Regular daily update on BTC ta analysts opinions.

**My summary - short-term sentiment: bearish ** (last: bearish)

We turned at 8'900 and it seems we holding. Pathways are not yet decided.

Two major pathways are seen: either turning from 8'900 area towards 9'300 bouncing within triangle or we correct in waves towards 8'600 - 8'400 (even 8'000 - 7'500 @lordoftruth).

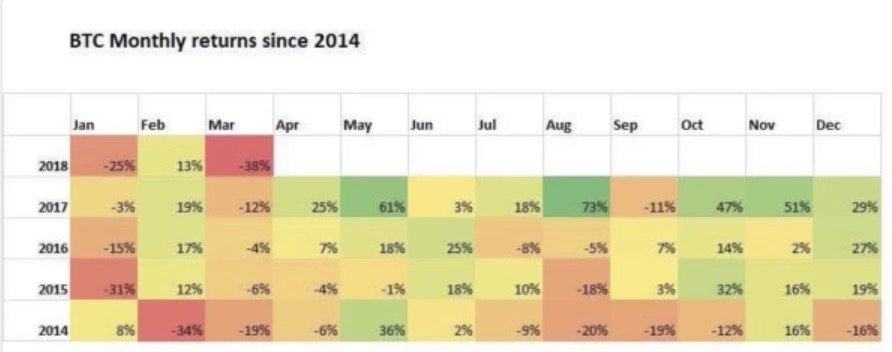

April was good month for crypto. June is usually also a good month - not as good as April though. Lets see.

News about the blog

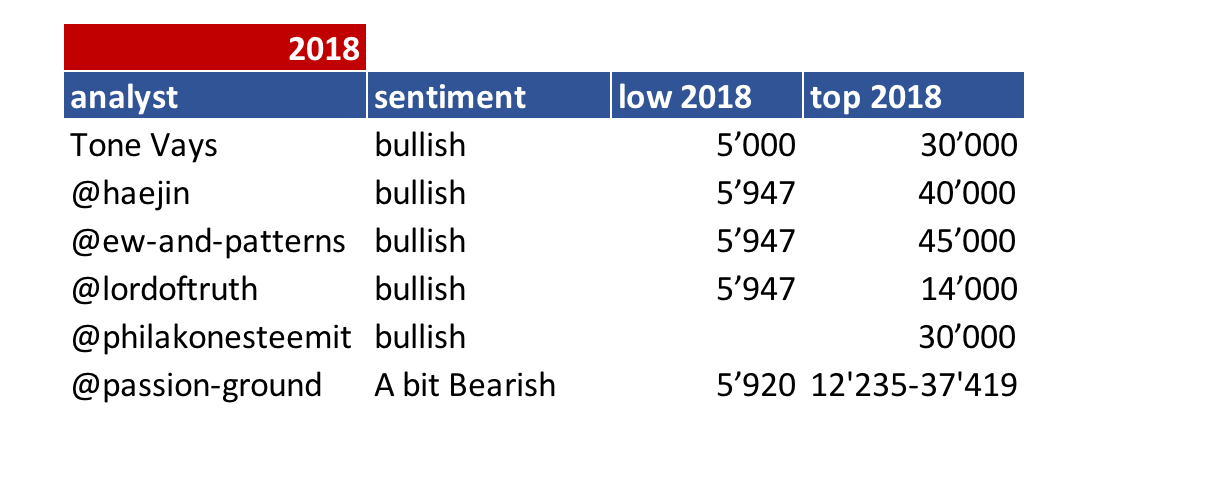

I need to revise my 2018 long term table. I need to add a 2018 and 2019 target an be more precise on the sentiment here. Will do that after I am back in Switzerland.

We lunched the bounty project beta. If you are interested and you like to create a bounty on your own have a look at this post

Analysts key statements:

Tone:

- Weekly: Week started off weak but several days more to go. His best case scenario for the bulls is a correction to 7'600 area and than go up to 10'000.

- Daily: Daily is very indifferent with a lot of flips (TD indicator). No clear trades.

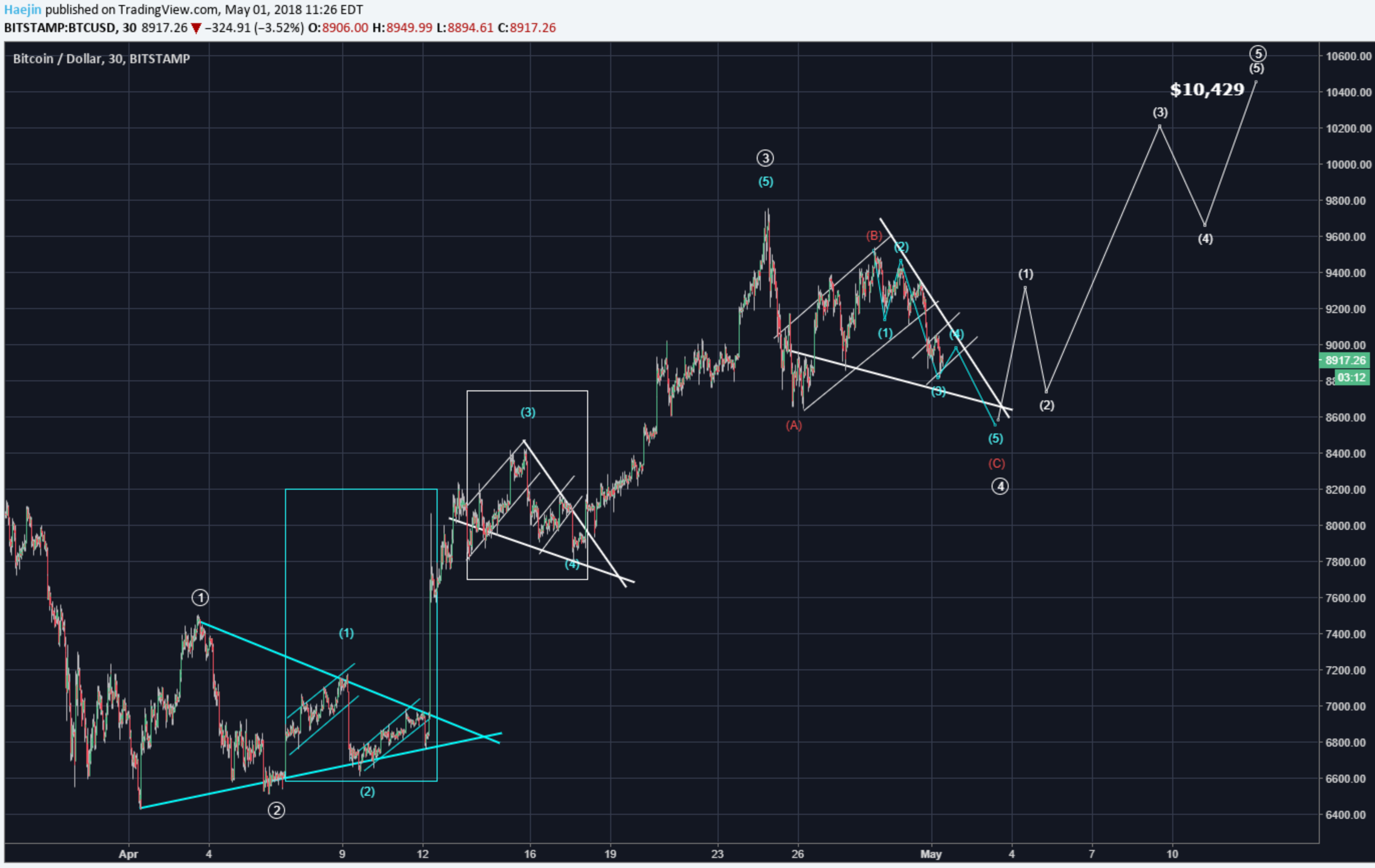

@haejin:

So overnight, price decline further down incrementally. The below chart shows an updated Elliott Waves for the subwave of red C. IF the wave 1,2,3 are complete and 4 up is next with a lower low on blue 5.

