Note this is from the New York Times as seen in the URL

According to Wral Tech Wire in August of 2019,

RESEARCH TRIANGLE PARK – GlaxoSmithKline and Pfizer have finally closed on a multibillion-dollar merger that combined their consumer healthcare businesses, creating the world’s largest over-the-counter business.

Well That's convenient!

https://www.wraltechwire.com/2019/08/01/gsk-and-phizer-officially-merge-healthcare-businesses/

Pfizer, meanwhile, operates a large campus and manufacturing plant in Sanford as well as another plant in Rocky Mount. In 2016, Pfizer purchased Chapel Hill life science startup Bamboo Therapeutics for $150 million in cash up front with another $400 million possible based on drug development milestones.

The merger will bring together Pfizer’s big sellers like Centrum and Caltrate with GSK’s top brands, including Excedrin and Nicorette.

GSK, which is headquartered in Britain, will own just over two-thirds of the joint venture, with US-based Pfizer (PFE) holding the rest.

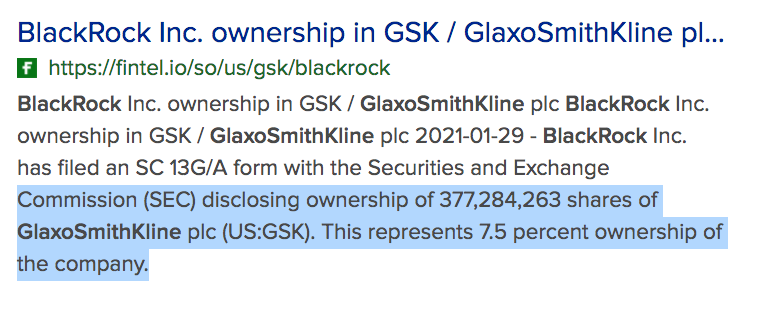

Black Rock Inc. has 7.5% ownership of the company as per Fintel

https://fintel.io/so/us/gsk/blackrock

BlackRock is the world's largest asset manager, with $8.67 trillion in assets under management as of January 2021.[6] BlackRock operates globally with 70 offices in 30 countries and clients in 100 countries.

Along with Vanguard and State Street, BlackRock is considered one of the Big Three index fund and passive management firms that dominate corporate America.

This is QUITE interesting!

The U.S. government contracted with BlackRock to help resolve the fallout of the financial meltdown of 2008.

Especially considering one of the founders received initial funding from Blackstone!

Fink sought funding (for initial operating capital) from Pete Peterson of The Blackstone Group who believed in Fink's vision of a firm devoted to risk management. Peterson called it Blackstone Financial Management.

In exchange for a 50 percent stake in the bond business, initially Blackstone gave Fink and his team a $5 million credit line.

In April 2017, BlackRock backed the inclusion of mainland Chinese shares in MSCI's global index for the first time.

As of 2019, BlackRock holds 4.81% of Deutsche Bank, making it the single largest shareholder. This investment goes back to at least 2016.

Which is interesting considering. . .

https://news.yahoo.com/banking-shares-plummet-laundering-allegations-161727719.html

In May 2019, BlackRock received criticism for the environmental impact of its holdings. It is counted among the top three shareholders in every oil "supermajor" except Total, and it is among the top 10 shareholders in 7 of the 10 biggest coal producers.

In his 2020 annual open letter, CEO Fink announced environmental sustainability as core goal for BlackRock's future investment decisions. BlackRock disclosed plans to sell US$500 million in coal investments.

In March 2020, the Federal Reserve chose BlackRock to manage two corporate bond-buying programs in response to the coronavirus pandemic, the $500 billion Primary Market Corporate Credit Facility (PMCCF) and the Secondary Market Corporate Credit Facility (SMCCF), as well as purchase by the Federal Reserve System of commercial mortgage-backed securities (CMBS) guaranteed by Government National Mortgage Association, Federal National Mortgage Association, or Federal Home Loan Mortgage Corporation.

In August 2020, BlackRock received approval from the China Securities Regulatory Commission to set up a mutual fund business in the country. This makes BlackRock the first global asset manager to get consent from China to start operations.[

In January 2020, PNC sold its stake in BlackRock.

BlackRock Solutions was retained by the U. S. Treasury Department in May 2009 to manage the toxic mortgage assets (i.e. to analyze, unwind, and price) that were owned by Bear Stearns, AIG, Inc., Freddie Mac, Morgan Stanley, and other financial firms that were affected in the 2008 financial crisis.

In 2017, BlackRock expanded its presence in sustainable investing and environmental, social and corporate governance (ESG) with new staff and products both in USA[72] and Europe.

BlackRock started using its weight to draw attention to environmental and diversity issues by means of official letters to CEOs and shareholder votes together with activist investors or investor networks like the Carbon Disclosure Project, which in 2017 backed a successful shareholder resolution for ExxonMobil to act on climate change.

After discussions with firearms manufacturers and distributors, on April 5, 2018, BlackRock introduced two new exchange-traded funds (ETFs) that exclude stocks of gun makers and large gun retailers, Walmart, Dick’s Sporting Goods, Kroger, Sturm Ruger, American Outdoor Brands Corporation, and Vista Outdoor, and removing the stocks from their seven existing environmental, social and corporate governance (ESG) funds, in order “to provide more choice for clients seeking to exclude firearms companies from their portfolios.

Despite BlackRock's attempts to model itself as a sustainable investor, one report shows that BlackRock is the world’s largest investor in coal plant developers, holding shares worth $11 billion among 56 coal plant developers.[83] Another report shows that BlackRock owns more oil, gas, and thermal coal reserves than any other investor with total reserves amounting to 9.5 gigatonnes of CO2 emissions – or 30 percent of total energy-related emissions from 2017.

