Over the last few months I have gone through government bureaucratic hell in order to achieve Permanent Residency in Panama. This article is not about the benefits of moving to Panama and the residency programs. See Why Panama is an Expat Haven to read about the programs.

What I want to highlight is the great lengths that countries go to in order to limit our movement as tax cows. For the average tax cow the idea of moving to a free roaming pasture is something dreams of made of. They walk about their enclosure moaning and complaining about their Income taxes, Property taxes, Sales taxes, VAT taxes, Gas taxes, Cell Phone Taxes, Cigarette Taxes, License taxes, Police Enforcement taxes, School taxes, Death taxes and every other tax that is levied upon them on a daily basis.

What they don't realize is that they could move to more friendly tax cow jurisdictions. I have to add that this is a possibility now, but I don't know when the window of opportunity will close. Many tax farms are increasingly making it difficult to move.

The top reason many tax cows, like myself, feel the need to move is because of high income taxes. I hail from the beautiful city of Rochester, NY. My former state thinks it is prudent to make its tax cows pay a hefty state income tax on top of the Federal income tax. The combined hit to my wallet made it difficult to survive off my income.

Then to make matters worse Rochester, NY (Monroe County) has one of the highest property tax rates in the United States. I was paying $2400 annually on a house value of $75K. After I compiled the numbers it made sense to leave that tax farm and head to friendlier pastures. Check out my old house.

Why Expatriating is a Good Idea for Tax Purposes.

If you feel like your taxes are way too high why not move? Most of you are probably not Americans and are lucky. You are fortunate to not be taxed on your worldwide income. This means all you have to do is literally move abroad. I don't know what kind of paperwork is involved for you but I imagine it is less complicated than myself and my fellow American tax cows.

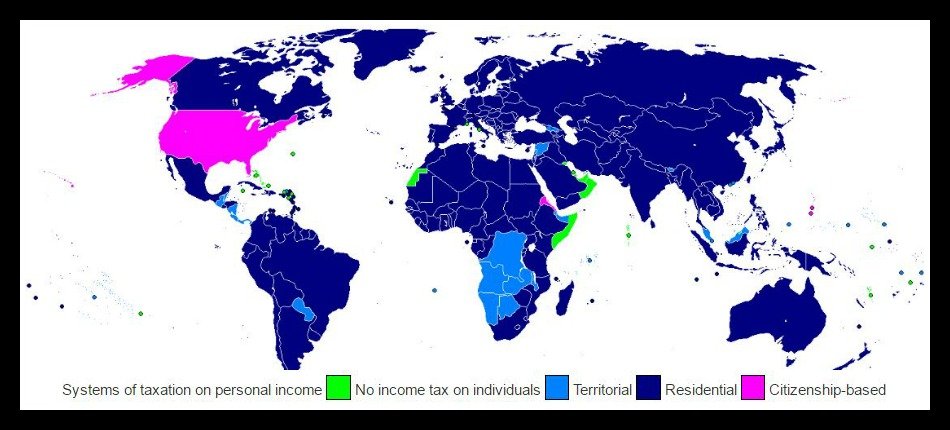

Did you know that Americans and Eritreans (East Africa) are the only two nationalities that I know of that are taxed on their worldwide income. This unfortunate rule makes it a little more difficult for Americans to find tax peace. I still have to file taxes. The good part is that I have a minimum amount to make before I am required to pay taxes.

Foreign Earned Income Exclusion

If you meet certain requirements, you may qualify for the foreign earned income and foreign housing exclusions and the foreign housing deduction.

If you are a U.S. citizen or a resident alien of the United States and you live abroad, you are taxed on your worldwide income. However, you may qualify to exclude from income up to an amount of your foreign earnings that is adjusted annually for inflation ($92,900 for 2011, $95,100 for 2012, $97,600 for 2013, $99,200 for 2014 and $100,800 for 2015).

Check the Chart on Wikipedia to See How Your Country Treats its Tax Cows.

You Realize it is Time to Make the Move.

So you decide that making the move to a more friendly tax farm is a good decision and you go for it. Well, most folks are like me and do not have a wallet that is overflowing with cash to throw at a lawyer. In this game having money to pay lawyers to handle 90% of your move is always nice. In the event that you are like me you will have to do a little more leg work.

This means many trips to government offices. Ever changing rules that will cause any normal tax cow to lose their mind. I have spent so much time in the Panama Immigration and other government offices that I actually need to mentally detox. I have an allergy to bureaucrats!

Part of it was my fault since I chose a path to Panama citizenship that was cheap but full of hurdles. I chose to do it through marriage but The Friendly Nations Visa would have been so much easier and only a tad bit more expensive.

Today I successfully completed my Panama Permanent Residency process. This is the second step on my way to getting Panama citizenship and eventually a passport. In three years I will be eligible for Panama naturalization. When I say there are many hurdles I truly mean it. Then ultimately the President of Panama will have to sign off my paperwork to request a Panama passport.

I am Just Thrilled to Be Legally Residing on a New Tax Farm and Before I Let You Go a Gentle Reminder, Taxation is Theft!!