The Experiment:

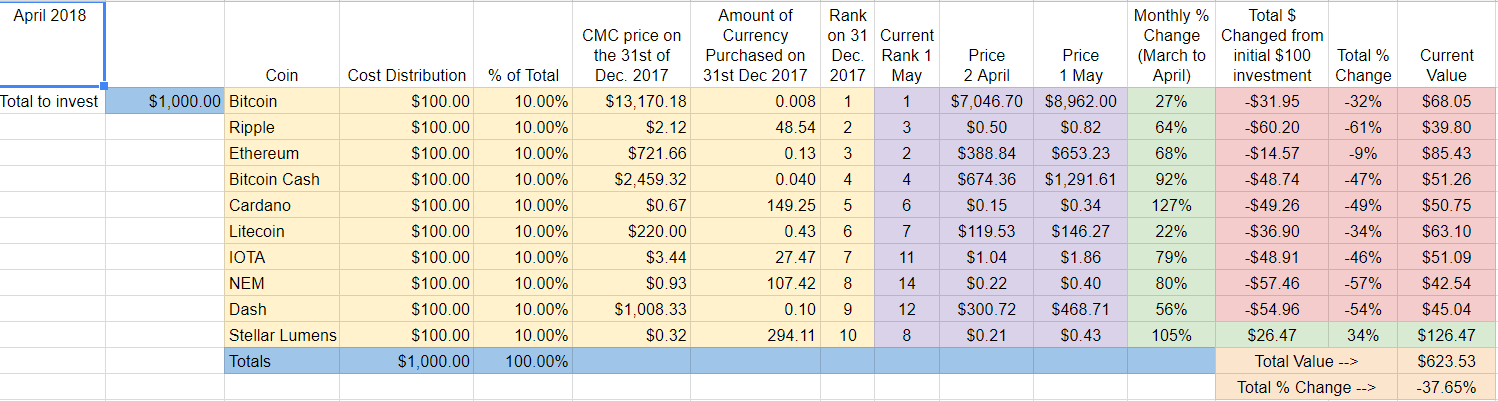

Instead of hypothetically tracking cryptos throughout the year, I made an actual $1000 investment, $100 in each of the Top 10 cryptocurrencies by market cap as of the 1st of January 2018. I'm trying to keep it simple and accessible for beginners, a type of homemade Index Fund* for those looking to get into cryptos but maybe not quite ready to jump in yet.(*without weighting and rebalancing it's not a true Index Fund - but hopefully still helpful as a proxy for the entire market).

The Rules:

Buy $100 of each the Top 10 cryptocurrencies as of January 1st, 2018. Run the experiment 365 days. Hold only. No selling. No trading. Report monthly.Month/Episode Four (April) update: A New Hope

Look at that! GREEN! A welcome change, all cryptos included in the experiment are green for the month. Plus Stellar Lumens emerges as the only Top Ten crypto that is in positive territory at this point in the year since the beginning of 2018.

April Winners - Cardano bested the field in terms of monthly change (+127%) and movement (climbed from 8th position to 6th position). Stellar was close behind, up 105% from the beginning of April (although it slipped in rank from 7th to 8th) followed by Bitcoin Cash, up 92%.

April Losers - I’m tempted to claim victory all around since every crypto that began 2018 in the Top Ten made progress in April, something we haven't seen all year. Litecoin grew the least gaining “only” 22% and slipped from 5th to 7th place. Bitcoin is up “just” 27%. But not bad at all in light of the rough year crypto has had so far.

Overall update – Only Stellar in the green in 2018. Ripple, NEM, and Dash underperforming

Of the cryptocurrencies that began 2018 in the Top Ten, only Stellar is in the green, +34% since the start of the year. Stellar has also had the most upward mobility, moving two places from position 10 on January 1st to position 8 today. After Stellar comes Ethereum, which is very close to the break even point, only down -9% for the year (Ethereum has momentum - it's coming back from down -46% only a month ago).

Losers? Ripple is down -61% with NEM and Dash close behind, down -57% and -54% respectively. Also of note, IOTA has fallen out of the Top Ten again, joining Dash and NEM. These three have been in and out of the Top Ten all year (mostly out). Replacing them in the Top Ten are Tron, EOS, and Neo.

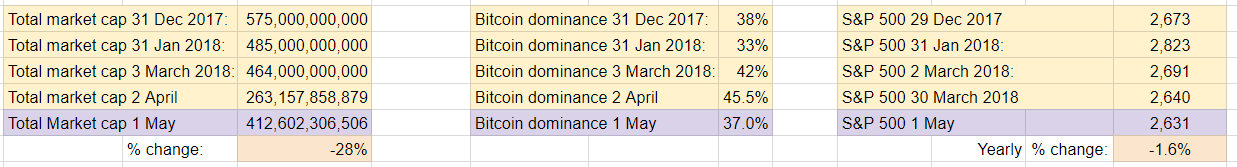

Total Market Cap for the entire cryptocurrency sector:

April was a good month for crypto. The total market cap is up approximately $150B at $412.6B. This is a positive development, but for a bit of perspective remember that the total market cap at the beginning of the year was around $575B – the overall market is still down -28% since January 1st and still under the levels of both February 1st ($485B) and March 1st ($464B).

Bitcoin dominance:

Bitcoin dominance is down quite a bit in April, falling from 45% to 37% today, about the same level it was at the start of the year. This signals that much of the recent rally has more to do with the altcoins gaining steam than the strength of Bitcoin itself.

Overall return on investment from January 1st, 2018:

My $1000 initial investment is now worth about $623, down about -37% from day I began the experiment.

Implications:

There has definitely been a shift in April as the worst of the bear market appears to be over. Stellar is having an excellent spring, having outperformed its Top Ten peers for the second straight month. And only Stellar has increased in value since January 1st.

Focusing solely on holding the Top Ten continues to be a losing strategy. While the overall market is down -28% from January, the Top Ten are down -37% over the same period of time. This approximately 9% differential is about the same as last month. At no point in the experiment has the Top Ten outperformed the overall market.

I'm also tracking the S&P 500 as part of my experiment to have a comparison point with other popular investments options. April has seen a return to volatility in the stock market. As of this post, the S&P 500 is down -1.6% for the year.

Conclusion:

April was a good month for crypto and it feels like the tenor has shifted from fear to excitement or at least hope (for the time being at least). All markets go in cycles: it was nice to have a break from the falling prices and the constant stream of bad news.

Thanks for reading and the support for the experiment. I hope you’ve found this snapshot helpful. I continue to be committed to seeing where the experiment leads and reporting along the way. I’m on the road again (in Nepal) so my update video will have to wait. Sorry to disappoint all three of you who were watching :)

Feel free to reach out with any questions and stay tuned for progress reports. Wishing you all the best in your crypto adventures!!