By investing clients' 401(k)s and other investments, BlackRock is a top shareholder in many competing publicly traded companies. For example, see the percentage of shares held by BlackRock in: Apple (NasdaqGS: 6.34%)and Microsoft (NasdaqGS: 6.77%), Wells Fargo & Co (NYSE: 4.30%)[95] and JPMorgan Chase & Co (NYSE: 4.41%).[96] This concentration of ownership has raised concerns of possible anticompetitive behavior.

In his 2018 annual letter to shareholders, BlackRock CEO Laurence D. Fink stated that other CEOs should be aware of their impact on society. Anti-war organizations objected to Fink’s statement, because BlackRock is the largest investor in weapon manufacturers through its iShares U.S. Aerospace and Defense ETF.

Due to its power, and the sheer size and scope of its financial assets and activities, BlackRock has been called the world's largest shadow bank.

BlackRock was scrutinized for allegedly taking advantage of its close ties with the Federal Reserve System during the coronavirus pandemic response efforts.

The non-profit American Economic Liberties Project issued a report highlighting the fact that currently "the ′Big Three′ asset management firms—BlackRock, Vanguard and State Street—manage over $15 trillion in combined global assets under management, an amount equivalent to more than three-quarters of U.S. gross domestic product."

The Report called for structural reforms and better regulation of the financial markets

This is a Big One!

You will recall who worked at Bear Stearns after he was a teacher at Dalton Prep, which was a private school to the rich and famous grades k-12 where Epstein worked under Attorney William Barr's father, Donald Barr, who served as the headmaster until June 1974.

This is something else. . .

http://www.jeffreyepstein.org/

http://www.jeffreyepstein.org/

Look at when and where Soros started his Open Society Foundation

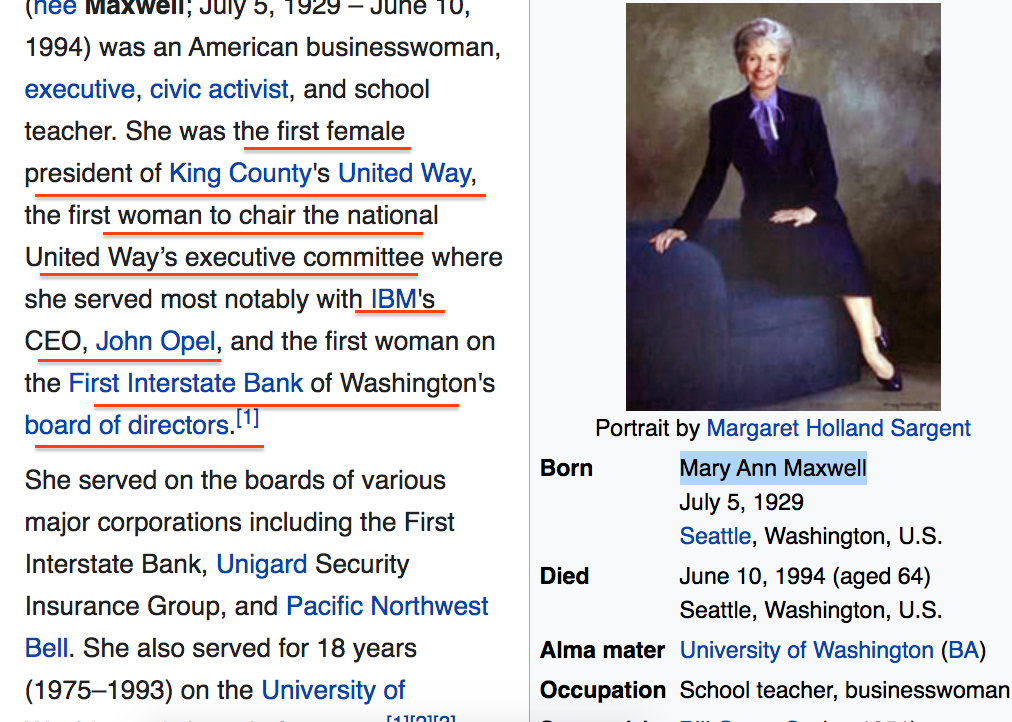

Interesting considering Mama Gates ties to United Way and Africa which helped get Bill's foot in the door for experimental vaccines in Africa and India.

WATCH

When you click on the link you see this

https://www.latimes.com/nation/la-na-gates16dec16-story.html

https://thebulletin.org/2018/07/vaccine-causing-polio-in-africa-context-from-an-expert/

Currently United Way is providing this. Are they trying to push an experimental jab?

Do you see how everything is tied together?

George Carlin was right. . .it's a black and you and I ain't in it!

