In the cryptocurrency world, an ICO or Initial Coin Offering is a crowdfunding event where a percentage of the newly issued digital currency is sold to investors in exchange for legal tender. This is also called a token sale or crowdsale.

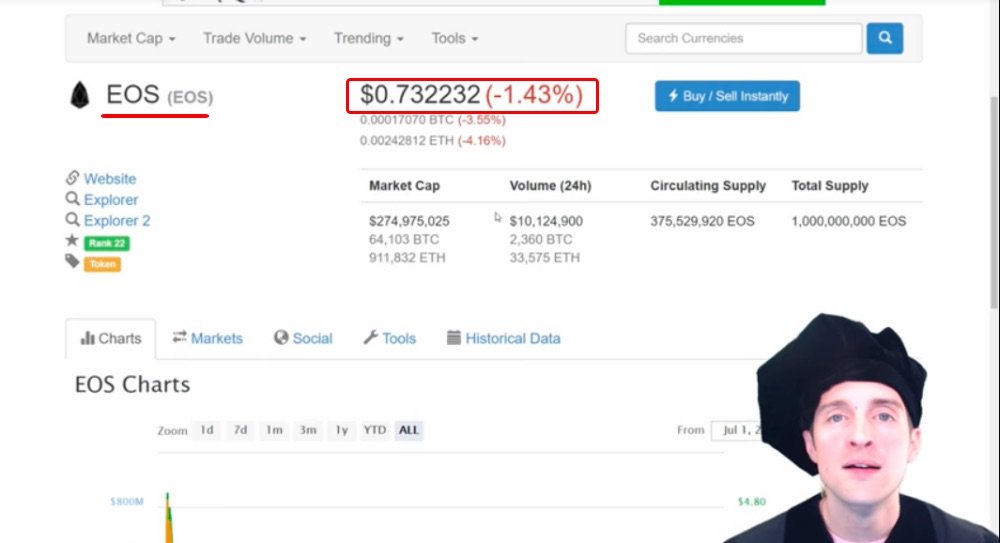

In this post I feature an example with the EOS ICO showing how the tokens are released each day and what impact this has on the cryptocurrency market!

What is an Initial Coin Offering or ICO?

An initial coin offering is basically the start of a new cryptocurrency, where the initial funds of that currency are being released and available for purchase.

If you are familiar with companies and investing in business, you might think of this basically as a startup company stock crowdsale.

In other words, think about a new company launching and offering stock in their company immediately as soon as that company launches, this is where the problem starts coming in.

If you think about what I just said, that doesn't sound very lucrative, does it?

Therefore, my advice in terms of what to do is avoid buying in during any initial coin offering. I suggest waiting 1 or 2 years to consider buying into any new cryptocurrency, unless we are all in. If we are doing that currency full time, if we are doing everything we can to contribute and support the marketing or development, then sure, go all in on it and then buy some right away.

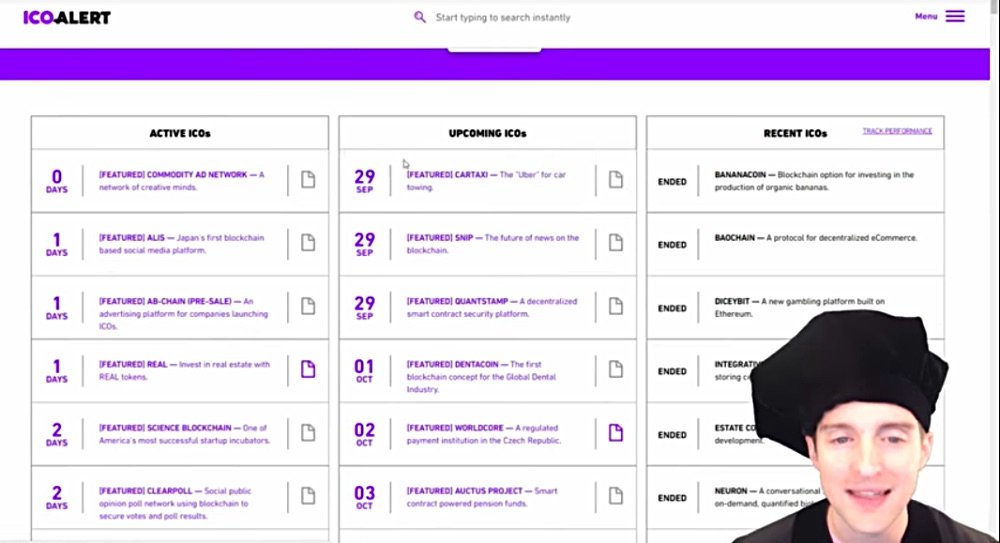

If you'd like to see a list of ICOs, go to icoalert.com where all of the ICOs are nicely listed.

