What is the number one tip I have for investing in cryptocurrencies? Read this post or watch the original video from YouTube to find out! I tried to post this an hour ago and got a really weird error where the post is not available which motivated me to try again here!

Thank you very much to @gmichelbkk for converting the transcription of the YouTube video from GoTranscript into this beautiful post for Steemit, which is much faster to read than the video and has all of the highlights in screenshots!

What is my number one tip?

The number one tip I have is to just bet the market over time. Buy different currencies and just hold onto them. The opposite of doing this is trading. That involves timing the market. I learned this by reading Tony Robbin's "Money: Master the Game" book. I learned this by reading a book called "What I Learned Losing a Million Dollars," which is about investing in the stock market. Most critically, I learned this by the hard way, by trading Bitcoin and losing thousands of dollars, by trying to time the market.

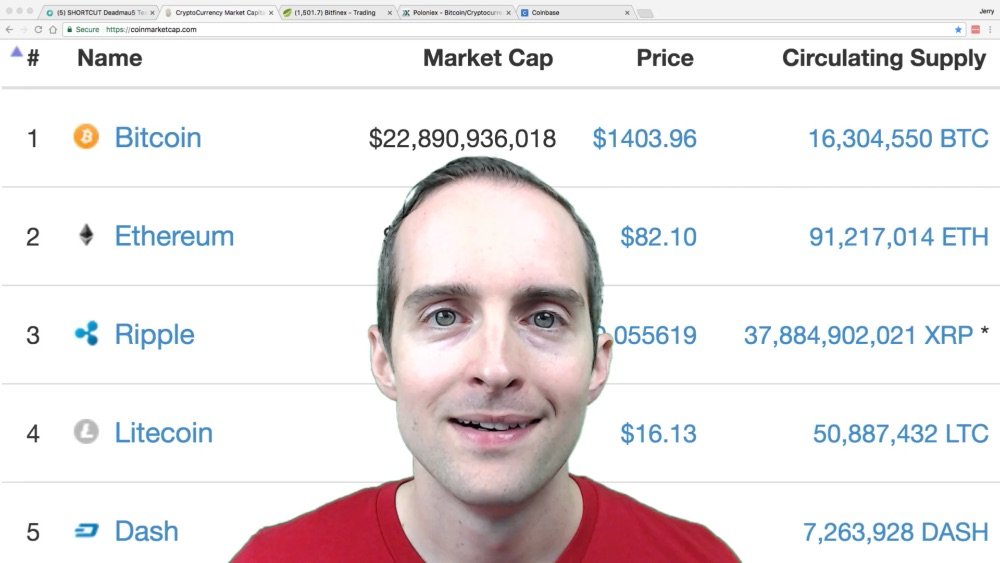

As I look at the currency prices today, most things are up at the top. Bitcoin is up, Ethereum just went from $40 to $80. Ripples went way up. Litecoin is way up. Dash is up like $20 from before. It's tempting to look at these and say, "Yes, if I had sold my Dash masternode when it was a hundred thousand and dumped a bunch of that into Ethereum, now, I could have $200,000."

The problem is that you can see what's already happened, but you're totally blind. The truth is that collectively, we are totally blind to exactly the details of what's going to happen in the future.

If you are like me, you are quick to think that you're really good at investing, that you are better than other people, that you are able to play the game more effectively than others. In my experience, I found the only way I can consistently win the game is to just invest a little bit over time.

