This is part 3 of my easy-to-follow series on Forex to teach you what Forex is and how to use it to make money.

How to Forex - A Beginners Guide to Forex Trading

Table of Contents

In this five part series you will learn:

An Introduction to Forex - What is Forex, the brief history of Forex, the benefits and risks of Forex

How to use Forex Platforms - Trading Applications, Brokerages, Opening live and demo accounts

Forex Trading Strategies - Trend trading, Scalping, Range trading, Breakouts, Signal trading, and Risk Management

Market Analysis - Fundamental and Technical analysis

Start trading Forex - Summary of all lessons, how to create your own strategy, the psychology of trading, and remembering the risks

3. Forex Trading Strategies

What is a Forex Trading Strategy

A Forex Trading Strategy is a proven method for trading Forex.

A Forex trading strategy is a mixture of technical analysis and fundamental analysis.

There are many Forex Trading Strategies.

Every trader develops their own strategy with time.

Successful traders create a trading strategies and stick to it.

Below I have provided definitions of the common trading methods used to build your own trading strategy

Trend Trading

Trend trading is a trading strategy that identifies a market price moving in one direction - moving upwards or downwards - this is called a trend.

A trend trader enters into a long position when the price is trending upwards and enters into a short position when the price is trending downwards.

Trend trading is the assumption that a currency price will continue to move in one direction.

A trend trader will hold their position - long / short - and close their position when they believe the trend has reversed.

How to identify a price trend

To identify an uptrend we look for higher highs and higher lows across the chart.

Below is an example of an uptrend. It has been marked with each high and low.

You will notice that each high is above the previous high and each low is above the previous low. This is a clear indication that the price is moving upwards.

To identify a downtrend we look for lower highs and lower lows across the chart

This is how we identify a trend.

Scalping

Forex Scalping is a trading strategy that involves holding buy / sell positions for short periods of time.

A Forex Scalper will make many trades in order to make a small profit each time.

Scalping involves large amounts of leverage to make large profits off of small price movements - between $0.0001 & $0.0010 price change.

Scalping is a very fast trading strategy - each trade is held for less than a minute.

A Forex Scalper will sit at their computer screen and wait for signals indicating whether they should buy or sell.

Scalping is considered a more advanced strategy for traders due to high leverage and fast trades.

How to scalp

A reliable trading platform

Ensure your trading platform is fast and reliable. Because you're making fast pace trades you need to execute and close your positions immediatelyTrade major currency pairs

Only trade liquid markets - high volumes - with high volatility so that you can profit as soon as the price movesIdentify a price direction

Identify the direction in which the price is about to move before entering the trade. Use technical analysis and fundamental analysis to predict which direction the currency pair may moveCustomize your platform

Set up your trading platform in manner that makes you feel comfortable. Make sure that your charts and your order execution buttons are easily accessible. This way you can easily manage your positions quickly and effecientlyScalp only when volumes are high

Wait for when the market is most volatile - high volumes - this way the price will move more in each direction and if you speculate correctly you will net a larger profit off of each tradeDo not scalp if you're not prepared

Make sure you're prepared to trade for an intended amount of time. You will find yourself staring at the chart watching each movement closely. Be sure you're ready and everything you need is at your fingertips to do so

Scalping is considered an advanced trading strategy. I do not recommend using this strategy if you're beginning. In order to scalp Forex you will also need to learn how to hedge your positions - add positions when losing - I recommend reading this whole series before using the scalping strategy

