There is an epic battle going on for Blockchain dominance and the real winner cannot and should not be forecast by looking at market cap but instead by two criteria, usability and scalability. Why?

To understand the answer to this question we need to examine the top coins according to their market cap and then compare those figures against which are the most used coins.

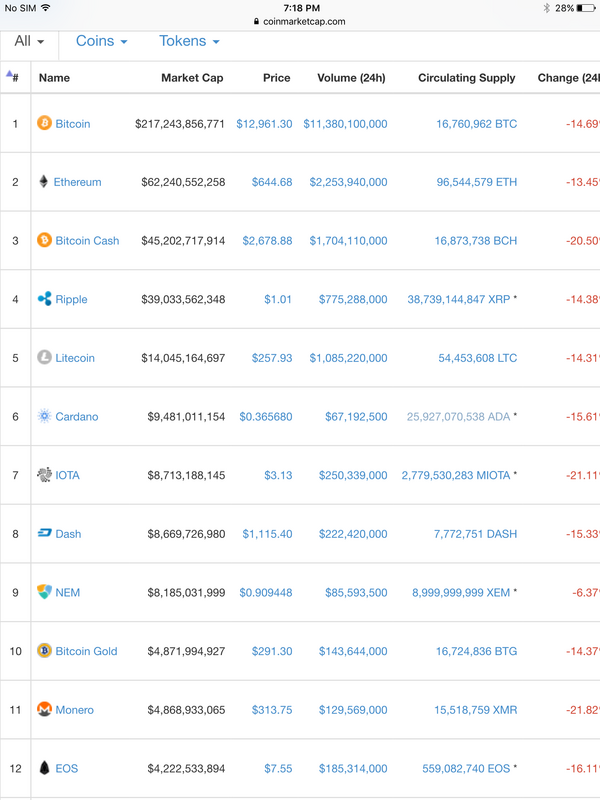

The Top Coins By Market Cap

Here we see that both BitShares and Steem are not in the top 10 or even the top 20 when it comes to market cap. They sit at number 24 and 35 respectively. However, don't let this fool you because things are going to change and I will explain why.

Don't let these market cap figures fool you as to which are the dominant tokens!

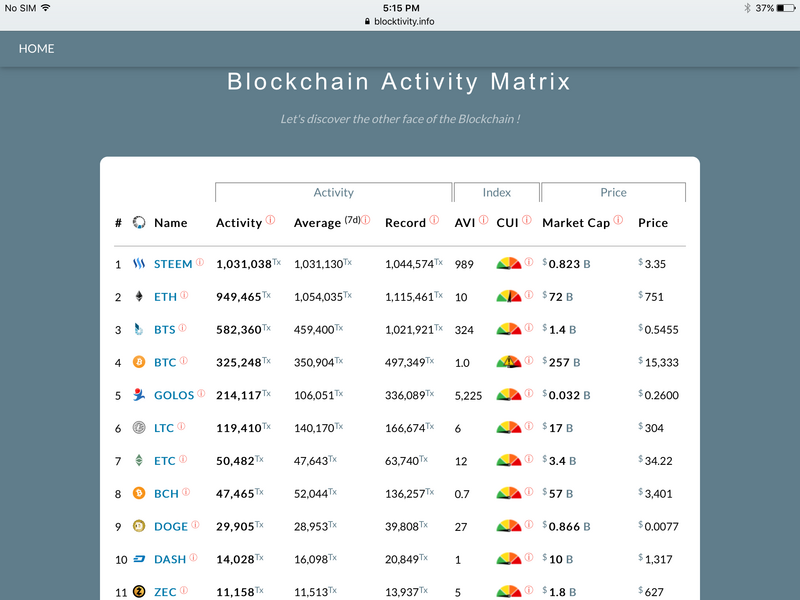

The Top Coins According to Use

Aha! Now things are becoming clearer. This chart from www.blocktivity.com shows which coins are actually being used. Take a look at the following cold hard facts:

1.)Bitcoin while clearly the market cap leader in our first chart is not at the top when it comes to transactions. Not only that but the stress meter shows that the block chain is hopelessly clogged and there are many transactions waiting in line to be processed. This is unsustainable and was the original reason for the fork that created Bitcoin Cash. While Bitcoin Cash has improved block times it too will soon again face scaling problems. To learn more about this subject and get another opinion I would suggest this great article/video by @exyle.

2.) Etherium while performing more transactions and sitting in second place according to market cap is also under severe stress and will face huge scalability issues going forward. In fact, in the image above their stress meter is in the yellow zone and at times it pushes into the red zone. We need only look at what the project CryptoKitties did to Etherium (see BBC article) to realize that a new champion will soon need to rise up!

3.) A project like Dash, while having an enormous market cap, is not performing transactions at a high level. How much value does a little used coin really have especially when it has never proven it's ability to compete against the big players when it comes to usability, Bitshares and Steem.

4.) If we examine Bitshares and Steem we see that while nowhere near the top according to market cap, they are both the big boys on the block when it comes to usability. Look at their number of transactions and check the stress meter. Both are capable of hitting 1,000,000 transactions a day while using much less than 1% of their capacity! That's huge! Keep in mind that the teams behind both of these projects are working right now on making even further scalability possible. According to many, Bitshares will be moved onto EOS once it launches which will turbocharge it into the stratosphere!

Combine this with the fact that Both the Steem and the Bitshares block chain are capable of launching other tokens (with Steem these will be called SMT's or Smart Media Tokens) and the true Blockchain leaders are becoming abundantly clear.

Once we include the fact that Steem is stealthily getting into the "hands" of hundreds of thousands of people in all corners of the globe we have the makings of a coin ready to take its true position in the market place. Remember, Steemit.com and Busy.com are just two of the foreseen dozens and dozens of front ends that will be built on top of our amazing Steemit block chain. Right now only users of Graphene products can even dream about this type of usability and growth.

To understand how Bitshares fits into this picture I would suggest that the article by Dan Larimer's father @stan entitled "When The Levee Breaks" be required reading for everyone interested in a block chain based economy. Soon more and more businesses will launch their projects on the Bitshares block chain after realizing that Etherium cannot provide what they need. That's right usability and scalability!

If you want to understand more about this subject I would suggest that you listen to as many interviews by @stan (Stan Larimer) as you can. He puts things in way that even Old Dog's like me can understand and he's out to teach the average Joe how to use these types of tokens.

A Point to Ponder: Steemit has zero transaction fees and BitShares transactions cost only pennies! AMAZING!

In Summary

Based on the two factors of usability and scalability it is continuously becoming clearer that the two Graphene projects will soon rise up and take their rightful place near the top of the market cap. The good news is that you're here, you're using a Graphene block chain and you're earning valuable Steem tokens! Smart choice, and hold on tight because we're just getting started!

What do You Think?

- Do you see the advantages of the Graphene projects?

- Do you also own BitShares?

- Do you enjoy @stan's articles and interviews

I hope that you enjoyed my attempt at explaining "Why I Believe That Steem And Bitshares Will Be Dominant Tokens!"

Until next time,

@kus-knee (The Old Dog)