Have you noticed your Steam Power going up without you doing anything?

Welcome to the wonderful world of STEEM mechanics!

If you're not familar with the difference between Steem, Steem Power, and Steem Dollars, go give @donkeypong's fantastic steam plant analogy article a read. Now let's go a little deeper.

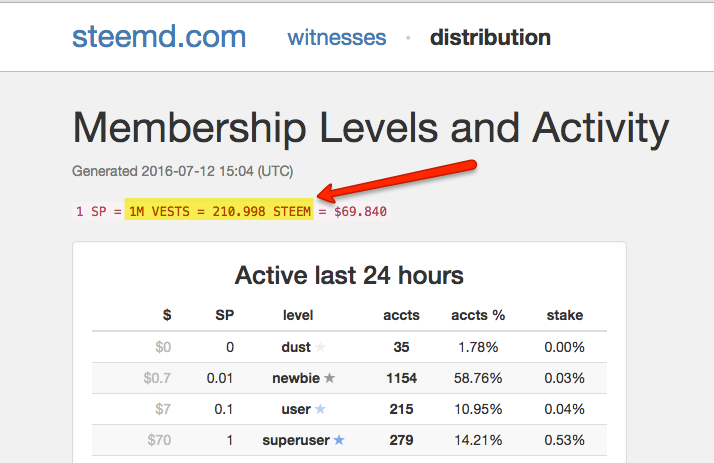

We're going to pick on @dantheman here and use his wallet as an example. If you've ever been to the fantastic steemd website, you've probably seen the term "VEST" (though I've been told the whitepaper has been edited to remove the term). At the time of this writing, Dan has 5,916M Vests. Vests have a conversion rate of 1M VESTS per 1 SP. I used to think "SP" stood for "Steem Power" which really confused me, but now I think of it as a bitcoin (1 SP) and a satoshi (1M VESTS). In order to go from VESTS to Steem (Steem Power and STEEM are 1:1), you need to figure out the current conversion ratio of SP to Steem. That's what this number over at https://steemd.com/distribution is all about:

Here are the relevant sections of the white paper which explain this (page 8 and 9):

Because Steem wants to encourage long-term growth, it is hardwired to allocate 9 STEEM to Steem Power (SP) stakeholders for every 1 STEEM it creates to fund growth through contribution incentives. Over time this drives the ratio of the total STEEM value of Steem Power balances to the total of STEEM balances toward 9:1 . (It seems likely that the ratio will be somewhat greater than 9:1 due to continued net Powering Up of the newly printed STEEM.)

and

STEEM is constantly increasing in supply by 100% per year due to non-SMD incentives. Someone who holds STEEM without converting it to SP is diluted by approximately 0.19% per day.

and

The majority of inflation is actually an accounting artifact rather than true reallocation of wealth. 90% of non-SMD inflation is distributed back to existing holders of STEEM proportional to the STEEM value of their SP balance, making inflation more of a “split”. Only about 10% of non-SMD inflation redistributes ownership in the network.

Want to see it in action? Check out Dan's wallet at @dantheman/transfers and note the total Steem Power. Now hit refresh. Did you see it go up? Pretty cool, huh? That's an investor being rewarded for long term investment in the success of Steem!

As more people find out about Steem, we're going to hear many more questions like, "But how does it create money from nothing?" Many people don't understand the dollar bills in their wallet are actually certificates of debt which are essentially created from nothing as well (but that's another story). For people to feel confident about something they might consider an investment or a money-making opportunity, we should be able to explain the mechanics to them.

If I calculate the interest rate per hour and per week for my Steem Power balance, it's a pretty compelling investment! Makes me want to dump everything into Steem Power! But, can I count on that interest rate? How much does it change over time? These are things I wanted to figure out.

Nerdy Code Warning

I'm a PHP developer, and I wanted an excuse to play with @xeroc's awesome Piston python library and command line tool. Just to get my feet wet, I thought I'd try figuring out what the current interest rate is. Knowing the interest rate can hopefully help me decide if I should buy some STEEM, sell some STEEM, or power it up. Not only that, the change in interest rate is important because if it goes down too much, I can't bank on future increases of Steem Power based on my current balance.

So here's what I came up with:

➜ php-steem-tools git:(master) ✗ php steem_rate.php dantheman

Sleeping 1 minute...

.

--------------------------------

Interest Rate Per Hour: 0.034620102305655

Steem Power Per Hour: 432.32445121743

Interest Rate Per Week: 5.81617718735

Steem Power Per Week: 72630.507804528

It's a PHP script you can find here on github: https://github.com/lukestokes/php-steem-tools It retrieves a user's balance in VESTS, then the current exchange rate, then waits a minute and gets the exchange rate again. From that it calculates the interest rate and return projections. It requires Piston be installed on your computer along with PHP. If enough people find this useful and would like me to explore it further and/or host it somewhere, please let me know. I'm also considering the possibility of building a payment gateway integration for Foxy.io which would allow merchants of FoxyCart to accept Steem Dollars or STEEM.

You can use any steem username you want and for more debugging information, include a true argument like so:

php steem_rate.php dantheman true

I had fun playing with it. Go ahead and check it out. Try runing it a few times for your own user and notice how the interest rate changes over time. While developing this tool, I saw the rate going down quite a bit. I began to wonder, if I convert my STEEM to Steam Power, will that rate keep going down to the point where I would have been better invested in Steem Dollars? Interesting questions and I was tinkering around with this script to find some answers.

I hope you enjoy this tool and this little journey into the mechanics of Steem Power interest rates. Please let me know if you'd like to see more.

Special thanks to @smooth for helping me understand this stuff better and once again to @xeroc for his great work on This.Piston.Rocks. After you're done here, head over there and give him a well deserved upvote.

Edit:

Thankfully @dantheman brought to my attention an important point in the white paper here:

Steem by contrast will achieve an instantaneous annual rate of approximately 12% after just 1 year (not including the effects of SMD operations).

That means the high interest rates we're enjoying now will only be around for another 9 months or so as it tappers off towards 12% a year (as mentioned in Dan's comment below).

Update:

I also put together a little PHP script to save your current Steem Power balance to a text file every five minutes. Very handy for keeping track of the change over time.