This is going to be a rather short post. I hope that the tables of data do most of the explaining. The other day I published a post about not supporting short term thinkers on Steemit anymore. This does not mean I will ignore content I like because of short term thinking, nor does it mean people won’t get a chance, because they will. What it means is that long term support and any spare votes I have will be given to the long-term thinkers.

If you missed that post and discussion you can check it out here.

/@paulag/this-is-very-frustrating-stop-blaming-the-whales

I understand that not everyone is a long-term thinker, but while steemit is in beta and trying to establish its self, we need more long-term thinkers, even medium terms so the ecosystem can mature, and app get established.

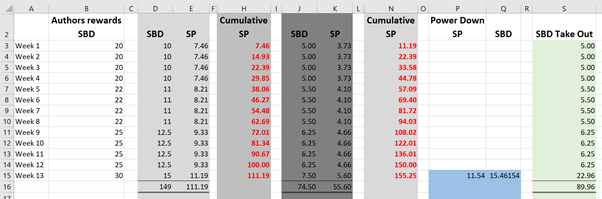

I have put some calculations together to shown you how your accounts could grow if you were to invest just 13 weeks in Steemit. If you right click on this image and view in new window you will see the values better

The first column (column A) shows the week number.

The second column (column B) shows attainable author earnings each week.

The Thirds and forth (columns D & E) shows how the authors earns would be paid out if the author selected 50%/50%

The fifth column (column H) shows the cumulative SP on author earnings assuming no Power Downs.

Just looking at these columns, if you take out all your SBD every week, by the end of the 3 months you will have taken out $149 SBD and you will have powered up 111.19 SP.

Now let’s look at the next two columns. Let’s say you take 50% of your SBD earning and use this to purchase STEEM on the internal market to power up. The balance of the SBD you cash out each week (column S). At the end of the 3 months you would now have SP of 155.25, which is 40% more SP than if you take out all your SBD earning each week.

You will note in week 13 a power down amount shows. Once you have completed the 12-week investment you could begin to power down. This will release your SP over 13 weeks. Column P shows the 13-week payment and column Q converts this into SBD. In week 13 our take out is substantially higher than previous weeks.

The table below extend this to 52 weeks. Lets just discuss the bottom line. If you take out all your SBD every week you would take out $1834 SBD and have an SP of 1368.

Applying the same principles of using 50% of this SBD to buy STEEM to power up then at the end of the 12 months you would have taken out SBD $2023 and have an SP of 1220. That’s 11% more liquid SBD and 11% less SP.

The values shown in the post are not guarantees of author earnings. The SBD STEEM exchange rate used was fixed at 1.34 and is subject fluctuation. Therefore, you could end up with more or less SP than shown. This is not financial advice.