Here’s what it looks like.

You can see ICOs in progress, ICOs that have finished and ICOs that are upcoming, that haven't launched yet.

Be aware that some countries such as China and I believe Korea have banned or are banning initial coin offerings, which means that it's not legal to buy into or offer an initial coin offering. Other countries like the USA are getting unfriendly towards initial coin offerings to the point where some initial coin offerings are not allowed to be purchased in the USA.

Again, the government regulation is pointing directly back to what I just suggested, avoid buying in during an ICO because it's basically a startup company stock crowdsale. If you've looked in anything, Venture Capital or Angel Investing, the rates of return on startup companies overtime tend to be horrible.

Sure, while occasionally a company like Google or Facebook, if we invest in those early, we might get fantastic returns, but most of the time, the companies fail and take all the money, and give nothing back ever besides time and aggravation.

If you'd like to see a list of all cryptocurrencies, go to coinmarketcap.com, which has a nice list of all the cryptocurrencies or most all of them.

If you've seen the Bitcoin and Ethereum price rise lately, a big part of this rise has been Bitcoin and Ethereum being purchased with US dollars in order to buy into ICOs.

Would you like to see how this works inside EOS because I think this case study will show the inner workings of an ICO that's proven successful and show exactly how it works inside EOS?

EOS case study

EOS is one, if not the top ICO that's happened recently as of September 30, 2017.

EOS is giving out two million EOS every day in exchange for whatever Ethereum is received. Now, this initial coin offering is repeating this process every day, it says for 350 days here.

Now, what happened with this initially was a huge amount of excitement in the first few days of the EOS sale, buyers paying into EOS.

So what you do, this is on the Ethereum Blockchain, you send Ethereum, although if you're in the USA, you're not allowed to participate as I would assume you're not allowed to in China and Korea, and perhaps some other countries.

So you send Ethereum over through this crowdsale, and then every 24 hours, the two million EOS is divided among all the Ethereum equally. This is providing an opportunity, if you watch the price carefully of both EOS every day and the amount of the Ethereum and Ethereum price on some days, buyers are able to put Ethereum in here and then make an almost instant profit.

Who's paying for that?

If you're just holding your EOS, every time the buyers make a profit doing this, you’ve essentially taken a big loss. This is one of the things that makes ICOs problematic, this is allowing smart traders to put in money with Ethereum at the very end of the distribution, and then immediately sell that to make a profit.

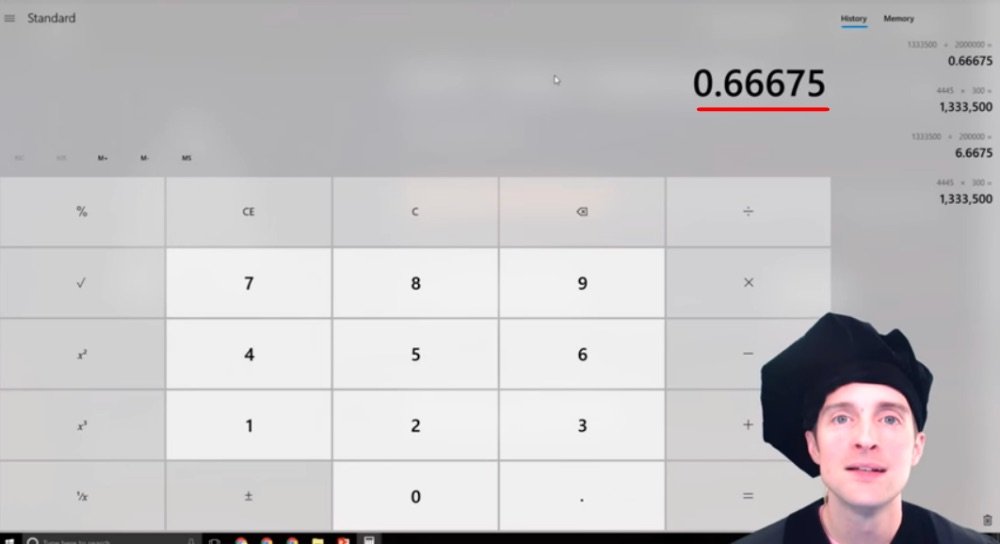

I just watched this happen earlier and I'll bring up the exact figures.

