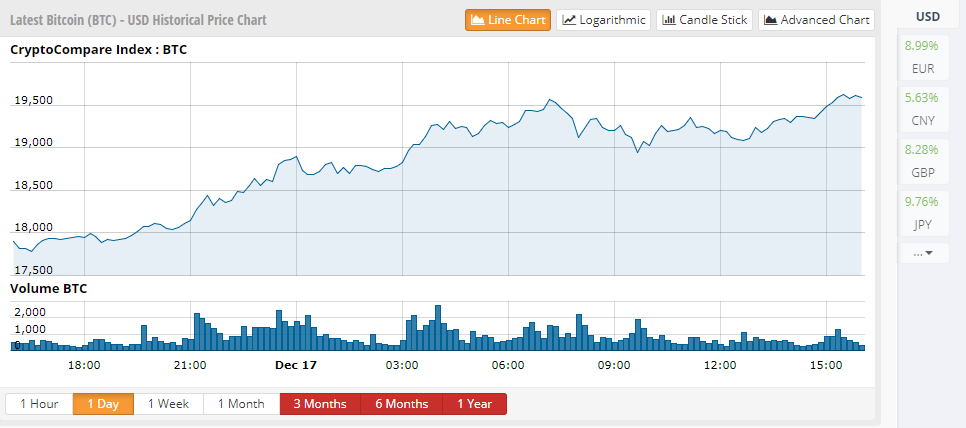

Bitcoin Price Surpasses $19,600 and is Up 9%, Rapidly Surging Towards $20,000

The bitcoin cost has outperformed the $19,600 stamp and is quickly surging towards $20,000. The market has shown confidence towards CME's bitcoin prospects posting tomorrow, on December 17.

Also Read : Exchanging Column `The Writing On The Wall' – Strategies for 2018; Hodl or Diversify?

Also Read : Exchanging Column `The Writing On The Wall' – Strategies for 2018; Hodl or Diversify?

CME's Bitcoin Futures Listing on December 18

The worldwide fund industry and bitcoin showcase are profoundly suspecting the dispatch of CME Group's bitcoin prospects on December 18, particularly after the effective presentation of bitcoin fates on the Chicago Board Options Exchange (CBOE).

Absolutely in light of every day exchanging volume, CBOE and CME won't outperform that of digital money trades and exchanging stages in the short to mid-term. In the course of recent days, the day by day exchanging volume of bitcoin crosswise over significant trades in locales including the US, Japan, and South Korea have come to $17 billion, a day by day exchanging volume that is bigger than most securities exchanges.

Be that as it may, CBOE and CME empower institutional speculators and retail dealers to contribute substantial totals of institutional cash and capital in bitcoin. All the more vitally, upon the presentation of bitcoin prospects on the CME trade, driving speculation banks Goldman Sachs and JPMorgan are set to clear bitcoin fates for the benefit of their customers.

Prior this month, JPMorgan worldwide markets strategist Nikolaos Panigirtzoglou, communicated his good faith towards the dispatch of CME's bitcoin fates trade. Panigirtzoglou accentuated that bitcoin fates will furnish the digital money with more authenticity and further approve it as a rising resource class.

"The planned dispatch of bitcoin fates decreases by built up trades specifically can possibly include authenticity and in this way increment the interest of the digital money market to both retail and institutional financial specialists," said Panigirtzoglou.

He included that in the long haul, controlled instruments, for example, prospects contracts will permit bitcoin to go up against conventional resource classes, for example, gold. Panigirtzoglou clarified, "the estimation of this new resource class is a component of the expansiveness of its acknowledgment as a store of riches and as a methods for installment and just judging by different stores of riches, for example, gold, cryptographic forms of money can possibly become advance from here."

Bitcoin is Nearing $20,000 With Very Little Institutional Money

Real multifaceted investments, venture firms, and monetary foundations including Man Group, Goldman Sachs, and JPMorgan have foreseen the dispatch of CME since October and are focused on clearing bitcoin exchanges for their customers, speculators, and clients.

As of now, the cost of bitcoin is nearing the $20,000 check without a lot of institutional cash put resources into the bitcoin advertise. The day by day exchanging volume of bitcoin is nearing the $20 billion without real locales, for example, India and South Korea appropriately directed.

The monstrous inflow of several billions in institutional cash in the up and coming months is required to prompt a short and mid-term value surge. As Bitfury bad habit executive George Kikvadze already clarified, it is more troublesome for huge scale speculative stock investments and venture firms to focus on a specific resource class in the event that it doesn't have adequate liquidity and hearty foundation encompassing it.

Bitcoin is starting to see an expansion and change of exchanging foundation in both the digital currency advertise and conventional back division.

All in all, what do you consider this? Just offer your perspectives and considerations in the remark area beneath.

Upvote For More Details >>> @wahabali

.gif)