Contribution in community

In the last two weeks(sorry about missing last week's report), I was researching solutions on @asshole issue, and posted Engagement-based Reputation System. Although this post didn't get much attention, I hope more people read it and will trigger productive discussion on our reputation system.

Another thing I did is creating BSIP(Bitshares Improvement Proposal) about Smartcoins on BitShares, which was evolved to Steem Dollar, and I am planning to develop an idea for SBD as well. From my perspective, SBD already resolved the problem what I pointed out on Smartcoins but I think it has another type of problem.

Technical contribution

I also uploaded source code SBD market making bot running on the internal market(Github Source). Voting bot is also upgrading but I have some difficulties to find out annoying bugs. I will upload it once I resolve them.

Policy

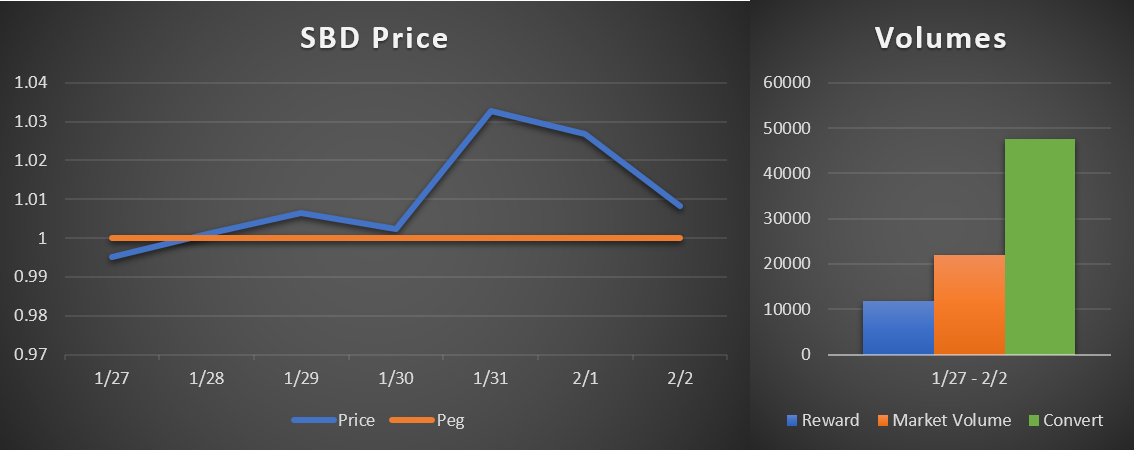

I decided to regularly update SBD stats in my witness report to provide useful information and help other witnesses to decide their policies.

According to Coinmarketcap, last 7-day SBD price was between 0.995 to 1.032 and above $1.00 except 1/27. Total converted SBD was almost 4-times than created, and market volume was in between. Given this situation, my judgement is there is no strong reasons to totally remove interest nor apply feed discount. More specifically,

- SBD price is greater than $1 -> rejects guideline 2 and 3

- However, SBD is not consistently trading above $1 yet (but seems becoming) -> rejects guideline 1

- SBD conversion is not inactive -> rejects guideline 4

So I will keep interest rate at 2.0% and no price feed adjustment.

But account creation fee is lowered from 30 to 20 STEEM based upon discussion with the devs.

Appendix: Suggested guide for SBD policy

1.If SBD > $1.00, then no interest

Any time SMD is consistently trading above $1.00 USD interest payments must be stopped.

2.If debt ratio is low and SBD < $1.00, then more interest

If the debt-to-ownership ratio is under 10% and SMD is trading for less than $1.00 then the interest rate should be increased

3.If debt ratio is high and SBD < $1.00, then feed discount

If SMD trades for less than $1.00 USD and the debt-to-ownership ratio is over 10% then the feeds should be adjusted upward give more STEEM per SMD

4.If debt ratio is dangerously high and inactive SBD conversion, then feed discount (the expressions are somewhat subjective)

If the debt-to-ownership ratio gets dangerously high and market participants choose to avoid conversion requests, then the feed should be adjusted to increase the rate at which STEEM paid for converting SMD.