Lately I've been thinking a lot about the cryptocurrency trading environment. At one point, my investments in IOTA, SAN, OMG, and NEO showed me with 5 BTC in profit. It was crazy. I should have sold. I knew I should have sold. And yet, others who knew they should have sold did sell long before that point and watched their recently abandoned coin 2x or 3x after that.

The markets, sadly, are not rational.

Or, to put it more clearly, the traders who make up the market are not rational.

2 months ago I argued for why it makes sense to not buy EOS now, but to wait. I argued the price would go down and maybe 6 months later would be a good buying opportunity. 20 days ago, I admitted I was wrong and the price of EOS was much higher than I thought it would go during the first 5 days of the ICO. Those who bought early did well.

Since then, it's been going down. Along with some of my other favorite coins like STEEM and BitShares. Maybe I was right after all. Maybe many months from now is the right time to buy EOS. Unfortunately, I didn't listen to my own advice.

A lot of traders like to share their wins and gloss over their losses. I'm not even really a full trader at this point. I still work full-time on my business FoxyCart, continuing to serve thousands of merchants around the world. I would love to trade more often because it's exciting and fun, much like playing Texas Hold'em. I enjoy the game. I enjoy trading, but I have a lot to learn.

I sold some bitcoin at $3,164. It was a new all-time-high, and I figured it was a good time to sell, wait for a retrace, and buy back in. The retrace never came. I was holding USD on Bitfinex when Bitfinex announced they were shutting down service for US customers. Not only that, they were suspending EOS and SAN trades for US customers in three days. So, I didn't listen to my own advice, and I went long on EOS. I bought some other things too and did well on those trades, but it just reminded me how irrational traders can be.

Technically speaking, BitShares and STEEM are two of the most performant, advanced, and useful blockchains in existence today. Traders don't care about that. Even huge fans of Steemit may not care about that. Why buy STEEM if you can invest in some new hotshot, yet-to-even-exist ICO and 2x, 5x or even 10x your investment in a matter of days or weeks?

Do investors and traders even care about a product delivering real value in this environment?

Right now, I think the answer is obvious. Very few people care. Many don't even read a white paper before jumping into an ICO. It's all about quick gains. Who can blame them. Rationality can't stand up against reality when the reality of returns is real in this speculative, quickly growing ecosystem.

I couldn't even listen to my own advice. Not only that, I sold my Bitcoin Cash at the all-time-low, which may be a first in the cryptocurrency world, considering how BCC/BCH was introduced. Most coins start with an all-time-low of $0.

And yet, I have hope. I recognize at some point the fever will fade and the creme will rise to the top. When the feeding frenzy slows down, this will no longer be our reality:

At that point, in that moment, people will look around and wonder, "Which blockchain projects are actually providing real value to humanity?"

The latest Understanding Blockchain Freedom video explored the real value of cryptocurrency a bit and maybe that applies here as well.

Maybe Gridcoin will get some attention for helping to fund science. Maybe those who have used EtherDelta, like I did this past week, will realize just how amazing BitShares and OpenLedger actually are (becuase when the Ethereum network is flooded, like it was last week, EtherDelta really sucks). Maybe people will see Steemit for what it is, a platform putting social back into social media. Maybe that's when rationality will return and the contrarian investors will have the last laugh. Those who buy coins everyone else is dumping. Those who know when to sell at the peak of the hype and buy what no one is paying attention to.

That's my hope, anyway.

That may also be my bias since I'm invested in BitShares, STEEM, and now EOS because I believe in the long-term value of these projects.

Maybe that's just my own confirmation bias, loss aversion, and so many other psychological mind games going on to keep me irrational.

Time will tell, I guess. In the mean time, I'm having fun and enjoying the ride. :) I hope you are as well.

We're going camping this weekend to enjoy the solar eclipse which is coming right through Nashville so my weekly Exchange Transfer Report will be a couple days late this week.

I hope you have a fantastic weekend. I probably won't be responding much until after Monday.

Steem on, my friends. As I argued recently, if you think STEEM and Steemit have long term value, maybe consider being a contrary investor and powering up while the price is declining.

Then again, why listen to me? I can't even consistently follow my own advice. ;-)

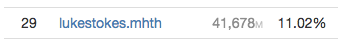

Luke Stokes is a father, husband, business owner, programmer, and voluntaryist who wants to help create a world we all want to live in. Visit UnderstandingBlockchainFreedom.com