There were 4,445 Ethereum that were put into the last token distribution just minutes before.

Now, if you multiply that by the price of Ethereum today, which is about $300, that was $1.3 million or so that was put in to buy 2 million EOS.

4,445 x $300 = $1,333,500

That means if I divide by 2 million EOS, the result is $0.66 to buy one EOS.

$1,333,500 ÷ 2,000,000 = $0.66

Now that's a really sweet deal if you're waiting till the last minute and calculating the price because you just got EOS for about 9% or 10% less than you can sell it for on the market.

This system is allowing smart traders to essentially grab the EOS through the ICO every single day whenever the price is ideal, and at the same time, this can go the other way.

For example, if the price drops, everyone who sent in Ethereum early that day, say the price dropped down to $0.53, and the Ethereum price and the other numbers stay the same, you would have paid $0.66 to get something that could be immediately sold at $0.50, which might have been the case yesterday or the day before.

Therefore, this ICO in terms of being able to buy in if you’ve got Ethereum is really easy. In terms of just looking at it as a part of a portfolio though, you can see what's happened so far. If you bought this when it initially came out and it was really exciting, you might have paid anywhere from $1 at the least to $5 at the most.

If you look just a few months later, this went off in the beginning of July, three months later, the price is down to $0.74.

This means that if you bought at the $5 high when everyone was most excited, you've lost 80% or so of your initial investment if you’ve just bought and held. Even if you bought in before hardly anyone knew about it at $0.90 or $1, you’ve still already lost about $0.30.

I would guess that the losses are going to continue to pile up because every day with two million EOS available, every single savvy trader who knows how to every day have the opportunity to grab EOS cheap, and immediately dump it, this is almost a sure thing for continued inflation of the amount of EOS. Therefore, a continued deflation or a continued drop in the price for those just buying and holding.

This is an example of why participating in ICOs in the first year is extremely risky, at pretty much any point you would have bought EOS before, you’ve taken a loss. Unless you just bought it in the last few days, and then immediately sold it, you could have made maybe a few cents on every EOS you bought.

This to me is a very typical pattern with not just ICOs, but if you look over the years and at the historical snapshots, you can see what happened to other currencies.

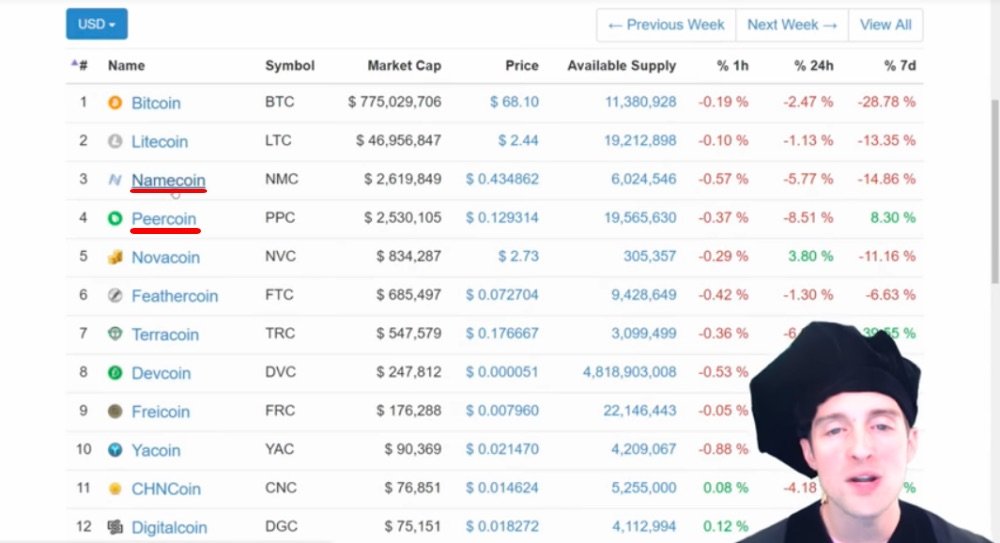

Let's just look at July, four years ago.

There's Litecoin and Bitcoin at the top.

Now, sure, if you’d known about Bitcoin and Litecoin, bought in and held them today, it’d be great, but what about Namecoin and Peercoin?

What about all these other coins, have you ever heard of any of these?

