- Bitcoin Course Challenge Week 9

- The 10 Biggest Myths about Cryptocurrencies - Part 8

- Central Banks and Bitcoin? A Journey around the Globe (Part 1)

- Envion: Mobile Mining Units - The Future of Mining?

- ManageGo adds Cryptocurrencies

- Bitcoin Course Analysis for Week 48/2017

🏆BITCOIN COURSE CHALLENGE Week 9🏆

The RULES are simple, write the Bitcoin Price USD for the next Sunday 13:00 UTC time and your Bitshares or OpenLedger account name ( like this $ 4,459.44 danyelk1 ) in the comment section of this post. I will accept your answers till Friday 13:00 UTC time.

The one who has the right Bitcoin price or has the closest guess will be the WINNER.

The WINNER will be announced next Sunday.

If you are new with Whaleshares please click HERE!

If you are new with Hairshares please click HERE!

To download Bitshares or OpenLedger wallet please click HERE!

For more information and questions about Whaleshares and Hairshares go to the WHALSHARES DISCORD CHANNEL!

Have fun and show us your Bitcoin forecast skills

☘ Best of luck to all of you ☘

BIG THANKS go to @akrid & @officialfuzzy who make that all happen by sponsoring the BITCOIN COURSE CHALLENGE!

@crokkon you are the WINNER of the BITCOIN COURSE CHALLENGE Week 8!!!

In the series "The 10 Biggest Myths About Cryptocurrencies", I take a closer look at the top 10 claims about cryptocurrencies and their opportunities and risks. In doing so, I will daily explore a new myth and check it for accuracy.

Myth 8: Cryptocurrencies have no intrinsic value

What determines the value of a currency? To determine this, let's take a little digression into monetary history. Since its first use, money has fulfilled two key functions: value retention and exchange. Thus money had a decisive advantage over the previously prevailing trade in goods, which it replaced by making it possible to preserve values over longer periods of time and transport them over longer distances, qualities that goods and services can not (always) afford.

At the beginning of the money trade were naturals, to which a certain value was attributed. This could be - depending on regional specificity - shells, rare stones or weights. However, in common, these naturals had that the exchange value attributed to them exceeded the material value. Over time, gold, silver and, to a lesser degree, other precious metals could emerge as dominant commodities. To give the whole thing a state verification, governments began to shape official coins and only accept them as a means of payment in their territory.

The coinage represented an important step in the development of the money, it created for the first time the confidence of the citizens in a fixed and guaranteed by the state side value of the object of exchange. Trust is the keyword here, because trust is what gives our money legitimacy as a means of payment even today. With the advent of paper money and electronic money, money has continued to evolve from an intrinsic value to an object whose value depends solely on trust in its acceptance. We accept money for a service because we believe we will get back a service of comparable value for that money at another time.

Money derives its value from trust, or more precisely from trust in institutions such as the state or the central bank. But what about cryptocurrencies, which are deliberately decentralized and thus organized beyond any state control? Here, the trust of users in the institutions as intermediaries is replaced by the confidence in the blockchain and its algorithm. The intrinsic value of money in cryptocurrencies is basically no different from what it is in Fiat currencies.

Moreover, decoupling the question of the value of a currency from the trust factor and looking only at the material component gives a completely different picture. Thus, at the latest since the abolition of the international gold standard, central bank money is maximally covered by the value of the paper on which it is printed. On the other hand, a large part of the cryptocurrencies have a high production value, which results from the mechanism by which these coins are produced. The proof-of-work algorithm, which underlies Bitcoin, among others, rewards miners for distributing their computer computing power to the network by distributing new cryptocurrency units. The production value of the cryptocurrency thus corresponds to the computing and hardware performance provided. Compared to fiat money, this is a much more costly process, especially since monetary expansion in a Bitcoin ecosystem, as is possible with a central bank, is inconceivable. Bitcoin is limited to 21 million coins and also the mining of the blocks can not be accelerated easily. These limits set Bitcoin remains scarce, which in turn has a positive effect on the value stability.

Thus, this myth can not only be rejected, but in a certain way makes a relativization of the term "intrinsic value" necessary. The value of any currency whose exchange value does not exactly correspond to its material value is trust. Only collective trust in the sense of widespread acceptance among the population and companies creates lasting and stable values. The process of building trust and adaptation takes many years and has to contend with great resistance and setbacks. Still, cryptocurrencies seem to be on the right track.

Part 1: Cryptocurrencies are mainly used for criminal business such as money laundering.

Part 2: States can not regulate cryptocurrencies and will sooner or later ban them.

Part 3: Cryptocurrencies price rises are a pure bubble formation.

Part 4: The storage of cryptocurrencies is cumbersome and risky.

Part 5: The tax situation for cryptocurrencies is unclear.

Part 6: Cryptocurrencies are not attractive to institutional investors.

Part 7: A regulated trade in cryptocurrencies is not possible.

While the Bitcoin of these days climbs unprecedented heights beyond the astronomical 10,000 US dollars, there is not only euphoria and gold digging mood, but also doubts, skepticism and fear of the next uncontrolled tulip - especially by state authorities and central banks. If governments, state institutions and authorities are asked, there is no consensus as to how to deal with the emerging economic power outside of conventional control. On the contrary, depending on where the gaze of those days falls, instead of a unanimous tenor, there is a patchwork of rags.

To regulate or not to regulate - that is the question. And the guards of the world economy are in disagreement.

While those who want to have a market power, cryptocurrencies know the status of money, do not even see the responsibility or consider their monetary risk as too low, get the other from the blow. With the regulative lasso they want to transport digital currencies into the safe hands of the authorities.

The following overview takes you on a journey around the globe: It is intended to provide an overview of the global situation and - without any claim to completeness - to disclose differences in state approaches.

Part 1 of my journey takes a look at a selection of those states that are particularly critical and want to put handcuffs on Bitcoin & Co.

China:

China is at the forefront of crypto-skeptical states. With the ban on Initial Coin Offerings (ICOs) and the closure of crypto exchanges in September, the Communist Party is not just putting a lid on cryptocurrencies. It also clearly makes one thing clear: The prosperity of the domestic economy lies solely in the hands of China. Currencies must not escape their controls. The Chinese state wants to remain guardian over its own economy at any cost, despite any opening ambitions Xi Jingspings. On the other hand, a revision of the hard crypto course is currently in question, contrary to many speculations about Chinese domestic politics.

Russia:

Russia is not in the mood for Bitcoin & Co. This becomes clear at the latest with the recent warning of the Russian central bank this week: According to the news agency TASS, the authority warns of a bitcoin bubble and high losses for investors. And in the past, cryptocurrencies were repeatedly confronted with the Kremlin's refusal: while Communications Minister Nikolay Nikiforov said that Bitcoin had no chance, the Russian government warned in November that it was using new crypto-cash ATMs and Bitcoin as a "foreign currency". ,

Rather, Russia is starting to strike back: in October, President Vladimir Putin announced the release of a state-controlled crypto-ruble, thereby pushing for a faster agenda for action against foreign payment alternatives. Because concrete legislative answers to Bitcoin are missing in the largest country of the world so far.

An appropriate law could remedy this situation soon. At present, the possibility of a regulatory proposal of the Russian State Duma for the coming year is emerging.

India:

The Reserve Bank of India, the central bank of the fastest-growing economy in the world, responsible for the monetary policy of the rupee, holds little of cryptocurrency - despite the exploding market. This is primarily due to the risks of covert terrorist financing and money laundering. The supreme tax authority of the South Asian country is currently seizing crypto transactions as a violation of foreign exchange law. Legislative clarity on the situation in the country should create a current petition process: India's Supreme Court, the Supreme Court of the South Asian country, called on the government and numerous authorities in November to examine possible regulatory laws against Bitcoin & Co. and set off bring.

Morocco:

From Asia to Africa: Morocco's foreign exchange authority also sees its foreign exchange laws violated by crypto transactions. In this context, the responsible office of the Change threatens the users of cryptocurrencies in November last with penalties. The authority relies on appropriate central bank regulations for foreign transactions.

The Sahara Kingdom believes that digital payments are not just risky for users. Rather, they would happen behind the back of responsible intermediaries. Thus Bitcoin's de facto foreign transactions in the Moroccan dirham and vis-à-vis were a violation of the current legal framework for foreign exchange.

Cryptocurrencies are a "covert payment system". Instead of Bitcoin, users should use the foreign currencies listed by Central Bank Bank Al-Maghrib. Thus the cancellation equals a ban.

