Indians are generally conservative savers, and I come from a family of such savers. My parents worked in the Indian banking industry. Their long term investment preferences were traditionally 'guaranteed-return' investment products such as fixed deposits, government bonds, public provident fund (PPF), and Gold.

Even insurance products are often perceived as instruments of long-term investment (often wrongly marketed) in India. While in reality, they should only be considered for mitigating our risk.

People generally, successfully secure their retirement years by putting their complete faith in our closed banking system, which fortunately has a good track record of securing savings of every participant in the system. Most of the time people comfortably lead their lives without having to dip into large portions of their retirement fund, unless they are in an emergency.

Today, I’m sharing a few key life lessons I've learn’t and in return I hope to learn further from your experiences dear Steemit readers.

So, Let's talk!

Important Lessons Learnt the Hard Way

It was early 2008 and I was a 19 year old college student pursuing my graduate degree in business management. My strong interest towards the financial markets led me to the world of internet forex trading as well as mutual funds in the Indian stock market. I borrowed some money (the ONLY time I took any loan) from my mother and dived right in.

Using Liberty Reserve to load up a Lite-forex metatrader account-I quickly learnt the basics and began day-trading. I won in some trades, and lost in a few but in the first month, my investment grew at a consistent 2% per week. Those were some exciting days learning to manage my risk while learning to leverage, ride the bull, even shorting and hedging as needed. Things were fine until one day my email account was hacked and the hacker managed to subsequently steal all the funds from my trading account.

I lost about $1500 in this online theft. The initial capital came my mother’s retirement savings—luckily she still loves me more than the money! At the same time (only time) I got suckered into a ponzi scheme (very popular in India) which I entered at the behest of a very close friend. Despite a terrible gut feeling against it, I proceeded and lost more money in the process.

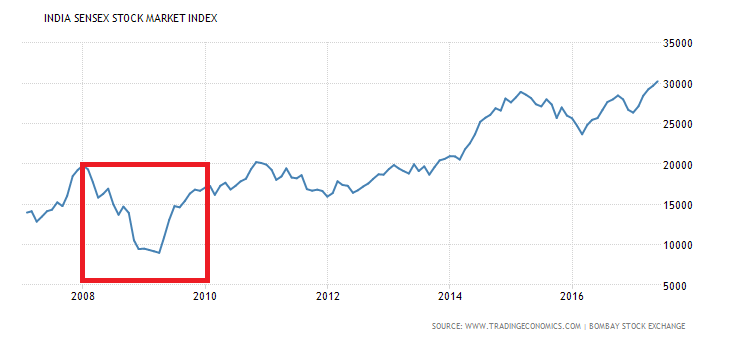

To make matters worse the financial crisis of 2008 also negatively impacted India. It caused a massive crash and a bearish run of the stock market until 2010 resulting in a further 20% capital depreciation of the funds invested into mutual funds. An urgent need of funds necessitated an early exit at a loss, leaving me with a terrible feeling in my gut!

Over a period of a year or so we were disappointed, saddened and I was absolutely gutted!

But my mother despite being a conservative saver is a genius in managing personal and household finances. She assured me that everything is okay as she had backups in place. A small backup emergency fund consisting of Gold jewellery and fixed deposit was there for the worst case scenario and short-term needs. When the emergency situation was triggered, we pulled from it.

She has never stopped trying to save up money, even as she continues receiving her pension today. She instilled the habit in me to save very early in my childhood and that proved useful later in life.

Importance of a Financial Contingency Plan

The whole point of any contingency budget is to provide a monetary backup during unexpected financial difficulties. It’s there to prepare ourselves against anything from a decrease in income, loss of a job, medical emergency, temporary disability, and in the worst case scenario, sudden loss of a bread earner and escalating expenses as a result thereof.

Earlier in February this year I met with a major accident. As I lay in the hospital wondering about the escalating medical costs which during my initial hospitalization amounted to $5000, I was worried if my health insurance would cover a significant portion of these costs. It was March, and Steem price was still in the dumps.

