Origin of BitShares - Part 14 -

This is a update of an article I first published on BitSharestalk.org on March 9, 2016 which fits into the historical record describing what we were thinking during the Fall of 2015. Here I present a layman's view of the unprecedented power of the Graphene technology that lies behind BitShares and Steemit.

This was the key question we were asking ourselves as BitShares 2.0 went on-line last fall.

Steemit is one of the recent answers, but if you are new to digital-currencies you may tend to take all that power you've been enjoying for granted. However, a year ago we had just blown the top off all the industry's benchmarks. People are still trying to catch up, although we now have several sister chains building on top of our Graphene technology.

Our 100 transactions per second throughput was scalable to 100,000 and our 3-second block times could be dialed to 1 second simply by public vote. What were we going to do with that much power? Even to this day, Bitcoin crawls along quite nicely with 10 minute cycle times and a mere 7 transactions per second peak throughput. Frankly, some folks thought our new levels of power were complete overkill. After all, “640K of RAM ought to be enough for anybody!”

Here I'd like to dramatize just how huge a leap we have made beyond Bitcoin's first generation technology.

Real Time Blockchain Platforms - An Unheard-of Concept

First, I’d better define some terms:

What is a blockchain platform? It’s an incorruptible peer-to-peer ledger on which to build crypto-currencies and other applications. Most decentralized applications develop or clone their own dedicated platforms, but we now see intense competition to offer multi-application platforms for others to use. These act like operating systems to provide common services to applications from many sources.

What is a “real time” blockchain? Simply put, it is a peer-to-peer ledger whose transaction times are only limited by the speed of light and the dimensions of the planet. Its benefit is real-time performance, the ability to keep up with live events and react to them in time to influence their outcomes.

Real time for global day trading must react in about 1 second, roughly the same as the response time of an aircraft carrier rudder. Other applications range from sports betting to live action video games.

- Light speed chains can produce a new block in the time it takes to deal a playing card or for each slot machine tumbler to “clunk” into place.

- One chain can process all transactions for all of the 600-plus digital coins now listed on coinmarketcap.com – with enough left over for all of Master Card or VISA.

- The cost savings for Bitcoin alone could provide a $3 million grant to each of 100 new crypto-startups – or fund 30 Bitcoin Super Bowl ads. Every year.

But the most important advantage of a blockchain fast enough to support many independent businesses is that you enter a frictionless economic environment where currencies, applications, smart contracts and entire enterprises can do business with greater liquidity, efficiency, market depth, network effect, and regulatory freedom.

Keeping all of the transactions with your application on the same blockchain means never having to encounter the regulatory and security hazards of passing through corruptible and fallible human institutions. That was an ideal worth pursuing!

And it’s a jump that almost any coin, exchange or decentralized application in the cryptocurrency industry could choose to make. All they need is an ordinary software upgrade.

Let’s look at the case for moving onto one of them.

In the cryptocurrency world it has long been considered kosher to clone somebody else’s open source platform when introducing a new coin. It’s also OK to upgrade your own platform from time to time. But it is much less common to see coins surfing from platform to platform as the technology advances. Why is that?

One obvious reason is that some coins exist for the explicit purpose of advocating a particular platform technology. Bitcoin, Litecoin, Ripple, and Peercoin come to mind as early examples. Their raison d'être was originally to advance a certain technology. Of course they are not going to jump to a better platform. That would be conceding defeat.

Or would it? Do we really believe that 100 years from now any of those coins will still be using the same platform technology? What about in ten years? If not, then why not upgrade next week? To the extent that each of these enterprises has built up an ecosystem of users and supporters that are now more valuable than their original base technology, do they even need to keep their first prototype’s technology alive forever?

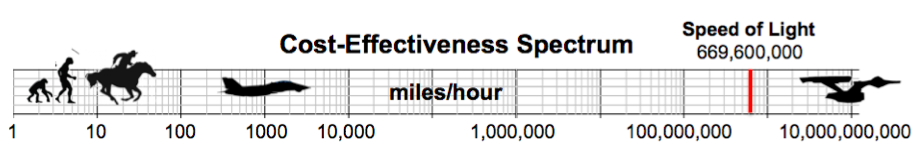

Well some will. And risk going the way of the dinosaur. Others will adapt and leverage what really matters – their brand and user base – and go on to achieve great things! Right now the Darwinian forces have never been stronger. Transaction cost-effectiveness varies by ten orders of magnitude between the strongest platforms and today’s industry average. Transaction times range from 10 minutes to 1 second. Bandwidth varies from 7 transactions per second to 100,000. The industry spends over 300,000,000 USD on transaction processing when it could be less than $250,000. Combined, that’s a net transaction cost-effectiveness increase from 1 to 10,000,000,000. That’s a pretty good incentive to jump to a better platform!

is only eight orders of magnitude.

The world had to know about this! We headed off to the four corners of the earth to tell everybody that we had a platform powerful enough to keep up with every transaction in the entire industry at the same time. ( ! ) This meant that the reduced economic friction of common blockchain infrastructure was available for free to everyone!

Next time I'll share what I offered the industry on a Blockchain Technology Trends and Scalability Panel at the 2015 Blockchain Summit in Shanghai - the same week BitShares 2.0 went live!

Cheers!

Stan Larimer, President

Cryptonomex

The Godfather of BitShares and Steemit

Coming up Next: Part 15 - Blockchain Platform Surfing

Previous in the Series:

The Origin of BitShares Rides Again (Parts 1-10)

Part 11 - It Is Very Cold in Space

Part 12 - Never Let Them See You Sweat

Part 13 - Cryptonomex Rears Its Head

About the Author -- Stan Larimer

Follow Me On Steemit - The Social Media Platform That Pays

Please Connect To Me On Linkedin!

Greatest Hits

Bitcoin and the Three Laws of Robotics

Engineering Trust with Charles Hoskinson

The Origin of BitShares

Why I will never give up Christianity