Blockchain gets interesting

Continuing my series of posts on Blockchain I explore different use cases for Blockchain and some interesting companies that have caught my eye beginning with banking.

How will Blockchain affect Banking?

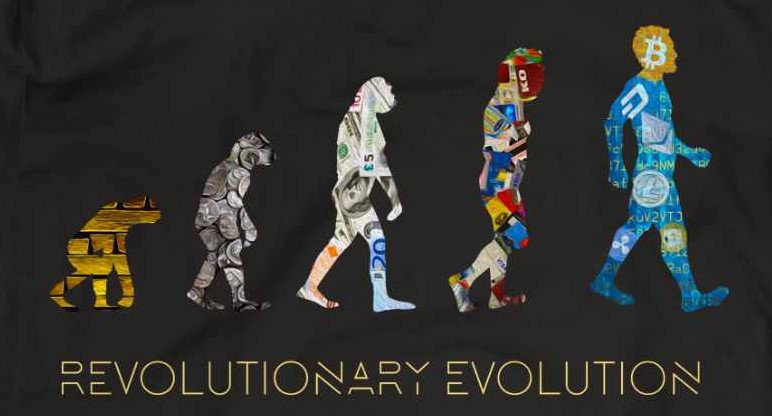

I have no doubt that existing mainstream financial institutions will continue to offer services and, in the developed world, where they work pretty well and efficiently, the likely impact of Blockchain will not be revolutionary but evolutionary behind the scenes; Interbank transactions will speed up, fees will reduce. The average person may not even notice much change. Blockchains influence will be as a catalyst for change to existing structures.

e.g. Visa to Launch Blockchain Payments Service

Blockchain offers exciting new fetures for banking ...

Day to day banking

Anyone with a smart-phone can now have a Digital Bank Account. This account will exists on their phone as a "Digital Wallet" but instead of using a bank, as an intermediary, it will use Blockchain.

Digital Wallets can be used to store value, send money cross borders or make payments via the internet or in person. In the early days, Bitcoin was the only Digital Cash and it was not very user friendly. There are numerous alternatives now which each offer slightly different features; Bitcoin, Dash, Litecoin, Monero to name a few. The technology has evolved since the early days where you needed to be a tech head to use this digital cash.

A bank account in your pocket…

Anyone now can send money from Europe to America from their Digital Wallet via Blockchain, as quickly and cheaply as making a local transaction, such as buying a cup of coffee.

Popular Digital Wallets

It costs nothing to store your money in a digital wallet (no quarterly fees). Freedom flexibility and cost go without saying but one other great feature of digital wallets is that of Multi Signature transactions (MultiSig).

MultiSig

Its possible to set up a digital wallet where money can only be spent only on getting approval from several parties for the transaction. For example you could have a holiday fund where the money can only be spent if you and your wife approve the transaction. You could have a work expense account where you need managers approval to make transactions in a very flexible and transparent way.

Its likely most people will continue to use traditional banking, in the developed world, but where people find traditional banking slow, costing a lot, or inflexible they now have an attractive alternative.

Financial Inclusion

In millions of cases where traditional banking is not available, Digital Banking is now possible for anyone with a smart-phone.

e.g. read Financial Inclusion in South East Asia

Bitwala is another example promoting financial inclusion which provides a service that lets you make international bitcoin payments that links into the traditional financial system, all without a traditional bank account.

Savings

The volatility of digital currencies mean they have not been a great medium for savings in the past but as their market cap grows and they become more stable they will become more attractive. There may even be Blockchain assets linked to fiat currencies in the future. Central Banks have been exploring the use of Blockchain technology.

- For short term savings wallets such as Copay are great and provide flexibility to let you separate funds such as "Holiday fund" and "Christmas fund" to keep your savings accounts separate. Combine this functionality with Multisig access and you get bleeding edge functionality that will never be possible with traditional finance.

- In the long term savings space (i.e. pensions, 401ks, etc) people will be looking for more robust portfolio management tools. The Exodus Project provides a platform for managing your Blockchain assets. View and trade your portfolio all from a beautifully designed app. It currently supports the main Digital Assets but this project has ambitions and will be a very powerful tool for managing your portfolio.

