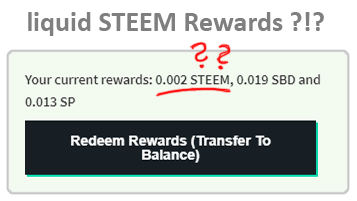

I'm sure most of you will have noticed this by now:

I don't think I was the only one who was pretty dumbfound to see that. So what changed, where is this coming from and why is it happening all of a sudden?!

The Short Answer:

The STEEM blockchain has a built in mechanism to control it's "debt-ratio" between SBD and STEEM. The plummeting price of STEEM and the resulting loss in market capitalisation has triggered this mechanism. As a result, the blockchain is basically trying to decrease the availability of SBD compared to STEEM.

@steemreports (as always) has a great tool that shows the situation with real numbers and they even manage to describe it in one simple sentence:

Because the SBD/STEEM ratio is above 2%, the SBD print rate has dropped, and payouts will include some percentage of STEEM instead until this ratio is back below 2%.

So now we know what happened and that the system is just working as intended.

But wait...

Let's think about that. In essence, the price of STEEM dropped and that has caused even more liquid STEEM to be issued in rewards? Does that make sense?

It's Not That Simple!

To fully understand what's going on, we need to take a look at what SBD actually is, or at least what it was intended to be: SBD stands for Steem-Backed-Dollar and I'll simply quote @dan from this post here, because he probably said it best himself:

When it comes to the Steem Dollar, their purchasing power depends upon the market demand for STEEM. The Steem Dollar is really nothing more than a smart contract for a variable amount of STEEM [...] The idea behind a Steem Dollar is that it should almost always be worth about one US dollar. We have set rules in place to make this statement true 99% of the time by making the Steem Dollar convertible to a dollar worth of STEEM.

and he goes on to say:

Anyone who promises you that any asset will always be worth something is either ignorant to some risks or a liar.

Which brings us to the more fundamental issue in understanding what's actually going on and where this mechanism might eventually cause more harm than good.

Pegging SBD to the US-Dollar, or not?

Back when these systems were put into place, making sure SBD's value stayed down to the US Dollar was simply not an issue, and afaik it might have just been overlooked. 2 years ago there was quite some confidence that the given rules would hold up for 99% of the time. Let me just repeat @dan's gospel here for clarity:

it should almost always be worth about one US dollar

Unfortunately, that hasn't been true in quite a while, we've been living in the other 1% of time for way too long and I'd argue it's not healthy for the steem ecosystem in the longer run.

In more economic terms, SBD is issued as "debt" against STEEM being the available "equity". There is a mechanism in place to "burn" SBD for STEEM (or to speak economically - to collect equity for those debts), but there is no mechanism on the chain to do a conversion in the opposite direction.

The "printing" of SBD on the chain happens under the assumption that it's value is exactly 1 USD of STEEM. To determine the final amount to be issued, the price-feed for STEEM/USD (a moving 7 day average) that is being broadcasted by the witnesses is being used. That's why we have been printing way too much SBD for quite a while and why it's "debt" isn't being settled.

It's a broken peg.

SBD is essentially only pegged one way - to be at least worth one US dollar. There is no mechanism to regulate the value of SBD back down to one dollar. And thus, the "debt" just keeps growing and we now started issuing even more "equity" to control the debt-ratio.

What Does That All Mean

And how can it be a bad thing we've been so generously overpaid with inflated SBD?

All these rules on this chain were designed around the assumption that SBD would be worth, at least roughly, one US Dollar. The fact that it's way above that, does cause a few easily overlooked problems. Now I am not an economic expert and maybe I am missing some insights. But here's where I see the issues:

- SBD does not get "burned"

Nobody is going to convert his SBD to STEEM via the on-chain method, because you'd be making a big loss! All that issued SBD stays out there - you could say all the "issued debt against STEEM" stays in existence and doesn't get settled. It really shouldn't come as a surprise that the ratio would grow above 2% sooner or later. - STEEM might "devaluate" further

Now technically the price pressure caused by the liquid steem rewards is only exercised on the SBD-to-STEEM price, but I would expect this increased supply to also create a bit of downwards pressure on the open markets. In turn, that would further lower the market cap and cause liquid steem to be issued at an even higher ratio. Looks like a dangerous downwards spiral could engage here. - The numbers are all "confused"

Ok, this is not really an economic problem, but I am sure most users are constantly puzzled about the $-values displayed on their posts.

In Conclusion:

I don't mind liquid STEEM rewards! At least we are lowering the rate at which "debt" is being issued, but as long as this pegging issue doesn't get addressed properly, it remains problematic and it comes with a bunch of long term risks in my eyes.

The core problem that I see is the fact that the SBD/USD-pegging only works one way, up. I know there's been a debate amongst the witnesses about introducing a two-way-peg (e.g. allowing on chain conversion from STEEM to SBD) but there doesn't seem to be enough consent on the issue.

I've heard a lot of arguments about how the high SBD prices are making this platform so attractive and that we dare not touch that. In all honesty, I think that's a very shortsighted argument... and it might even just be an easy excuse for a greedy focus on individual short term gains versus long term health in this ecosytem.

I'm not an economist, all I have is my common sense!

Maybe I am seeing things from the wrong angle?

Do you think overpriced SBD are a good thing?

How do you feel about your liquid STEEM rewards?

I really think this issue needs more disussion.

Further reading:

The SBD:STEEM debt and payouts by @tarazkp

STEEM Rewards News Flash by @eonwarped

Witness Discussion – SBD price and reverse peg by @reggaemuffin

Should SBD Be a Pegged Asset? by @lukestokes

Warning: Don't search for "pegging GIF" images on google!