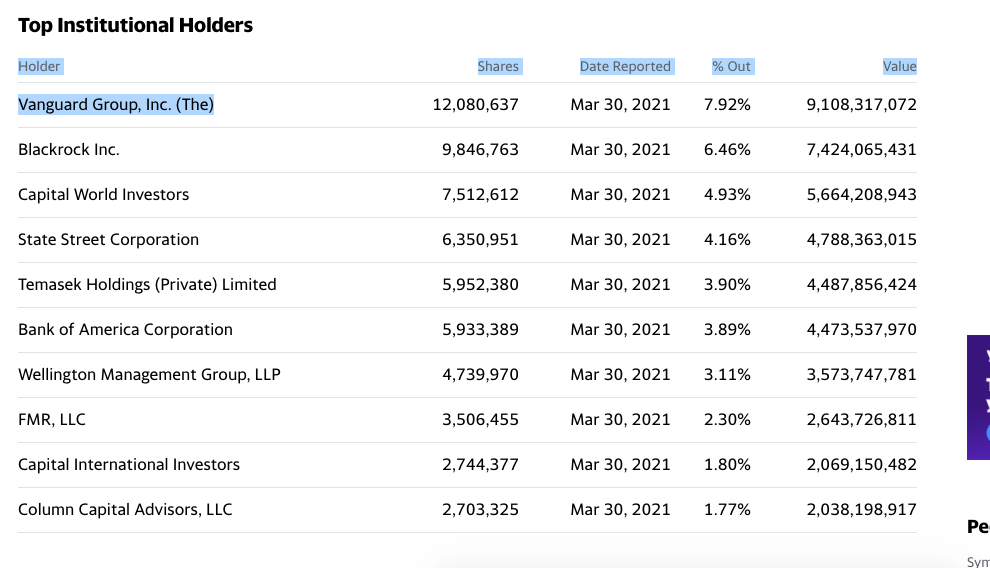

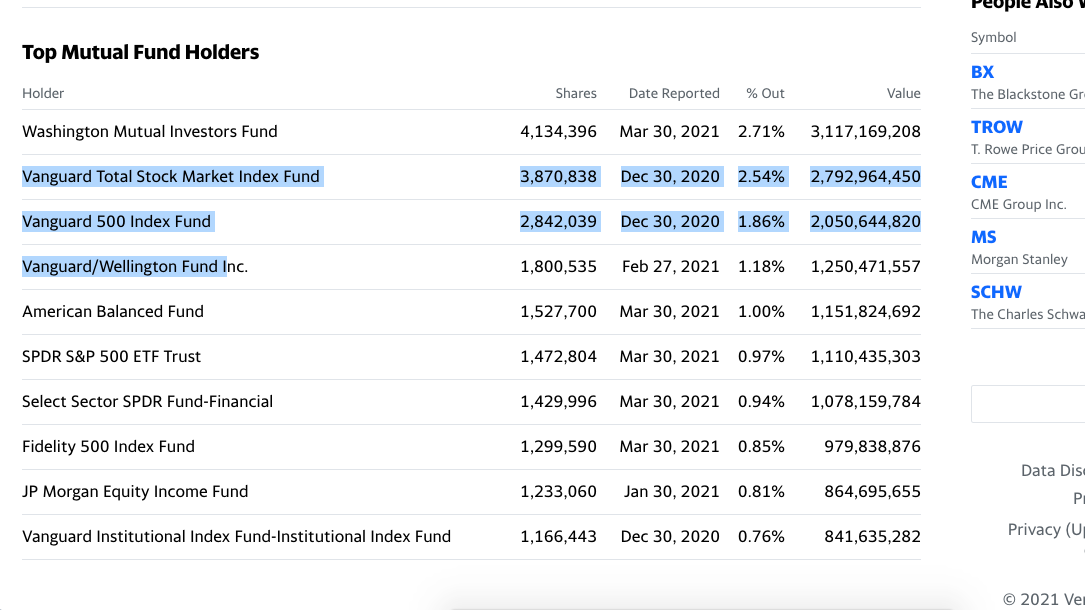

Basically just two major companies both BlackRock and Vanguard run and own Everything when you start poking around.

There isn't Really any competition because the very same investors that have ownership in Coca Cola also have ownership in Pepsi.

When you look at who owns BlackRock, guess who the biggest shareholder is?

Vanguard. You cannot see who the biggest players and steerers of Vanguard are can you?

There's a reason for that!

Project Syndicate

Conflict of Interest Much?

The organizations that bring the news get paid by non-profit organizations, of the same power players, elitists and controllers that also owns the entire media but also a part of taxpayers money is used to pay them.”

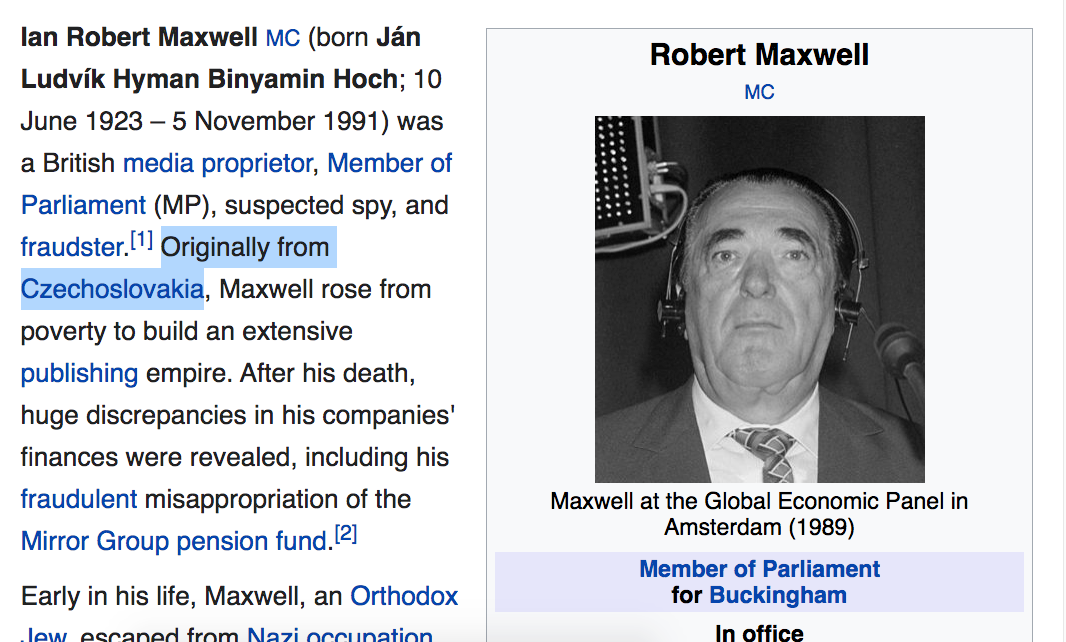

This is interesting as Robert Maxwell, Ghislaine Maxwell's father was born in the Czech Republic.

Hear a report in detail here,

ROBERT MAXWELL HIS REAL NAME, HIS POSITION IN ARMY, UKRAINE BIRTH, TRIPS 1950'S YT WOULDN'T LET THRU

Guess who is also a major shareholder of Microsoft?

https://www.investopedia.com/articles/investing/122215/top-4-microsoft-shareholders.asp

Just as Carlin said. . .

Here is where I am picking this up for those who read the prior article.

And just Who their major shareholders are.

Have a listen if you haven't already. . .

Where he talks about the Big Owners of this country!

*Not Safe for little ears, please listen with headphones.

George Carlin - It's a Big Club and You Ain't In It! The American Dream

This really all started with One Big Question so many have, yet you have to stay it quietly in only certain circles of those seeking Truth and All of the Truth!

You decide.

Is the Wuhan lab owned by Glaxo Smith Klein which owns Pfizer?

Gave prior examples so let's pick up where we left off.

Origins of Vanguard

Vanguard was founded by John C. Bogle as part of the Wellington Management Company. Bogle earned his degree from Princeton University. The fund grew out of a bad decision Bogle made on a merger. Bogle was removed as the head of the group, but he was still allowed to start a new fund. The main stipulation of allowing Bogle to start the new fund was that it could not be actively managed. Due to this limitation, Bogle decided to start a passive fund that tracked the S&P 500. Bogle named the fund "Vanguard" after a British ship. The first new fund launched in 1975.

Although the growth of the fund was initially slow, the fund eventually took off. By the 1980s, other mutual funds began copying his index investing style. The market for passive and indexed products has grown substantially since that time.

Along with BlackRock and State Street, Vanguard is considered one of the Big Three index funds that dominate corporate America.

- Immediately after graduating from Princeton University in 1951, Bogle was hired by Wellington Management Company.

- In 1966, he forged a merger with a fund management group based in Boston.

- He became president in 1967 and CEO in 1970.

- However, the merger ended badly and Bogle was therefore fired in 1974.

- Bogle arranged to start a new fund division at Wellington. He named it Vanguard, after Horatio Nelson's flagship at the Battle of the Nile, HMS Vanguard.

In May 2017 Vanguard launched a fund platform in the United Kingdom.

In 2020, Vanguard rolled out a digital adviser and began building up an investment team in China. In October 2020, Vanguard returned about $21 billion in managed assets to government clients in China.

Together BlackRock and Vanguard form an immense network comparable to a pyramid. The smaller investors are owned by larger investors.

According to The Conversation,

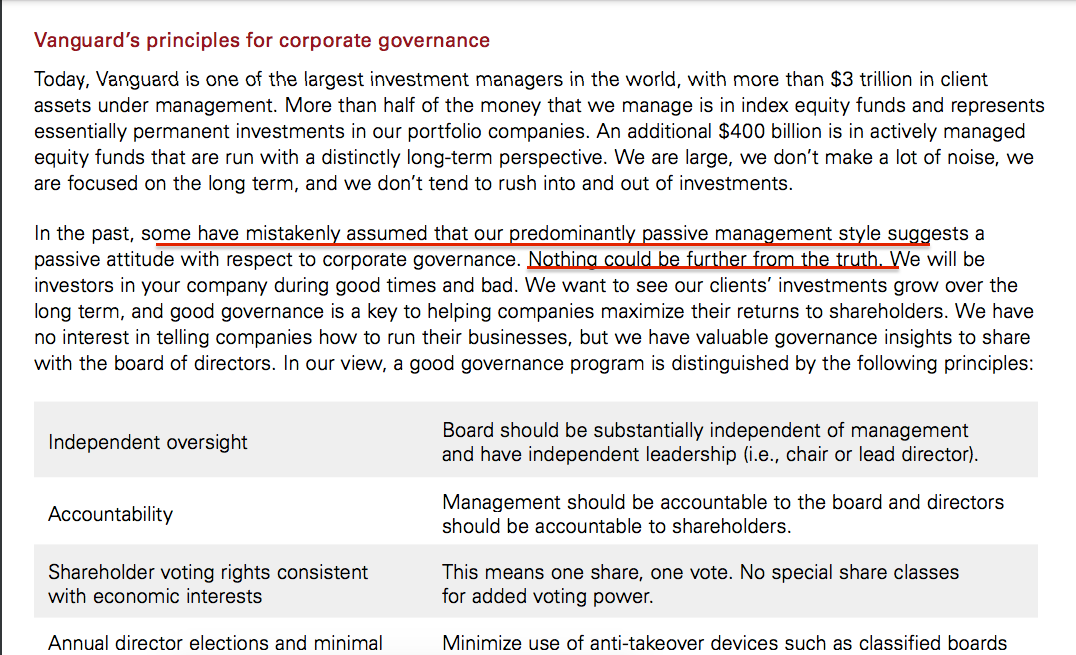

The power of passive investors

With corporate ownership comes shareholder power. BlackRock recently argued that legally it was not the “owner” of the shares it holds but rather acts as a kind of custodian for their investors.

That’s a technicality for lawyers to sort. What is undeniable is that the Big Three do exert the voting rights attached to these shares. Therefore, they have to be perceived as de facto owners by corporate executives.

These companies have, in fact, publicly declared that they seek to exert influence. William McNabb, chairman and CEO of Vanguard, said in 2015 that, “In the past, some have mistakenly assumed that our predominantly passive management style suggests a passive attitude with respect to corporate governance. Nothing could be further from the truth.”

When we analysed the voting behaviour of the Big Three, we found that they coordinate it through centralised corporate governance departments. This requires significant efforts because technically the shares are held by many different individual funds.

I tracked the letter to here,

See more here,

https://pressroom.vanguard.com/content/nonindexed/Vanguard_CEO_Shareholder_Relations_Letter_3.4.2015.pdf

Hence, just three companies wield an enormous potential power over corporate America. Interestingly, though, we found that the Big Three vote for management in about 90% of all votes at annual general meetings, while mostly voting against proposals sponsored by shareholders (such as calls for independent board chairmen).

Corporate American monopoly

What are the future consequences of the Big Three’s unprecedented common ownership position?

Research is still nascent, but some economists are already arguing that this concentration of shareholder power could have negative effects on competition.

Over the past decade, numerous US industries have become dominated by only a handful of companies, from aviation to banking. The Big Three – seen together – are virtually always the largest shareholder in the few competitors that remain in these sectors.

This is the case for American Airlines, Delta, and United Continental, as it is for the banks JPMorgan Chase, Wells Fargo, Bank of America, and Citigroup. All of these corporations are part of the S&P 500, the index in which most people invest.

Their CEOs are likely well aware that the Big Three are their firm’s dominant shareholder and would take that into account when making decisions. So, arguably, airlines have less incentive to lower prices because doing so would reduce overall returns for the Big Three, their common owner.

In this way, the Big Three may be exerting a kind of emergent “structural power” over much of corporate America.

See the following video from

Social Science Research / University of Amsterdam

Looks like this all benefited these 3 large firms when there was a massive crash in 2008

Who owns big business: the rise of passive investors (@uvaCORPNET)

According to the Social Science Research team from the University of Amsterdam done in 2016,

The financial crisis of 2008 changed everything.

After the financial market crashed, investors fundamentally changed the way they buy stocks.

Before, they invested in actively managed funds.

Active fund managers buy stocks they believe will outperform.

And they get paid well for this.

Who was at the helm during that crisis and made sure the banks got paid off?

But after the crisis, passively managed funds grew rapidly.

Passive funds basically buy stocks of all firms that are part of an index, such as the S&P 500.

They are much cheaper, but perform as well as most active funds.

As a result, investors sold off $800 billion of actively managed mutual funds, while passive funds attracted $1000 billion.

This huge and growing market of passive investment is dominated by only three big American asset managers:

Blackrock, Vanguard, and State Street

What are the consequences of this shift in corporate ownership?

This is a key question for the CORPNET research team at the University of Amsterdam.

Using data analytics, they uncovered this intense concentration of corporate ownership.

Together, the Big Three are the dominant shareholder in 88% of the 500 largest US firms.

which together employ 23 million people and have a market capitalization of 17 trillion dollars.

That is the same as the GDP of the whole United States.

And with the ownership of firms comes shareholder power.

- This means that the Big Three can vote on important issues such as:

- Who runs the corporation or executive compensation.

CORPNET found that The Big Three indeed coordinate their voting and thus centralize their shareholder power.

Does this worry the CEO’s of big business?

Maybe not.

The Big Three vote against management in only 10 percent of all votes.

But they do influence management behind closed doors,

through private engagements.

The Big Three may be passive investors,

but they certainly are active owners.

This means that the fundamentals of corporate governance are changing.

Regulators and the public had better wake up to this new reality.

I believe we have all watched this play out in the Cancel Culture we have been observing since President Trump fulfilled his calling that was announced way back in 1999. Did the globalists and cabal puppets need to set the stage in an attempt to thwart the threat to Their control? You decide.

Evidence of a Presidential Exploratory Committee inside here from a JFKjr. letter read on Larry King Live to Donald Trump as guest that evening.

Whether or not they sought to, the Big Three have accumulated extraordinary shareholder power, and they continue to do so. Index funds are a business of scale, which means that at this point competitors will find it very difficult to gain market shares.

In many respects, the index fund boom is turning BlackRock, Vanguard and State Street into something resembling low-cost public utilities with a quasi-monopolistic position. Facing such a concentration of ownership and thus potential power. . .

What have we observed

What will be the final outcome and

What is the countdown?

Europe - The Final Countdown(with lyrics)

Speaking of odd phenomena and time travel. . .

See more in this article titled,

Plum Island- how many are there? Super Prison for deadly animal diseases? Can they affect us? Some seem to think so concerning what everyone is Fearful of Right Now from 2019-2021

And here,

Philadelphia Experiment, Montauk Project, Plum Pudding Island, JFK saves the Day! Missing ships, some cut in half, WHAT? Who in the World is Charles Dellschau and what were his connections to people and secret Aero Clubs? Prt 1

Concerning Staple Street. . .

Dominion announced in 2018 it had been acquired by management team and Staple Street Capital. William Kennard former EU Ambassador appt. by Obama named to board of Warner Media parent AT&T owns CNN

The Nashville Explosion according to local reports the Christmas Day Explosion contributes to 911, wireless service disruption

Part 2 of the Nashville Explosion Christmas Day 2020 have you seen the history of the airport there? Nashville International Airport Known for it's call sign BNA. Here are some other BNA Connections! Deep Dive!

Nashville Explosion area and 211 Commerce Street

@artistiquejewels/nashville-explosion-area-211-commerce-street

So how about that Key Question?

Is the Wuhan lab owned by Glaxo Smith Klein which owns Pfizer?

Let's finish the trail. . .