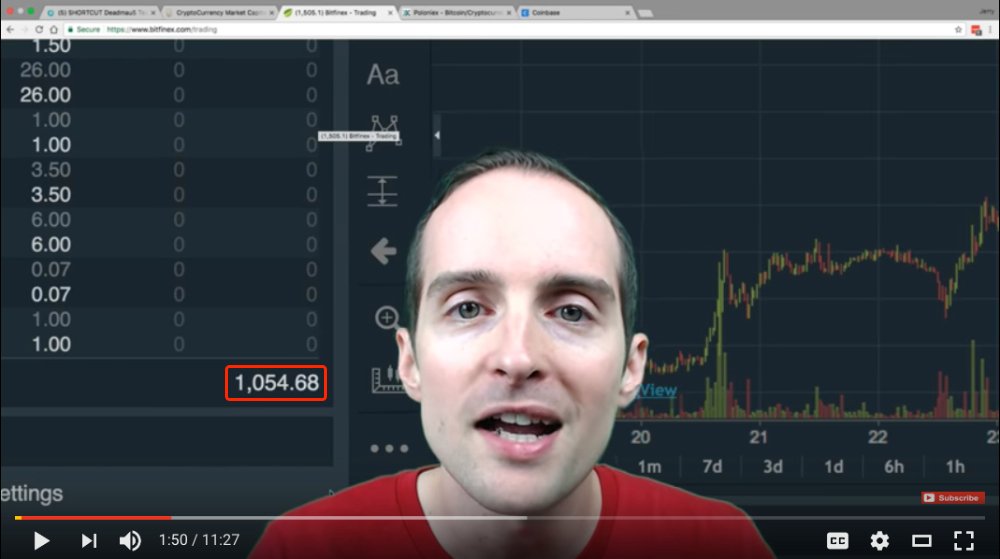

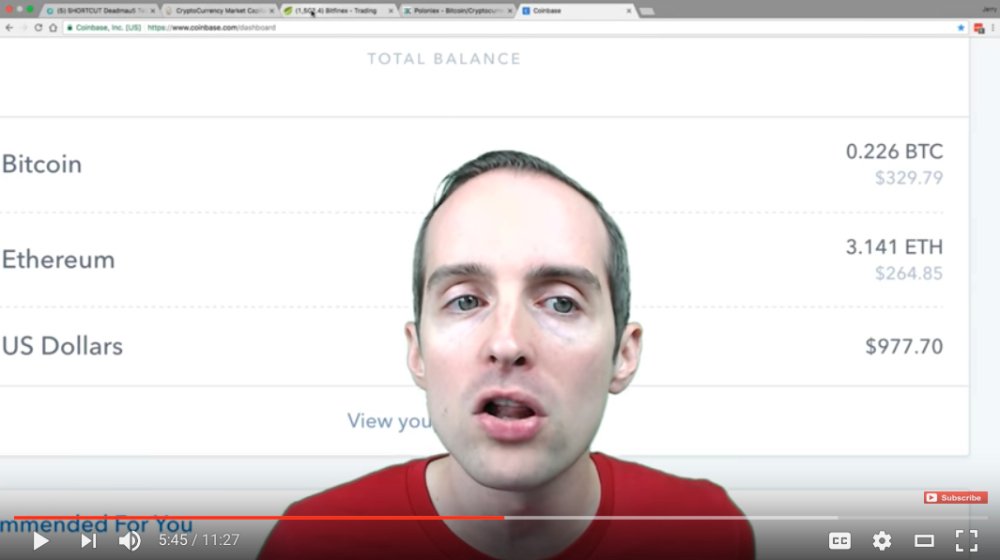

I put $600 or so into BitFinex and I'm grateful today that I currently have $1,000 just a few weeks later.