But, between 2010 and 2017 my experiences had taught me a valuable lesson. Any emergency fund that you create must ideally be kept in a liquid form of investment. You must be able to access it fully and immediately if needed. It should be sufficiently large enough to last about 1 year and you should never touch it unless there’s a real need for it.

A bank fixed-deposit always made good sense and by the end of January, 2017 I had once again managed to save a liquid emergency fund ready to last me atleast 6 months, after having utilised the previous one in 2015.

Steem and Cryptocurrencies based Financial Backup

With my right hand not working up to its potential, and the uncertainty of it's recovery, I had to make a difficult decision to close down my business after my accident, ergo losing some precious clients built over 5 years.

Momentarily, I began considering job opportunities in different domains. With my multitude of skill-sets, sufficiently wide network and goodwill, I figured I could atleast find one to get me back on my feet. A job that only required minimal use of a computer—I wonder how many such jobs exist today! This was the worst case scenario and it was staring me in my face!

Luckily enough, my health insurance covered most of my expenses, but soon I was going into another $2000 surgery again and my emergency fund was dwindling down faster than expected. I was going into my fourth month of unemployment. Steem at the time was hovering around 20-30 cents and I figured I could sell a little to tide over these tough times. But, even as I powered down, I decided against selling any!

My mother is there to support me financially if needed. Even my friends, including a few Steemians offered financial assistance. @donkeypong straight away sent me some Steem, and never even mentioned it until when I looked into my account and found it there after several days. I cannot thank him enough for his kind gesture!

Truth is, I just didn’t want to burden anyone. It’s just the way I go about my business! I wanted to make it on my own, atleast in most aspects of my life! Well, what’s the point in growing up if one cannot manage their personal finances! Right?

Riding the Rising Steem Crypto Wave

Steem continued to remain bullish, ergo I set aside 2000 Steem on Polo for a quick sale. When it hit 65 cents, I sold it and kept tracking its progress and bought it lower again. Whenever I could be online, I followed the discussion in price channel on Steemit.Chat with @wingz, @ats-david, @kingscrown and many others who made it easier to follow the market as best as possible, whilst being their funny selves!

I found @ats-david’s Steem price analysis posts corroborating my basic understanding of the charts, analysis and judgement. Therefore, I continued trading occasionally, just as I used to until January with a bunch of different cryptos. This helped restore some of my confidence in general after the recent accident.

Easily enough, with some luck and as expected Steem rallied and retrenched a few times, but eventually going up to $1.30+ couple of times allowing me to rinse, repeat and make approximately an additional 1353 Steem which I sold at the most recent $1.50 rally and I’ve now set that aside as my emergency fund already!

Last year, I had also invested in the ICONOMI ICO and continued buying it when it was still low in January. Today, it's worth a lot more than 6 month emergency fund. I also hold a few tokens of other cryptos, all of which have increased their initial value and even found a tiny sum of bitcoin stashed away in a BTC wallet that I had momentarily forgotten about!—Something that'll never happening again!

These developments made a positive impact that I so badly needed and gave me the confidence and financial stability to tide over these rough times.

Which brings me to @jerrybanfield's article that I agree with: 10 Reasons for $10 Steem Price in 10 Months! and @decentralized feels that Steem could potentially reach a 1 Billion USD valuation in the short-term. Anything can, and will happen!

If I had dipped into my ‘retirement fund’ I would have lost considerably on years of planning and I came so close to liquidating it all! Feels adventurous for sure, doesn't it? Steem, for me now is nothing short of a precious metal, just as Gold is to Indian people. I’m going to HODL my Steem for a long time to come!

I’m also going to buy a little bit of Gold using Vaultoro to set aside as a long term precious-metal based backup investment which I could potentially withdraw anytime, any place if needed—as I understand it! You can read more about this service in Steemit user @petethekiller’s post on Vaultoro: Old Gold vs New Gold

What is my situation today?

Over the past several years I’ve steadily focused on building a ‘retirement fund.’ Now, I have a decent portfolio for a 29 year old solopreneur and digital-nomad from India who wasn’t born with a silver spoon and had to work his way up as any other person born to a middle-income family—I’m actually quite proud to say it today!

