https://s26.postimg.org/ap9sknxwp/Crypto\\_News.jpg

- ECB Considers “Legal Restraints” Against Bitcoin Says Council Member

- Calm Before the Fork? Segwit2x Goes Silent as Bitcoin Spilt Looms

- ICO’s Still Have Options Despite Increasing Regulation

- Above $4,300: Bitcoin Is Up, But Is It Out of the Woods?

- London Firm Uses AI to Improve Premium Beer

- Japan’s Finance Industry Embraces Bitcoin Mining

- BTC Trading Update by @cryptopassion

🗞 ECB Considers “Legal Restraints” Against Bitcoin Says Council Member

This week the European Central Bank (ECB) Governing Council member, Ewald Nowotny, stated in an interview that the ECB is discussing “legal restraints” for bitcoin and other cryptocurrencies.

ECB Council Member Says Bitcoin Lacks Supervision

The ECB has said a lot of things about bitcoin over the past few years, and this week the Austrian economist and ECB council member Ewald Nowotny gave his opinions. Nowotny says the bank is currently looking into regulating decentralized currencies but did not detail what kind of mandates the institution would enforce. The European official believes bitcoin is too volatile and lacks in regulatory supervision.

“Bitcoin is not a currency, it is highly speculative and volatile, it is not subject to any supervision either, and the stock market movements of the recent period make it clear,” explains Nowotny speaking with the Austrian weekly trend report.

“More and more of our customers are investing in cryptocurrencies, and therefore it is natural that they can follow the value directly with us,” explains the stockbroker’s CEO Johan Prom.

Discussing Bitcoin Legal Constraints Within the ECB

Alongside this, last month the president of the ECB, Mario Draghi, told a European Parliament committee that “it would not be [within] our power to prohibit or regulate [bitcoin].” Draghi did detail to the committee members that the ECB hasn’t discussed the regulatory possibilities yet. But the ECB president did, however, reject the Estonian government’s plan to create its own sovereign cryptocurrency. The president told the country, “no member state can introduce its own currency — the currency of the eurozone is the euro.” Moreover, Draghi recently stated in a letter to the EU Parliament, that there is no evidence showing the current cryptocurrency economy is affecting the “real economy” in any positive way.

Read more & Source: https://news.bitcoin.com/ecb-considers-legal-restraints-against-bitcoin-says-council-member/

🗞 Calm Before the Fork? Segwit2x Goes Silent as Bitcoin Spilt Looms

“It's sort of like the quiet tension before a battle."

That's how Jean-Pierre Rupp, a developer at bitcoin wallet provider Blockchain, described the current state of Segwit2x development. With the code labeled "production ready," and the work of contributors like Rupp nearly complete, the main step left is the activation of the code, scheduled for late November.

That's when the next stage of bitcoin's scaling debate, as they say, will come to a head.

First proposed at a private meeting of industry players in May, Segwit2x was intended to forge a compromise in bitcoin's long-raging scaling debate. Still, it has attracted opposition, primarily for its approach to upgrading the bitcoin software. Chief among concerns is its use of a hard fork to increase the block size, a contentious mechanism due to the fact it could result in the creation of two competing bitcoin assets, or perhaps a single one that no longer interests a certain portion of users.

While Segwit2x's proponents and detractors permeate social media channels, there's been comparatively few statements from the group working on the software.

Rupp told CoinDesk:

"Nothing is really being done at the moment until the fork date. As the most recent document that we published states, we are in a quiet period. We aren't discussing much about the direction of development afterwards, nor being too active on the technical front until the fork happens in November."

Measuring sentiment

Still, users and companies, it seems, are being slow migrate.

Though 144 companies claim they will eventually update to support SegWit, at press time, the percentage of transactions using SegWit is growing slowly, and still in the single digits. Whether because they are uninterested in adoption or unwilling to, it seems, Segwit2x proponents are keen to use the statistic to argue that SegWit doesn't go far enough.

Read more & Source: https://www.coindesk.com/calm-fork-segwit2x-goes-silent-bitcoin-spilt-looms/

🗞 ICO’s Still Have Options Despite Increasing Regulation

These days, it seems that regulation for ICOs and token sales is popping up everywhere. The SEC has already famously ruled on the DAO tokens, and both China and Korea have banned ICOs for the foreseeable future. Even the Swiss are starting to get cautious. It may well be that the ‘wild west’ days of the ICO are over.

However, some ICOs are seeking new ways to work around regulations in different countries, both regulations that deal with ICOs and other regulations dealing with distributed businesses. Below is a summary of three attempts to overcome regulation in a legal way, and how they might fare.

Stox hopes that the buyout will allow them to actively use these licenses in the UK and Malta, where they had been previously obtained.

Stox recently said:

“Today Stox became the first regulated ICO prediction platform when it announced its first acquisition of a company with a gambling license, CommoLogic… Through the acquisition, Stox will acquire three gambling licenses from CommoLogic: A software license in the UK., an operating license also in the UK .and a Class 4 (B2B) license in Malta.”

Read more & Source: https://cointelegraph.com/news/malaysian-central-bank-close-to-deciding-on-digital-currency-regulations

🗞 Above $4,300: Bitcoin Is Up, But Is It Out of the Woods?

The bitcoin-US dollar (BTC/USD) exchange rate is gaining altitude after the bearish Doji reversal seen earlier this week failed to keep the cryptocurrency below its 50-day moving average.

