The more I've looked into Banx (a group of companies led by Mark Lyford), the more convinced I am that it was a pure scam. There is no way it could have been legitimate business. Lyford has been lying, deceiving and misleading people the whole time.

Just recently one of Banx's investors, Phil Winfield, joined Steem and warned others about Lyford. I wrote about Banx already once, but no that I have been digging into this case more, I thought it might be a good idea to do a follow-up.

If you want to know more what Banx was supposed to do, check their prospectus. Some really grandiose plans in there.

July 2014

In this video (recorded 18th July 2014) he tells his investors that public selling is not permitted.

Practicly, what does that actually mean, it means we can't go online and offer shares to the public. But we can raise as much private investment as possible.

October/November 2014

Lyford was selling Banx Shares in C-CEX (later it was also added to alcurEX). So basically he is breaking the law already at this point. Apparently he wasn't able to sell shares to private investors so he started selling them in cryptoexchanges which means he was offering them to public. Chatlogs with C-CEX show without a doubt that it was Lyford himself who was selling the shares.

By this point it should have been clear to Lyford that he is not going to get the funding he is after. Private investors are not interested, and neither is anybody in the cryptoscene. According to the chatlogs, Lyford was very disappointed because there was so little demand for Banx Shares.

Every real businessman would have drawn the conclusions about the situation. If it was necessary to get enough funding to get things really running, the plan wouldn't be successful. There just wasn't enough money coming in. Lyford should have close down Banx at this point. But he didn't.

Instead of returning the money back to investors, he kept the "business" going. He knew he had to deceive potential investors to give him more money. If he had been honest about the situation, nobody would have invested more money.

In this chat Lyford is pissed off because C-CEX is letting free markets to set the price of Banx Shares to lower than Lyford is selling.

[15/11/2014, 18:33:11] Mark Lyford: YOU ARE LISTED ON COINMARKETCAP.COM

[15/11/2014, 18:33:20] Mark Lyford: thats my issue

[15/11/2014, 18:33:25] C-CEX.com: oh, let me think

[15/11/2014, 18:33:28] Mark Lyford: if you were not on CMC I wouldn't care

[15/11/2014, 18:33:41] Mark Lyford: fundamentally thats the issue

[15/11/2014, 18:33:44] C-CEX.com: so investors look coinmarketcap and make headake because of this?

[15/11/2014, 18:33:56] Mark Lyford: the trading of 1/4 of share price on your exchange effects my price on CMC, bottom line, thats the issue

[15/11/2014, 18:34:08] Mark Lyford: yes all my private non crypto investors look at CMC

[15/11/2014, 18:34:10] Mark Lyford: thats the issue

[15/11/2014, 18:34:20] Mark Lyford: they see shares being sold for 33 cents on your exchange

[15/11/2014, 18:34:26] Mark Lyford: they question, and it brings the price down

[15/11/2014, 18:34:30] Mark Lyford: bottom line thats my issue

[15/11/2014, 18:35:14] Mark Lyford: without us raising the money from private investors ( nothing to do with crypto traders etc) normal business people we have no business until we get the funding to pay the real profits we want, the profits we paid last week are just a small amount to what we want to be doing

So basically his plan at this point is to get Banx Shares ranking to go high in Coinmarketcap.com so that he can show it to private investors and deceive them to think that Banx is a successful business and give him more money.

28th November 2014

Banx Shares are moved to a new blockchain. Although from a cryptoperspective, this is done very badly because the process isn't automated. Lyford has stated that most of the shares were transferred to the new chain, apparently manually, but he hasn't shown any evidence for this. I haven't even seen any accurate information about how many shares actually existed at that time.

Correct way to handle the situation would have been automated transfer process, where shareholders send their share from the old chain to the new (something like Bitshares did when it was updated to 2.0).

The new blockchain and price manipulation

When the new blockchain was running, no other exchange could list Banx Shares except Banx.io, which happened to be owned by Banx.

So the question is: Did Lyford continue to manipulate the price to get more money from investors? Everything suggests that he did.

In June 2015 people started to wonder how it's possible that Banx Shares are so high at Coinmarketcap.com. They started doubting if the volume is real what CMC was showing. Lyford's answered:

We believe in open communication and transparency which is why we are responding to this post. Thank you for pointing out your concerns but, as we will demonstrate, the suspicions raised here are unfounded.

After the evidence was clear that the volumes of Banx.io and CMC didn't match, Banx was forced to admit that there was some problem. But instead of admitting that they lied, they just claimed it was a bug and fixed it.

Allen Byron Penner aka ByronP

The guy who was running Banx.io exchange was ByronP:

The exchange may say Banx on it but it is still me writing the code and running it of which history has shown I don't play games and would not have anything to do with any company that is just out for a dollar.

Given that in his communication with C-CEX Lyford was very clear that he wanted to manipulate the price, it's really hard to believe that he wouldn't do the same thing in an exchange that he owns himself.

At the end ByronP had to fix the price API where CMC got their data because it was so clearly wrong. It's also really hard to believe that ByronP was totally unaware of Lyford's need to manipulate the market price. That's why I'm assuming that ByronP was the one that actually manipulated the price feed of Banx.io. Lyford himself seems to be incapable of doing anything so complicated.

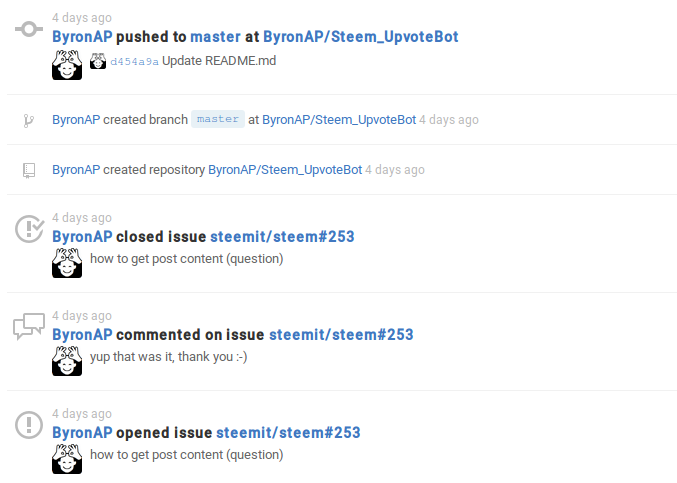

By the way, I happened to notice that Byron is doing something with Steem currently. Not sure if that is something to be worried about, but maybe somebody should keep an eye on him. Upvote bot from a scammer doesn't sound nice.

Quantity of shares

I'm not fully aware how the quantity of Banx Shares has changed over time. Apparently it started with some premined/preissued shares and more came into existence with mining. By moving to the new blockchain it was changed to proof-of-stake and mining wasn't possible anymore. I think it was around 6 million shares that existed when the new blockhain was made.

Somewhere along the road the amount was doubled to 12 million. In 2016 it was increased to 120 million.

I haven't seen any reasonable explanation for this. So it's quite obvious that it has been just another trick to make market cap look bigger. Of course the price of one share didn't go down because Banx owned the only exchange where it could be traded.

Investors are very disappointed and police is investigating the case

Re: Are BanxShares as good as GAW Paycoin? April 23, 2016, 01:50:31 AM:

Here's something that all of Lyford's investors should be looking at, what exactly has he closed down?, there are no formal filings with companies house that I can see so perhaps all he has done is turn off the website & turn his back?, is he naive enough to think that this will suffice?

Then the question arises, what entity exactly sold the shares to the investors>, was it Banx Ltd?, if so than a formal liquidation needs to occur with a full winding up process undertaken with final tax returns filed,

or was it Mark Lyford as an individual? in which case, given that you cannot liquidate an individual if he cannot repay the investors he will need to file for personal bankruptcy (again), this will be a good thing as it will kill his directorships of any other company he may be associated with & offers the investors the opportunity to pursue adversarial proceedings against him to deny him bankruptcy protection from his debts,in other words, kill his credit for at least 20 years,small token,

something to watch

Re: Are BanxShares as good as GAW Paycoin? April 24, 2016, 12:29:55 PM:

a UK based investor managed to track Lyford down yesterday via 'phone, Lyford agreed to meet the investor to offer an explanation of what had caused the problems & a way forward, no one will be surprised to read that Lyford was a no show, no explanation no excuse he simply didn't turn up, he is a sociopath, he simply does not care about anyone but himself & he will do whatever it takes to get what he wants, he has hurt a lot of people & it means absolutely nothing to him, now the situation is that he sees himself as the victim, after all he has done for everyone!!

anyway, the investor went straight to the police & filed a complaint, best thing he could have done given the circumstances,

Re: Are BanxShares as good as GAW Paycoin? April 25, 2016, 06:30:21 PM:

"I know Mark didn't set out to scam everyone"

well,maybe not "everyone" but it's close, for my part I know that he stole $30k from me & tried to grab an additional $150k during 2015 & into 2016,in my opinion what he presented to me was pure fabrication from day one, the profits that were allegedly being generated and which he added to my balance statements (giving me a total declared value of $52k in Dec 2015) were bogus & had never been achieved by any legitimate means, (net value today $6.41...........maybe!)

