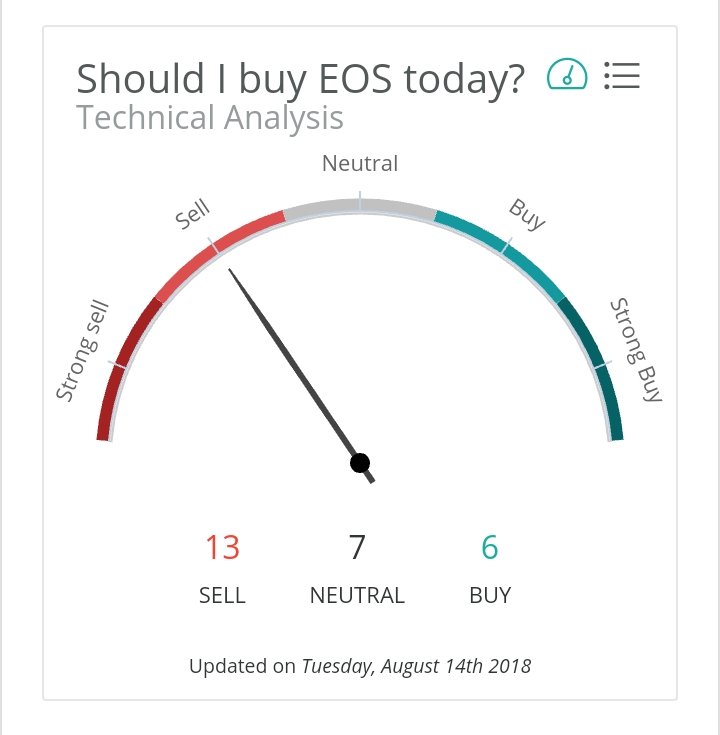

No, so many shares are held by top whales EOS is already centralized. Witnesses will be picked not elected and its not even legal to buy EOS or mine it if in the U.S. or Canada. Here you can see one of the "voted witnesses" is already decided & advertising to mine for them. You can mine in the pool if not in the U.S. or Canada really...Of course like EOS they missed their launch date of 7-3-2018 also.

image source

CoinCheckUp.com

image source

crypto tokens created by Block.one's $4 billion EOS initial coin offering (ICO) are locked up until the network elects 21 "block producers" (the equivalent of miners for the new network), and as that still hasn't happened, currently no one can start using EOS just yet.

As it stands, the blockchain will go live if 15 percent of all tokens – an equivalent of 150 million – are "staked" in a vote on block producer candidates. Staking tokens allows EOS holders to vote for up to 30 block producers – the groups in charge of verifying transactions – and votes are weighted by how many tokens are staked.

"Some of these [block producer] candidates in the top 10 came out of nowhere. How they got in the position they are in is pretty obvious – they had a lot of tokens (or access to them) and voted themselves in," he said. "It's a whales' election." source

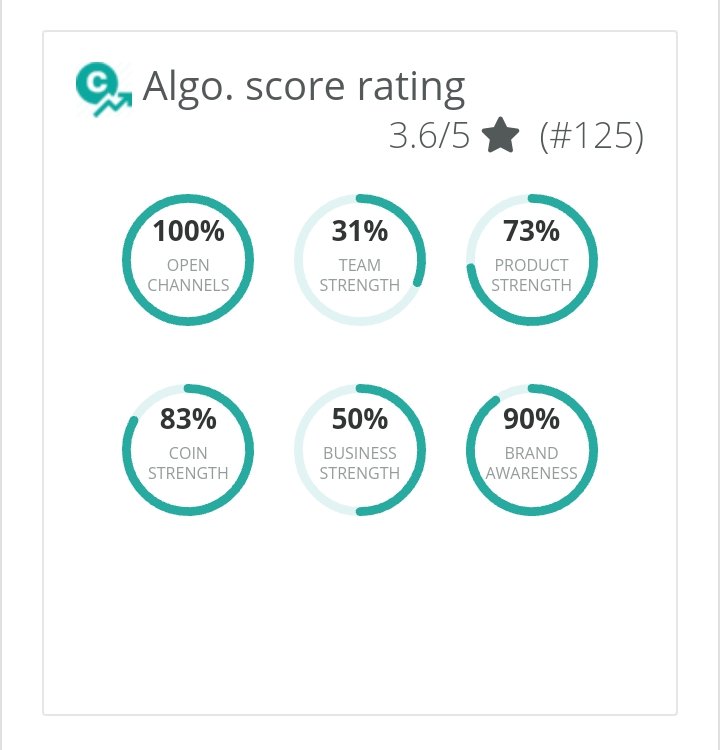

EOS is not any of the above. The project is ambitious, technically quite interesting and generally looks promising. The problem is that they entered into their ICO without a completed project. This has become increasingly common for ICOs but it should represent a real problem for investors.

EOS launched a crowdfunding campaign without any product, because of this they had to create a token with no practical use on another company’s platform that users will potentially be able to reclaim at some point in the future if the project is a success through a fairly arcane process. Despite this the EOS token is still holding steady at around $5 per token.

-John Oliver

Minnow Resource Highlights

Curation Have You Stumped?

How To Tutorials