At press time, bitcoin is trading at $4,325; up 1.46 percent as per data from CoinMarketCap. The two-day sell-off ran out of steam earlier today at the low of $4,150. The subsequent rebound then gathered pace above the 50-day moving average of $4,187.

However, the rebound from the 50-day moving average support seen in the one hour indicates the fears over the event are overblown. So, is bitcoin set to fly high or is the rally a bull trap?

The price action analysis suggests the cryptocurrency is currently hovering in the no man's land.

Read more & Source: https://www.coindesk.com/doji-reversal-bitcoin-battles-bears-in-bid-to-stay-above-4000/

🗞 London Firm Uses AI to Improve Premium Beer

With so many different types of beer in existence all over the world, it is definitely becoming much harder to provide something unique to the world. One way to go about this is by creating “intelligent” beer. More specifically, IntelligentX Brewing Co. is using artificial intelligence to brew their beer. Machine learning algorithms can be used in unique ways; that much is rather evident.

For IntelligentX Brewing Co., it was seemingly a rather straightforward decision to brew premium beer using machine learning algorithms. While the rest of the world is baffled by this venture, the company itself has done so with a specific purpose in mind. While it has been able to put together algorithms capable of making beer, it also wants to collect consumer feedback. This feedback will be used to improve the beer itself in future iterations. It’s a very interesting take on things, to say the least.

As of right now, IntelligentX Brewing Co. provides four different types of conditioned beers. Every one of these flavors can be sampled by consumers, after which they provide feedback to this artificial intelligence through an online feedback system. Based on this user input, the algorithms powering this solution will go to work and make adjustments for the next batch. It is highly doubtful there will ever be two versions of the same flavor due to the continual progress being made.

By collecting this information and feeding it to an artificial intelligence, the company will be able to brew beer to match what consumers say they want. More data means more variations of beer and more satisfied customers in the long run. It is a pretty interesting feature and one that can certainly bring stiff competition to existing breweries. As we have seen before with coffee flavors, there are some pretty odd combinations to be had (and tasted).

Read more & Source : https://themerkle.com/london-firm-uses-ai-to-improve-their-premium-beers/

🗞 Japan’s Finance Industry Embraces Bitcoin Mining

Japan’s major players in the financial industry are eyeing bitcoin mining with a goal of generating new revenue. They also hope to help set the ground rules for using bitcoin. In early September Japan’s GMO and DMM.com said they were moving into the mining space. Both companies have started crypto and bitcoin exchanges.

Why mining, why now?

With greater adoption and usage occurring in the bitcoin ecosystem, the mining rewards for bitcoin are also becoming extremely lucrative. However, an individual or organization must have a lot of dedicated resources to get involved. Currently, large mining pools are a necessary prerequisite to generating massive revenue. Combined, miners across the world collect $7.84 million a day.

>According to Blockchain, a British startup, miners across the globe collectively make $7.84 million a day — 10 times more than two years ago.

Read more & Source: https://news.bitcoin.com/japans-finance-industry-embraces-bitcoin-mining/

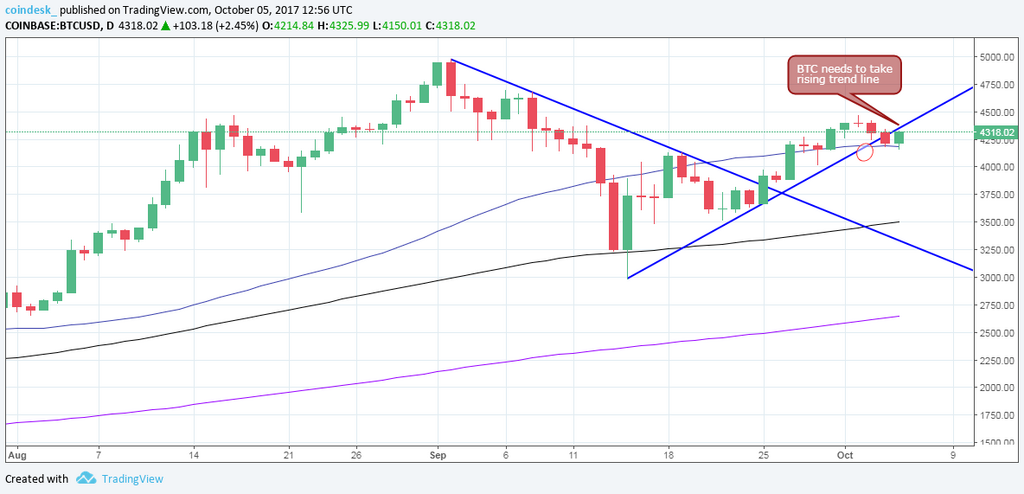

BTC Trading Update by @cryptopassion

As I was explaining you yesterday in my post BTC - Support line broken - We are near to a short term bottom or..., I detected very well the short term bottom.

We did a up as I was expecting and so we avoided to validate the head and shoulders pattern.

We will now test very soon the upper resistance line and if we are able to break it, a nice up trend is back :-)

🗞 Daily Crypto News, October 5th 💰

🗞 Daily Crypto News, October 4th 💰

🗞 Daily Crypto News, October 3rd 💰

🗞 Daily Crypto News, October 2nd 💰

🗞 Daily Crypto News, October 1st 💰