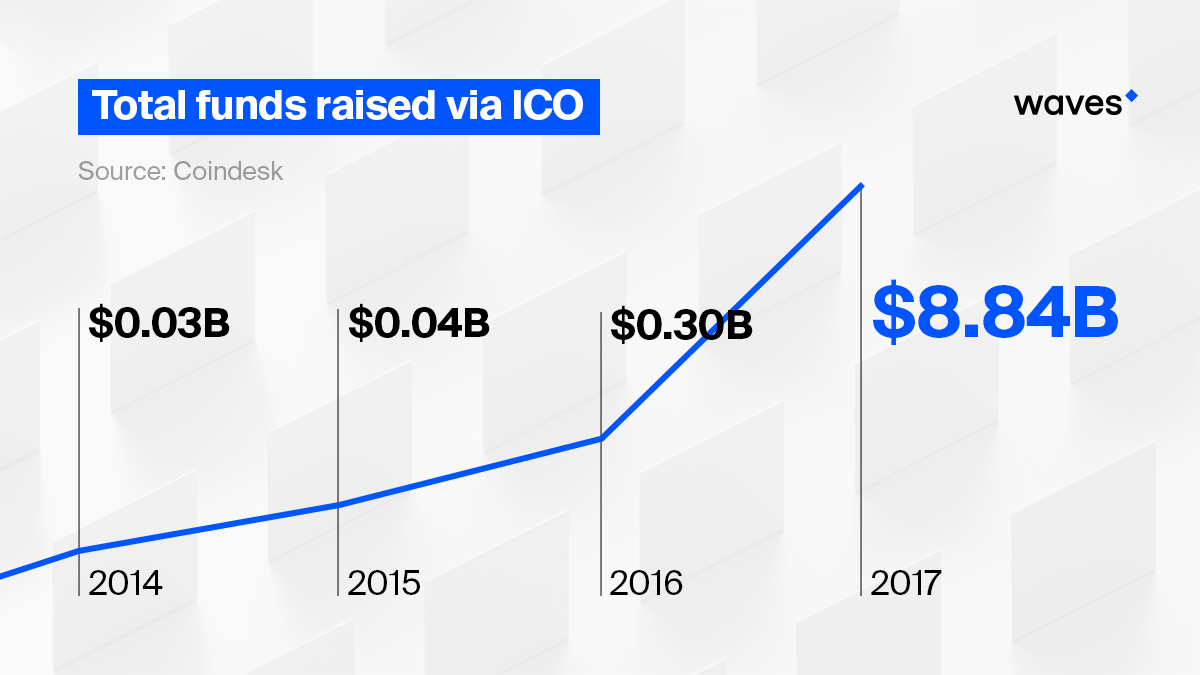

Investing in an ICO is similar to the investment process for the traditional markets in many ways. Just like conventional investing, it has its pros and cons. Blockchain technology and ICOs in particular are still evolving, so you really have to keep up with the latest trends — both technological and legal. If you are careful enough, you might profit from an ICO. Here’s what you have to consider in the first place.

Types of ICO

Currency ICO

A proposition of a new currency system, when already established coins are exchanged for new tokens that will circulate on a brand new blockchain platform.

Project ICO

Issuance of so-called work tokens on an already existing blockchain platform. Such tokens give its owners certain rights and capabilities within project’s community, e.g. for buying goods or getting/giving a reward.

Pros of ICOs

Easy Access

Unlike traditional investing, investing in ICO is literally for everyone — you don’t need to go to the bank or venture fund to invest in a potentially profitable project.

High Returns

Attracting more and more attention from people and business, blockchain-based projects are booming, so are the returns.

Cons of ICOs

Regulatory Oversight

Today everything associated with blockchain technology is in the center of a regulatory debate, whether crypto tokens as a whole or crypto exchanges, in particular. ICOs are no exception. Adoption of worldwide and regional crypto regulations have been showing moderate progress. By far, most countries provide no legal protection from crypto scammers or a solid guarantee of compensation in case you lose money.