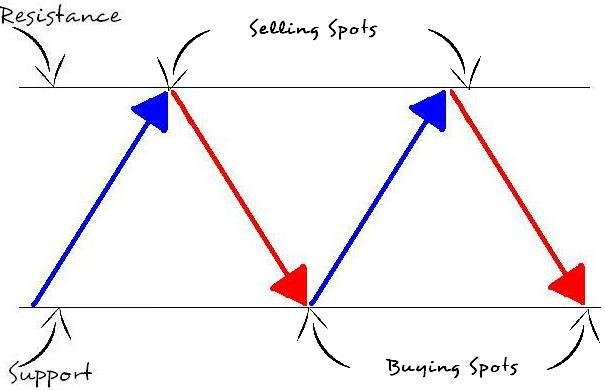

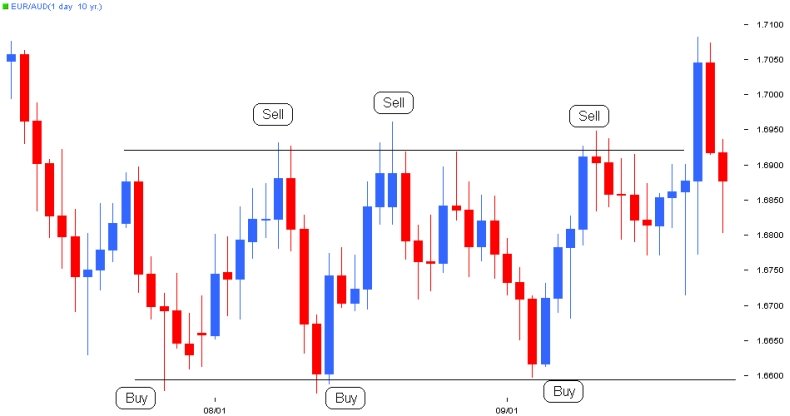

Range Trading

Range trading is a trading strategy that identifies a price channel.

Range trading identifies the high and low - support and resistance - levels that the market will not break out of.

Range traders will buy when the price is at a low level (support) and sell when the price is at a high level (resistance).

Range traders close their positions in the middle of support and resistance levels to ensure they make a profit.

How to identify a price range

To identify a range we must first identify the highs and lows across the chart.

Below is an example of a price range / channel. High levels have been marked with sell and low levels have been marked with buy.

You will notice it has been marked this way to indicate when you can buy / sell when a currency price is ranging.

By identifying clear resistance and support levels ( highs / lows) we can identify the channel in which the price is moving along and at what point the price will reverse.

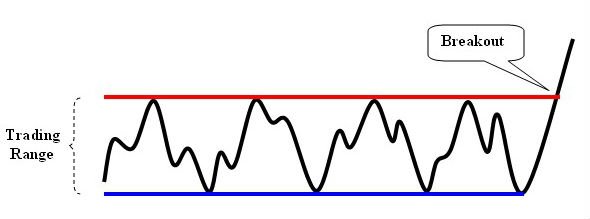

Breakouts

A breakout is when the price of a currency moves outside a defined support or resistance level with increased volume.

Breakout traders enter into a long position when the price breaks resistance levels and enter into a short position when the price breaks support levels.

A breakout occurs after a price has been moving within a range.

When a breakout occurs volatility increases - the volume of trades being executed increases - a currency will then begin to trend in the same direction as the breakout.

How to identify a breakout

To identify a breakout we must first identify the support / resistance levels across a chart.

Below is an example of a breakout. It has been marked with a range channel and the moment the price breaks.

You can see that a breakout occurred when the price moved above the resistance level indicated by the top line of the range channel.

We can use horizontal line tools provided by a trading platform to mark these channels for ourselves just as the example below.

This is how to identify a breakout.

Signal Trading

Signal trading is a trading strategy that uses signal providers to suggest when to trade.

A signal is generated and communicated to a trader through email, SMS, tweet, or other relative method.

A signal trader uses each signal to buy / sell at a specific price and time.

Signal providers may also execute trades on a traders behalf.

How to choose a signal provider

Proven History

Choose a signal provider with a proven history - months of successful trading signals - if they have a positive Return-on -Investment (ROI) over their history then you will feel more confident following their tradesRealistic Goals

Choose a signal provider who has set realistic goals. If a signal provider says they can make one million dollars in a few months then they're obviously risking too much capital and are most like over leveraging. This is what we call bad tradingClear Description

Choose a signal provider that has provider a clear description of their trading strategy and how they intend to trade over a certain period of time

Risk Management

- Risk management is a part of every trading strategy.