The sheer length of time that Mark kept this scam running could very well be his undoing, there is no logical,sensible or believable explanation for what he was doing or why, we have a total mix of initial inducement to misrepresentation to bogus profit shares to a total lack of fiduciary duty,

It now appears that the folks who were assisting him are scrambling to make distance, I only dealt with Mark Lyford, I had no involvement with ByronP or Simon & I do not know who they are but it's telling that both have now made statements on this forum basically saying "nothing to do with me Guv"

Re: Are BanxShares as good as GAW Paycoin? April 27, 2016, 11:31:27 AM:

As of now I have managed to connect with 7 of Lyfords investors, we are uniting to lodge formal complaints with various authorities, is there any other investor out there that may want to join in?, you can message me via this forum,

I have to say that after talking to my fellow investors that this situation is nothing at all to do with bad luck, it has nothing to do with the world not being ready for Lyford's business, it has everything to do with it being a concerted effort by a morally bankrupt Lyford to scam as much money as possible from wherever he could get his thieving hands on it, he has lied & misled everyone, he is even now still trying to buy time to avert any negative action,

If you are an investor or anyone here knows of anyone that has opted to believe in Lyford at this late stage & to give him time to make things right, get in touch, share your experience, you will find that he is not legitimate, he has no plans to make anyone whole, I'm wondering where the off-shore money is stashed & just when he will hightail it out of Dodge,

Lyford is a con, it is that simple,

Re: Are BanxShares as good as GAW Paycoin? April 22, 2016, 11:47:09 AM

He deleted his post on Facebook and therefore all the comments that went with it.

I saw four of the comments he got before it was deleted:

Begin copy/paste from FB

Commenter number 1

Think you should hold your hands up and be a bit more truthful Mark. Half a million dollers investment and u created fuck all. Most investors are going to be wondering where the money has gone coz i believe you used Banx shares to pay for the exchange and other services etc. It was only one month ago you were mivering me for more money for investment when you know the company had already collapsed. I can honestly say the trolls were 100% correct, you were running a ponzi scheme and u were caught out. Everything they said was true and the worst scenario for investors has come to pass. I think you owe investors some detailed transparency of where the funds have gone coz as i've said u created next to nothing with alot of money. I hate to say this but its true, your monthly updates in videos etc have proven you to be either full of shit or your living in some kind of dreamworld. I hope you do the correct thing and produce some legitimate transparency where investors can see that you have'nt spunked the investment on other things. Most people as you said yourself invested in you, what a mistake this has proven to be

Commenter number 2

I couldn't have put it better myself

Commenter number 3

Well said Commenter number 1! Turns out the so called trolls have been right about this clown all along! He's spanked away half a million dollars and told us nothing but a pack of lies from day 1. My friends and I invested over £100k into this shambles of a company. I wonder how much of our money he actually has left in his bank? That's a nice big house he's sitting in, who's paying for that? (There were a list of names here) where has our money gone? No transparency whatsoever. Just smoke and mirrors!

Commenter number 2

All the bullshit he's been posting on the forum for the last few months as well. Whilst all long knowing this day was coming. What a scumbag of a human he turned out to be.

End copy/paste from FB

For me this looks like Lyford might very well end up in jail. It would be nice to know what's the current situation with investigation by the authorities. Does somebody know anything about it?

Was Banx a ponzi scheme?

Banx promised to distribute profits that it makes to shareholders. It's hard to know how much profits Banx really made and where those profits came because Lyford hasn't been open about that.

Banx actually did pay to it's shareholders several times. But it's quite suspicious because none of the actual businesses, that Banx was supposed to be doing, looked profitable.

In October 2016 Ian DeMartino published an article in Coinjournal where he presented his findings that indicated Banx being a scam. According to the article, income that Banx was generating was quite unclear.

I asked Lyford several times where Banx Capital’s income was coming from, to the point that he started to express frustration, but there was an important reason I asked multiple times: Every time he told me something different. The first time I asked, Lyford pointed to BanxMint and Banx Platinum as the primary sources of income. Another time, it was trading activities and mining, and yet another it was Banx.io fees.

Eventually, after showing me JVZoo, he said the company’s income was from educational videos, affiliate selling of software and webinars. That fits into exactly what Banx Platinum claims to be.

Lyford hasn't revealed more details about the income, which of course makes the whole thing very suspicious. If there were no legitimate income, then the dividends for shareholders were not paid from profits. That's exactly like a ponzi – participants are paid as long as the company has some money left. Most important thing is to keep up the image that company is making money. The system of course collapses sooner or later when nobody is willing to invest any more money to it.

One thing that points to a ponzi is the fact that Banx was still claiming to do a very profitable business as late as March 2016. When DeMartino published his latest article in Coinjournal, Lyford accused him for using an old screenshot of their website that claimed that Banx was making huge profits.

But reading the discussion that Lyford and DeMartino had at Bitcointalk, it becomes very clear that Lyford was lying. DeMartino had bigger screenshot that showed the date (March 21st) when it was taken and it was also found from Google cache dated March 16th.

So Lyford was still trying to get more investors on board – why else he would have kept that falsified information on the website? – even when the whole system was pretty much collapsed. At that time Banx was moved to Bitshares as an asset. Lyford couldn't manipulate the price anymore so Banx Shares became very quickly worthless.

