Time: 8.30 A.M. / GM+2 / 22 Apr 2018 – Sun.

The last upmove from April 1 lows below 6.49K towards 8.64K ( 34 percent ) was not surprise for us, as we expected in our previous posts:

/ 556 / Pretty Upside Move On The Way on April ( It is historically considered as one of the best months for the digital currency ).

/ 559 / Bitcoin Prepare For A Boost as Tax Day would eventually trigger an upside move for the bitcoin price.

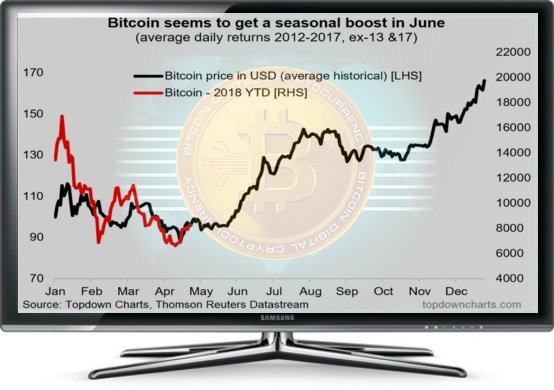

And as we see, since tax season came to an end bitcoin price is performing well in the market today as it tests 9.06K. So seasonality analysis for April worked fine and seasonality indicator reflect that An another seasonal surge will occurs around the middle of June. So my question is, should be on any bitcoin / crypto-investors mind is will June see the same seasonal surge as on past? We have to wait and see, time will tell.

In our previous post / 569 / we had forecast the trading range will be between 7.90K and 9.12K. The intraday high was 9.06K and the low was 8.61K.

After the consolidation between 8.00K and 8.40K , we finally saw the breakout of the 8.64K resistance and as we mentioned in / 569 / breaking this level will send the price up to test 9.12K over the weekend, and we still wait for an eventual retracement from 9.12K to confirm the continuation of uptrend. Because most likely a profit taking at this level will take place, therefore, traders should be cautious with longs above 7.84K which has become a support. The reason why we believe a retreat will take place in the coming days.

The trend is slighty bullish as long as we are above 7.84K. If this uptrend is sustainable, we're still in the recovery phase and will have plenty of room to enter. Let wait for an eventual retracement to confirm the continuation of uptrend.

Despite the pullback from 9.06K, bitcoin price may crowd out weak bulls by revisiting the trendline support ( former resistance ) before testing 200-day MA at 9.73K.

Support 1: 7840.000 level.

Resistance1 : 9122.000 level.

Support 2: 7240.000 level.

Resistance2 : 9737.000 level.

Expected trading for today:

is between 7840.00 and 9122.00.

Expected trend for today :

Slighty Bullish.

Medium Term:

Neutral.

Long Term:

Bullish.

The low of 2018:

5947.00.

The high of 2018 (BitcoinTrader's Year):

13660.00 level / Expected.

The high of 2019 (Bitcoin Holder's Year):

25000.00 level / Expected.

/ Project by @knircky & @famunger /

You must write a comment to the this post.

investing considerable time and effort up front in

hopes of considerable returns down the road.

I'm so proud of my little blog, and so grateful to all of you

for support to keep it going.