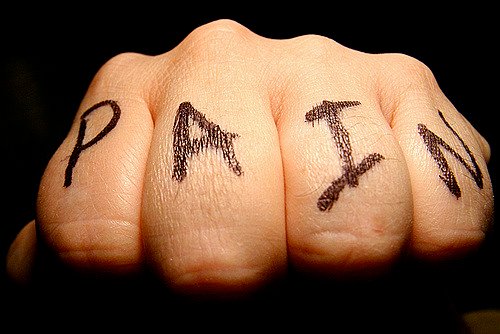

Since joining the Steemit community only days ago, and ponying up some cash to “power up,” I’ve been thinking a bit about the dumbest thing I ever did with money. It was a very painful lesson, but it made me wiser and taught me to make better decisions. Hopefully, this story can help you too.

I’ve shared this online before, both in this mini eBook and in this article, and probably a few other times on PropertyInvesting.com.

But here’s the full version for you, my Steemion friends, with some special application to what we’re all doing here.

“I’m ‘bout to get rich!”

I had just graduated from college with a degree in finance and was working as an intern for a stockbroker at Merril Lynch. The DotCom Bubble of 1999 had just burst, and considering myself to be a sophisticated stock market professional, I saw an opportunity to “get rich.”

I did the only rational thing that any poverty-stricken recent college graduate could do. I emptied my savings account and borrowed $6,000 cash off my credit card to deposit it all into a newly opened brokerage account.

After all, I had a degree in finance and an internship with a major investment bank. What could go wrong?

I had my eye on a tech start-up incubator company called CMGI. The stock price was rolling for months between $100 and $120 per share. Investors were buying at $100, selling at $120, then buying again at $100, and selling again at $120, over and over again.

After the NASDAQ bubble burst, CMGI fell to $55 per share. What a bargain!

I went all in, buying 200 shares, using about half my own cash and half what I had borrowed off my credit card.

After reading an analyst’s prediction that CMGI would eventually be worth $550 per share, my emotions lit up. I would lay in bed at night and dream about what my winnings would bring me: a new car, a trip around the world, the respect and envy of my friends.

Almost a month later, my broker called and said, “Jason, CMGI is now valued at $75 per share. I think it’s time to sell.”

I thought to myself, “What kind of weak, short-sighted, pansy-ass stock broker am I working with? Doesn't he know these shares are headed for $550?”

So I simply replied, “No way, we’re gonna let this one ride.”

“Oh, %$&!, what have I done?”

A few weeks later, CMGI fell and was trading again at $55 per share. I thought, “Maybe I should have sold at $75. Oh well, this is temporary. I’ve learned my lesson. I won’t be so greedy. I’ll just double my money, then get out.”

Another week passed, and now my shares were trading at $45. I still remember the sick feeling in my stomach as I anguished over what to do. Do I cut my losses and sell now or hold out? Fear gripped me.

My new plan: “If they go back up to $55, I’ll sell and break even.” I started bargaining with God. “If you get me out of this, I will never…”

Before long, CMGI hit $35 per share, and then $25. I was already all in, and had completely lost faith in the future value of this stock.

So again, I did what any rational-thinking investor gambler would do. I maxed out my credit card, and bought another few hundred shares of the exact same stock.

Now, if it would only go up to $33, I could sell it all, break even, and walk away with a lesson learned.

CMGI kept falling to $15, then $5, then $2 per share where it stayed for years. I finally sold at $2.16.

I told you it was a painful story. But thankfully it taught me something.

1. Only speculate with what you can afford to lose.

The most obvious mistake I made was borrowing money to buy an asset that was highly volatile and which I knew very little about. I had a university degree and an internship – just enough knowledge and arrogance to get me into trouble.

There will be many new people attracted to Steem in the near future. Most of them will be like me, having never owned a cybercurrency before.

This is a beautiful thing, because we Steemians are awaking the world to the value of the blockchain. But it could also potentially present great risk to people.

Warren Buffett once said, “Risk comes from not knowing what you are doing.”

Some people will look at Bitcoin’s growth and assume that Steem’s growth will be exactly the same. Some may even be as dumb as I was 17 years ago, and borrow big to speculate on Steem’s future value.

Steem could be huge, or as any venture in its infancy, it could all fall apart. We’re all here because we expect the best, but we need to be aware of the consequences of being wrong.

For now, because I know very little, I’ve only invested what I can afford to lose. Perhaps in the future, as my understanding increases, it will be wise to buy more Steem.

In the meantime, what I can do is leverage off my skill and knowledge in other areas, create content, and hope that by adding value to the Steemit community, I can grow my Steem holdings gradually over time.

Which brings me to my second revelation…

2. Think long term and do your part to add value.

I’m reminded of an ancient Hebrew Proverb, “Wealth from get-rich-quick schemes quickly disappears; wealth from hard work grows over time.”

I made the CMGI mistake because I was greedy and wanted to go from pauper to mogul overnight. Even worse, I failed to appreciate the reality that wealth follows those who consistently add value, little by little.

That’s one of the beauties of Steem. You receive an instant reward based on the degree of value you offer to the community.

Not every post will be a grand slam, but through consistent effort, you can grow an asset base of Steem Dollars and Steem Power by sharing your creativity, talents and knowledge with the world. How amazing is that!?

3. Check your motives for why you’re here.

As you can imagine, after the loss that I experienced, I did a lot of soul searching. How could I have been so dumb? What was I really chasing?

King Solomon of Israel, one of the richest men to have ever lived, once wrote, “Those who love money will never have enough. How meaningless to think that wealth brings true happiness!"

One of the things I realised was that what I was really after were feelings of validation and significance from other people. I wanted to be respected. My deepest problem was I was insecure and thought that by making a lot of money I would feel more important.

The starting point of true happiness is a contentment with and gratitude for the more important things that one already has – family, friendships, health, meaningful work, and life’s basic necessities.

If you want to check your motivation for why you’re here, read what my friend @lukestokes wrote here about how the real currency of Steem is relationship. It challenged me.

Do you have any additional wisdom to offer? Have you ever done anything dumb with money? If so, I’d love to hear about it.