Before you start playing around with digital currencies it is important to understand their risks. Like all forms of money there is the risk of losing it and the risk of having it stolen from you. But when you move into electronic money, you encounter a whole smorgasbord of new risks along with all those attractive benefits. This article compares the relative risk of several digital currencies against the all too frequently ignored risks of currency allegedly backed by gold or, ahem, the US Dollar.

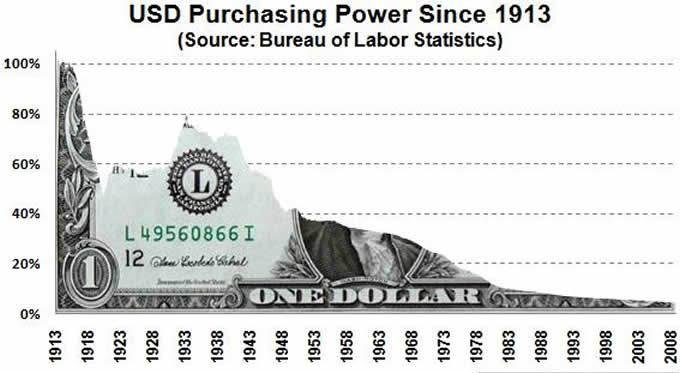

Even the world's so-called reserve currency, the US dollar, is not risk free. It's almost guaranteed to lose purchasing power, it can be seized from you without due process, and it is long overdue for the mother of all currency collapses -- this time on a global scale.

And what about gold backed assets? Just how sure are you that the gold is really there and doesn't have multiple owners? Such currencies are only as good as the counterparty that is holding the backing. Which big institution do you still trust?

Digital currencies are designed to mitigate some of these risks while introducing others. The nice thing about having so many of them is that you can reshuffle your risk profile by changing the mix you have in your wallet... assuming that the exchange you are using doesn't freeze up the moment you need it most. This week, for example, Poloniex shut down withdrawals of BitShares and Steem blaming it on the developers of those blockchains. No other exchange had such troubles. What exactly was Poloniex doing behind the scenes with your money?

Rats, there are those darn middlemen again. Humans in the loop!

Of course, if you have a decentralized exchange like BitShares there is no middleman making such decisions on your behalf! And, you can change the risk mix in your basket in about three seconds -- while the world is melting down around you. The whole BitShares exchange is managed by incorruptible robot accountants. Give me that kind of risk any day!

So what risks are left for BitShares and the Hero?

The Billion Hero Campaign will be conducted on a level playing field populated with some of your favorite digital currencies. You can score points by holding any of these popular assets on the robotically honest BitShares exchange:

- Bitcoin

- Ethereum

- Dash

- BitShares

- Hero

- Freero

- Brownie.PTS

Are you saying you're going to let some of your competitors play in this challenge?

Sure, why not? The Harlem Globetrotters always bring the Washington Generals with them don't they?

The risks, Stan, you were going to tell us about your risks!

Ok, ok. Let's start with the lowest risk way to participate in the Billion Hero Campaign and work our way up. Note that this represents my own weighting of risks and your actual mileage may vary. Generally, holding the higher risk assets are worth more Campaign points but there are other weighting factors as well.

Risk Level 1 - The FREERO. We will shortly begin giving these away for free to those who sign up at billionherocampaign.com. There's no risk because they don't cost you anything. But each FREERO counts as one vote toward which team wins the billion-hero-prize. And you can pass them around and trade them to try out the BitShares network without risking your own money.

Risk Level 2 - The HERO. The HERO is a market pegged asset backed by the equity of the Bitshares network. Each one is backed by at least two HERO's worth of BTS and you are guaranteed to be able to cash it in directly with the robotic network for at least 99% of that value, if you can't sell it for more on the open market. That guaranteed cash value is designed to grow by 5% annually against the dollar - so there is less inflation risk than holding dollars. And no one can seize your HEROs.

Risk Level 3 - BTS. BitShares has high market volatility risk. It can pump and dump on you. So you should be prepared for a wild ride holding them. However, if you buy the arguments we make in the webinar below, you might agree that it is well positioned for historic growth in the coming year. Your actual mileage may vary and this is not financial advice.

Risk Level 4 - Non-Native Coins Like all centralized exchanges, BitShares allows you to trade Exchange Issued Assets against its native (counterparty risk free) assets. So, if you are trading tokens representing Bitcoin, Ethereum, Brownie.PTS or Joe'sLubeAndPizza you have the risk that when the time comes to cash out the exchange or company that issued them might fail to honor their promise. Just like Poloniex did to BitShares and Steem depositors this week. Still, while the issuing exchange can be trusted this gives you exposure to the price of all those other coins and the ability to trade them around the world in 3 seconds. You still, of course, have the unique risk of those coins on their native blockchains as well.

Risk Level 5 - Backing HEROs. Don't do this unless you really know what you are doing! This is for professionals only! Remember that guaranteed growth that HERO holders get above? You are the one guaranteeing it! If someone want's to cash out, it's the person who has the least collateral backing their HERO's that get's cashed out. The price of BitShares could be low at that time and you might lose a lot more of them than you got when you first sold that shiny new HERO you decided to back with your BTS. Example of what can happen.

This is not an exhaustive list of risks, just an assessment of relative risks among these five options on the BitShares network. You'll have to decide which you trust more - the trusty BitShares robots or the nefarious Federal Reserve. Either one could black swan on you.

Three minute video on heroic risks

Here's a three minute excerpt from our July 3rd webinar that talks about four of these levels of risk - one for every appetite.

<c/enter>

<c/enter>

Here's the full webinar if you haven't seen it.