Thank You For Your Support and For Honoring Me With Your Up Vote...

As a reminder the course is aimed for complete beginners.

I tried to keep the lessons short and to the point giving out clear examples

and videos where required.

Lesson 11. Currency Leverage and Margin

Brokers offers high leverage even to beginners.

You will see leverage advertised in every broker’s adverts.

What is leverage?

How does it effect you?

Is it good to have high leverage?

COUTION: Leverage is dangerous, very dangerous, extremely dangerous. So keep reading.

COUTION: Leverage is dangerous, very dangerous, extremely dangerous.

No it is not a mistake of copy and paste, but it is just a way to get your attention.

Leverage is the most confusing thing that newbie’s do not understand,

and some will never understand.

The culprits are basically the brokers, it is their fault that there is this confusion going around leverage.

They market leverage as an advantage, as a must have for newbie’s,

in reality again it is very dangerous.

Let me explain carefully since probably right now you are going bananas since I am contradicting what marketers have been bombarding you for many years now.

Just to make it clear straight away, margin and leverage is the same thing.

They are just used interchangeably to confuse people.

So it is very possible that with just 1 pip movement, you may earn $10.

What? 1 pip movement is worth $10? If you are excited then read this.

With just 1 pip movement you may earn even $40! Pause.

What are you thinking? I know what are you thinking.

You are thinking that all you need is 3 – 5 pips a day.

Meaning $30 – $50 if 1 pip is worth is $10, or $120 – $200 if a pip is worth $40.

Correct? Yes my life is sorted now. 3 – 5 pips a day is easy to get.

Right? Wrong! Very wrong! This is exactly the marketing tactic brokers use every single day.

Ah yes not only brokers, but also Internet Marketers with their crap products / robots.

If you think that I am talking nonsense just leave now, just press X on your browser, but if you want to know the dirty tricks of brokers / marketers whatever, then keep reading.

Market Perils:

First, who said you are going to win every trade?

Who said that when you enter a buy trade, the price will go up?

Who has given you the guarantee that once you enter a trade, the market will always go in your favour?

No one can give you that guarantee. Remember that there is the spread to cover first!

So your trade starts always with -$20 or -$80 assuming a 2 pip spread.

Brokers Leverage:

When you open an account with your broker you are offered a leverage level to use.

A leverage is basically a temporary ‘loan’ given to you by your broker when you enter every single trade.

Normally the leverage is written is 1:50, 1:100, 1:200, 1: 300, 1: 400.

These are common leverages levels offered by many brokers.

What this means is basically that

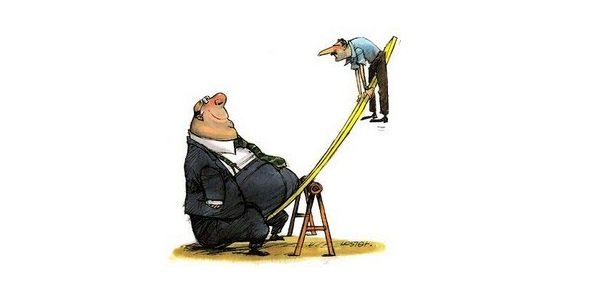

For a leverage of 1:100, for every $1 in your account you are in fact controlling $100.

For a leverage of 1:400, for every $1 in your account you are in fact controlling $400.

So if you have an account of $250, and a leverage set to 1:400, in reality you are trading with $100,000! $1 is worth $400, so $250 x $400 = $100,000.

Similarly, if you have an account of $250, and a leverage set to 1:100, in reality you are trading with $25,000! $1 is worth $100, so $250 x $100 = $25,000.

So where is the problem?

This is cool that the broken is lending me money.

First and foremost, the broker’s money lended to you are never at risk.

The broker will never lose money.

You will lose money.

But this kind of leverage is what makes Forex trading enticing to many people since you can make money fast if you know what are you doing.

A slight 1 pip move is worth $10 or $40 depending on the leverage, so intraday traders that go for 30 – 50 pips trade means that they profit $300 -$500 per trade.

Of course if the trade goes against you, and your stop loss is 30 pips, you lose $300. You can make money fast, but you lose money faster, trust me on this.

If your account is running out of money, the broker will close the trade for you automatically, to protect his lended money.

This is called margin call.

This is why brokers will never lose their money.

This is software controlled so do not think that this is manually being monitored.

So do not take risks thinking that someone will oversight your trade.

Once your account is in danger zone, the trade is closed automatically to protect their assets.

Default Leverage:

For some strange reason, leverage in most brokers is set to 1:400 the most risky!

You should immediately set it to 1:100 or less.

Do not join brokers that do not offer leverage less than 1:100.

Final Words:

To conclude, leverage is two double edge sword.

It can cut from both sides.

You can make money fast but you will lose money faster.

Just mark my words, start demo trading, be profitable in demo trading, then switch to live account with low leverage, 1:100 or 1:50.

When you are also profitable in the live account with small leverage you may then decide to increase the leverage.

Every comment, every upvote, every support is really appreciated.

Thanks For Reading,

@lordoftruth

Samer

Below you can find the list with all the series of articles: