We all know that EOS is underway and Tezos is coming up, but before you jump in feet first, let's talk about hedging.

No part of this publication may be reproduced, stored in or introduced into a retrieval system, or transmitted, in any form or by any means (electronically, mechanical, photocopying, recording or otherwise), without the prior written permission from me.

All rights reserved.

Image Source

For the uninitiated, like me, EOS has too many hurdles to its ICO, but following simple instruction could get me there, however from a pre cursory read of the length of the sale, I am in no hurry to get in atm.

Thanks to helpful articles from @wolfofcrypto, such as EOS: Initial thoughts on how to play the EOS ICO, I feel better about my waiting.

Also I signed up for Bitfinex today and am ready for when the time is right.

As for Tezos, @heiditravels shared some invaluable information with her post Tezos ICO.

In the Additional Reading/Sources: section she shared a link to a Tezos Reddit critique that has changed my mind on how much I am going to put into this effort.

I am still going to put some towards the project, but a few flags were raised that I needed to see before going all in with what I had in mind.

But what about the hedging?

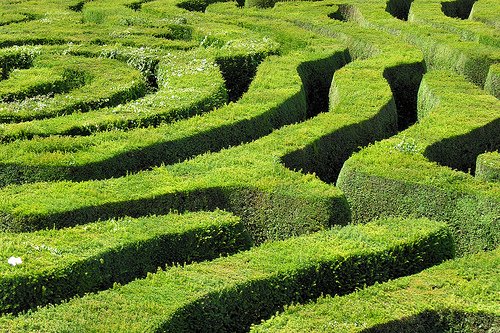

Image Source

First we must understand what it means to hedge an investment.

When hedging an investment, the investor is strategically protecting themselves against investment risk by making another investment instrument to offset the risk of any adverse price movements (Bodie, 2014, p. 782).

As an example, a firm that sells oil may anticipate future market volatility and want a way to protect its revenue against price fluctuations so to do so they enter a short position in oil futures (Bodie, 2014, p. 782).

Some hedging instruments include: Foreign exchange futures, Stock index futures, Interest rate futures, Swaps, and Commodity futures (Weiss, 2016).

A hedging strategy might be useful for someone in charge of a trust fund, which is an instrument created to provide financial security to an individual or organization at some future time.

The attempt to protect the ability financial stability of earnings into the future makes sense because a hedging strategy is a way to provide portfolio protection which can be as important as portfolio appreciation.

If we know anything at all about crypto, at this stage, it is highly volatile.

In every day “old school investing”, the use of a Treasury bond future to hedge the account portfolio requires the need to understand the relationship between bond prices and interest rate fluctuations to know how hedging might help.

An important metric concerning the performance of bonds is the relationship between the bond’s yield and price movement (Labuszewski, n.d.).

“In general, as yields increase, bond prices will decline; as yields decline, prices rise” (Labuszewski, n.d.). Therefore, when rates are rising the bondholders principal value declines and in a decline rate environment the market value of their bonds will rise (Labuszewski, n.d.).

Consequently it is reasonable that a bond fund manager would seek to protect the portfolio’s gains against a rise in rates (Weiss, 2016).

The question then becomes how best to do this.

Hedging strategies can be either a long hedge or a short hedge.

A long hedge is when an investor takes a long position in a futures contract, meaning that they will purchase a futures contract which guarantees them a specific buying price in the future (CTU Derivatives, 2016).

On the other hand, a short hedge is used by selling a futures contract, meaning a firm guarantees a set price for something that it will be receiving in the future (CTU Derivatives, 2016).

The difference being if the company will be buying something in the future, which they would use a long hedge, or selling something in the future, a short hedge. These are both methods to control future cost and reduces the risk of future price fluctuations.

In general, a longer term hedge will provide a better hedging value because the cost is spread of a greater period of time and can be rolled over into other future investments.

This long hedge approach will allow somone to take into account how future increases in the interest rate could have an impact on their portfolio’s earnings and then could be accounted for in a discount cash flow model and provide a more predictable return.

I think this is a wonderful and interesting time to be alive.

What do you think?

The future together is bright.

Join me.

See the latest adventures and creations from my wife Sarah on steemit!

Also Check Out Some of My Previous Post:

Hey, before you go, I have a question for you, Are you interested in taking out a loan to consolidate debt?

If you use my Credible Referral link, you can get a cash bonus if you take out a loan.

It can be a Personal Loan or a loan to consolidate Student Loans.

Either way, if you use my link, it can be a "win-win" for us both by saving us money on interest and getting a little bit of money now!

Bodie, Z., Kane, A., Marcus, A. (2014). Investments, 10th Edition. [VitalSource Bookshelf Online]. Retrieved from https://bookshelf.vitalsource.com/#/books/1259676943/

Labuszewski, J. W., Kamradt, M., & Gibbs, D. (n.d.). Understanding Treasury Futures [PDF]. CME Group. Retrieved from: http://www.cmegroup.com/content/dam/cmegroup/education/files/understanding-treasury-futures.pdf

Colorado Technical University. (2016). Derivatives, Options, Orders, & Risk [MUSE]. Retrieved from Colorado Technical University Virtual Campus, FINC605-1601A-01: https://class.ctuonline.edu/CbFileShareCommon/coursebuilder/30000/29381.pdf

Weiss, S. (2016). FIN 605 Phase 3 Chat 3: Market Efficiency [PowerPoint]. Retrieved from Colorado Technical University Virtual Campus, FINC605-1601A-01: https://campus.ctuonline.edu