Interim conclusion:

Bitcoin not only makes hope, but stokes every euphoria to defy even fear. Government agencies and governments fear losing their control over their own economy. The consequence: the central bank authorities and financial institutions put on hard bandages. They express their refusal and look for legal hurdles to put cryptocurrencies in their place.

The examples given here provide an overview of how states respond and what answers they choose for their interventions.

That despite all skepticism this must not remain the only answer, proves the second group of states, "The waiting States".

More in Part Two of my journey around the globe.

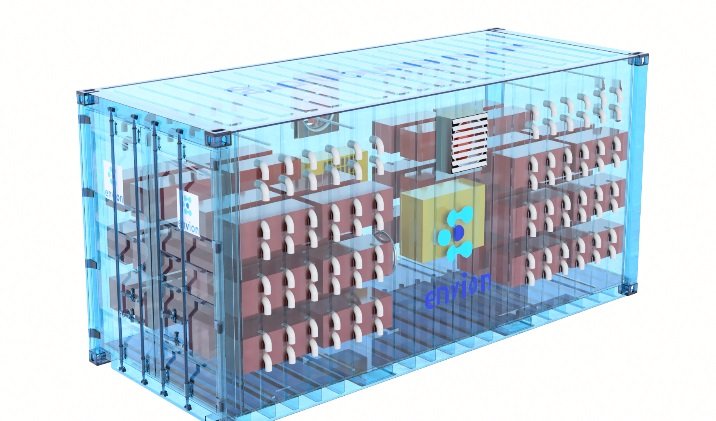

Envion AG presented in a smaller scale on Wednesday in Berlin its technology of mobile mining units, which is designed to take anywhere unused energy capacity and use these to mine cryptocurrencies. To finance its infrastructure, the start-up has launched on December 1, 2017 an ICO - with the promise of a 100% profit distribution.

And again, an innovative blockchain idea from Germany. The start-up Envion has set itself the task of creating a link between two different types of problems and to create a mutually profitable solution by combining both loose ends.

Mining has been steadily changing since the early days of cryptocurrency, not least because of its increased popularity. The high intensity of mining now makes it increasingly unattractive to min mine the large cryptocurrencies thanks to the built-in difficulty algorithm for private miners. As a result, rewarding mining is limited to a steadily shrinking circle, and energy consumption per coin is increasing steadily.

The development of mining meets an energy world in which - especially in the field of renewable energies - there are untapped potentials in many places, because energy production does not pay off permanently, but only in stages, due to the low utilization of the grid. This state of affairs is reflected, for example, in the fact that there are energy producers who have been taken out of the grid for more than 100 days, since electricity generation and feed-in to the grid is not only unprofitable, but also incurs additional costs for the producer.

The approach developed by Envion brings both problems together and creates a solution that brings together both energy producers and miners - with the help of an innovative technology: the Mobile Mining Unit.

Placed in a common shipping container, which can be placed virtually anywhere in the world, is high-quality and powerful mining hardware. When placed in the right place, mining infrastructure can tap untapped energy sources and use them to mine cryptocurrencies. To maximize mining efficiency, the container is optimally insulated, such as a modern ventilation and cooling system that keeps the air clean and temperatures low, so as not to interfere with the miners' work. As a result, such a container - in each modified form - the same extent in the desert (for example, solar panel) as well as in Nordic-cold environment (for example, for wind or water energy) placeable.

Matthias Woestmann, the CEO of Envion AG, said that the goal was to station between 50 and 100 of these containers around the world in the medium to long term to ensure truly decentralized mining. There are already discussions about possible partnerships, some of which are already in the final stages. Although the focus should clearly be on renewable energy, Woestmann acknowledged that it would never be able to achieve this 100% and still rely on conventional energy sources.

The investors are to be 100% involved in the profits of the mining units. The token sale of the EVN token launched on the Ethereum Blockchain promises this payout to all those who wish to participate in the ICO and acquire tokens for profit sharing in the Mobile Mining Units. The proceeds from the ICO are intended to finance the further expansion of Envion and to constantly improve the technology behind the Mobile Mining Units.

Here you can read the white paper and here you can participate in the ICO.

Disclaimer:

The information presented in this post is not a recommendation for purchase or sale. It is only an opinion of me the author. They serve merely to describe the project and are not to be understood as an investment analysis.