E-Commerce and POS

Digital Currencies provide a secure way to make payments. Paying for something with digital currency is analogous to paying for something with cash. You dont give to anyone your account details you just top up their wallet. Compare this to a credit card transaction where you give your details to someone and they then take the money out of your account.

Not everyone has a Digital Wallet or knows what crypto is however. People generally need a way to link back to the mainstream economy for practicality and there are a growing list of alternatives to Paypal and Visa for Online or Card based transactions with reduced fees and enhanced security but link back to the mainstream economy!

- Bitpay

Provides conversion of digital cash to fiat and deposits directly to a bank account. This is widely used by ecommerce sites who want to accept bitcoin but get paid in fiat. - Xapo

Provides a debit card that convert bitcoin to fiat when you make a purchase. The retailer gets paid in fiat. They dont even know bitcoin is involved. - Wirex / Shakepay

Provides a debit cards that have in app accounts denominated in fiat with which you can make a purchase. The retailer gets paid in fiat. Digital Currencies make these apps possible as you use Bitcoin to top up your account. - Plutus

This will provide a way to pay for items via a tap and pay with your phone and will be powered by blockchain technology. Its due for release in beta in December.

Online Personal Loans

BTCjams mission is "to make credit affordable and accessible everywhere."

Foreign Transactions

Digital Currencies are borderless. There will be no FX charges for purchases anywhere in the physical or digital world via digital currency.

Micro payments

As fees for transferring small quantities of digital currency are so low it becomes possible to make micro payments and online tipping becomes feasible.

- Instead of subscribing to digital content you could pay as you go with a nominal fee for reading a newspaper article or blog for example.

- Steemit is another example where votes give remuneration for authors and curators. You can get paid to blog via the Blockchain.

To get a loan to buy a house I would probably still need to go to a local bank but as digital currencies stabilise they become more and more appealing to use for everyday stuff.

Merchant Banking

Interbank Transactions

Blockchain networks will allow these to be verified and cleared much more quickly. This ultimately should reduce costs.

The Ripple Protocol is one such initiative in this space.

Bond Trading

Fund Raising

The Funding model for business is also up for challenge.

- Its now possible to have an Initial Coin Offering (ICO) to raise funding where a company issues a digital token which acts as a share in the company for willing investors.

- There is a platform called Bnktothefuture where investors can invest in businesses via the site.

These new paradigms mean there is less need for Merchant banks to be involved in the fundraising stage for new businesses. These options are likely only suitable for niche businesses and investors but again are an appealing alternative and compliment to traditional finance.

Conclusion

Digital Banking will find its niche and supplement rather than replace the traditional finance industry.

- It will grow in importance particularly in relation to online transactions where its competitive advantage is security, speed and cost.

- It will improve traditional banking which will utilize Blockchain under the hood more and more.

- More people will be integrated into the global economy. Bank accounts are now possible for everyone with a smartphone.

- The speed of cross border payments and remittance will increase and costs reduce. This is one industry which will be significantly affected. Traditional remittance channels may no longer be necessary.

- Blockchain assets will be used more and more as a way to save and store value. As their use grows, their value stabilises and they become more predictible.

- Niche currencies will be used specifically for their unique properties. Monero for its privacy, Litecoin for its speed, Bitcoin for its liquidity.

- Crowdfunded loans and financing will increase.

Thank you for reading this blog. The next post in this series will cover Applications of Blockchain in Trade and Commerce.

Other Posts in this series

Blockchain – Beyond Bitcoin

Blockchain - Beyond Bitcoin (Part 2)

Blockchain – Beyond Bitcoin (Part 4) Trade / Ecommerce

Blockchain – Beyond Bitcoin (Part 5) Investments and Insurance

Image Credits Many thanks to Stone Banana Bitcoin Series for allowing the use of the fantastic image “Revolutionary Evolution”, which chronicles the evolution of money. Other images have been sourced from https://pixabay.com and https://copay.io