( )

)

Like 50 Cent said, Get Rich or Die Trading.

This guide is for everyone who's ever wanted a basic "how to trade guide" to learn the ropes. Please bump this if you enjoyed it.

In March 2016, when Ethereum was $10, I wrote this on the Ethereum Forum, a thread that got 100,000 views:

"My advice to everyone is and take it with a grain of salt: .

You have a chance, a small chance, if you play your cards right, to get filthy rich. For example, there was one year where $100 of litecoin was worth $30,000 AFTER ONE YEAR. What you do now with your ether is up to you. You can horde it and hope (it will.. trust me it will go up so friggen much that it's going to blow your face away) it goes up. You can sell it right away or use the extra capital for trading crypto.. the choice is yours.

But just remember that Ethereum is HUGE. This is the biggest thing to happen on the internet in the longest time. How much you believe in Ethereum versus how much time you can afford to wait will determine what you do."

The best thing I've ever done in life was TAKE MY OWN ADVICE ABOUT ETHEREUM.

Follow me on Youtube for my 9K in 90 Days Challenge starting with $200. Follow me on Twitter and Trading View too!

Youtube - https://www.youtube.com/user/philakone1

Twitter - https://twitter.com/PhilakoneCrypto

I remember two years ago when I first started trading. I was overwhelmed with the information out. So, here is the universal guide for all beginners that is proven to work time and time again. I highly suggest to study risk management, which will be a blog I'll touch briefly on soon.

Remember that we’re all in different stages of the game. Some of us just heard about it this year and are now curious because of the allure of making huge profits. While most of us reading this right now are enthusiasts, like myself, who’s constantly striving to learn, improve his kills, rid of arrogance and stubbornness, all for the grand goal of making profit. How can we do this? By sharing ideas and improving the community. Take what we’ve learned and pass it on, while filling our insatiable appetite to devour knowledge and grow further.

This is a guide solely intended for new audiences trading Bitcoin, where technology and politics are set aside.

"Dont predict the market. React to it."

The bulls make money. The bears make money. And the pigs get slaughtered.

Do not trust anyone’s advice except your own and put in the hard work. Remember, we’re all competitors at the end of the day and every time a trader profits, another trader loses.

Here's the most simple and detailed guide to trading on the internet:

Before I begin, I want to highly emphasize that trading is ruled by fear and greed. If it were easy and only the smartest people were successful, everyone would be doing it. Even the smartest guys lose money. Why? Because this is a game where your emotions MUST be controlled. You MUST exercise discipline, caution, and patience. You MUST make your own decisions, do the research, and perform the technical analysis.

Learn the necessary skills emotionally and technically to succeed. The emotional part of trading is not discussed much, but know that it’s just as important as the technical aspect. Stick to a strategy, eat, breathe, and sleep it while checking your emotions at the door. Do NOT panic my crypto friend, we will overcome the learning curve with ease.

Choose your trade platform, set up your screens, pick a few indicators

I trade at http://bitfinex.com/ and am a very happy customer.

Trading View charts built in. Best charts you can get. Unlimited saves.

Clean and customizable platform

Margin trading to leverage 3.3X

Constant improvements and new coins added

High liquidity

Can trade /ETH/USD/BTC

Visually easy on the eyes

I have to admit there’s sometimes lag and orders don’t execute how you want them to, but every exchange has their issues and we can’t expect perfection. Deal with them as best we can and reserve our emotional energy because after all, trading is all about managing our emotions.

Here’s my setup on my main screen.

Remember that screen space is real estate. You want to have as much as possible in an ideal view to prevent neck and eye strain. My recommendation is at least 2 monitors. Some people may need more, and some less. It just comes down to what you need to monitor and personal preference. My other screens are a bunch of charts in different time frames of other coins, and another for social media/entertainment.

The most important things to have is the level 2, which is also known as the order book / trades. This let you see in real time momentum changes and potential walls. Also, you MUST have your order form readily available to execute quick decisions.

The time frames you monitor is dependent on what type of trader you are and what time you can allocate. For example, if you have a full time job, day trading on a 5 or 15 minute chart may not be for you as it requires too much time. Though a good choice would be to trade on a daily chart if you can only make a few trades a week.

For myself, I’m a day trader so I have 5, 15, and 30 minute charts up usually. Sometimes the 1 minute and 3 minute chart when precisely timing my entries and exits.

Be sure to familiarize yourself with all the tools and layout of your exchange. Know what everything is and be one with it. It’s important to ask yourself what kind of trader you want to be. It comes down to do you want to look for new opportunities with new coins or trade high liquidity and market cap coins like bitcoin, ethereum, and litecoin, or maybe a combination of everything.

I personally trade Bitcoin, OmiseGo, and Ethereum. These are the 3 coins that take up a large portion of my portfolio. It’s good to familiarize yourself with a few coins only so you can become experts by knowing their pattern and chart history. I don’t waste time looking for ICOs (initial coin offerings, like when a stock goes public, but here a coin) because most of them are scams. Nor do I care about what happens to them 6 months from now because I’m a day trader.

INDICATORS - RSI, MACD, Moving Average

There are pros and cons of all indicators. Some swear by some, some swear by others.

When you read a large majority of technical analysis, you’ll find most of them reference these indicators. So it’s good to speak this language and also understand what these indicators are, how they’re used, and general strategies.

Let’s learn them quickly, but properly.

RSI – Relative Strength Index

This is a measure of momentum and how much strength it has to go up, sideways, or down. It’s a indication for momentum shift when combined with watching the level 2.