Alternate update:

Bigger picture:

@ew-and-patterns:

Bitcoin is moving down as expected. The following two pathways will apply:

A:

B:

@lordoftruth:

Outlook stays unchanged; April high 9'767 - correction ahead towards 7'500 - 8'000 (early May) to build iSHS pattern. than move towards 12'400 (5/8 reaction form 6'490). So the pullback is considered a buying opportunity.

Clear breaking of 9'911 will invalid current scenario.

Todays trend is slightly bearish. Expected trading for today is between 8'350 and 9'384.

@philakonesteemit:

Bullish scenario got confirmed. Possible further small wave up to come. See bull/bear scenarios below.

@passion-ground:

It is rather important for me to note that the largest “secular trend” (monthly chart) is turning bearish against a backdrop of the long-term (daily and weekly charts) turning bullish. The battle is on, and a victor is far from being decided at this juncture.

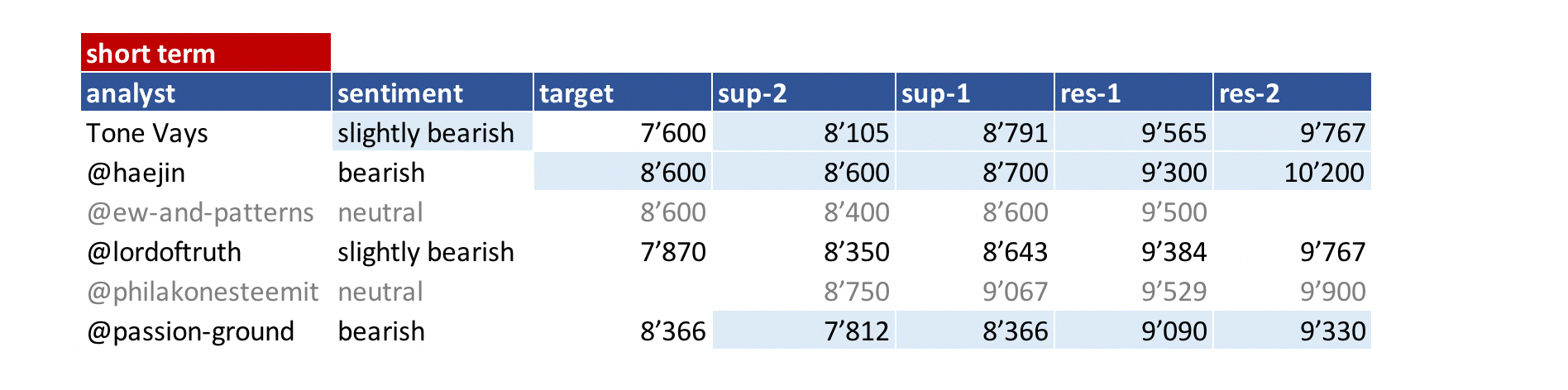

Summary of targets/support/resistance

Reference table

| analyst | latest content date | link to content for details |

|---|---|---|

| Tone Vays | 1. May | here |

| @haejin | 1. May | here |

| @ew-and-patterns | 1. May | here |

| @lordoftruth | 2. May | here |

| @philakonesteemit | 24. Apr | here |

| @passion-ground | 2. May | here |

Definition

- light blue highlighted = all content that changed since last update.

- sentiment = how in general the analysts see the current situation (bearish = lower prices more likely / bullish = higher prices more likely)

- target = the next (short term) price target an analysts mentions. This might be next day or in a few days. It might be that an analyst is bullish but sees a short term pull-back so giving nevertheless a lower (short term) target.

- support/res(istance) = Most significant support or resistances mentioned by the analysts. If those are breached a significant move to the upside or downside is expected.

- bottom = -> now renamed and moved to long term table. Low 2018

- low/top 2018 = what is the low or the top expected for 2018?

Further links for educational purposes:

- From @ToneVays: Learning trading

- From @philakonecrypto: Like in every post you find links to his amazing educational videos. For example here

- From @lordoftruth: Fibonacci Retracement

- From @haejin: Elliott Wave Counting Tutorial

*If you like me to add other analysts or add information please let me know in the comments.