Being an example of a successful ICO, Waves realized the importance of making ICOs more legal, thus more transparent and effective. Waves’ partnership with Deloitte is aimed at developing the legal mechanisms for regulating ICO projects.

Unclear Conceptual Basis

Currently the blockchain world is flooded with crowdsale projects that provide zero guarantees of success. Usually ICO initiators see making a profit as a walk in the park. A perfect whitepaper does not mean that the project’s initiator really knows what he is doing.

Possibility of Fraud

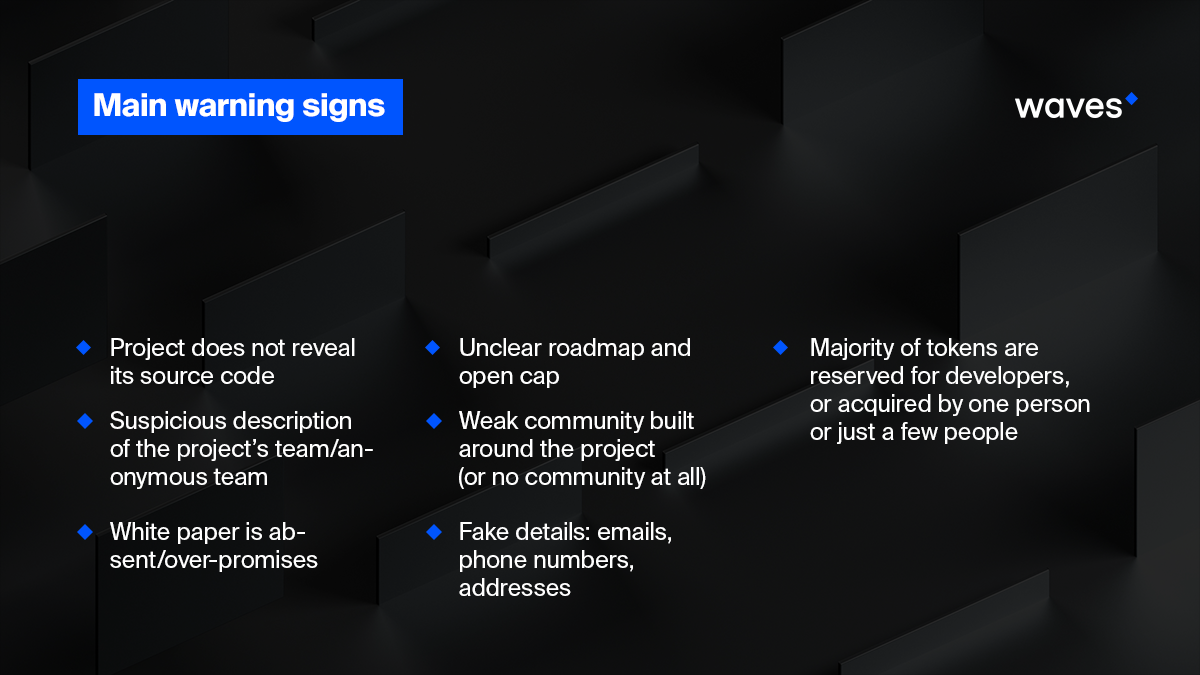

Poor legal frameworks, absence of rules around whitepapers and the ability for anyone to run an ICO makes them a perfect scam instrument. All ICO scams have common traits, but what really makes them special is how ridiculously they are proposed to the public.

Moreover, even if an ICO itself is not a scam, scammers continuously plague investors, for example, by sending fake promotional sales or bonus messages, asking people to send money or cryptocurrency to a “ICO related wallet”.

Considering all that, you have to be cautious at every step. The key question you have to ask yourself before investing in a particular ICO: Is this project really worth it?