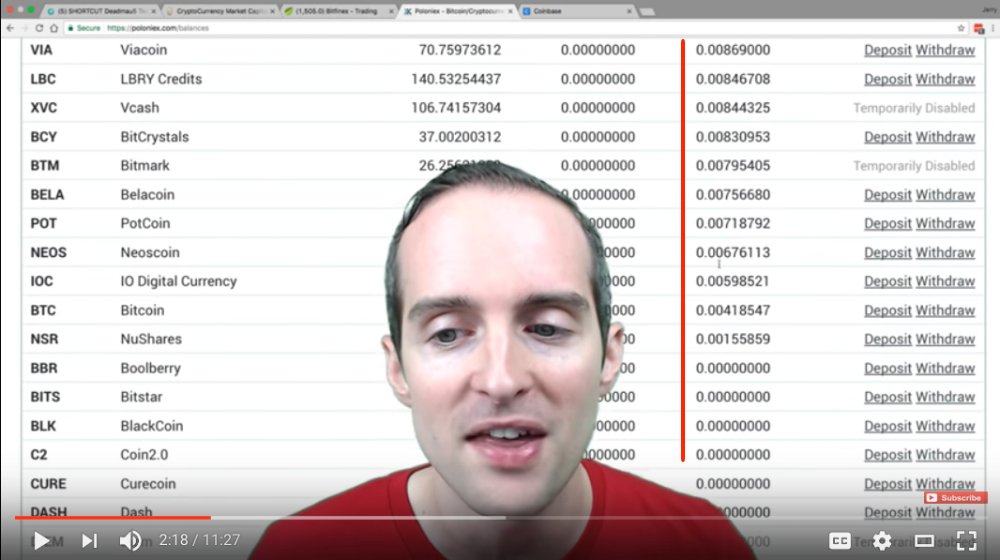

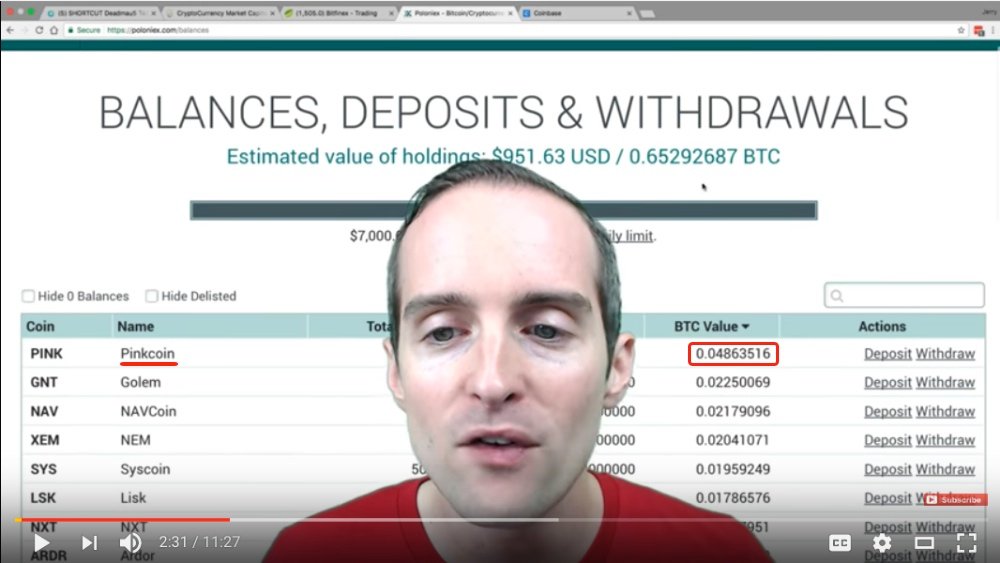

I also have a Dash masternode, which is a thousand Dash, that I'm very grateful for. On Poloniex, I put in about $600 or so the other day, and I just bought the market.

I bought a bunch of these different currencies. I bought a hundredth of a Bitcoin of several of these different currencies. One of them has gone down and I lost almost everything. A couple of currencies have dropped 50%, but another couple have also gone way up.

This one I bought 0.01 BTC and now it's worth almost five times what I paid for it.

I'm grateful now that as Bitcoin went up, I put about 0.05 Bitcoin on. I've now got more Bitcoin than I put on, and it is worth more than when I put it on as well.

I do the same thing on BitFinex. I buy $10 a day, and just as this is going up, I continue to have more value in it.

Don't play around trading!

The thing is that I've learned the hard way: Don't play around trading!

Why?

Number one, it takes too much time. You have to obsess over it. You have to be checking the prices all the time to make the right moves. The fact is that it is very uncomfortable because you don't know what's going to happen next.

