Last month I posted about using BitShares and bitUSD to essentially short the USD. See the videos and links there for detailed instructions on how this all works.

Here is a simple example of shorting the USD over the last five days to gain an extra 2,383 BitShares and $11.59 in bitUSD for a total of around $45 in value essentially out of nothing. Obviously, this only works if the price of BitShares is going up and/or the demand for USD (bitUSD) is going down. This is a simple, short example, but I could also hold longer or invest in something else besides BitShares with by bitUSD before selling and unlocking my collateral.

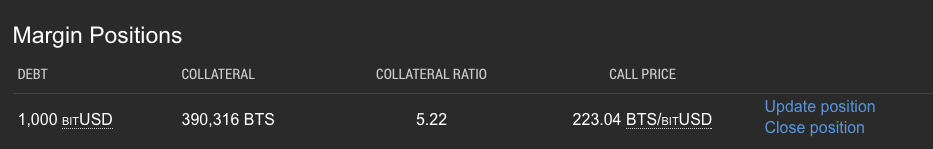

It starts by locking up some BitShares in a smart contract which is used as collateral to borrow bitUSD into existence. In this example, I burrowed $1,000 at a 5 to 1 ratio. I like not having to worry about it, so I went with a really high ratio. You're probably fine with 4 to 1 or 3 to 1. You won't be automatically called until much less than that (I think 1.5 to 1).

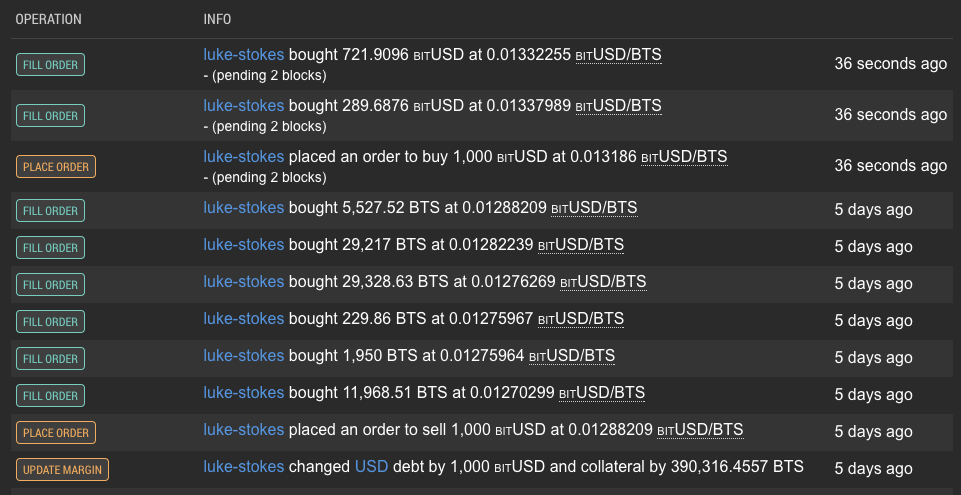

Once I borrowed the bitUSD, I bought BitShares with it. Five days later, the value of BitShares went up so my collateral was above 5.0 meaning anything sold at this point is a profit.

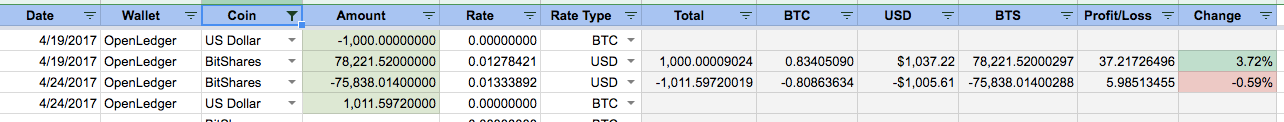

You can see from my Cryptocurrency Bank Spreadsheet all the trades involved here:

I didn't have to time the market perfectly for this to work, I just had to sell the BitShares back for bitUSD at a higher price than I started.

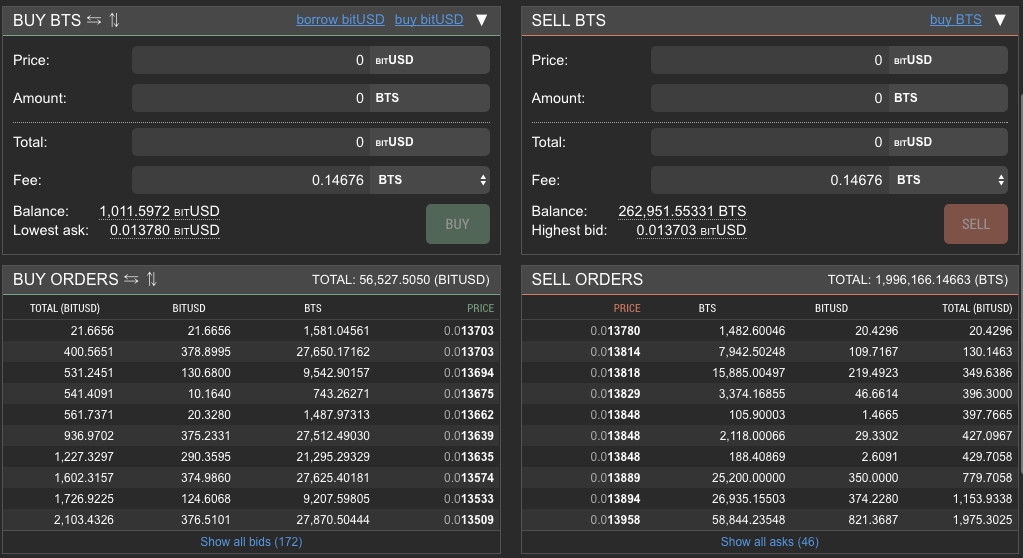

This gave me an extra 2,383.5060 BitShares and 11.5972 bitUSD. It's really pretty simple. The trickiest part involves getting familiar with the order book and how to use the Buy Orders and Sell Orders screen. If I was going to buy some BitShares right now, as an example, I could click on any of the sell prices and my order would be filled up to the amount I specify. Same thing goes for selling BitShares and clicking on a price somewhere in the Buy Orders order book.

You can also just add an order to one side of the book if you think the market price will meet you there with the price either going up or going down. One thing I've found is that often it's best just to pull the trigger right away at the current prices if you've already made a decision to buy or sell. If the liquidity is low, you'll have to worry about slippage depending on the size of your order, but most of the time it won't matter too much. You might be able to squeeze an extra penny here or there if you wait for the market to meet you, but I've missed out quite a bit when I end up planning in the wrong direction.

I hope you find this useful. You can use the BitShares wallet (pictured here) at https://bitshares.org/wallet/ or you can use Open Ledger at https://bitshares.openledger.info. Nothing here should be taken as investment advice, it's just for entertainment/education only. If enough people started playing around with BitShares to increase the liquidity there, we'd have a nice, secure, decentralized exchange with keys we control directly in our own backed up wallets.

That's pretty cool.

I'm not one to margin trade with debt by borrowing from others, but when it's my own collateral being used, it makes a lot more sense to me, as long as I'm patient for the market to trend in the direction I need in order to make a profit. If you have any questions, feel free to ask in the comments.

Luke Stokes is a father, husband, business owner, programmer, voluntaryist, and blockchain enthusiast. He wants to help create a world we all want to live in.