I love data. Well, to be more precise, I love to make statements based on data, and not on hunches, my own expectations or other people opinions. It seems to me that statements based on data seem to be more accurate. Those of you following my daily market snapshots know what I'm talking about.

So, in this post I will try to look at two data sets that are relevant for the Steem ecosystem. The first data set is the STEEM price, as crawled by Coinmarketcap. The second data set is the daily traffic of the steem.supply website. The time span is one year.

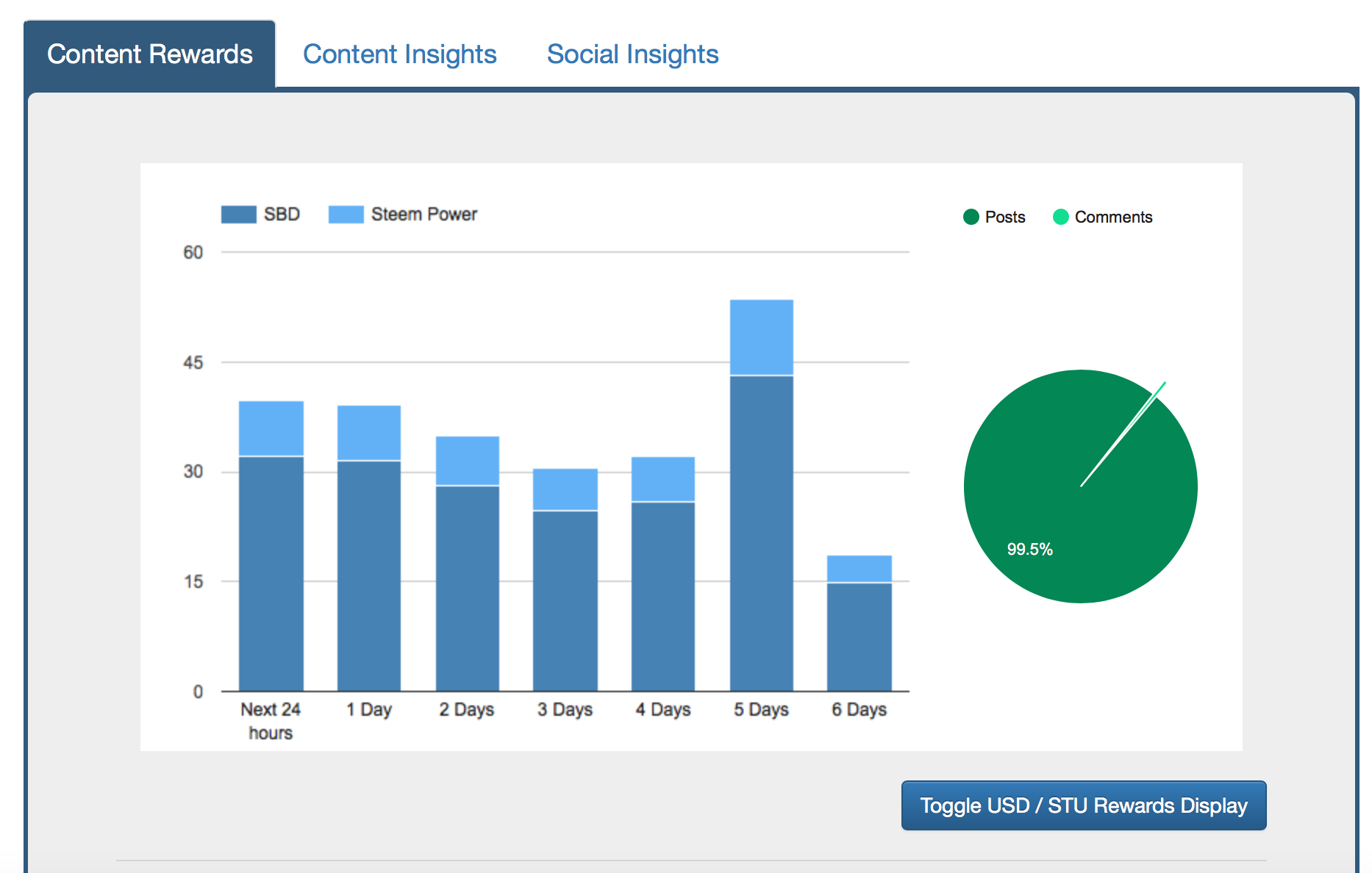

If you don't know what steem.supply is, it's a free service where you can see the upcoming rewards on the Steem bockchain, for any user. It's one of the most popular tools in the ecosystem (according to the users' opinion, not mine).

