source

We human meat bags like to share our success stories on social media in a "Look at me, I'm awesome! You should be part of my tribe to be awesome too!" sort of way. What I personally enjoy is genuine, "Yeah, I'm an idiot too sometimes" perspectives.

Today I lost 16,126.97 BitShares.

Let me tell you the story so you can hopefully avoid a similar fate.

I've posted many times on how fantastic it is to short the USD using BitShares and bitUSD:

- Playing in the Margins: bitUSD and BitShares on Open Ledger

- A Simple Example of Shorting the U.S. Dollar With BitShares

- 9 Day bitUSD Loan Result: 19,821 BitShares and 199 ZAPPL for Free

- Are you Shorting Fiat Currency yet?

A really important thing to keep in mind is this only works if the price of BitShares is going up compared to USD. An additional hard lesson learned today was that being highly collateralized is not a guarantee you won't have your margin called.

I've been playing around with HERO lately which is a pegged asset based on a formula. I won't go into the details here, but you can follow @stan's blog to learn more. For the most part, it moves along with bitUSD. It's also new, speculative, and has comparatively low liquidity (for now). They are supposed to trade for around $156 (based on the peg and the formula). I used my BitShares as collateral to create 50 HERO (much like the articles above describe creating bitUSD). There were two different times I could have sold some BitShares to close out my HERO margin and make a small profit. But... I didn't. I held on believing in larger future rewards.

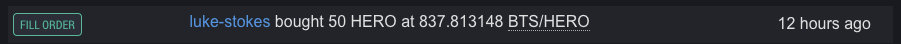

Today, I was surprised to see this:

Ouch.

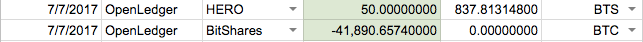

Even at more than a 5:1 collateral ratio, my margin was called. The 50 HERO I had sold for 25,763.69 BitShares was just automatically purchased back for 41,890.66 BitShares. I essentially lost 16,126.97 BitShares in the process (which was worth over $5k not too long ago).

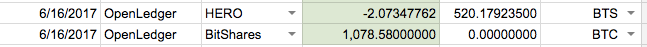

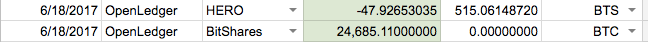

Here are the purchases of BitShares I made using the HERO created from margin:

And the resulting carnage today:

The BitShares Margin Positions work as smart contracts by not only liquidating your position if your collateral falls too low (I believe 1.5:1 is the breaking point, but this page is too confusing for me to fully understand), but also by liquidating your position if someone requests settlement and you happen to have the lowest collateral ratio on the network.

This can happen even if you have a 5:1 ratio or better, like I did.

The BitShares and OpenLedger wallets have a slider you can use which only goes up to 6:1:

I found out the hard way, if you want more than that, you have to manually enter in a higher number in the Collateral box.

Today, when I saw the price of BitShares tanking against HERO, I considered updating the ratio but figured, "Surely 5:1 will be fine." I was so wrong.

I hope this helps some others avoid a similar fate. If BitShares drops 30% or more like it did today and you're not highly collateralized, you may be forced out of your position at a terrible time. My previous posts on this topic make it sound like you can make free, easy money shorting the USD with BitShares. For the most part, you can, if the price of BitShares is going up. Today's post also demonstrates how you can lose big.

Be safe out there, kiddos. Crypto trading is a wild ride, especially if you include margin trading.

I'm still up in the long run, but I might take a little break from playing the margin game. I've enjoyed the process of learning, even if the tuition cost is a little steep at times.

If you're looking for a way to keep track of your crypto holdings and trades, check out The Cryptocurrency Bank Spreadsheet I created a few months ago.

Luke Stokes is a father, husband, business owner, programmer, and voluntaryist who wants to help create a world we all want to live in. Visit UnderstandingBlockchainFreedom.com