How will Blockchain will shake up Investments and Insurance?

In this post I focus on two industries that will feel the Blockchain as a force for change.

Investments

Traditional Investments include Stocks, Bonds, Commodities, Property, Currency, Derivatives. Financial services firms innovated by introducing such items as Funds, Mobile Apps, Wrap Accounts etc. These were supposed to be places where you could manage all your investments. The downside is inflexibility, lack of features and charges!

Outside Wrap accounts and Investment funds; Stocks, Bonds and Derivatives continue to need to be purchased through a stock broker but now here comes the Blockchain….

The Blockchain provides so many possibilities.

Commodities and Currency

Digital asset platforms such as Uphold let you buy gold, platinum, silver as well as most of the worlds major currencies. You no longer need to buy physical assets. You can have an app on your phone that lets you switch your investments at will.

The 21st Century Gold Standard

New Possibilities..

Digital Equity and Bonds

A company no longer needs to use the Stock market to raise Equity or Debt capital. Companies can now effectively issue stock using platforms such as BnkToTheFuture or as an ICO. BnkToTheFuture operates in a very similar way to traditional Stock Markets but its open to more investors, not just via a broker. Whats new is that Investors can invest in Blockchain based stocks and bonds via ICOs or subsequently by buying digital Assets.

Investment Portfolios

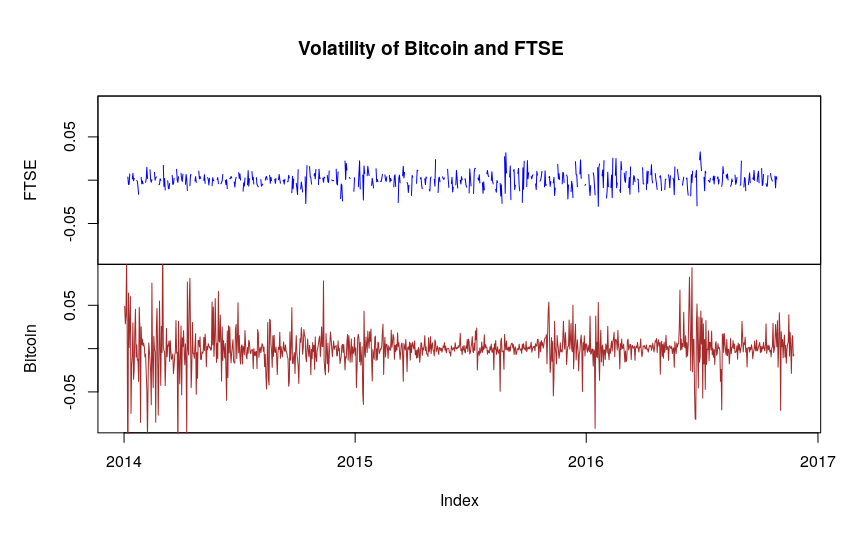

- As Blockchain based digital assets and digital cash mature and grows in size they will become more stable in value. They will be more useful as a store of value as we see less volatility in price.

Currently the value of Bitcoin, and other digital assets are much more volatile than investing in established Stock Markets such as the FTSE as the follwing graphs shows. - For investors Blockchain based digital assets and digital cash also offer a chance to diversify their portfolio from traditional economies.

Multi Asset Investment Platform

With the host of new opportunities to invest, at the moment, you need to be a bit of a computer whiz just keep track of your investments. Platforms for managing your investments are developing and when these mature it will be as easy for people to manage their complete investment portfolio through Blochchain based assets. It’s entirely possible that digital tokens, (like Tether) will develop which are linked to other assets such as Gold, Euro, or even Stock Market Indices or Investment funds. These would be no different than the concept either of the gold standard in the past or more recently investment funds which mirror the performance of an underlying basket of stocks.

The only question mark is how will regulation step up to the plate on this one?

Portfolio Management Tools

Xapo and Jaxx are multi asset platforms but are mainly wallets for storing digital cash.

Uphold takes it to the next level with the sheer volume of currencies and commodities available.

The platforms I most admire have a vision of one day being the go-to place for storing all your digital assets.

- ICONOMI is an online based tool based on the Ethereum Blockchain which also aims to be a multi asset platform for investment.

One to Watch

- Exodus is my favourite. As more coins are integrated into Exodus you could have a complete investment platform which would allow you to manage all your investments in one place, at very low cost. The Exodus team are also very helpful and welcoming to new people to the space.

Disclaimer – the above is not investment advice, do your own risk assessment before investing in any Blockchain based assets.

Insurance

- Public facing consumer Insurance comes in two forms; life Insurance, and Insurance not related to Life (i.e. Car, Home, etc …). These are mass market price sensitive products.

- Commercial Insurance, which is less visible to the public, accounts for a significant portion of the Insurance Industry; including everything from Ships, Office Buildings and Oil Rigs to Footballers feet.