So, let's go for this:

STEEM Price For The Last Year

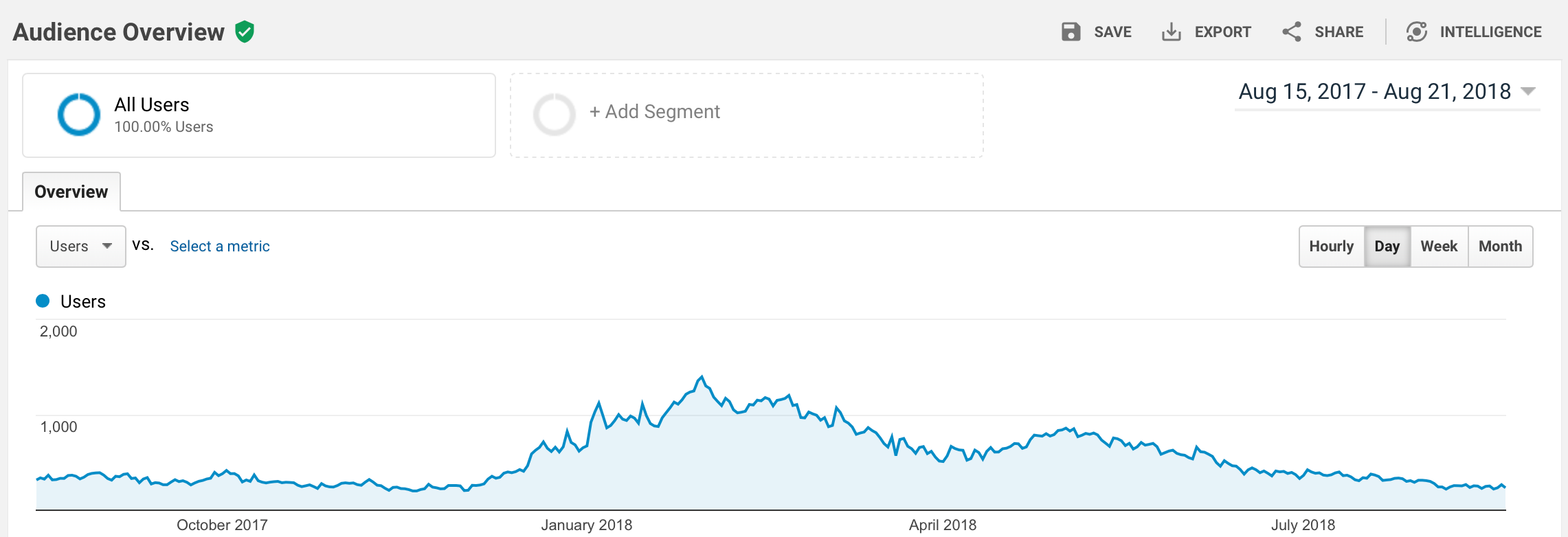

Steem.Supply Traffic For The Last Year

Here are my thoughts about these two charts:

There's a clear correlation between the price of the underlying asset of the blockchain, STEEM, and the user's interest on the platform.

In other words, the higher the price of STEEM, the higher the interest of users about their rewards. It may seem a no-brainer, one of those "Dooooh!" moments, but this correlation is so tight that it becomes very relevant.

Simply put: users are incentivized by the value of the asset to participate more. The current structure of the asset (with limited liquidity, see the Steem Power locking down mechanism) plays a very important role here, because it's basically turning users into stakeholders.

The user base is still relatively low, but once this user base goes over a certain threshold (I have no idea what that threshold should be) it will be incentivized to maintain and increase the value of the asset. It's like being a whale in the Bitcoin world.

After a certain threshold, the user base can act like a "collective whale" that will protect the asset.

We are in the same place as last year

From an economical point of view, we are in a very similar place (read: STEEM price) with last year August.

But from a technological and social point of view we are in a very different position. We had a few profound updates of the platform and the user base grew over 1,000,000 (I estimate that the active user base is somewhere between 100,000 and 200,000, though).

That means the value of the asset is actually bigger than last year. It's one thing to have 20 people owning each a dollar, and a completely different thing to have 200,000 people owning each a dollar.

That's going to have a snowballing effect once the speculation frenzy will start to dwindle.

Any economy works in cycles

If you look at the big hump in December, you may recognize it as a "super-heating" symptom. It gradually went down and now it's stabilizing on a previous stable level.

Looks like we might be at the beginning of a new cycle.

Wether or not this will happen, though, is out of my reach. It just remains to be seen, but I'm leaning towards the optimistic side on this one.

I'm a serial entrepreneur, blogger and ultrarunner. You can find me mainly on my blog at Dragos Roua where I write about productivity, business, relationships and running. Here on Steemit you may stay updated by following me @dragosroua.

Wanna know when you're getting paid?

|

I know the feeling. That's why I created steem.supply, an easy to use and accurate tool for calculating your Steemit rewards |