The typical view of an ICO is:

- you issue coins

- people buy coins

- PROFIT

In reality it is not that simple. Putting aside scammers and hype hunters, in practice a normal ICO (for example when you get some help from an incubator) works as follows:

- a team comes up with an idea for a potentially viable and profitable project (product) in some industry (e.g. in blockchain, gaming industry, healthcare, editorial, etc.);

- the team does all the necessary preparations before running an ICO: issuance of a detailed whitepaper, provision of a solid legal basis for the ICO’s viability and transparency, detailed roadmap, explanation of token structure and cap type, work with communities, etc.;

- running the ICO;

- after the ICO is complete, further work continues, focused on implementation of the proposed product (for example, a launch of new blockchain platform or a decentralized author reward system);

- the product’s implementation results in:

- steady profit, meaning that the team had been doing a great job from the very start, having given the market and users the product they demanded;

- excessive profit, meaning that the team came up with a revolutionary innovative product that disrupted the industry;

- significant losses or no profit at all, meaning the team was unable to reach the goal it initially meant to achieve.

Right now most ICOs are run by people who do not know exactly what they are doing, or who are tapping into the hype or even actively scamming their supporters. None of these is good for you and your money. In order to figure out speculative and scam-like projects at the very start, you have to find out whether the project really needs its own token or whether it really is, in fact, capable of “disrupting the blockchain industry”.

Projects aimed at creating a new cryptocurrency/blockchain platform, that “will change the world”

Without a credible conceptual basis, evaluated by the community and its prominent members, stale explanations like “We want to create the next Bitcoin” sound like a scam or just meaningless. By far, we’ve seen fewer examples of immensely successful projects who did create a viable Bitcoin alternative or a quality new blockchain platform.

Projects saying they need their own tokens so badly... well, just because

Tokenization and decentralization are good. But you have to tokenize and decentralize things properly. Moreover, not everything needs to be tokenized and decentralized. For example, a popular blogger, a social media page or even a whole country announces an ICO, saying “We’re all gonna be rich, just buy the token already!”.

The bad news is that tokens for the sake of tokens, that will automatically bring profit to their creators and buyers, don’t exist. Usually such positioning is all about a race for popularity, a scam or just a joke. Among such projects are Useless Ethereum Token, a popular Russian VK public page that tried to run an unsuccessful ICO and the Venezuelan national cryptocurrency Petro.

If you think the project that you find attractive is none of those things, you can proceed to actual investment. A competent project always acts consistently and can be defined by the following.

Solid proposition from the very start

Find as much information about the project as you can. Usually a project-related thread on Bitcointalk clarifies a lot about the project’s perspectives and the team’s goals. Also don’t forget to subscribe for updates from sites, like ICO Watch List and ICO Rating.

Transparency in everything

- website — the project must have a user-friendly website with all the information, including a whitepaper, thoroughly explained and distributed

- team members — photos and detailed bios of team members must be provided (if any of the team members is already known within crypto community, that might be one of the potential reasons to invest in the ICO)

- for blockchain-focused projects — free access to the source code for developers’ community to discuss and evaluate it

- token reservation structure — if most of the tokens are reserved for a single person or few people (sometimes these are members of the team), there’s a reason to start worrying

- listing on exchange — if the project is never listed on any exchange, there’s a high possibility it is run by scammers

location — check the project’s office address, usually scammers put down a random street address (hard to believe, but such ICOs do exist, and have raised millions) - contact information — fake emails and phone numbers are easy to spot: in reply for your letter you’ll get a typical “Mail Delivery System Failure” message; the phone won’t answer, or someone who has nothing to do with the “project” will pick up

- plans — a detailed roadmap linked to cap, token and funds’ distribution structures must be provided

- dialogue with communities — besides a Bitcointalk thread, good representation on social media and feedback options for users, the project must actively communicate with its communities, so they can constantly evaluate the project’s credibility and commitment to their goal

What projects are more likely to make it?

- Those that involve reputed crypto enthusiasts and renowned professionals from other spheres as arbitrators

- That deposit funds on a third party’s account (escrow)

- That are backed by established crypto, law and/or financial institutions (e.g. funds, banks, governmental institutions, law companies, developers’ communities, etc.)

- That choose their jurisdiction wisely (applicable to projects that want to develop blockchain technology further) — the most favorable countries for blockchain startups are: Singapore, USA, Hong Kong, Switzerland, Scotland

The bottom line is that an ICO is no magic bullet or free lunch (46% of ICOs were unsuccessful last year). It is a cutting edge investment tool, available for everyone. Yet, like any investment tool, it has nuances that you have to take into account.

