In this second of three parts, @dragosroua’s and I talk about the dollar value of Steem, some of its technical aspects that are superior to other blockchain technologies (including both Bitcoin and Ethereum), the arbitrary split of rewards, his new project Steem.City, and much more. If you missed it, you can read Part 1 here.

What can you say about the volatility and potential of Steem?

Dragos: I don’t know if you were here to notice the big swings that started in July last year. Steem was as high as $4. People were cashing out like $15,000 for one post – that was amazing. Basically, it went down from there as a lot of initial investors – there as one guy who invested 400 bitcoins into this, which is a lot – a lot of them got screwed, so they sold pretty quick. It was then very flat for a few months, and then around February or March it got to 8c for 1 Steem. But from there it got back to almost $2 in June. We’re talking about 20x in a window of 2 months. This happened in one year.

It’s normal to have this variation in the initial stages, but what this tells me is that there is a lot of potential. We’re not talking about variation from 10c to 12c… we’re talking about 8c to $2.

I’m on Coinmarketcap and seeing $2.50 for June 7th. That’s phenomenal.

Dragos: Yeah. I think we are at the beginning of a new rally. Time may contradict me, or not, but by the end of the year we may get a little bit higher than June.

I want to ask you about that – about the actual dollar value of Steem. There’s talk of it reaching crazy heights, like $10 by January, but those claims are never backed up with convincing reasons why. It’s not based on any fundamentals, but rather what they want it to be. Maybe even attempts at hype-generation to get people to buy now.

Dragos: OK, so the fundamental reason that the price of Steem will be high is that people will see it as a store of value. The first reason is that the Steemit blockchain as a technology is, believe it or not, more advanced than Bitcoin’s or Ethereum’s.

I’m running witness and seed nodes for almost a year. I know how the blockchain works as I’ve compiled it many times and did the replay of the blockchain many times. I’m monitoring my witness node about half an hour every day or else it doesn’t work, so I know how it goes. First of all, you don’t have transaction fees. This is something that is fundamental.

And they’re super fast as well.

Dragos: Yes – so the transaction goes from one user to another super fast, but it’s also super fast in terms of the number of transactions it can encompass. It can have thousands of transactions per seconds. And I’m not talking about hype… it is based on Graphene, which is the engine that powers Bitshares and PeerPlays. You’ve got three blockchains based on the same engine that Dan Larimer built.

They tested Graphene on Bitshares in a public stress test a couple of months ago and they got up to 4,000 transactions per second. So, first of all is the technical side of the project. The technical side is good – far better than other technologies. In my opinion, it’s better than Litecoin! It’s better than Monero, it’s better than a lot of others.

So you’re saying that in terms of doing what Litecoin or Monero do, Steem would actually be better at delivering on what their value proposition is?

Dragos: Exactly. Now, the second reason is that the platform itself is going through some very important scalability issues right now. Running a seed node requires close to 100GB of RAM right now. The seed nodes are broadcasting all transactions, including posts and other stuff.

The witness nodes are less – between 15GB and 20GB of RAM required – and are much easier to do. But if you want to run a service like steem.supply that I wrote, you have to have a seed node, which I don’t have at the moment but am in the process of building one.

So, they are working on this, and very close with the Github development. We’re coming to some amazing resolutions: basically, Steem as a piece of technology will be divided into a few parallel blockchains that will each validate a certain type of transactions.

OK so there’s upvotes, there’s posts, there’s transfers of Steem or SBD – what kinds of things require different kinds of blockchains?

Dragos: Well, each and every blog post or comment is held in the blockchain. So, probably the storage could be moved to IPFS or other storage technology. It could be moved into a separate blockchain powered by Graphene as well, requiring a different type of storage.

Right now, everything in the Steemit ecosystem is a type of transaction. When you post something, it must be included in the block as a huge pile of characters. So if you want to keep all the history, you end up needind 100GB, and the conundrum is that the more people you have, the more RAM you need! If you grow, it’s going to be exponential.

So, I know for sure that they are solving this scalability issue which is fundamental from a technology point of view.

