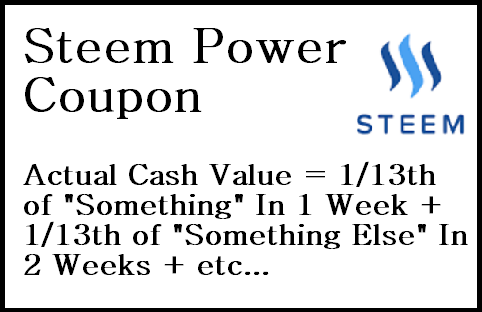

Steem Power literally has no immediate cash value. It can't be liquidated instantly. It's technically restricted such that you can only liquidate 1/13th, or about 7.6%, each week, starting with week 2. It's more like an unvested stock share or a coupon with no immediate cash value. You must wait 1 week to receive 1/13th of it, then 2 weeks to receive the second 1/13th, etc.

Therefore, Steem Power has no immediate liquidation price, and it is 100% incorrect to value it as income at the time of receipt at the current free market price. The IRS' own guidelines on employee stock options make that clear as well: "Taxation begins at the time of exercise." I would argue that for Steem Power, the "time of exercise" is Powering Down, and there are at least 13 "times of exercise", and that even if one wants to pay full income tax and maximize their tax liability on all their Steem Power earnings, they are likely still regularly overpaying their taxes.

This makes Steem Power different from most every stocks, bonds, physical assets and other forms of cryptocurrency. Even if we set aside the realities of the order book we discussed in part two here, and price Steem Power at the current Steem price, it simply is factually and mathematically not worth what the rewards payout says it is "at time of acquiring".

With Steem Power, I'd say the "time of exercise" is very clearly the moment at which your power down activates each week, resulting in you having an actual liquid and tradeable asset. This creates a situation whereby the burden of even correctly reporting ones taxes is almost too much to bear. When the bar for reporting one's taxes correctly becomes "You must be a Tax Lawyer, Accountant, Block-chain Technology Expert, Mathematician, and Logical Philosopher," we've reached the zone where compliance is ludicrous and almost any internally consistent reporting strategy will result in "good faith" clause protection.

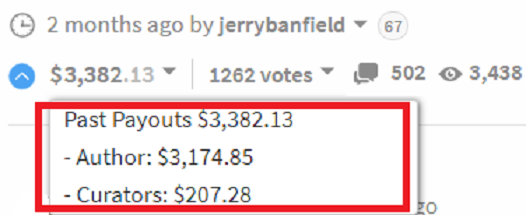

To illustrate the burdensome nature of attempting to value Steem Power, regardless of whether one intends to file it as income or not, I will calculate a hypothetical payout using a post from our positive friend, @jerrybanfield, whom is responsible for yours truly arriving here in the first place. We will be using the (soon to be shown fallacious) method of "valuing the reward payout at time of acquiring", thus temporarily conceding all arguments from part 1 and part 2.

For the sake of this post, we will assume this post was 100% powered-up (this actually simplifies the calculation process), but do note that this applies to all Steem Power rewards since half of the payout, at minimum, is always in Steem Power. Furthermore, I will be ignoring the curation cut, as this again simplifies our calculations.

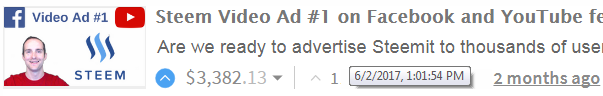

Here's our guinea pig post:

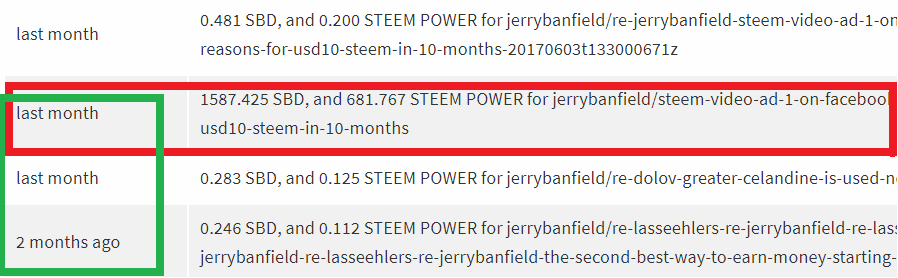

And the rewards:

And here's what Jerry is probably thinking of me right about now:

Jerry's post paid out rewards on approximately 6/9/17, as near as I can tell (without digging into the blockchain). That makes the approximate date of posting 6/2/17:

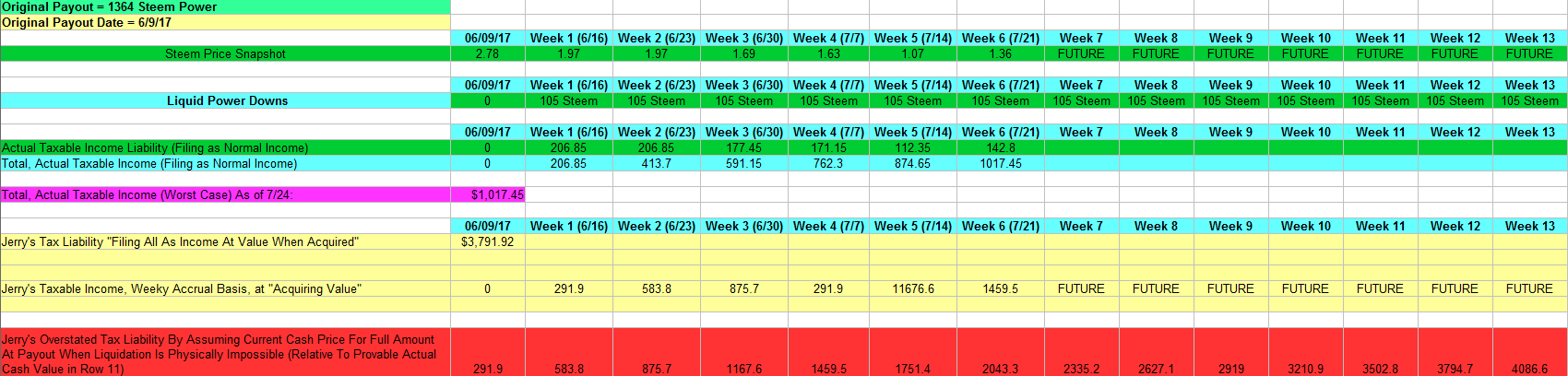

I doubled the Steem Power reward for this post and ignored the SBD, so we could assume a 100% powered up post (as noted above). This results in a payout of 1364 Steem. Using a Steem price from that day of $2.78, that results in a total payout of $3791.92. That's higher than the post tool-tip shows by $617 (+curation), likely due to different price snapshots on a volatile day, but the math will all work out. At the end, we will reduce our estimate of Jerry's overstated tax liability by 19.4% to account for this discrepancy. For the record, it's still possible after these adjustments that we will overestimate Jerry's over-payment. That's fine, we're not doing the man's 1040 here, we're illustrating overall concepts.

I will provide my work below, but for the sake of brevity, I will cut to the chase right now:

Using IRS-acceptable methods of determining tax liability that I believe would hold up to scrutiny, I was able to show that @JerryBanfield substantially overstated his tax liability. Further, this was done ignoring the arguments I put forth in parts 1 and 2 of this article series, and simply stipulating to a fact (that I do not agree with) that Steem Power rewards are regular taxable income. In other words, we deliberately avoided reducing our tax liability here and paid the maximum possible amount, like a "good tax-payer", and we STILL came in way lower than Jerry's (well-intentioned) math.

In his attempt to remain an upstanding citizen (and on the pain of the fear of imprisonment), Jerry's filing strategy under our assumptions came up with a taxable liability for this post totaling $3791.92 (less curation; post value discrepancy noted above). Since we can't hop in a DeLorean and get future price data, we are forced to look only up to the present time on an accrual basis. Jerry's strategy came up with a (pro-rated) taxable liability of $2043.3 (through week 6).

My strategy of accounting for the actual liquid value of the rewards once exercised (or even, exercisable), which I believe would pass IRS audit (except I didn't use 24h Steem price averages, just pulled snapshots), came up with a (pro-rated) taxable liability of $1017.5. That would mean that Jerry's accounting method overstated his tax liability by $2043.3 - $1017.5 = $1025.8.