Four years ago some of these were a big deal, but today, not much of an investment.

As you see, it's very risky to participate in something in the beginning because the failure rate is almost universal. If we look over at all these cryptocurrencies, nearly all of these are going to be failures.

There are hundreds of these cryptocurrencies, and almost all of them are just going to fail whenever things get difficult. Therefore, participating in an initial ICO is so risky that in fact, EOS is not even offered in the US for fear of response both by the US government and by customers buying EOS at a higher price such as a dollar or $5 dollars, and then watching the price continue to go down over a year.

Now, this is an incredibly clever business model for the companies that are able to run it. You see, millions of dollars every day are pouring into EOS and all they have to give out in exchange is a token, which may or may not have any value at all in a year or two.

Now, it might have a lot of value, it might change the world, it might be the one cryptocurrency that replaces it there, it might, it might, it might… but that's a big leap of faith. Why not wait a little bit longer?

Now, sure if you bought in on Bitcoin at $68, that looked like a big risk at the time and today Bitcoin is up to $4,300.

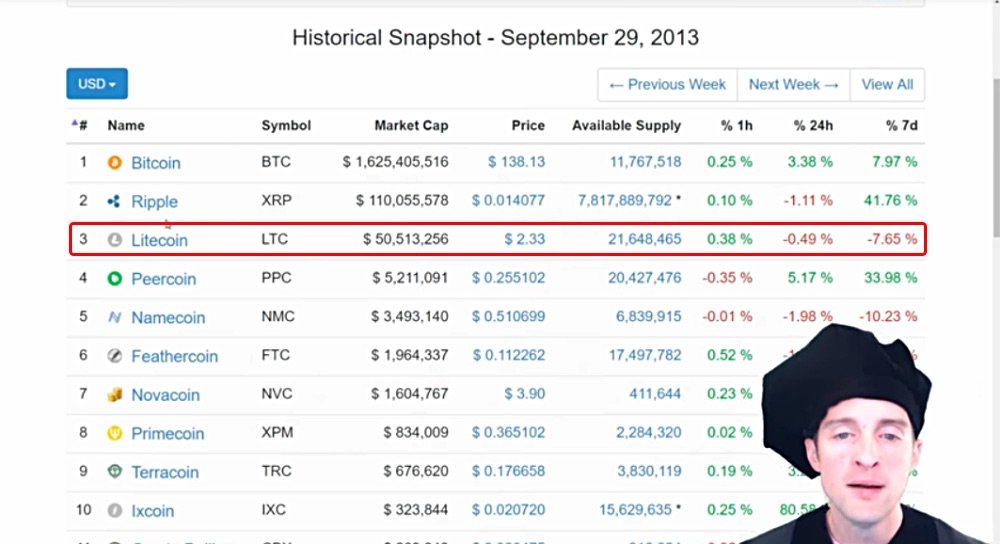

Let's look at the snapshot for September 29, 2013, which is four years ago. What happened if you bought in to some of these other cryptocurrencies. Let’s ignore the one at the very top, but Litecoin actually produces a good case study.

Now, Litecoin is $54 today, but if you bought in the Litecoin four years ago, the price was $2 and something. It hit an initial spike, and then the price proceeded to stay nearly the same for almost four years until it hit another price spike.

Now, let's look at some of these other cryptocurrencies.

I'm just randomly browsing through this.

Peercoin is $1.30 today and it was $0.25 four years ago, and meanwhile, it's been around where it is today for a long time.

Let's see some of these other ones like Namecoin, I've never made a transaction in Namecoin. Most of the time since four years ago, Namecoin has been worth less than it was four years ago.

What are some of these other ones?