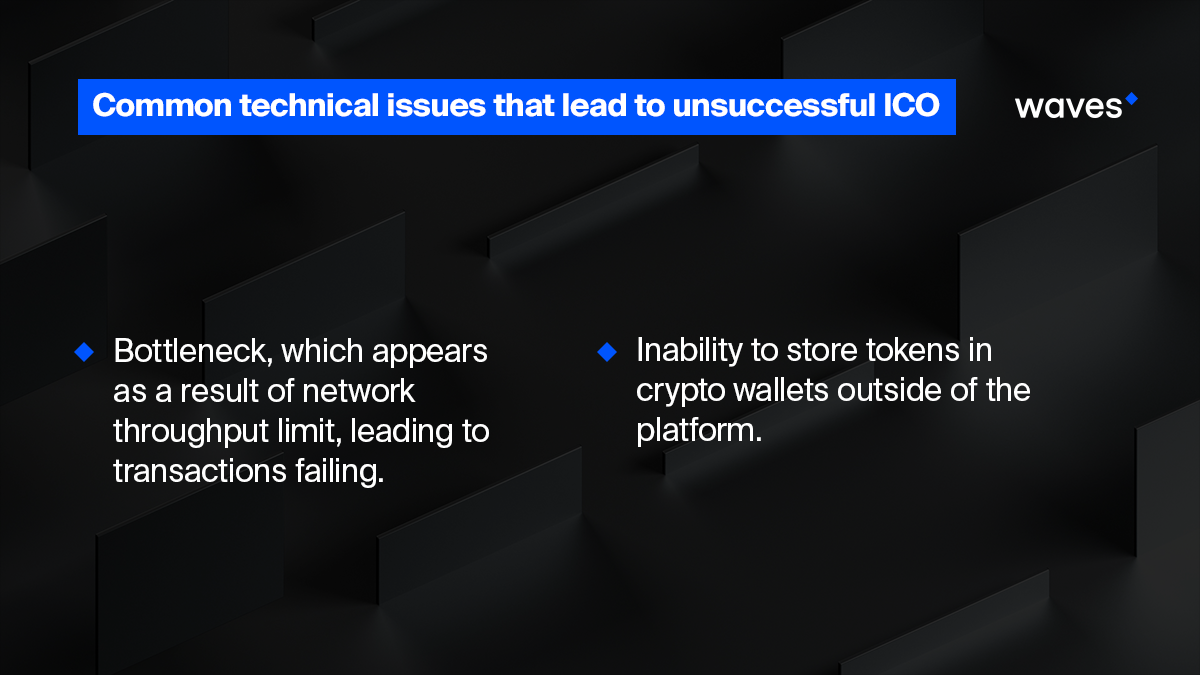

In fact, scammers and hype hunters are the least you have to worry about, since they are easy to figure in most cases. There’s still a possibility that something might not go as expected, even if the team’s intentions are pure. For example, due to irreconcilable differences, the team can split up even after a successful ICO, losing its key members, so the product just won’t make it.

The industry within which the project is implemented also plays a significant role. Some spheres, besides fintech, can be decentralized and tokenized. Such attempts are already being made, e.g. in education, healthcare, labour reward system, aviation safety, food delivery, etc. There are both successful and failed examples, so each new ICO should be treated individually, if you want to invest in it.

On the other hand, for many projects an ICO is just one of the steps towards effectiveness. Running an ICO does not necessarily mean the project will become profitable right away. For some projects the ICO becomes more of an unexpected test, rather than a mechanism for instant success. The rest depends on your investment strategy.

In the short term, you’ll have to wait for returns, and the profit might be less than expected. On the contrary, long-term investment, with all the ups and downs of product’s evolution, can bring you serious returns: if we look at traditional markets, the example of Amazon illustrates this approach perfectly.

Join Waves Community

Read Waves News channel

Follow Waves Twitter

Subscribe to Waves Facebook