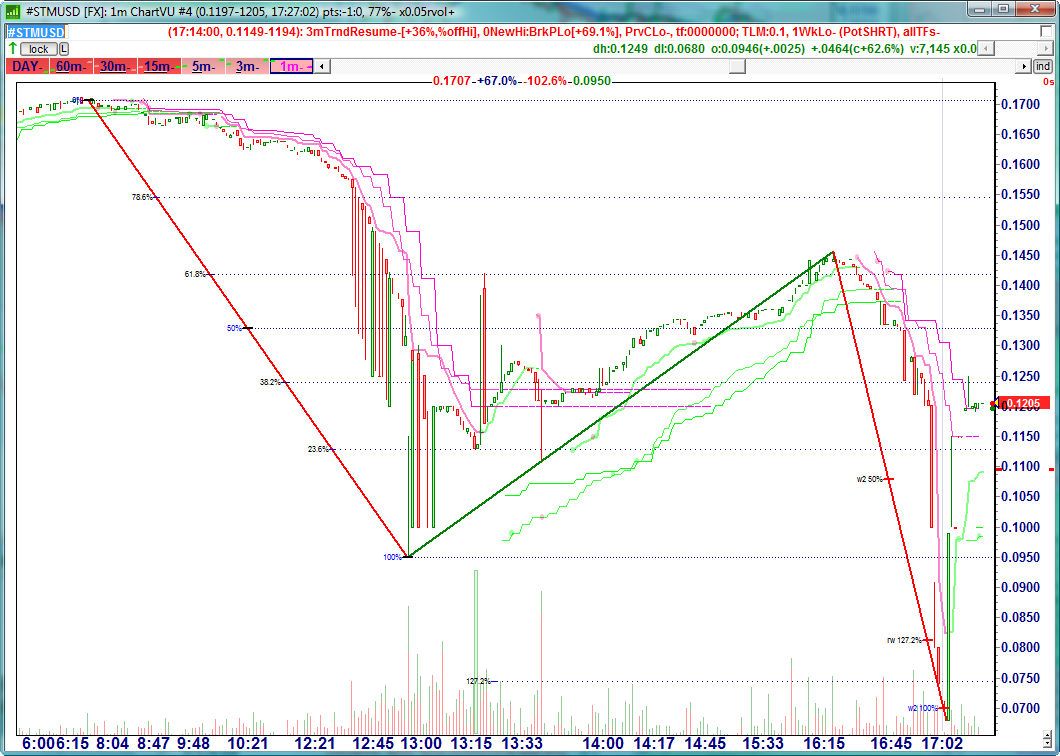

Another few days of wild volatility in STEEM/SBD. These moves also seem to happen at the oddest of times (such as on a Saturday or Monday morning for no apparent reason, except perhaps some market whales (or large exchange) chose that time to orchestrate an FX-style "panty raid" and run stops). For those who may like to see what some of the action looks like on the charts, here are some screenshots of the last few days of price action:

Not sure what prompted this latest move, except maybe all the recent hype caught a lot of newbie traders off guard who didn't quite understand the meaning of low liquidity combined with stop orders all piled up around the same price levels.

Keep studying and observing the markets my friends, lest you find yourself in a crappy situation such as this one: Apple Trader loses nearly $2.5 MILLION bankroll then tries to "GET IT BACK" on one BALL-BUSTING BET!

For those wondering why I call it STMUSD, it's kind of inherent that the first conversion of STEEM will be to STEEM DOLLARS (SBD), not to mention it's the internal market of SteemIt that doesn't take advantage of you with huge 0.25% commissions in and out of each trade. Also, officially SBD stands for "Solomon Islands Dollar", which oddly enough currently trades for almost the same price versus $USD (at 13 cents) as does STEEM.

I'd say the markets take a lifetime to master, but that would probably give some of you false hope that you could actually "master" the ever-evolving markets in a single lifetime! Look for the patterns, study history, and look for the "rhymes", avoid "buying into" the hype, and always practice sound risk management (further discussed in the Apple post).