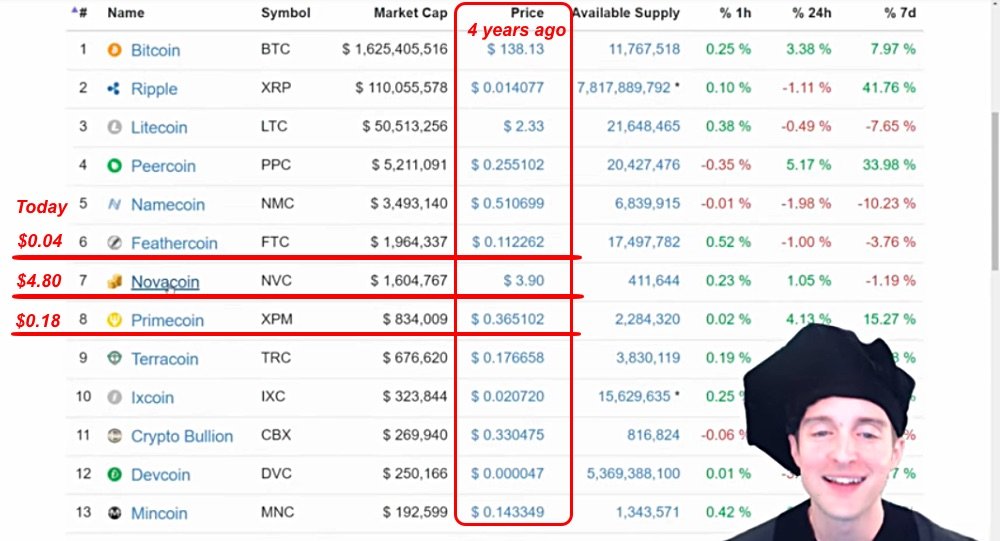

When Bitcoin was $138 four years ago, Feathercoin was $0.11 and it’s $0.04 today. I'm just clicking because this is a consistent trend. Novacoin was $3.90 four years ago and it’s $4.80 today. Primecoin was $0.36 four years ago and it's $0.18 today.

In other words, most all these cryptocurrencies are losers. Most all these cryptocurrencies will never produce consistent good returns over time.

An initial coin offering is the very most risky thing to get involved with unless you've got some kind of guaranteed profit system that is a quick turnover.

If you were smart enough to send in Ethereum a few hours ago, you could have made 10% on just sending in the Ethereum to the ICO and immediately dumping it right away back on the market.

Now, who's paying that 10%?

Everyone who's essentially holding it already is watching their value drop and all of this is conditioned on the price of Ethereum. If the price of Ethereum plummets, if the price of Bitcoin plummets, all these things suddenly get more difficult, and then you see how all these equations are very delicate.

I hope this has been helpful in looking at what an ICO is today. I hope I've shown you the inside of an ICO. I've given you the basics of it, I've provided a recommendation. Wait a year or two to buy in.

Now, yes, if you'd bought into some of these Ethereum ICOs before, sure, I know there's data showing how great it'd be if you bought in before, but it's not before, it's now. These ICOs are getting regulated by governments, these ICOs are going to consistently be big losers.

I've done this with the hope to help you avoid paying the price to fund basically a startup company. These ICOs are startup companies. I've done this to give you the chance to avoid just blindly investing into ICOs.

If there is an ICO you love, if you love EOS and you're going to give everything you've got in EOS, then sure, buy into it, buy some every day, use the crowdsale, but to just passively put these on a portfolio and hope they'll go up is insane. If you looked at the data I showed, most of these over time continue to go down and down. They go through awful downs and are lucky to even come back up.

I'm very grateful to share this with you today based on receiving a question on my blog saying, "Jerry, would you explain what an ICO is?"

If you have more suggestions, the best place to reach me is on my blog on Steemit. This is my single and only cryptocurrency investment because I find Steem is absolutely outstanding in terms of getting a consistent return and providing real value.

Would you follow me on my blog on Steemit because there I can actually give you money to make a comment?

This is the one cryptocurrency, I believe, that has mass adoption potential and why buying into almost any ICO is unnecessary because the cryptocurrencies that have proven value tend to be a much better buy over time.

Final Words

Thank you very much for reading this post, which was originally filmed as the video below!

If you've enjoyed this video, would you please leave a like because that helps motivate me to make more videos for you.

I appreciate you being here and I hope you have a wonderful day today.

If you found this post helpful on Steemit, would you please upvote it and follow me because you will then be able to see more posts like this in your home feed?

Love,

Jerry Banfield with edits by @gmichelbkk on the transcript by GoTranscript

Shared on:

- Facebook page with 2,247,212 likes.

- YouTube channel with 206,697 subscribers.

- Twitter to 105,021 followers.

PS: Would you please make a vote for jerrybanfield as a witness or set jerrybanfield as a proxy to handle all witness votes at https://steemit.com/~witnesses because as a top 20 witness I am pledging 80% of my earnings (~$200 a day) to funding our Facebook and Google ads? Thank you to the 1361 accounts voting for me as a witness, the 718 M VESTS assigned from users trusting me to make all witness votes by setting me as proxy, and @followbtcnews for making these .gif images!