Part 1 | Part 2 | Part 3 | Part 4 | Part 5 | Part 6

Part 7 | Part 8 | Part 9 | Part 10 | Part 11

The economist John Maynard Keynes believed that higher spending could cure a sluggish economy and if private citizens weren't spending enough – or were saving too much – he recommended taxing them so the government could spend their money for them. This idea is known as “tax and spend.”

It's a simple and straightforward idea. Divert money that's being saved in the private sector so it can be spent in the public sector.

But Keynesian economics goes beyond tax and spend, and actually recommends a policy of “spend and tax,” otherwise known as deficit spending.

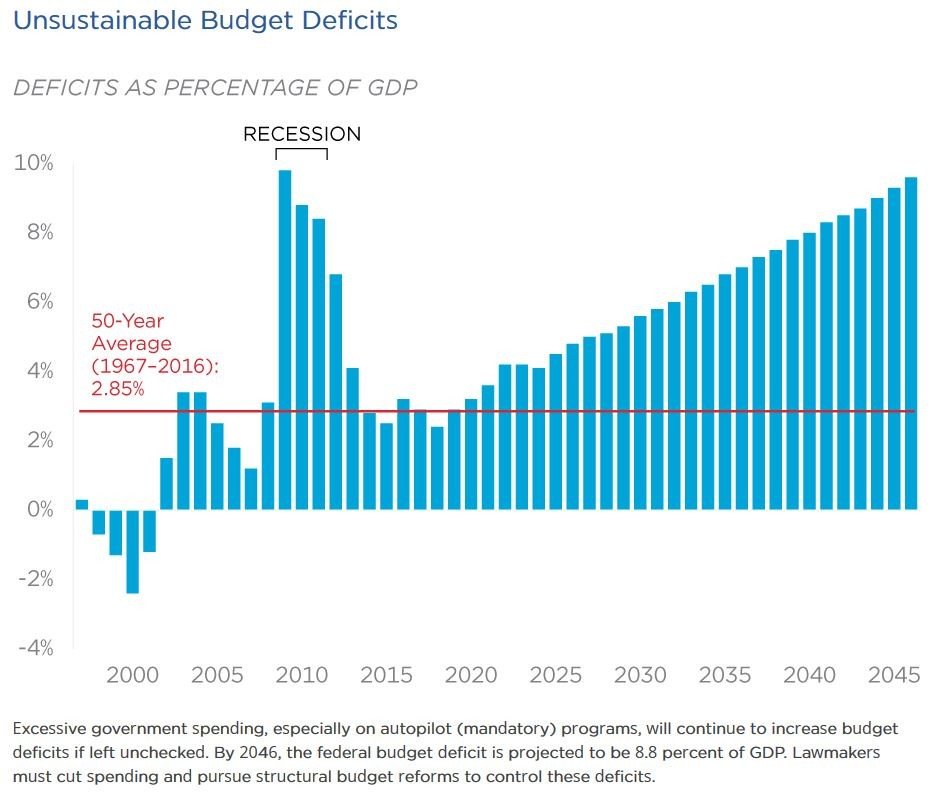

And even Keynesians will admit that “spend and tax” is not sustainable. For this reason, Keynesians tell us that deficit spending should always be temporary and should only be done during a recession.

Source: federalbudgetinpictures.com

It's important that when you hear the word “deficit,” you always add on the word “spending.” Because that's what the media means when it refers to the deficit: it means the government has spent first, and is taxing (paying for it) second.

The idea behind “spend and tax” is this: the government gives a poor individual a welfare payment that isn't yet “paid for” by taxes. Let's say this individual then spends the welfare income on shoes. If enough people spend their welfare income on shoes, it allows the shoe company to expand its factory. This larger factory benefits people into the future, making a whole segment of the economy a little richer. Eventually this brings in higher tax revenues than if the deficit spending hadn't occurred.

The obvious argument against doing this is that the government should have its money in hand before spending it. That's responsible and sustainable money management. To not do this is using a huge governmental credit card, and credit cards are expensive because money spent before you have it, like on a credit card, costs you in interest.

But the less obvious argument against “spend and tax” is that the money the shoe company receives from welfare recipients comes at the expense of the company's future earnings that will be taxed to pay back the welfare payouts in the first place. And the money will be paid back with interest.

Finally, there's a third reason why deficit spending is bad policy: it's inflationary. That means, the government is creating new money to do this. Inflating the money supply, as we explained earlier, causes every dollar already circulating in the economy to lose value.

Some Austrian school economists point out that “spend and tax” isn't just bad economics, it's also immoral. And it's immoral because it's not sustainable: it puts the burden of paying this money back onto future generations. As time goes on, this burden gets bigger and bigger, and it's one of the most unsustainable and expensive policies of consumption our society has ever implemented.

So how do we reverse all these trends leading us to higher and higher spending, debt, and overconsumption? We can start by understanding an idea called Say's Law that completely contradicts the Keynesian suggestion to spend and tax. We'll look at that next time.

This article is one of a series I'm writing for the 30 Day Writing Challenge hosted by @dragosroua. If you want to join, write on a topic that interests you or that you'd like to learn more about and use the tag #challenge30days. As Dragos says, "The key word sequence here is: "write every day."

Think you'd like to wash up on our shore?

The treasure map will bring you right to our door!