If you tell the truth and you're like me, you don't know whether the Ethereum price is going to go from $82 to $200 or from $82 to $8. Either one is equally possible in my mind. We don't know what's going to happen next. That means we're completely blind going forward.

Most of us are subject to acting stupid as a part of the crowd. How does that happen?

When everyone gets excited, we want to throw money in. When everyone else panics, we want to pull our money out.

What happens?

Most of us think we're smarter than others. We buy high, we sell low.

What do most of us do if you look at the data?

If you look at the data, the first several years, I traded cryptocurrencies, I bought high and sold low. I bought high when there was excitement. I sold low when there was a panic. Even when I was able to buy low, I was so impatient that I would sell when it made a small game.

I bought something like 20 Bitcoin when it was worth $170. I couldn't take the stress of it. I was so impatient that when it went over $200 again, I sold all of it. I felt good at the time, "Look, I made this money selling my Bitcoin," and yet, if I'd hold on to 20 Bitcoin today, you can do the math on that. That would be $28,000 I'd have today. That only cost me a few thousand to go buy.

I'm grateful I've learned to do that. I'm holding my Dash masternode, even when the idea of selling my masternode and getting $93,000 is very tempting, especially because all I have in cash right now is about $8,000 or $10,000. It's really attractive to dump that masternode and take $93,000 out of it, but that's not what I set up to do.

I made a plan and I stick with it. I buy and I hold. If you try to trade, it takes a ton of time and energy, and lots of times you miss out on the best action. If you are like me, you want to be in on the best action.

Buying a little bit every single month

The only guaranteed way to be on the best action is to consistently buy a little bit every single month. Then, "Look, I'm in on all the action right now." As the price of Bitcoin went up, as the price of Ethereum went up, I've made money in all of it.

The nice thing, when you do a buy and hold strategy, is that you don't have to follow everyone else. When everyone else sells, for example, you can stay where you are. If the Dash price plummets to $8 or something like that, I don't need to sell. I can afford to let the price plummet and then go back up.

I'm putting money every month into these cryptocurrencies and I'm essentially just buying the market. When I do that, if there's a huge down spike, I essentially get a really good deal then because I just consistently buy every month and hold it. If there is a plummet, that's when I get a really good deal.

If Ethereum goes back down to $7, I'm going to continue buying it anyway. Then, if it goes up back up a bunch, I've got a good chance to earn. The best part of this is that I don't have to check how much it's worth. I don't have to care what the numbers are. The numbers are almost irrelevant because I'm buying and holding.

I'm buying and holding.

So what if the price goes up today?

I'm not selling.

Now for Dash, because I've got the masternode, the higher the price is, the more I am able to buy of the other currencies. I get dividends paid in Dash from the masternode. If you're not getting dividends paid from something, it's especially tempting to just trade. It's tempting to buy something and sell something, and say, "Look, I bet Ethereum's going to go up to buy a bunch of that, and then if it goes up to sell it."

What if you buy it and it goes up way more than when you sold it?

What if you buy it and it goes down?

There's all this anxiety, fear and uncertainty then, and you have to obsess over it. I just put my money in every month because I believe that these online currencies are amazing.

Believing in the long term

I believe in the long term. In 10, 20, or 30 years, I think the majority of the world will work and deal in online currencies. At some point, governments may start to actively fight it. But I think these online currencies will overcome governments fighting about them as more of us continue to put our money in.

Therefore, I buy some today and I hold. I buy more each month and I hold.

I've pulled my retirement out of everything else to make money for this. I've cashed out all my other retirement, taking the money, so that I could put it in these online currencies every month.

This way, if the price goes up, I make money. But when I buy more, I don't get to buy as much. If the price goes down, I get to buy more. Then when the price goes up, I make more money.

Then, I have peace of mind.

I'm setting up a retirement account. I'm not trying to just trade and make money. See, when you trade to try to make money, you might win, but that might be the worst thing that can happen to you.