The Internet Era…

Sales

In the 90s and 00’s the internet transformed the high volume, price sensitive consumer market. Car and Home Insurance is now sold on-line. Sites search all the Insurance providers and give you the best deal. Life Insurance can also be purchased in this way and there is generally no need to get a specialised quote from a company unless you have a very unique condition or history.

The high volume mass market generally allows insurance companies to put people into boxes (e.g. male/female, good driver/bad driver) and charge them a suitable price for their risk of claiming.

More specialised Commercial Insurance has not seen such a change in the Internet era and is generally still sold on a face to face basis, with experts setting the details of the cover manually on a case by case basis.

Claims

The Blockchain Era…

The Sales and Claims process as it stands can be unnecessarily slow. Lots of paperwork, people on phones, approvals, authorisations. There is no good reason why this has not been automated to a greater extent so that a customer could apply on-line, get their details automatically synced to a database and an acceptance letter automatically generated and posted. Even low complexity claims settled and paid quicker.

Opportunity for Traditional Companies

The exisitng system could have, and should have evolved and modernised but in most cases it has not. Having everything stored on a Blockchain (policy details, claim details etc) would not be a huge advantage over a well evolved traditional IT system however reality is that in many company's these details are still often stored in paper files, disparate databases. Blockchain offers an opportunity to upgrade out of date systems.

Companies could continue to do everything under the same governance structures, regulations etc. Just faster and much cheaper!

Sales

For the mass market Insurance, the Blockchain offers an opportunity for traditional insurance companies to integrate the whole sales process and streamline it end to end. Polices details entered automatically, approval given, policy issued. MI would be instantly available to drive business decisions and customer details would be stored efficiently and securely for later reference. This could happen on private Blockchain or a public encrypted one.

Claims

Some aspects of the claims process could also be automated. For example using Oracles, factual based claims could be automatically accessed (e.g. has a flight been delayed) and low value, non complex claims could automatically be handled.

Here come the visionaries

Universal Basic Insurance

@dantheman in How does Universal Basic Insurance compare to Universal Basic Income? describes a way of sharing risk among a society using Blockchains. This is an interesting idea.

Insurance Clubs

Another idea is that of a Blockchain based Mutual Insurance model. These mutual clubs have existed for 100’s of years and the Blockchain now offers a vehicle for anyone to set-up such a club using smart contracts with risks shared among a group. https://teambrella.com and have https://bitpark.net/ have developed versions of this idea which takes the Insurance Company out of Insurance.

Taking Insurance Companies of Insurance

I will watch Teambrella closely, but I wouldnt discount the need and value for Insurance Companies to be involved even if the contract is managed on a Blockchain. We can learn lessons from history.

The Challenges

Insurance can be a complex business which plays out over many years. Existing Insurance companies are regulated and have to hold an amount of capital so they can fulfil their obligations, even years after events. There are consumer protection obligations, data protection obligations, legal obligations. These are all there to provide a level of protection to consumers.

Insurance is complex because it involves not only paying out claims but also settling disputes, investing money and planning for the future.

- Money paid into a Blockchain app would need to be invested, held to cover future claims etc.

- In many countries there are data protection and data storage regulations. Theses will need to evolve to allow for data stored on Blockchains.

- One of the most tricky aspects of Insurance is dealing with complex claims.

There are legal considerations, expert judgement etc. which can cause claims to be dragged out for many years and may cost millions of dollars. How would these be settled?

Lessons from history

- In the UK in the 1960’s Emil Savundra ignored the Insurance Industry and went into the Insurance business ignoring all the ramifications and obligations that went with it. If you have a few minutes watch this Trial by Television to see what happened.

- More recently in Ireland in the 00s Sean Quinn, a business man not a fraudster, entered the Insurance Industry and it also ended badly for him.

I have no doubt that, with the use of Oracles and specialist professional adjudicators, Insurance will adapt to Blochchain but it will also need the participation of the Insurance Industry. I am sure that we will also see a few Emil Savundras in the early days of Blockchain based Insurance.

Conclusion

Blockchain offers:

- A rich new platform for investing and managing portfolios. This could change the way investments are managed and transacted for both individuals and retail business.

- A new way for managing and enforcing Insurance contracts, particularly for high volume Life, Motor and Home Insurance, as well as low complexity Travel and Health Insurance.

Thank you for reading this. I write on Steemit about Blockchain, Cryptocurrency, Science and lots of random topics.

Other Posts in this series

Blockchain – Beyond Bitcoin

Blockchain - Beyond Bitcoin (Part 2)

Blockchain – Beyond Bitcoin (Part 3) Banking

Blockchain – Beyond Bitcoin (Part 4) Trade / Ecommerce

Image Credits, images have mainly been sourced from https://pixabay.com.