Even as I spent a lot of money traveling across my country, I made sure that I save up alongside, just as my mother has all these years!

Much of my portfolio today is spread across fixed deposits, mutual funds, public provident fund and equity—in this order. Indian economy is booming which has resulted in a steady 14%-15% appreciation p.a of my mutual funds—my risk spread across 20 of these and 8% approx appreciation p.a of my fixed deposits and PPF. As you can tell, it’s not a high risk, high yield portfolio. On the outset it looks moderately-conservative with ‘protected’ debt-based investments taking lead but then this is where cryptos come in!

I've invested any extra that I’m willing to risk 100% into my crypto allocation from over a year now.

Massive increase in Steem price and overall crypto market turn-around, has in-fact turned around my portfolio completely. Cryptocurrencies, with Steem leading the crypto allocation now represents a greater part of my overall asset allocation at ratio of 2.5:1.

If you are on the fence about cryptocurrencies then you must read @nanzo-scoop's fantastic article: Cryptocurrency is exploding! Should I invest more? before proceeding, and certainly watch several easy to comprehend videos on cryptocurrencies for beginners at our beloved @heiditravels' blog!

In the World of Motorcycling, There is a Saying:

When in doubt, go throttle wide open!

So basically, I:

- Never lost hope that Steemit is real, tangible and it will grow with

time. - I accumulated more Steem/crypto till January.

- Continued working towards building a Steemit community which

stands by me! - When in panic, HODL! (hold)

- Kept FOMO (fear of missing out) at bay!

- I never stopped believing in myself!

- Stood by my financial decisions.

- I Keep calm and Steem on!

Best part about all this is that today I have ZERO liability in spite of all of these incredible situations. In fact, since 2010 till date I’ve never had any financial dues towards anyone, in spite of various roll-coaster moments in-between. I've an excellent credit score as well!

I’m not rich or wealthy yet however, I have achieved greater financial security; today more than yesterday! While my mother’s retirement fund is not only intact but also steadily appreciating in it's value!

Steemit to My Rescue!

I'm proud to say that I'm now Steeming full-time! I’m now totally focused on creating content at Steemit moving forward, even more than ever before! Given my health, it's now easy to just focus on one task at hand, and share my experiences here.

I’ve only authored 23 posts till date as I’ve been heavily invested in trying to build our thriving Steemit community on Steemit.Chat and off it! I've been assisting in running curation guilds and aid in increasing user engagement, retention levels and promoting Steemit within my circles. I’ve set a few challenging targets moving forward as I slowly bring myself to working longer hours again. As you can tell, I’m also highly self-motivated!

I hope someday we can switch to banking with our favourite cryptos like @lpfaust tried do with bitcoin in his latest piece: Deeper Dives: Living la Vida Unbanked in the World of Digital Currencies

If you truly believe in happy endings, you must first be prepared to take the journey, with all the accompanying struggles! —@firepower and you read it first on Steemit! ;)

Did you ever go through a similar struggle? What were your best and worst financial decisions and how did you see them through? Have you had any negative experience investing in cryptocurrencies?

I'd love to learn about your experiences in the comments.

Disclaimer: This isn’t financial advice, only just an account of my personal experience.

I’ll see everyone again at SteemFest 2 as Firepower crew assists @roelandp in pulling it off once again! Roeland will soon be making the announcement!

Thank you dear readers for your time and attention!

Check out these 3 excellent Steemit articles on financial planning and budgeting:

- Setting Goals Towards Successful Financial Planning

- How To Budget: A Step By Step Guide To Create A Financial Plan And Become Debt Free

- Managing your money with a personal financial planning spreadsheet

If you like my work, please share my posts and follow my blog to support me. You may also continue reading my recent posts which might interest you:

- How a Himalayan Alpha Dog Domesticated a Hooman!

- How I faced my demons and fought back!

- Starting 2017 with a Bang by Bringing Joy to HIV Positive Kids!

- Steemit Veni, Vidi, Vici! SteemFest 2016—Together, WE made it happen! Thank you Steemians!