So far we have

Black Rock finances.( you know, the same one attached to Bidens Ukraine Scandal)

According to DW,

BlackRock CEO Larry Fink said earlier this year that by the end of 2020 the financial corporation would stop its actively managed funds from investing in companies that get 25% or more of their revenue from coal operations. Furthermore, it would enhance transparency over how it votes in shareholder meetings of firms in its portfolio, create investment products that screen for fossil fuels, and ask companies how they plan to navigate the climate crisis.

BlackRock is close to Biden and some, though not that many, believe a partnership of the two could herald real change in the US's environmental strategy.

https://www.dw.com/en/german-police-raid-blackrock-offices/a-46182751

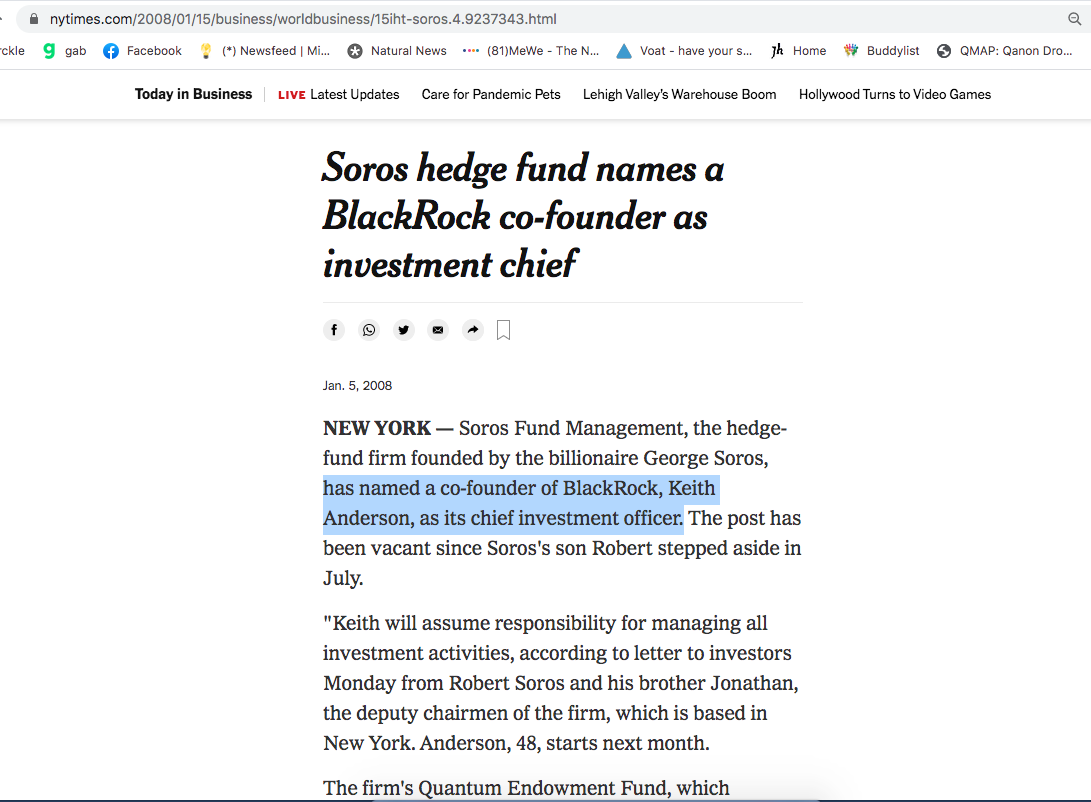

Soros Fund Management also dramatically boosted its shares in BlackRock Inc - the world’s largest asset management firm, overseeing $6 trillion - by nearly 60 percent to 12,983 total shares in the second quarter.(SOROS FOUNDATION)! the one that funds “fact checkers”by way of Poynter and open society.

https://www.reuters.com/article/us-investment-funds-soros-fund-mgmt/soros-fund-management-adds-popular-tech-names-blackrock-in-second-quarter-idUSKBN1KZ2KF

