Financial incentives are heavily built into the Steemit platform: posting, commenting and voting are all rewarded by various Steem coins. Although the original idea was that these incentives should facilitate higher quality content, in reality they probably hurt the quality just as much as they help, because "writing quality content" is, at least at the moment, not necessarily the most optimal way of realizing the financial incentives that the system is built on.

Because of that one can observe a swamp of unimpressive self-shilling posts, endless "follow me" requests, a myriad of "upvoting bots" (which upvote other upvoting bots' posts!), random "give me your money" lotteries, etc.

Although this state of affairs may seem a bit sad for a potential creative platform, it does raise interesting mathematical questions about the properties of the various schemes for gaming the system. Consider, for example, the concrete case of a Steem Power auction, where one user delegated 10000 of their Steem Power for a week to another user for 191 SBD. Was it a good investment? What could be the baseline price for such a loan of Steem Power? What is, in general, the return on investment for Steem Power, assuming its holder is not interested in being creative or inventing complicated schemes.

Of course, the most straightforward method for monetizing Steem Power is simple self-voting. Automatically posting useless comments somewhere in the dark corner of the site where no one can see them and immediately upvoting each should give the author a share of the common reward pool. There are just two questions here: how exactly should one vote to maximize profits, and what could these profits be?

The Voting Strategy

The current voting system in Steem works as follows: the user has a certain voting power, which ranges from 0 to 100%. When they cast a vote on a post or a comment immediately after its creation, the post (or comment) receives a reward, which is proportional to the voter's voting power times their Steem Power.

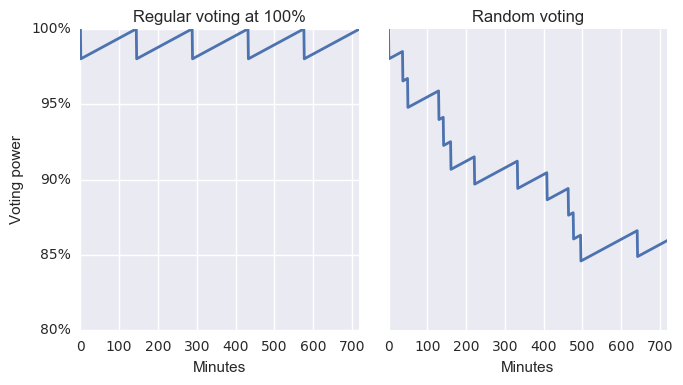

Each vote decreases the voting power by 2%. At the same time, the voting power constantly replenishes at a linear rate of 20 percent points per day.

It means that there is a choice of strategy in voting - you may vote once at 100% power, wait a couple of hours until your power gets from 98% back to 100% and vote again, etc. Alternatively, you may give 50 votes in a row, decreasing your power from 100% to 36.4%, then wait an hour until it recovers to 37.25%, then vote a couple of times again, etc. It is not immediately obvious which strategy should give you the best return.

It turns out, it does not matter! As long as you do not keep your voting power unused at 100%, self-voting with any frequency or order (assuming you keep within the bandwidth limit, of course), will give you the same daily return. Let us see why this is so.

Suppose your current voting power is V, you cast a self-vote, and wait until the power recovers back to V. Let us measure the earnings per unit of time in this situation. Right after casting the vote, the power will decrease by:

We know that voting power replenishes at a rate of R = 0.2 per day, hence the time it takes to recover to original value is:

The vote will earn you k · V Steem Dollars (where k is some constant, which depends on your Steem Power and the overall activity on the site - it represents the earnings for a 100% vote).

If you continue voting and waiting to keep your power returning to V, your daily earnings will average to:

Note that this value does not depend on V! It follows that no matter at what voting power you begin voting, nor what frequency of voting you use, if you return to the same voting power eventually, your average daily revenue will always equal to 10 full votes. Shooting 50 votes and leaving for a couple of days has the same effect as voting only at 100% and then carefully waiting until it recovers again. Not immediately obvious, is it?

The Return Rate of Self-Voting

Now that we know that self-voting brings 10 full votes-worth of SBD per day no matter how you vote, let us measure its return rate for the particular case of a 10K SP loan.

The earnings of a vote generally depend on the activity on the site (because a single reward pool is shared among all upvoted content). Right now, for example, it seems that my own 100% upvote is worth about 0.07 SBD, which corresponds to 430 SP. If we extrapolate this, the price of a full 10K Steem Power vote should be 1.63 SBD. Dealing ten such votes per day for a whole week results in expected total earnings of 113.95 SBD. This is less than the 191 SBD paid by the borrower, thus the borrower could only profit from the power loan if they found a more creative use for it than self-voting. On the other hand, the lender is also not beating the baseline, because he loses this power for two weeks (Steem Power is disabled for a week after its delegation is retracted), yet he could earn 227.9 SBD during these two weeks via dumb self-voting.

Finally, note that at the current prices 10K Steem Power correspond to 13600 SBD. Receiving 113.95 SBD per week on a 13600 SBD investment, compounded weekly, corresponds to 54% annual return rate. In the real world this is a lot.

Although opinions on the ethics of self-voting vary, it seems to me that if most of the cash-greedy earners would switch from flooding the ecosystem with bots and "follow me" requests to silent "self-vote mining" somewhere inside a "trash" tag, the overall quality of the visible content on the site would only benefit from it.