You've been writing articles on Steemit for almost two months and have enjoyed some success. You decide to sell some of your Steem dollars.

After transferring the Steem dollars to your account on Poloniex, you head to the exchange. You don't have much experience in trading and are hesitant to sell, worried it will rise. After rising a little, you sell, worried this time it will fall and you'll miss your chance.

The next day you look at the price to find it rose twenty-percent overnight. It also looks as though the rise will continue. Disappointed, you say to yourself: "I knew this would happen. I knew I should have waited."

Congratulations! You've just fallen victim to the hindsight bias!

The role of severity

Hindsight bias is not only affected by whether the outcome is positive or negative, but also by the severity of the negative outcome.

In a 1996 experiment participants were told of a psychiatric patient that had informed a therapist that they were contemplating harming another individual. They were also told that the therapist did not warn the threatened individual.

Participants in the first group were told that the attack happened but the threatened individual received no injuries; the second group were told the individual received minor injuries; and the third group were told the individual received serious injuries.

They were all asked to determine if the therapist had been negligent.

Participants who were told that the injuries were serious not only considered the therapist negligent but also rated the attack as more foreseeable; participants in the other groups were more likely to see the therapist's actions as reasonable.

Maybe five computers

In 1943 Thomas Watson, the then CEO of IBM, is alleged to have said the following:

I think there is a world market for maybe five computers.

It's funny to read that quote. The thought of a world with only five computers is unimaginable given how prolific they are today. We even carry them around with us every day in the form of a mobile phone! It's not surprising that most people wonder how such a prediction was made, concluding that they wouldn't have made the awful prediction themselves.

This is the hindsight bias in action.

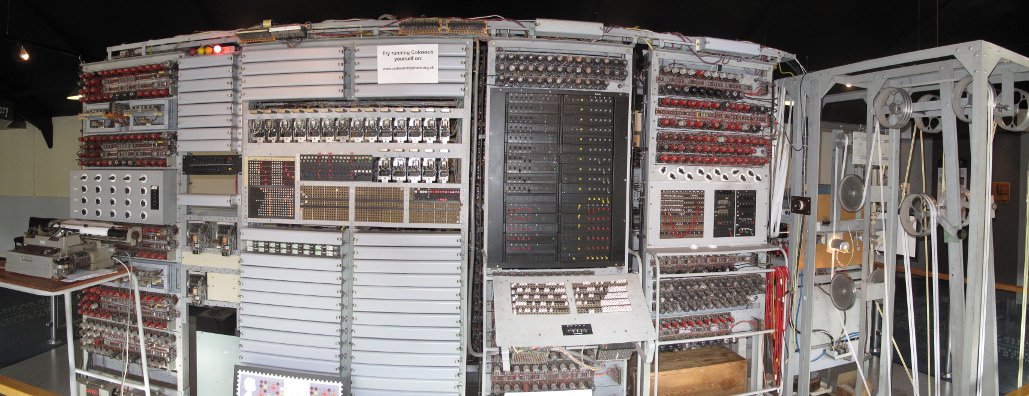

In 1943 computers didn't fit in your pocket. In fact, you were lucky if they'd fit in single room. The computer used by the British during World War II to decode the Lorenz cipher (also the World's first programmable computer) was called Colossus for a reason:

They were also incredibly slow. Colossus had a processor speed equivalent to about 5.8MHz. In comparison, modern phones have processors with multiple cores, each in the region of 2000 MHz; super-computers are astronomical in comparison.

Programming them was also painstaking work. ENIAC, also built in 1943, was the first general purpose computer. Programming it involved setting thousands of ten-way switches, often taking weeks to complete.

Given this view of computers, I'm not surprised Thomas Watson only imagined a market for five.

What can we do about it?

Research shows that even those who know about the hindsight bias, and actively try to avoid it, still fall victim to it.

You can, however, try to reduce its effects by considering other hypotheses. Whenever you conclude that a result was obvious in hindsight, consider if other options are possible and ask yourself if you would have chosen them at the time.

Try to imagine the set of circumstance under which the decision was made. Although it seems obvious now, perhaps at the time it wasn't.

Banner photo by Robert Couse-Baker used under the CC-BY-2.0 license. Changes were made to the original.

Other posts in the series:

- The lies we tell ourselves - authority bias

- The lies we tell ourselves - the halo effect

- The lies we tell ourselves - the gambler's fallacy

- The lies we tell ourselves - the sunk cost fallacy

- The lies we tell ourselves - the framing effect

- The lies we tell ourselves - cognitive dissonance

- The lies we tell ourselves - confirmation bias