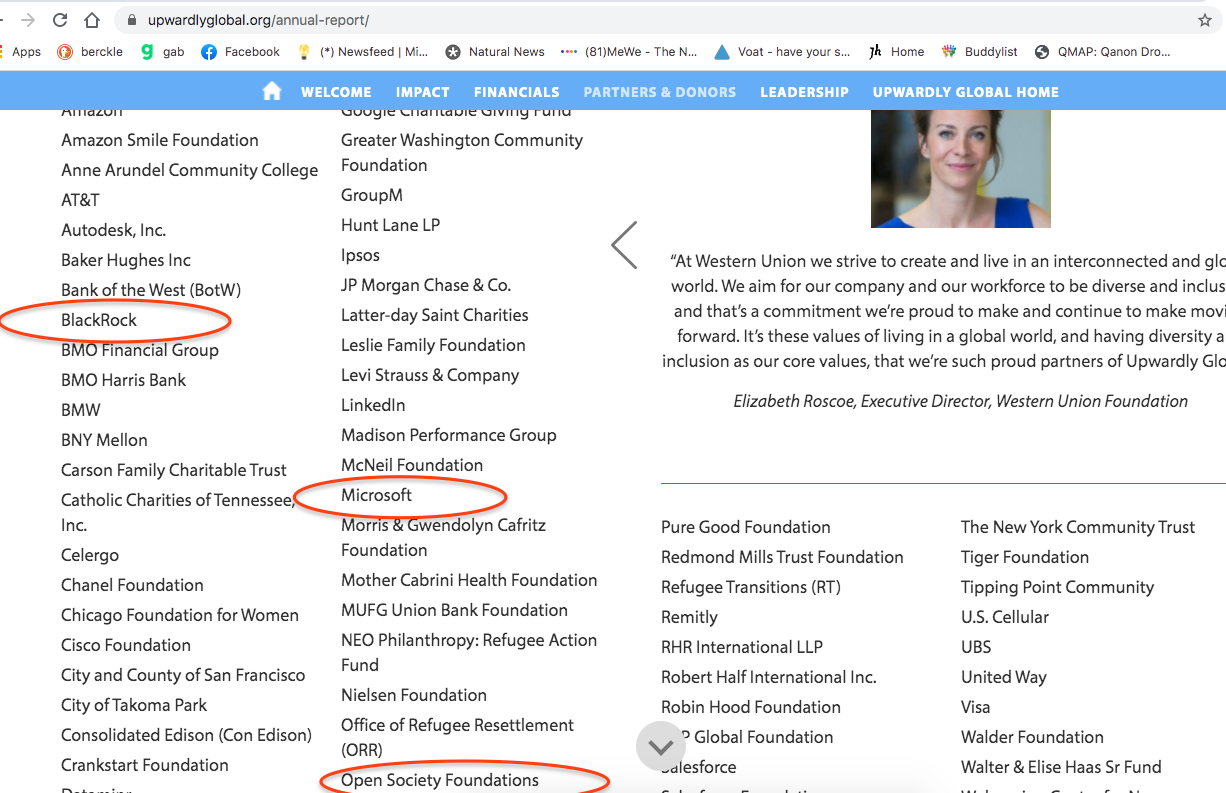

Note they are both funding partners for Upwardly Global

See more funding partners here,

https://www.upwardlyglobal.org/annual-report/

See what their theme is?

BlackRock has a partnership with Thomson Reuters, a multi-million dollar multi national media conglomerate.

https://www.thomsonreuters.com/…/blackrock-partners…

Thomson Reuters happens to have created a branch within its editorial department to “Fact Check” information on social media.

https://mobile.reuters.com/fact-check/about

George Soros manages the interests of the German branch of Swiss founded company Winterthur Group.

On June 14, 2006, Axa acquired Winterthur Group from Credit Suisse for approximately €9 billion. As of 2011, Axa was the second most powerful transnational corporation in terms of corporate control over global financial stability.

Winterthur was bought out and merged with French multi national insurance firm Axa in 2006.

https://en.m.wikipedia.org/wiki/Winterthur_Grou

Axa created The Axa Research Fund in 2008 and funds hundreds of research projects in research laboratories around the globe each year.

Winterthur, prior to Axa acquisition, built the Chinese research laboratory that was accidentally bought by the German company Allianz.

It just so happens Allianz has had a branch in China since 1917, and has engaged in several partnerships, including forming one with the CITIC Group owned by the People’s Republic of China, and being a founding partner of the Canada China Business Council.

Allianz, coincidentally, is also linked to Chinese Beijing based firm, Mabworks.

Mabworks, coincidentally, was a company which played a crucial role in developing a cure for Ebola in 2014.

Coincidentally, the 2014 clinical trials for Mabworks were funded by the Bill and Melinda Gates Foundation.

Mabworks, coincidentally, is the same company that Chinese Scientist Dr Qui provided research for whilst working for the Canadian government.

In 2014, coincidentally, Dr Qui replicated research and a drug (ZMAPP) created in the National Microbiology Lab in Canada to treat Ebola (without authorisation), and handed it over to Mabworks who put it in the hands of the Chinese military.

Coincidentally, Dr Qui is currently under investigation by the RCMP for potential intellectual and pathogen theft.

Dr Qui, coincidentally, is the Chinese scientist who set up and then trained staff for the level 4 Wuhan National Biosafety Lab at the epicentre of the C0VID-19 outbreak.

Allianz is coincidentally owned by corporation giant Vanguard Group.

Vanguard Group, coincidentally, is a shareholder of Black Rock, which controls and manages 1/3 of the world’s capital.

https://www.burenlegal.com/en/news/allianz-and-axa-join-vanguard-china-courts-capital

Vanguard Group, coincidentally, is owned by the Rothschilds.

