I have written a few posts about my views on how powering up is beneficial to one's Steemit journey. This post is different in such a way that this is not merely based on my views, rather it is backed by data.

I have been contributing analysis to Utopian.io, and I am advocating powering up from the start of my journey, so I thought about putting those two together in a single post to talk about the benefits of powering up at a data analysis perspective.

There are five major benefits that I always cover when talking about the benefits of powering up. In this post I will present data points related to them.

- Increased Curation Rewards

- Steem Power Interest

- Widening or Increasing the Value of One's Reach within the Community

- Some People Follow The Money

- Price Appreciation

This analysis focuses on the financial benefits of Powering Up. The data-points were collected via the use of @arcange's Steem SQL Database using the TxClaimRewardBalances table. The claim variables are based on actual data from my own account using this query:

SELECT reward_sbd, reward_vest, timestamp

FROM TxClaimRewardBalances

WHERE account in ('steemitph')

GROUP BY reward_sbd, reward_vest, timestamp

Gains in $ Comparative Analysis

Taking my curation rewards for the last seven days against my Steem Power holding will give a value of 0.026%% in percentage. At the time of doing the analysis, I made an average of .96 Steem per day on curation rewards, I divided that by 3630 which was my average Steem Power for the same week to get the % of curation reward value I used as assumption.

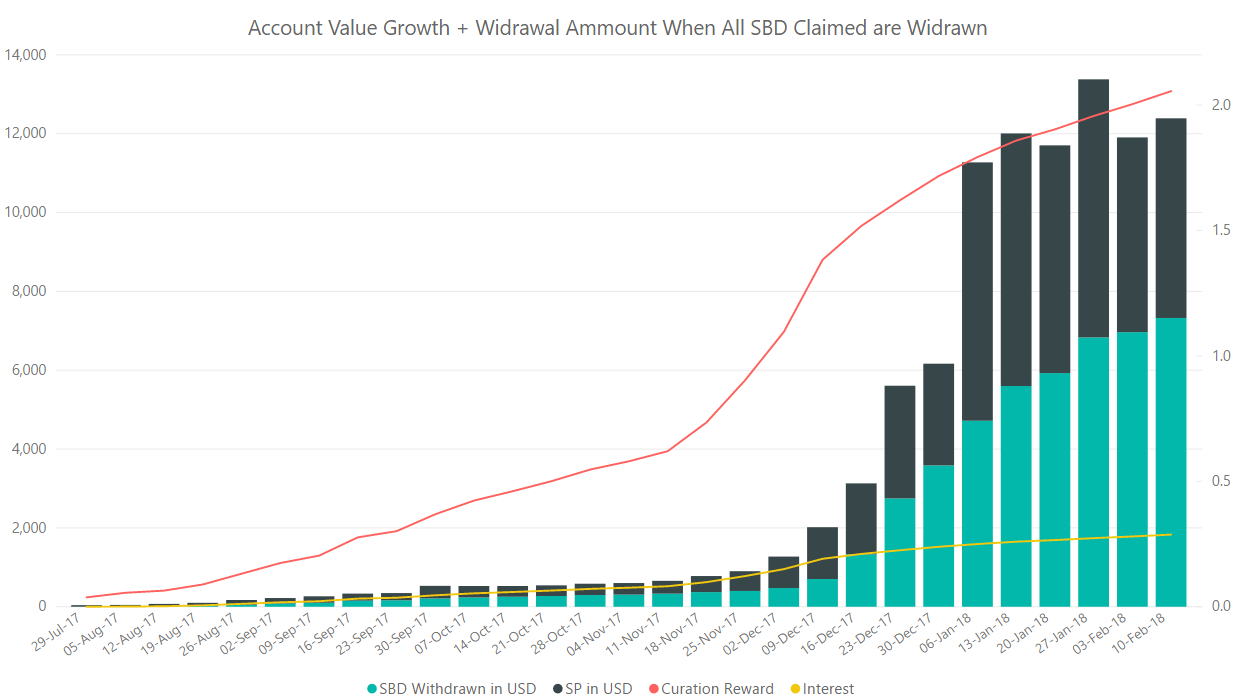

The chart below used these assumptions:

- The claimed Steem Power rewards were kept, while all SBD rewards were withdrawn

- A flat curation reward in relation to Steem Power holding (0.026%)

- Steem Power interest rate of 1.38% per annum

- Daily price table of Steem and SBD based on Coinmarketcap's historical data feature. I took the closing price data for this analysis.

In this scenario, I would have withdrawn a sum of $7,326 worth of Steem Dollars and have a Steem Power holding of 1,128 worth $5,064. These two together would have summed up to gain of $12,390 for the period of the study.

The withdrawn Steem Dollars here is cumulative, thus you will see a steady increase. You will notice a fluctuation in the size of the bar representing the Steem Power in USD since that is dependent on the price fluctuation of Steem. The Curation Rewards and Interests are represented in Steem and not USD, and is dependent only on the size of Steem Power holding.