In my eyes this looks very much like a classic ponzi scheme.

Michael Taggart aka Michael X aka Murderistic

One person of interest in this case is Michael Taggart. According to a pdf dated 5th November 2015 Banx and Taggart had a deep businesspartnership. The pdf was meant for Banx holders and it presented the plan for 2016. There were at least four businesses that were owned by Banx and Taggart (Remittio, Lotto Shares, CrowdMy.com and DigitalMoneyTimes.com).

Banx owns 50% of Remittio.

Remember, Banx Shares holders ultimately get a part of the profits from Remittio, Lotto Shares and CrowdMy.com.

We are working closely with Michael Taggart and his staff, dealing with display advertising for the DMR [Digital Money Revolution] funnel.

We have some exciting news about DMT [DigitalMoneyTimes.com]. Michael Taggart and I have struck a deal for his company to take 50% of this website.

We currently have over $25,000 of investment into Lotto Shares.

CrowdMy.com will be a 50/50 partnership company with Banx and Michael Taggart’s company.

A couple of things indicate that Taggart knew very well what Banx was doing:

- Apparently Taggart and Lyford have known each other for a long time already. This isn't a new partnership.

- By the end of 2015 it should have been very clear to everybody that Banx is a scam and it will fail soon.

- Taggart and Lyford are currently doing business again together in Steem Cash, a get-rich-quick marketing scheme.

- Taggart has been defending Lyford very aggressively and denied that Banx has been a fraudulent business.

- Taggart has tried to hide the fact that he and Banx had a business partnership.

Banx investors might be interested to know if some of their money went to Taggart's companies.

Accounting books could tell a lot about this case

I can guess how Lyford will be answering to this post. "You are just a hater", "you don't know anything", "nothing I say could make you change you mind". But there is actually one thing that would make me change my mind about Banx being a ponzi scam.

If Mark Lyford and Michael Taggart want to prove their innocence, they should publish all relevant financial information of their companies that have been involved in Banx case.

If Banx was a legitimate business that just didn't work out because of bad timing and whatever, accounts could prove this. I'm pretty sure that investors would like to know this too. Lyford hasn't been very open about expenses. How much money actually came in and where did it all go?

- How much money you got from investors (in crypto and fiat currencies) in total? How much from private and how much from public investors?

- What were the running costs?

- How did you actually invest the money you got from the investors? There were plans for several different businesses. How much money did you put in each of them?

- How much profits Banx made? Where did the profits come from?

- How much did Banx pay for it's shareholders?

- How many Banx Shares actually existed? There has been some unclarity what was the initial amount, how much shares miners mined, etc.

- What are the details of partnership between Banx and Michael Taggart's companies?

Banx was closed down in April, so everything should be pretty much clear now, if Lyford has finished the accounting books. It shouldn't be too hard to find all relevant information and publish it. Unless, of course, this is a scam and Lyford don't want to publish anything because the records would prove that he didn't have any intention to do legitimate business.

Let's keep Steem free of scammers

The more I've been digging into this case, the more convinced I am that this really is a pure scam. There should be no doubt about it in this point. If somebody can show evidence that indicate otherwise, please do.

I personally happen to hate scammers quite a lot. That has given me motivation to spend hours and hours googling around and reading messages from forums.

I don't like the idea of seeing these kind of people in Steem. There are two reasons for that.

- Communities that don't exclude fraudsters are weak. If dishonest people can come in and do business without an adequate protest, the whole community will suffer eventually. Strong communities can stay strong only if they kick out scammers and don't let them do anything potentially harmful.

- Scammers will do legitimate projects every now and then to fix their reputation. Steem Cash, which is a business run by Lyford and Taggart, might be their way of showing that "we can do legitimate business". After they have played nice and made some new friends, they will cash out with a bigger scam. Best way to prevent all kind of scamming is to show zero tolerance for scammers.

Sources

- Are BanxShares as good as GAW Paycoin? (Unsencored Bitcointalk thread)

- The case of Banx & C-CEX (my previous post)

- Ponzi Accusations Fly As BanxShares Is Set To Be Removed From CoinMarketCap Rankings

- Banx Three Months Later: No BitShares Integration, Less than 1% Sold, Network Is Down

- Mark Lyford Opens Banx Sales, Quickly Becomes Worthless

- Banx and how they mislead their customers, includes deceptive name, manipulation and PONZI ALERT (Bitcointalk thread)

- [ANN] Banx - Liquidity Paid Back In From Profits (Bitcointalk thread heavily edited by Lyford)

- Banxshare scam.. Fake market cap coinmarket (Bitcointalk thread)

- BanxShares was Removed From CoinMarketCap Rankings and NOT because of Ponzi Accusations – The official response from Mark Lyford