There are also two very important developments, one of which is often overlooked: the arbitrary split of rewards. In the blockchain there is a piece of functionality – a certain type of transaction – when you publish a post there’s a parameter where you can say, “I want 10% of whatever I make to go automatically to this user, 5% automatically to that user” and so on.

I’ve only ever seen it that I want, say, all in Steem Power, or 50/50, or no rewards – you know, the standard options when posting something.

Dragos: This is very hidden in the blockchain structure. You can do it with a cli_wallet if you want, or in a library like Javascript. This feature is already used by at least three apps in the Steemit ecosystem at this point. These apps are eSteem, where 5% of whatever you make, is going to that app. There’s also busy.org, and then there’s chainBB, a forum using between 8 and 15%.

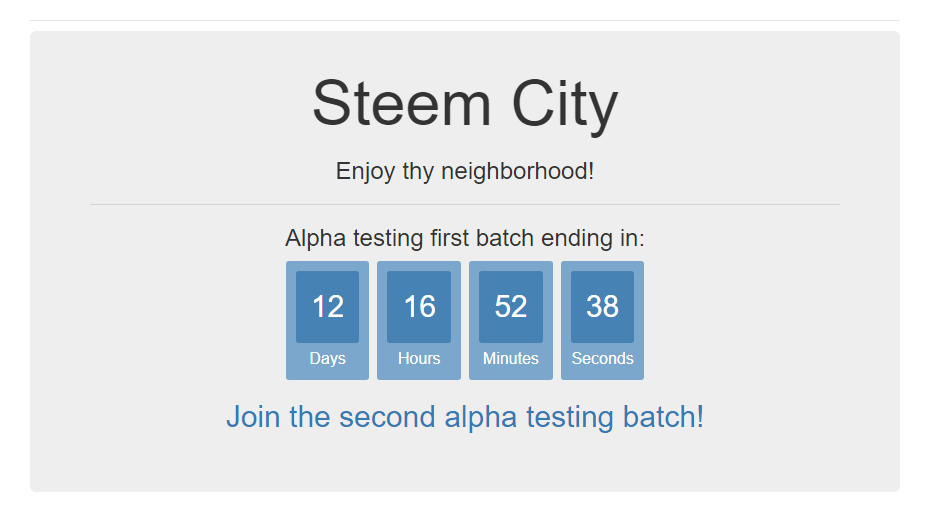

One of my projects I’m working on, called Steem.City is going to take advantage of that. Steem.City is basically a tool for creating specific communities. It takes this to the next level. When you go in to Steem.City you create a community which is a layer of functionality on top of Steemit. It’s basically an app separate from Steemit. You have all the Steemit users that join your community, and you start to post in that community, and it’s sort of a Tumblr blog and you can see what all the other people are publishing in that community.

You can learn more about Steem.City by joining the alpha test – just sign up to its Slack, linked from the site.

The beauty of it comes when you get to the algorithm of rewarding. You have three ways of rewarding people: you can be 50/50, where all the people that are writing there take 50% for themselves and donate 50% to everyone else. This is something that will incentivise people and increase engagement. Right now there is very little you can do on Steemit for a collusion factor other than licking Whales’ balls! (laughs) You understand? So people are focusing on this right now – I know people who are actually waking up through monitoring the time window when Whales are active on Steemit and when they might upvote them!

So, this is absurd – firstly because it is not scaleable. There are only so many whales, so let’s create some whales-on-demand by building strong communities that grow together by colluding with themselves. I did a few simulations and anywhere between 50 and 150 members in this community can create the effect of a whale. That’s one idea that I believe will also contribute to Steem as a store of value.

So that’s one thing. The arbitrary split of rewards will also incentivise developers like me, like @good-karma of eSteem or @jesta of chainBB, to create new applications on top of Steemit. That, strategically thinking, is a very good approach. It’s not monolithic where you have only Steem.

One other thing that is often overlooked is – and it’s quite a technical thing – is that you will be able to build out your own assets on the blockchain. As in, user-issued assets. Like you can create a token on the Ethereum blockchain right now, you can also create a token on the Steemit blockchain. This is something that is already doable because Bitshares already does it. I have one of my coins issued as an asset on the Bitshares blockchain, so I know it is possible.

