward mechanism fundamentally. Here I will explain why.

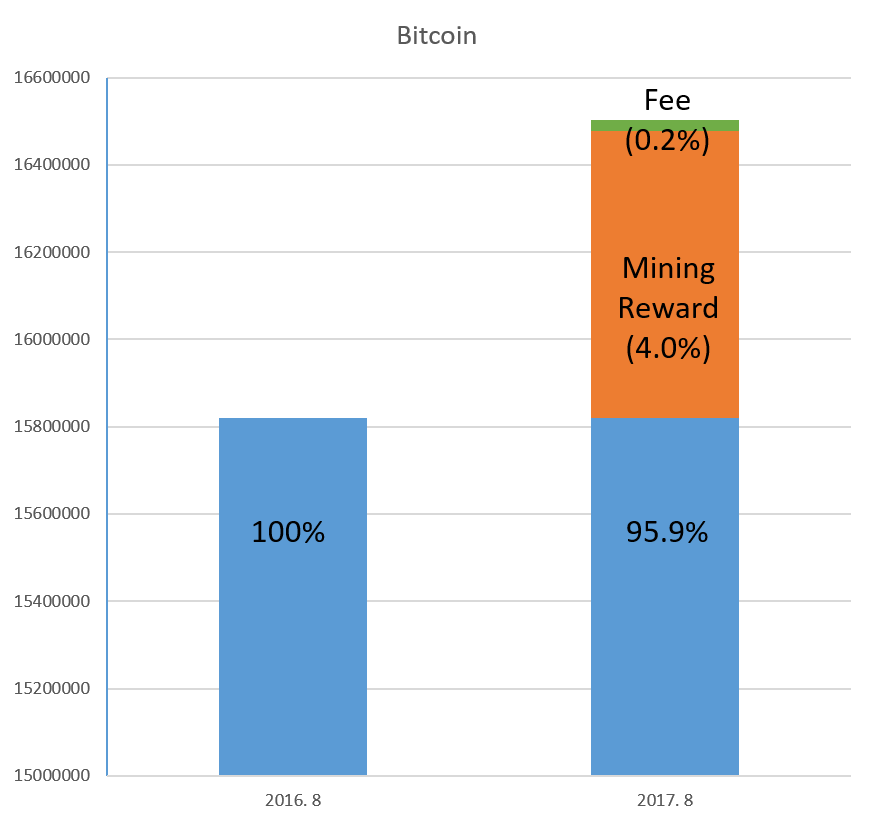

Bitcoin Rewards Miners Only

Let's look at Bitcoin first. The current supply of BTC is about 15.8 millions. Everyday, 12.5*6*24 Bitcoins are created as a mining reward, and about 70 BTC is paid as fees.

Then, what will happen after a year?

- Current supply: apprx. 15,820,000 BTC

- Mining reward (estimate, 1 year): 12.5*6*24*365 = apprx 657,000 BTC

- Fees (estimate, 1 year): 70*365 = 25,500 BTC

- New supply after a year: 16,502,550

The total supply of BTC is increased by 4.3%. Given an assumption that Bitcoin's total market cap is fixed for a year, this increased supply means that BTC price will drop by about 4.3%. An important fact is that this 4.3% goes to miners.