Adjusting for that 19.4% overage we noted above, and I suspect that Jerry's accounting method has overstated his tax liability by slightly less than $825 so far, and we are less than halfway through his theoretical power-down period! This number could still double.

That's an 81.25% liability overstatement, an absolutely mammoth number! Some of that differential comes from valuing the rewards in the first week where they are not liquid, but even ignoring that, we are well over 50% overstated tax liability! Without knowing his tax bracket, Jerry could be paying upwards of 50% income tax on this post using his method, and I guarantee you the IRS isn't going to point out his error.

Further, I think you will all agree that this is an absolutely huge burden of tax calculation and no person can be expected to spend this kind of time attempting to determine their tax liability on every last post or comment they receive an award on. In fact, the reason I started constructing this series of posts in the first place was I watched 90 seconds of Jerry's tax filing video and immediately thought "Jesus, expecting anyone, but particularly creative types, to deal with this mess is a gross misuse of time and human resources."

I mean, look what I had to do to calculate half of one of Jerry's post's liability. This is half my day, shot, and it's not even totally accurate or been triple-checked yet:

@JerryBanfield , I hope some of this is useful to you going forward. You have 2 years from the time you have paid your taxes to file an amendment, so clearly every single Steemian still has over a year to figure this out for themselves. Everyone should find a tech-savvy accountant to run these suggestions by unless they are one themselves.

Stay tuned for part 4, where I hope to give my own take on a fair way to file one's Steemit taxes. Those that I haven't yet bored to tears will hear all about the excitement of "qualified dividends being taxed at the capital gains rate" and other potential filing options.

In a bonus part five, I hope to take questions and cover a few potential outside-the-box ideas for reducing tax liability that may not make it into part four. Island vacations and trust divulgments, oh my!

PS - The clever will have noticed that this phenomenon can work in reverse selling into a strong bull market. This is just one advantage that stock options have - you do not value them until they are exercised, and therefore, you choose when they become taxable by your own actions. That's why you don't pay the value of the stock options right when you get them, but when you exercise them.

IMPORTANT NOTE: I do not advise making tax decisions based on this post. The IRS is an unconstitutional organization that most closely resembles the authority of a fascist state. You don't want to be a trend-setter in this area. I expect that anyone attempting to justify large amounts of Steem Power earnings using these arguments will be bullied and potentially jailed. You must maintain a consistent tax reporting strategy that is internally logical and consistent if you wish to rely on the "good faith" clause to avoid penalties in the future:

"IRC 6664(c) provides a reasonable cause exception to the penalties under IRC 6662 and IRC 6663 where the taxpayer had reasonable cause and the taxpayer acted in good faith. The reasonable cause exception in IRC 6664(c) applies to all of the components of the accuracy-related penalty on underpayments and the fraud penalty, except for any portion of an underpayment that is attributable to one or more transactions lacking economic substance as described in IRC 6662(b)(6), or that is attributable to a gross valuation overstatement with respect to charitable deduction property. In addition, there are special reasonable cause rules outlined in IRC 6664(c)(3) for certain substantial valuation overstatements."

Tag @exyle, you're it!

IMPORTANT NOTE AGAIN: I AM NOT (CURRENTLY) A PRACTICING ACCOUNTANT OR ATTORNEY. YOUR TAXING AUTHORITY IS PRACTICALLY ABOVE THE LAW. PROCEED AT YOUR OWN RISK WITH ALL TAX LIABILITY REDUCTION STRATEGIES. DO NOT BE THE GUY IN JAIL BECAUSE SOME DUDE WHO PHOTOSHOPPED A POSTER OF MICHAEL J. FOX'S ONLY CLAIM TO FAME RANTED ABOUT TAXES TO YOU ON SOCIAL MEDIA. GEORGE TAKEI IS (STILL) NOT A LEGITIMATE SOURCE FOR TAXABLE INCOME CALCULATIONS.

Apologies for any math errors.

Copyright: Parker Brothers, Back To The Future, Jerry Banfield, UK NHS, 3rd Rock From The Sun

Sources: IRS Site, Wikipedia, Investopedia, Imgflip, A Bunch Of Education(tm)