Generally speaking, BUT NOT ALWAYS:

If the RSI is under 30, it’s OVER SOLD. As it approaches 30, be cautious as a reversal may happen soon to the upside.<

If the RSI is over 70, it’s OVER BOUGHT. As it approaches 70 and above, be cautious as a reversal may happen soon to the downside<

As it flattens out, it loses strength (called convergence) It has to reach a higher RSI than the previous high to have momentum to go higher. And vice versa on the down side.

This doesn’t mean it’s always going to bounce off 30 or 70. In my opinion, for a very strong bullish push, it MUST reach the 80s, and for a very strong bearish push, it MUST reach the 20s.

Here’s OmiseGo reaching 10 RSI, which is a very strong downtrend. Notice that it was already at 30? Most would “assume” a bounce off it, but always be cautious.

A general strategy that can be used on a high time frame chart such as 6 Hour on OmiseGo:

1 - buy when the RSI is near 30 and bouncing off it, and sell it when it nears 70 and bounces off it.

2 - short when it’s near 70 and bouncing off it, and buy in when it nears 3- and bounces off it.

This alone would actually make you REALLY profitable. Let’s look at OmiseGo over the last month using this strategy alone.

Betting that a market is going up is just half of trading! You can also bet on the market going down called shorting. Long means you’re betting it goes up, and short means you’re betting it goes down (margin trading)

A – Short at A. Close at B

B – Long at B. Close at C

C – Short at C. Close at D

D – Long at D. Close at E.

In hindsight, it’s easy to say we can do this because we see the charts. Though, I must emphasize to look for the flattening out I’ve mentioned and highlighted above. This is called. convergence. This is a very strong indication that the momentum is lost and a reversal is likely to happen.

MACD – Moving Average Convergence Divergence

Now that we have a basic understand of RSI, let’s combine with MACD. The MACD is a momentum indicator that shows the relationship between TWO moving averages.

BUY AND SELL WHEN THEY CROSS

A - Short at A. Close at B

B - Long at B. Close at C

D – Long D. Close at E

E – Short at E. Close at F

OmiseGo Example on 3 hour time frame

Litecoin 3 hour time frame

I can’t emphasize how basic of a strategy this is, but how successful it is. Sometimes as traders, we forget about the basics and let our emotions ride us. Stick to the fundamentals, be consistent with your strategy, check your emotions at the door, and understand price doesn’t change instantly will allow you to ride out the shorts and longs just like this.

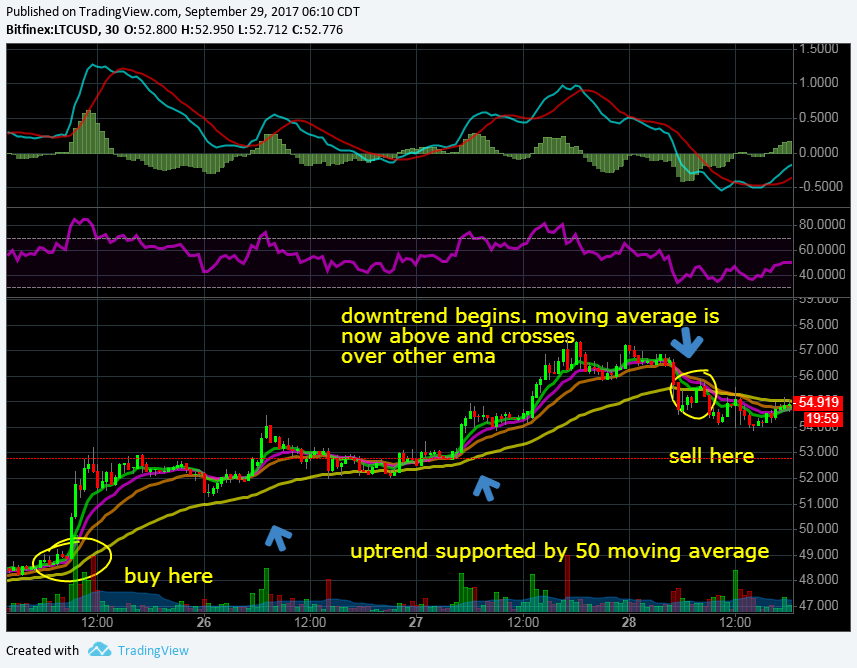

EXPONENTIAL MOVING AVERAGES

I use exponential moving averages , 8, 13, 21, and 55, which are tuned to Fibonacci numbers. The general strategy is this:

Go Long when the moving averages cross, with the 50 moving average BELOW all the others. Ride the wave until they cross again and the 50 moving average moves to ABOVE the other averages. One will argue “well we should’ve sold it at the very top.” In hind sight, yes it’s easy to say that we we never know when the actual top is. Once more well versed, you can combined the moving averages with the MACD and the RSI to align the stars.

Let’s look at Ethereum

Let’s look at another example of Ethereum

And another exmaple of LiteCoin

What we're looking for are reasons to enter a trade and reasons to exit a trade. The more green lights we have, the more we can rev our engines and let loose.

I hope this gave people a quick overview of some general strategies that can be used when trading. The best advice I can give to anyone is to back test your strategies. See if they would've worked on previous setups. Remember to look to the future, we have to first look into the past.

I also have tons of video content on youtube. I started a video series of "How to make 9K in 90 Days with $200."

Please don't hesitate to ask any questions and I'd be more than happy to help. I'll go over my strategy and thought process in high detail, with clear explanations that anyone can understand.

A video of all all my trades live will be posted daily. I'm very active on Youtube and twitter constantly sharing ideas, so definitely subscribe as I'd like to help out.

Youtube - https://www.youtube.com/user/philakone1

Twitter - https://twitter.com/PhilakoneCrypto

Post any questions here and I'll answer as thoroughly as possible with respect and patience.