Once they have gotten rid of the scaleabiity issue, I know this is one of their priorities. Ned was quoted saying that in an interview maybe three months ago, so I am sure that is going to be really interesting.

So, if you put together the ability to create different communities with arbitrary splitting of rewards, and creating user-issued assets on the other side of the blockchain, now you see that Steemit is evolving into something that is better than Bitcoin or Ethereum. It doesn’t have the hype, it doesn’t have the adoption and it doesn’t have the age. I’m very aware of that, but that’s why I think it’s going to be 2.5, maybe 3x its current value by the end of the year – and not $4000 like where Bitcoin is right now! (laughs)

Sure – now, I was talking to one of the team members of Ubiq and there are actually reasons why in some ways it’s better for its value not to go too high. Is there anything like that in terms of Steemit?

Dragos: I don’t think from a philosophical point of view that the value of Steem will be as high as Bitcoin because there are fundamental differences between the two from a financial point of view. Bitcoin is deflationary, Steem is inflationary. Everybody knows that there will be a limited supply of Bitcoin, and that usually increases demand.

But, Steemit is inflationary. There is 43,000 Steem ‘printed’ every day, so it is something that will be more available to the masses for as long as it goes, and it will be something that will set the baseline for the value of social media interaction. It’s not going to be like the premium hype that you see on Bitcoin, because if you have a highly inflationary currency you will never see the price very high. You will see it very liquid and very available.

I think that’s the way in which we should consider Steem. It’s not going to be like a jewel or something like that, which nobody will have in 10 years. Everyone will have it in 10 years and it will be very liquid, very affordable and everyone can use it – stuff like that.

If you look purely from a financial point of view and begin to make the speculation, if you have an increase of say 10x, imagine what it would look like when you have 43,000 Steem created every day and you sell it for $10, that will be almost half a million dollars printed every day. So, what will happen with this given the very broad distribution of the holders is that many holders at the ends of the leaves of the tree will start selling it – and the more you get, the more you sell, the more you get, the more you sell, because there will always be supply.

No matter how much or how high you get, there will always be people at the end of the tree that will sell it for a quick buck because they know that tomorrow there’ll be more. So you see purely from a financial point of view, it’s not possible to get as high as, say, $100.

And if you’re coming to Steemit hoping to retire in 5 years on your 100 Steem, well, you’re doing it wrong. You’re thinking about Steemit wrong.

Dragos: Oh, no! You know, there’s a very interesting part of the Steemit blockchain is the Steem Power thing. It motivates and incentivises you to stay in the platform and accumulate SP in order to draw more from the reward pool every day. So, you may retire in such a way that it’s an active retirement in that you have all this SP but if you’re not using it, it’s useless! (laughs)

So you delegate it to an auto-upvote bot and you put your feet up!

Dragos: Yeah, there was a time when it was profitable to delegate it to a voting bot, but not anymore. I have been there, I ran my voting bots, but no. You have to make it very, very smart and you have to have a lot of SP behind you to make it worth it to build a very AI-enhanced bot, because right now you have only 10 votes and you have to really calculate how exactly you get there.

Your SP would be a way to keep you involved and active in the platform. You know, you won’t retire on 100 Steem but you may retire actively with, I don’t know, 500,000 Steem and you just vote once or twice per week in a way that will keep that from devaluing!

Thanks again to @dragosroua for such an engaging and in-depth discussion about this platform. In the third and final part, we look closer at some of the problems facing Steemit, and what should be done about them.

He also wrote a great post expanding on his thoughts about the rising Steem price, which you can read here:

3 Reasons Steem Price Will Go Up - And One Reason It Will Not Reach The Moon

You can check out @dragosroua’s posts, vote for him as witness, and visit his website at http://dragosroua.com/. Curious about when your next Steemit payments are due? Check out his app at http://steem.supply/

Previous:

Interesting People #21: Dragos Roua on his journey to becoming a Steemit witness

Next:

Interesting People #23: Dragos Roua on Steemit’s problems, and what we should do about them