I've always had an interesting relationship with money. Being a volunteer or humanitarian worker my entire adult life, I didn't earn a regular paycheck until I was in my mid 30s. It somehow worked out perfectly and it's not as bad as it sounds. In fact, it's probably kept me out of trouble: it's hard to develop bad financial habits when you don't have much to work with.

Having a reliable income stream at all is fairly new to me. It's made me pretty careful with money and I want to pass on some of the lessons I've learned along the way.

Full disclosure - there is no full disclosure. I have no relationship to any of these companies and no links are referral links. These are just some of the tools I use.

Anyway, I have to give the spiel - this is not financial advice, do your own research, just my opinion, blah blah blah. But I think it's a good opinion, so pay attention :)

Okay, here we go.

Step One: Step on the Financial Scale Regularly

This may be the most difficult step of all. Just being open to the reality of your situation freaks many people out to the point of ignorance-is-blissism. But just like stepping on an actual scale can be painful sometimes (especially after polishing off that box of jelly doughnuts, alone, in the dark, late at night) it's essential to be in touch with reality.

What does this look like practically?

Simple: add up all of your assets then subtract your debts. This equals your net worth.

This is an important number, write it down. I'd suggest recording your net worth monthly. It might be painful at first, but stick with it, watching that number slowly increase can be a huge motivation.

You can do this on your own with a spreadsheet or there are tools that can help you. I use Mint.

If you feel comfortable inputting your financial information, Mint will do the math for you. It keeps track of your cash, credit cards, loans, investments, and property. It will total your assets then subtract your debts and voilà! You got your Net Worth.

Mint has one big drawback: it's only able to connect to American and Canadian banks.

There are some budgeting apps that may provide a nice alternative to Mint:

- Personal Capital

- You Need a Budget

- EveryDollar

- PocketSmith

For my non-American/non-Canadian friends, I'd suggest checking out PocketSmith which claims to be able to connect to banks in 36 countries.

Step Two: Get Organized

After you're aware of where you stand financially, you'll want to get a handle on your bills and make sure to pay them on time. According to a recent survey of 1000 people by creditcards.com a whopping 42% admitted to being late on at least one credit card payment.

Any guesses on the #1 reason people paid their bills late?

60 percent of cardholders who paid late said it happened because they just plum forgot

We get busy. We forget.

How do we not forget?

Set Reminders - This is a relatively easy fix: set a Google calendar alert or an alarm on your phone. Pick a memorable day of the month to pay your bills. Have a responsible friend give you a reminder text or call.

Align Bills - Another organization hack - align the timing of your bills around your paychecks if possible. Most credit card companies allow customers to change the due date of the payment quite easily online. If you are paid at the end of month consider making all bills due sometime in the first week of the following month before you've had a chance to spend everything.

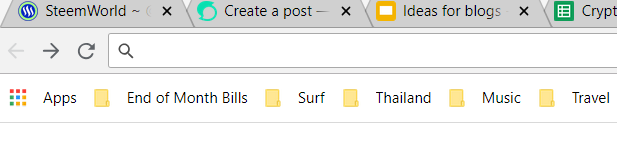

Bookmark! - One last practical suggestion is to create a "Bills" folder of bookmarks in your web browser.

Catch the not so subtle shout out to @steemchiller? You should check steemworld.org when you have a chance, it's fantastic.

But I digress. When it comes time to pay bills, you don't have to remember each individual bill/website, just click "open all tabs" and you're all set.

3. Do What You Can to Feel More Pain

What if you're aware of your situation and you're paying your bills on time but still find yourself over-spending?

You're going to have to trick your brain by introducing a little more pain.

How?

Consider using cash more - Do you know you're more likely to spend more if you pay by credit card than if you pay by cash?This is because we tend to feel more pain when we let go of the physical cash than we do when we pay by plastic. Some hard-liners pay 100% in cash and swear by the method. They argue that the perks and convenience of credit cards pale in comparison to how much they're saving just by spending less.

And why do they spend less? Because they feel the pain more than those who pay with credit cards.

There's also evidence to suggest that using cash increases the feeling of satisfaction with the purchase compared to the satisfaction received when paying with credit.

Turn off auto-payments - While I can't make 100% cash work personally, I have found that turning off auto-payments has had a similar affect. I have never used auto-payments. It goes back to the pain principle. I want to feel the money leaving my pocket or bank account. If not every transaction at least regularly, when I pay my bills.

Budget to the last penny - Talk about pain! But again, you'll find some very well off people that swear by this method for similar reasons. Accounting for every single last cent will give you a very real sense of value and the consequences those designer jeans may have on your bottom line.

Remember to Give Back

I'll get more into this in my next post in this series, but I want to mention it here as well. In your pursuit of your financial goals, don't forget to give back. The fact that you're reading this on a smart device or computer puts you in pretty fantastic financial standing compared to many others around the globe. If you're looking to wealth as a source of happiness, I'm afraid you'll be disappointed. But there is a link between generosity and happiness.

If you happen to be in Thailand and are interested in giving back, I invite you to check out my recent post on Four Worthwhile Causes in Thailand. There is a lot of good work being done here!

Teaser for my the next blog in my Personal Finance 101 series - I'll talk about establishing an emergency fund, whether to prioritize investing or paying off debt, and then I'll get into very basic investing.

Allow Me to Introduce Myself! | Husband / Father / Humanitarian / Traveler / Expat Abroad

- Street Art in Bangkok - A Walk Through the Neighborhood

- WINNER ANNOUNCEMENT - Think you're well traveled? Name that.... TAIL!

- Giving Back: Thailand - Four Worthwhile Causes to Support

- Why I Disappear from Steemit on Sundays

- Well Off the Beaten Path - Restoration of Saat Tale Royal Palace - Nuwakot, Nepal

- It's July 4th - Happy Birthday America!

- Cox's Bazar Surf Report and the Father of Bangladeshi Surfing

- World's 50 Best Restaurants for 2018 Announced

- How to Overcome Screen Addiction - 5 Practical Tips