You only need to be right 30% of the time and still be profitable - that is a very low number - this is because Forex is a highly volatile market. No one can predict winning trades 100% of the time. For this reason it is most important to develop a sound risk management strategy when trading. By knowing your risks and how to trump them you're guaranteed to come out on top, even when the market goes against you - which it will - there is no crystal ball or perfect trading strategy out there but having a safety net is the best way to protect yourself against all odds.

Know the risks

To reiterate the relativity of risk management we must remind ourselves of the risks involved when trading Forex.

These risks include:

Leverage Risk

It is important to understand exactly how much you're leveraging on your positions as leverage is one of the main things that traders fail to understandRisk Capital

Only trade using risk capital - an amount that you're willing to lose - as Forex trading is not without risk and if you're not smart you could lose more than your initial depositVolatility

Prices can breakout in the opposite direction to your long or short positions. There is no gaurantee that the price will go in the direction you hope for.Psychology

Becoming emotionally attached to your trades is dangerous. Many traders have blown their accounts because they have changed their strategy in the middle of a trade because they experience fear or greed. Stick to your game plan

How to build a good risk management strategy

Set Rules

Create rules and stick to them. It sounds simple enough but it is the best way to stop yourself from making silly decisionsSet Risk Capital

Decide on an amount you're willing to lose whilst trading. If you lose this amount you should stop trading, reassess your strategy, and come back when you're feeling confident enough to trade againDemo accounts

Set up different Demo accounts to test your trading strategies until you're comfortable knowing that your strategy worksRisk per trade

This comes under rules but it's important. Know how much you're risking with every trade. Don't risk more than you may profit. Your potential profit should always be the same or more than the amount you riskHedging

Using buy / sell limits we can set positions to buy / sell automatically at a given price. We use this is we think our position may only fall for a certain period o time and profit off of that short term price fall; we profit either way

- Buy /sell limits

buy / sell limits are a type of *spot contract*. We trade currencies for spot prices. You can set stop-limits or stop losses where ever you like so that your trade automatically closes and your position does not lose anymore money.We use stop-limits and buy-limits to close position before the market price reverses; known as hedging

I will be talking a lot more about Forex hedging in the final part of this series.

Now you know basic Forex Trading Strategies

In the next part of this How to Forex series you will learn Market Analysis

- Fundamental Analysis

- Technical Analysis

- Advanced trading strategies

I will try add each part of this series within 24 hours of one another

You can view Part 1 of the series here

You can view part 2 of the series here

Thank you for reading this article

This article is exclusive to Steemit

It has been provided to you by @senseiteekay - An aspiring Anarcho-Capitalist

All learning resources and references for each part of this series will be linked below

If you would like to donate towards my work you can do so using the button below

Disclaimer:

The contents herein these articles are not investment advice. Follow this guide of your own accord. If you do choose to follow these guides do so at your own risk. I am not a qualified professional. I am self taught and provide these guides as a guide only and not as a step-by-step rule to make money.

The Forex market carries many risks and anyone who decides to trade on Forex should know these risks before opening an account. I advise you to fully read each part of my series and to also do further research if there's anything you do not understand herein these guides.

Please be safe when trading.

Learning Resources & References:

Video: Trend, Range, Scalping and Breakouts - Learn to trade Forex with cTrader - Episode 7

http://www.investopedia.com/terms/t/trendtrading.asp

https://www.dailyfx.com/forex/education/trading_tips/chart_of_the_day/2013/07/04/Identifying_a_Forex_Trend.html

http://www.investopedia.com/terms/forex/f/forex-scalping-and-scalper-system-strategy.asp

http://www.investopedia.com/articles/forex/11/beginners-guide-forex-scalping.asp

http://www.investopedia.com/terms/r/rangeboundtrading.asp

http://www.investopedia.com/articles/trading/08/trading-breakouts.asp

http://www.investopedia.com/terms/forex/f/forex-signal-system.asp

https://en.wikipedia.org/wiki/Forex_signal

http://www.investopedia.com/articles/forex/10/forex-risk-management.asp

https://www.dailyfx.com/forex/education/trading_tips/daily_trading_lesson/2012/06/22/How_to_Build_a_Strat_part_5.html