https://fintel.io/so/us/vig/rothschild-investment-corp-il

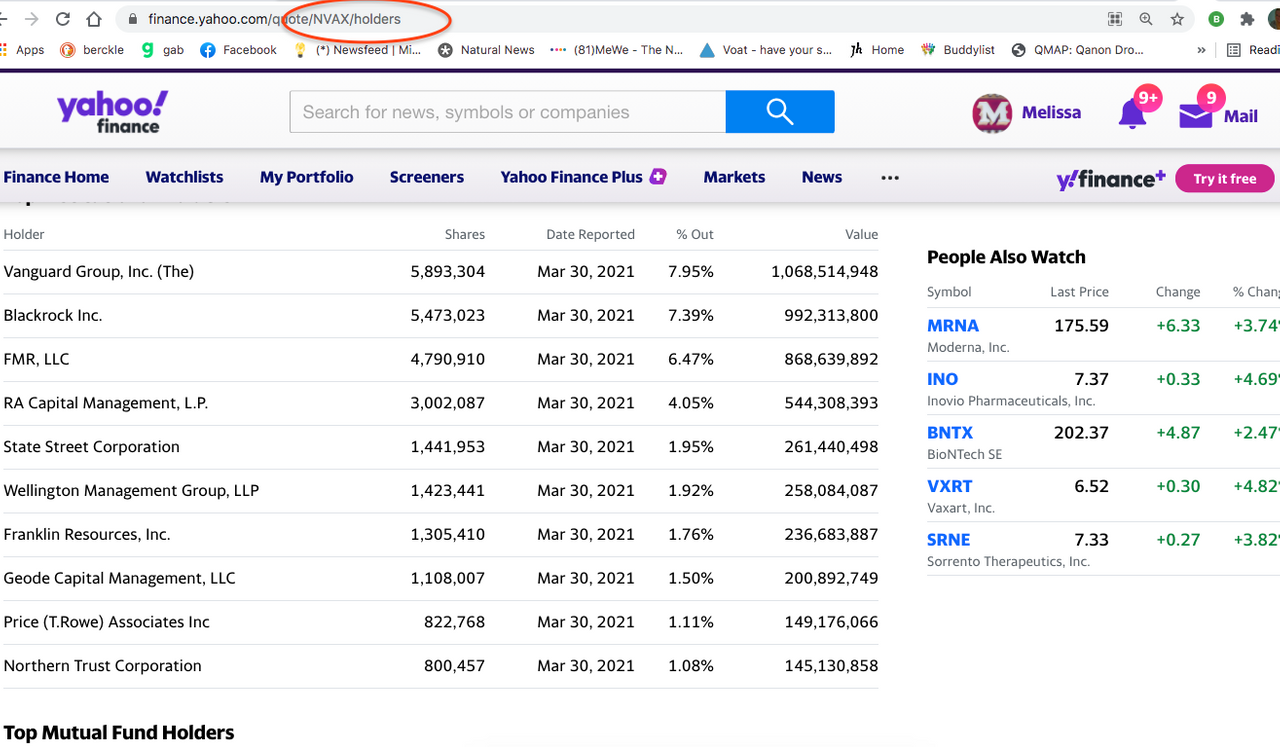

Vanguard Group, Allianz and Black Rock, coincidentally, are the top Institutional Shareholders for a company called Novavax.

Note URL at the top for these top major investors in Novavax

https://finance.yahoo.com/quote/NVAX/holders

Novavax, as it happens, was another key developer for an Ebola vaccine in 2014, and is currently also involved in the development of a C0VID-19 vaccine.

The Bill and Melinda Gates Foundation, coincidentally, funded the clinical trials for the Novavax Ebola drug.

Bill and Melinda Gates Foundation, coincidentally, funded the clinical trials for the Novavax Ebola drug.

Novavax, coincidentally, has experienced a 71% jump in share values since they began developing a C0VID-19 vaccine.

Allianz, one of the the Institutional owners of Novavax, has coincidentally partnered with Microsoft to “digitally transform the insurance industry” and work together on various health-related initiatives.

Coincidentally, Black Rock is also a major shareholder of Microsoft.

Microsoft is owned by Bill Gates.

Bill Gates also happens to be a major shareholder of Pfizer, AstraZeneca and Novavax.

Novavax, Pfizer and AstraZeneca have all received hundreds of millions in funding towards vaccine research from the Bill and Melinda Gates Foundation.

Coincidentally, since the development of the C0VID-19 vaccine began, the net worths of Novavax, Pfizer and AstraZeneca have all skyrocketed – funding these companies is a sound investment.

In late 2019, coincidentally, the Bill and Melinda Gates Foundation hosted Event 201- a pandemic exercise that simulated a global virus outbreak.

See all the proof and evidence here with source links.

PANDEMIC SIMULATIONS BY BILL GATES FOUN USA & WUHAN'S GOV DRILLS FOR CORONAVIRUS PRIOR TO OUTBREAK

Coincidentally, the Bill and Melinda Gates Foundation also funds a UK based organisation called Pirbright Institute.

Is Bill Gates trying to Help you or Harm you? Perhaps you should ask women in Kenya given Tetanus shots with sterilization hidden. Bill Gates and Dr. Fauci evidence from the WHO site of working together for a decade on vaccines. Gates came from Money.

Pirbright Institute, as it happens, is over 100 years old and has transformed from a bovine tuberculosis testing station into one of the UK’s leading virus diagnostics and surveillance centres – at the forefront of global virus research.

Pirbright Institute, coincidentally, has held the coronavirus’ patent since 2015 – on June 19, 2015 a patent application for the live coronavirus was filed by the Institute, and it was approved on Nov 20, 2018.

Bill and Melinda Gates, coincidentally, when they are not leading scientific coalitions on coronavirus vaccine research, are firm believers in population control.

Bill Gates is currently the World Health Organization’s largest financier.

The World Health Organization leads the world response on global pandemics.

But of course – this is all just a big coincidence that points back to somebody, somewhere, eating bat or chicken soup.

We are, after all, somewhat of a very well scientifically-educated coincidence theorist.

Coincidences, too many of it. Follow the money.

https://nypost.com/2021/05/26/biden-orders-90-day-review-of-covid-origins-lab-leak-theory/

BUT wait. ..before do you remember this?

https://www.thesun.ie/news/7048297/biden-shut-probe-china-lab-leak-covid/

Sources

https://finance.yahoo.com/quote/BLK/holders

https://www.investopedia.com/articles/investing/110515/who-are-owners-vanguard-group.asp

https://www.thebalance.com/which-firms-have-the-most-assets-under-management-4173923

https://theconversation.com/these-three-firms-own-corporate-america-77072

https://www.imdb.com/title/tt0080736/

https://www.dw.com/en/joe-biden-stuck-between-blackrock-and-a-hard-place/a-55294044

https://www.nytimes.com/2008/01/15/business/worldbusiness/15iht-soros.4.9237343.html

https://www.blackrock.com/corporate/about-us/social-impact/our-commitment-to-social-impact

https://www.opensocietyfoundations.org/how-we-work

http://robert-gorter.info/follow-the-money/

https://globalizationandhealth.biomedcentral.com/articles/10.1186/s12992-016-0194-4