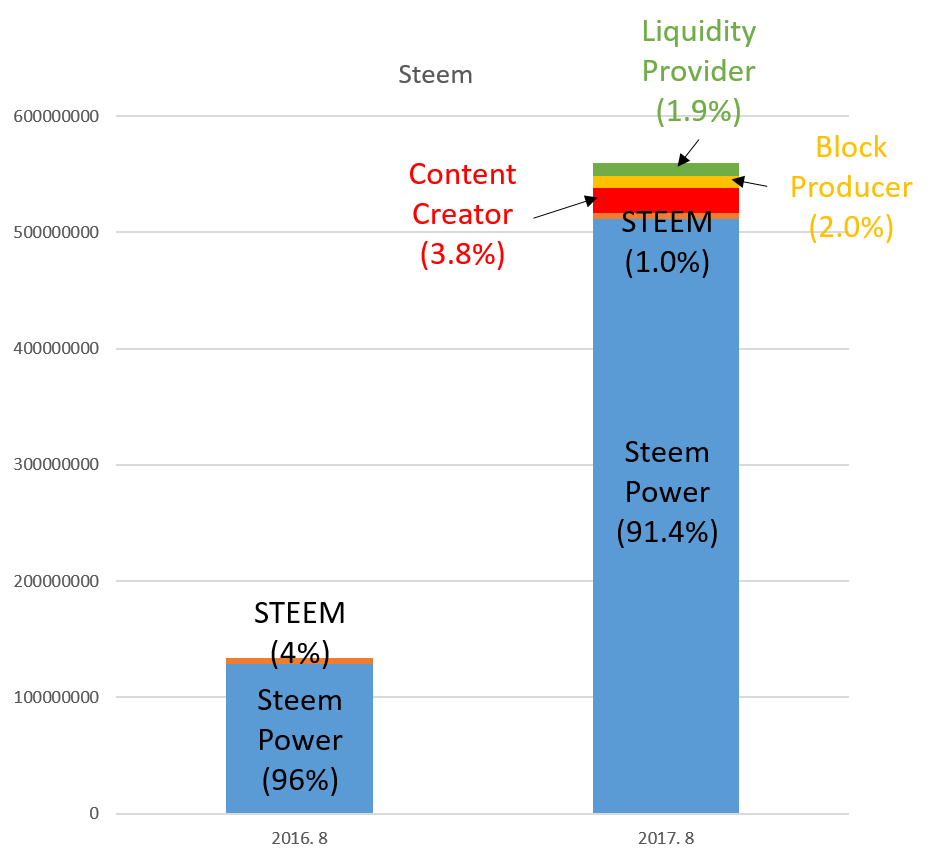

Steem Rewards Contents Creators Too

Steem has similar mechanism with Bitcoin. Steem creates 400 STEEM per block (3 sec) currently and 90% of them goes to Steem Power pool. The details can be found in Steem Whitepaper page 35. Here I assume that there is no Steem power-up and down for avoiding a complexity. Also, I picked an approximate ratio between Steem Power and Steem (96% vs. 4%).

- Current supply: apprx. 134,000,000 STEEM (Steem Power pool: 128,640,000 STEEM / 5,360,000 liquid STEEM)

- Witness/Miner rewards (estimate, 1 year): 1.0476*20*60*24*365 = 11,012,371 STEEM

- Contents creation/Curation rewards (estimate, 1 year): 2*20*60*24*365 = 21,024,000 STEEM

- Liquidity reward (estimate, 1 year): 10,512,000 STEEM

- New supply after a year: 559,483,710 (Steem Power pool: 511,575,339 STEEM / 5,360,000 liquid STEEM)

We can discover a hyper-inflation, say 317% increase a year, from 134M to 559M. But this is not the point. If the inflation makes no changes in terms of a share (percentage owned), it can be considered as just a splitting your shares. Regarding percentages, we can find STEEM holders have dramatic decrease, from 4.0% to 1.0%. This means that a unit price will dropped down by 1/4 if the market cap is stable. Meanwhile, Steem Power holders have slight decrease from 96.0% to 91.4%, about 4.8% decrease. That is, when price become 1/4, you have about 3.98 times more STEEM because you are holding Steem Power.

Interestingly, we can find 3.8% of new shares go to contents creators and curators. Where does the money come from? Obviously from STEEM and Steem Power holders. This is a kind of redistribution as like Bitcoin, but while Bitcoin only rewards miners, Steem has diverse types of rewards and different dilution rate between STEEM and Steem Power holders.

Conclusion

Steem is not a ponzi scheme but a novel platform that rewards content creators and curators through redistribution.