If you are like me, any time that I've traded and made money, I got this big head. Then, I got wiped out when things went down. At first, with some of these currencies, I've traded and made a little bit of money, and I got destroyed when they went down.

I'd traded and made three Bitcoin in a few months just playing around on Poloniex, and then I lost all of my earnings in one day.

Guess what I did?

Not long after that, I sold.

If I'd held those by now, I'd have something like 10 or 15 Bitcoin. Instead, I put all of it in Dash. I then self-promoted Dash and the price went up a whole bunch.

That has worked out good.

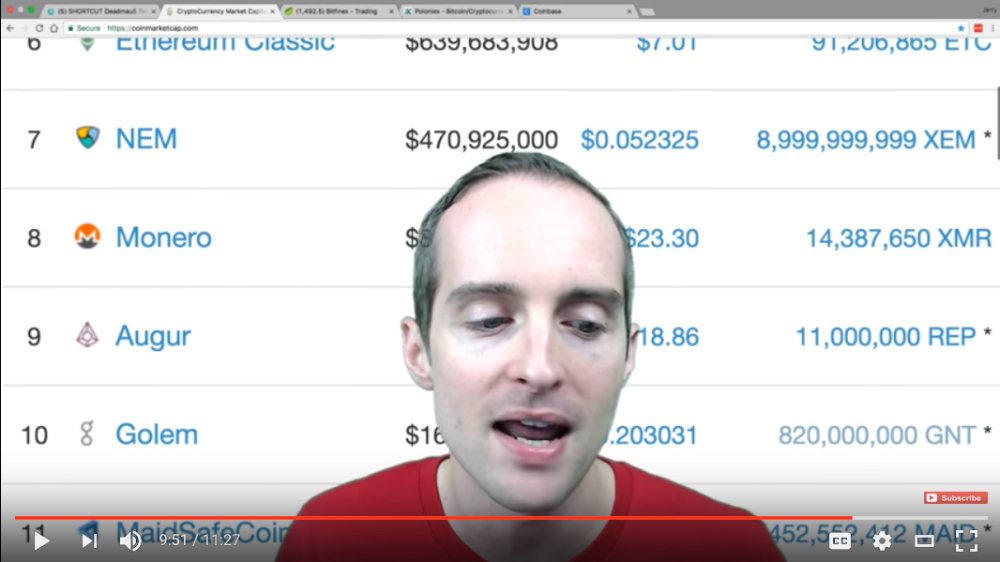

At the same time, I'm now very vulnerable. If the Dash price goes down, I could easily lose the majority of all my online currencies. What I'm doing is consistently investing in each of the others. I'm not putting any more money in Dash because I've got a masternode. I'm consistently putting my money into most of these currencies into the top 10 on BitFinex, whatever they have there. Over time, I'm consistently putting my money into the top 50 on Poloniex.

I'm grateful today. It doesn't matter what the price is, I'm buying every month and that's simple for me. I hope this quick tip post has been useful for you and thank you very much for reading the whole thing.

Would you please upvote this post, or like the video, so that other people like you will be able to experience the same thing?

If we reach 1,000 likes on the video, or a significant amount of upvotes, I will do another live stream, and blog post, showing exactly how I make all these transactions, which I hope will be helpful whether you are beginner or whether you want to just see the exact system I use to do this every month.

I've got a class that goes into all the details on how to do this in much more depth on Skillshare. There's also a two-hour free version that has many of the same things on YouTube. It's called "Simple Cryptocurrency Investment + Retirement Plan" where I show the details of how I do all of this.

If you are a member, the Skillshare class has more depth and it doesn't have any ads. It's also more polished and organized.

Thank you very much.

I hope you have a wonderful day today and I hope this is useful for you. If you found this post helpful on Steemit, would you please upvote it and follow me because you will then be able to see more posts like this in your home feed? If you would like me to follow you, would you please read this post next?

Love,

Jerry Banfield