The ManageGo app will also offer Bitcoin, Litecoin and Ether as payment options in the future. ManageGo makes it possible for tenants to process the payment of the monthly rent digitally.

This step is made possible by the Application Programming Interface (API) from Coinbase. The app will automatically convert digital currencies into US dollars and forward them to landlords.

Chaim Lowenstein Deputy Head of Corporate Strategy told Technical.ly that the company itself was not interested in investing in or storing cryptocurrencies. Instead, it wants to convert it immediately into paper money.

He told the news site:

The company based in New York leases itself no real estate. It merely provides a platform for tenants and landlords to settle payments.

Lowenstein explained that the company hopes to stand out through the various cryptocurrencies. A survey conducted by ManageGo revealed that customers value cryptocurrencies as a means of payment.

"We thought this would lead to greater comfort," said Lowenstein.

In general, crypto-friendly letting programs are rather rare. In Switzerland alone, Bitcoin payments are available as a rent from VisionApartments. Unlike ManageGo, however, VisionApartments leases its own real estate.

With some turmoil between November 29 and 30, the price rose to reach a new all-time high of 9,664.65 EUR (11,498.09 USD).

Image based on data from coinbase.com

Summary

- The Bitcoin price has gone up during the week.

- Between 28 November and 30 November, the Bitcoin price experienced dramatic fluctuations, but has since risen again.

- A real short-term resistance can be seen in the current rally at best at the new all-time high of 9,664.65 EUR (11,498.09 USD). Most important short-term support is 8,241.37 EUR (9,805.01 USD).

Inexorably, Bitcoin races to the moon. At the end of the week, it was felt that the current rally had come to an end, but it was only a slight quake that did not end the existing bullish trend. On the first of December, the price stabilized again, following the trend - which led to a new all-time high of $ 9,664.65 ($ 11,498.09) on December 2.

The MACD (second panel) is correspondingly positive to the uptrend and the MACD line (blue) is above the signal (orange).

The RSI (third panel) is at 64 and thus bullish.

The analysis of the moves in the 60 mins. chart speaks a bullish language. Most important support is described by the dip during the price turmoil and stands at 8,241.37 EUR (9,805.01 USD). A real resistance is not yet visible in the 60 mins. chart; at best, the current all-time high at 9,664.65 EUR (11,498.09 USD) can be seen as such.

The long term course development

How is this rally to be evaluated in a larger context? Let's take a look at the medium and long-term price movements, first in the 240 mins. chart:

Image based on data from coinbase.com

The medium-term chart is also characterized by an upward trend. Instead of the already discussed here the upward trend, which is pursued since the middle of November, drawn. This is flatter than the upward trend that came out last week. Overall, since mid-November the price has been well above the exponential moving averages for one or two weeks, which has been called into question even in the recent price shocks.

The MACD is accordingly positive, as is the MACD line above the signal. The RSI stands at 62 and is thus bullish. In the medium term, the situation is also bullish. Key support is described by the exponential moving average over the last two weeks, which is currently at 7,935.39 EUR (9,440.97 USD). In order to indicate a possible resistance beyond the all-time high, a negative fib retracement level of 31% relative to the upward trend as a resistance since mid-November was suspected. This is then at 10,089.93 EUR (12,004.29 USD).

Let's take a look at the 1D chart:

Image based on data from coinbase.com

It all looks like another, even steeper upward channel is forming. Anyway, in the rally this week, the resistance of the previous upward trend was broken. So far, the price is not interested in correcting and re-entering the original upstream channel.

The MACD is positive, as is the MACD line above the signal. The RSI stands at absurdly high and is thus overbought.

Overall, the long-term outlook is bullish from a technical perspective, but the price is extremely overbought. So far, there has always been a consolidation or at least a break to catch your breath. Anyway, the main support is described by the former resistance of the old and the support of the new upstream channel and is at 7,679.00 EUR (9,135.94 USD). Resistance here is the same as the 240 mins. chart.

Disclaimer:

The course analysis is from the morning MUT time zone and can have changed since. The price estimates presented in this post are not a recommendation to buy or sell. They are merely an estimate of me.

I wish you all a lovely Sunday and a great start in the new week!!!

ⓁⓄⓥⒺ & ⓁⒾⒼⒽⓉ

Best regards

@danyelk

.gif)