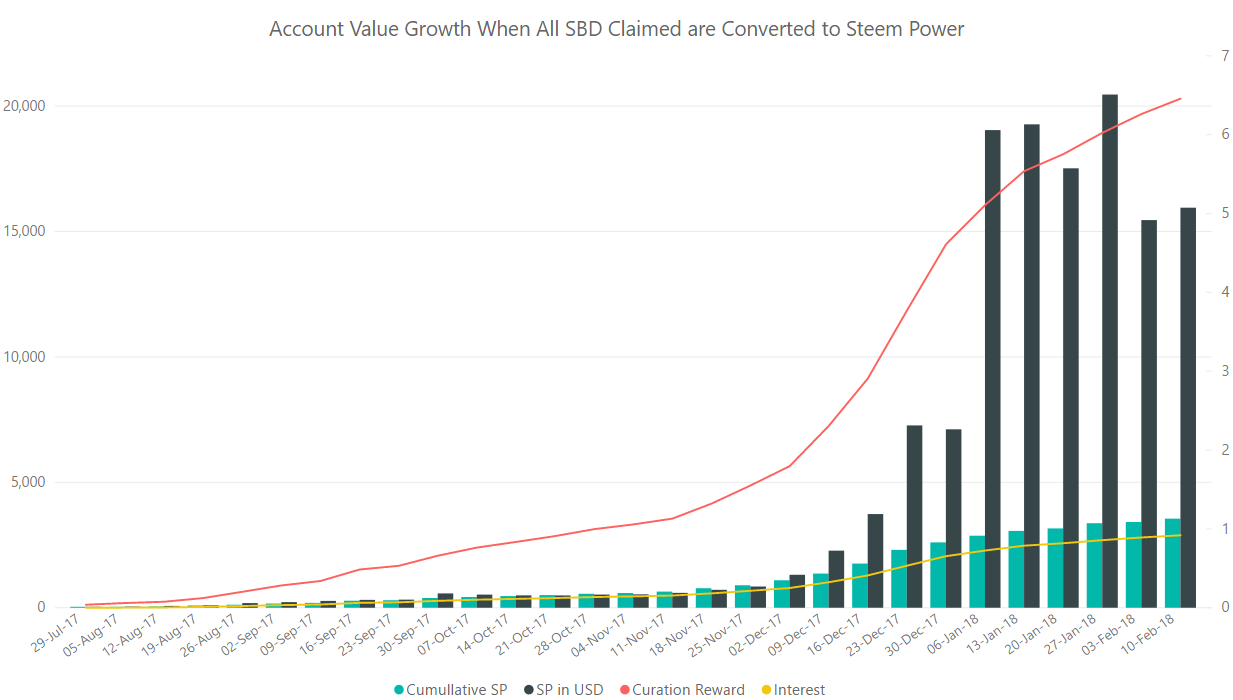

In comparison the below chart shows results using these conditions:

- The claimed Steem Power rewards were kept, while all SBD rewards were converted to Steem, then powered up

- The same curation reward ratio to Steem Power, and the same interest rate as the chart above

- The same price table of Steem and SBD as the one used for the chart above

In this scenario, I would have built a Steem Power holding of 3,552 worth $15,948. This scenario would have made me an extra $3,558 compared to the first scenario. I showed both the actual cumulative Steem Power holding in this chart which will seen at a steady increase, and the value in USD of such Steem Power holding which is dependent on the price of Steem. The highest was in the week of January 27 when the price of Steem closed at more than $6 for the week.

Same as in the chart for the first scenario, Curation Rewards and Interests are represented here in Steem and not in USD. This scenario earns nearly three times as much in curation and interests as the first scenario.

Conclusion:

Profitability is just the measure studied in this analysis. I have mentioned many other benefits of powering up on previous posts on the subject. Here are some of my posts regarding powering up and why we are doing it.

What I Bought with My Steemit Earnings

2017 Steemit Personal Year End Review #1: Statistical

💵 STEEM is a Currency of LOVE ❤

A Steemit Short Story: "Delayed Gratification"

Based on the data-points presented here it is more profitable to power up for the long term. This would of course mean that your earnings will be tied to the platform for at least 13 weeks, but if you don't have an immediate need for the cash re-investing through powering up may be beneficial for your journey over time. These are all dependent on the price of Steem and Steem Dollars however which is dictated by the market.

If you have some expectancy that the price of Steem will appreciate, and you are planning to be in the platform for the long haul then this analysis says power up. Please note that this is not an investment advice. I am not a financial expert, and in no position to give such recommendation. In the end, the choice is yours to make.

Credits

Cover Photo Background - Pixabay

Light Bulb Image - Pixabay

Choice Road Sign Image - Pixabay