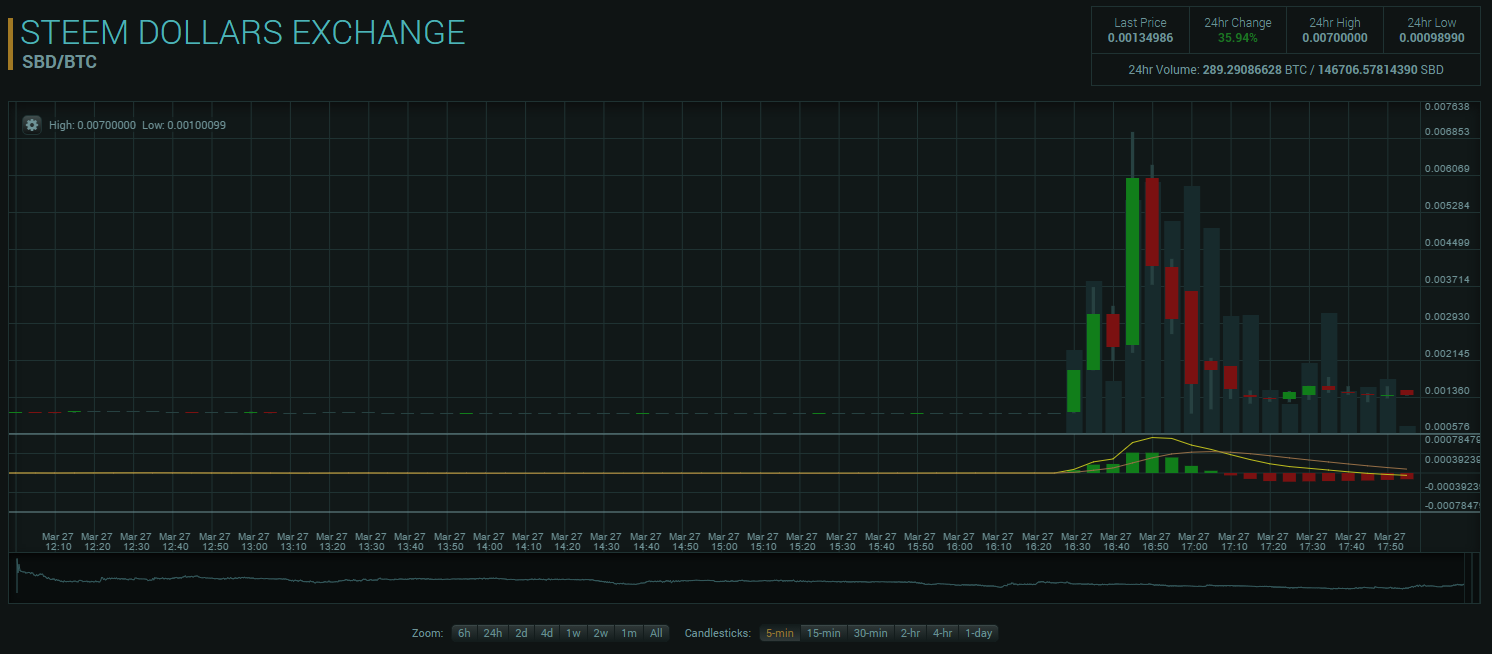

UPDATE: It seems this "flash crash" was related to a recent run / pump (or possibly a fat-fingered trader) on SBD trading at the Poloniex exchange where SBD traded for as much as 6x its normal $USD peg price in BTC for a short time. Those who quickly noticed it were likely dumping their STEEM for SBD on the SteemIt Market in order to take advantage of the price discrepancy. Everything's connected, and many things are not immediately obvious. So while some bots may have panic-dumped their STEEM trying to fill STOP MARKET orders in a low liquidity environment, other traders were trying to lock in 3-6 fold gains on a rare extreme arbitrage opportunity. Of course that doesn't quite explain the first STEEM dump earlier that day, unless it's related to those who were trying to load up on SBD in anticipation of orchestrating such a move.

Link: Mystery Steem-Dollar Pump