- NFL and NBC blocked AML Bitcoin at the Super Bowl!

- Venezuela wants to propose OPEC a common Oil Currency!

- ECB: Interest in Bitcoin Futures, but not in Bitcoin!

- IOTA announces Development of the IOTA Ecosystem by March 2018!

- Grayscale launches Fund for the Top 5 Cryptocurrencies!

- New Monero mining Malware surfaced: Android Users affected!

- USA: Crypto-Investor is suing T-Mobile!

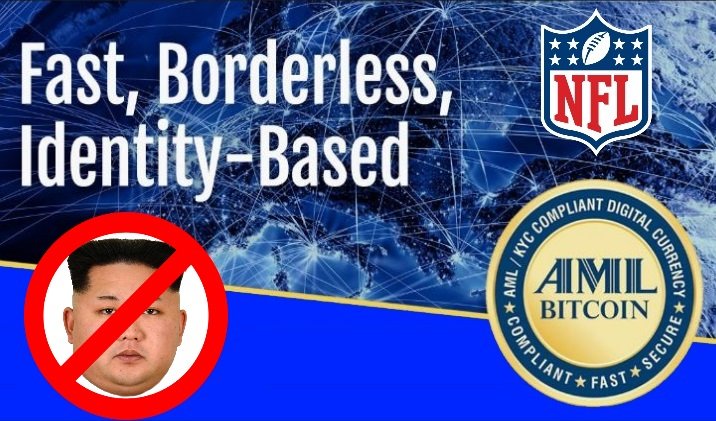

AML BitCoin, a cryptocurrency that stands out in terms of security and financial compliance, has apparently been denied the chance to be featured in a humorous Super Bowl ad this week for the American public. The National Football League (NFL), NBC and the network that aired the Super Bowl LII on Sunday decided not to air AML Bitcoin's humorous advertisement titled "North Korea Can not Steal AML BitCoin."

However, one should absolutely know that the ad showed the North Korean dictator Kim Jong-Un, which is raging in the advertisement, because despite previous successes in other crypto currencies, it was simply not possible to hack AML BitCoin. Finally, the ad of AML BitCoin ended with the slogan "Sorry, dear leader ... "

Note from me:

For political reasons, I can understand the stop of the advertisement at the Super Bowl, certainly. To make the story more tangible for my readers, here is the official video of AML BitCoin.

Video source: YouTube / AML BitCoin

To better understand the ad, one has to keep in mind that other cryptocurrencies are sometimes notoriously vulnerable to hacking and phishing - often because the user does not pay enough attention to their security. Unfortunately, the user, as soon as he became a thief, hardly had a chance to get back to his coins.

For this reason, AML BitCoin was developed with the aim of creating security for the user and, of course, to ensure compliance with legal regulations. For example, AML BitCoin has built-in anti-money laundering, anti-terrorism and anti-theft systems, and complies with banking secrecy, know-your-customer (KYC) and other anti-financial crime laws.

Unfortunately, the National Football League does not give any specific reasons for not using AML BitCoin Super Bowl advertising. Nevertheless, AML BitCoin creator Marcus Andrade was extremely angry. It says in a letter he wrote to NFL Commissioner Roger Goodall:

This behavior at the Super Bowl could now be or become part of a growing trend of shy media, leading to the rejection of further media advertising by cryptocurrency companies and the dread of the topic. A prime example is Facebkook. A few days ago, this company announced that it would stop showing ads for products and services "that are often associated with misleading or misleading practices," including cryptocurrencies.

As with many innovative technologies, the blockchain technology underlying the cryptocurrencies can be well utilized to produce positive effects and results. Depending on the field of application, blockchain technology can of course also be used for practical jokes. In particular, the extremely strong growth in the value of cryptocurrencies in 2017 unfortunately led to many scammers being magically pulled out of the subject, so that certainly a lot of mischief happened here in 2017 as well. To warn against it and to do something about cryptocurrency frauds is, of course, right, but the path must fit the theme.

Both business and government have clearly and repeatedly stated that a digital currency is needed that can prevent fraud and comply with established regulations. Therefore, AML BitCoin is making great strides to achieve this goal. Their Initial Coin Offering (ICO) has been particularly successful and is currently in Phase 3, the public sale of tokens.

AML Bitcoin was founded by the NAC Foundation, which is based in the United States and is a member of the American Bank Association. For more information (including a link to the Super Bowl ad), visit www.amlbitcoin.com.

Venezuelan President Nicolas Maduro wants to warm up members of the Organization of Petroleum Exporting Countries OPEC for a common cryptocurrency. This reports Al-Jazeera on Tuesday. An example could be his own controversial digital currency Petro announced in December, which is being held with the oil reserves of the crisis-ridden country. Whether Maduro's proposals on the oil producers on fertile ground falls, is questionable.

If the pre-sale of the Petros starts in less than two weeks, this should only be the beginning - at least when it comes to Nicolas Maduro. The president of Venezuela announced on the radio of the South American country this week that they want to launch a common oil currency of the OPEC states.

Nicolas Maduro describes his vision:

According to Maduro's ideas, the oil producers could thus issue a value-stable, oil-backed currency based on the Petro model.

Securing with the oil of others?

Such an OPEC Petro would be a veritable coup for Maduro. Because the OPEC with seat in Vienna represents beside Venezuela, also the oil-rich Gulf states. Thus, the association is responsible for an estimated 45% of world oil production. In addition, 75% of the world's oil reserves are dormant in the soils and waters of the member states.

A common currency would protect Venezuela against the possible resistance from abroad, which is only directed against Caracas. Maduro is with his back to the wall. His economy creeps, the luck of the experiment "Petro" is questionable.

While the local opposition is referring to the barricades, calls Petro "illegal" and an "illegal government oil reserve loan", one thing the US does not want under any circumstances. And that will be witness as Venezuela bypasses the international financial sanctions.

One will not want to allow an OPEC Petro and in case of doubt set all levers in motion to prevent it. Although the organization once displaced the Americans as the world market leader and is currently trying to dictate the price of oil through production cuts to the displeasure of the United States. Moreover, the US influence on the OPEC competitors is still largely foreign policy. Thus, OPEC engine and world market leader Saudi Arabia is seen as a close ally of Washington.

In the fight against the downward spiral

Last December, Maduro announced its digital reserves based on oil reserves. It is intended to benefit the country from the ongoing crypto-boom, to find its way out of the economic crisis - and consequently to lay the chains of international sanctions. Because with a currently galloping inflation of 2,900%, Venezuela has been in an ever-faster downward spiral since last year. Food is scarce, public order is falling apart. The International Monetary Fund is forecasting Venezuela an inflation rate of 13,000% by the end of the year.

A first cash injection, however, could be the Petro presale. This starts in less than two weeks. Last week, the President, signing the Petro-white paper, announced it and released new details for the first time. Thus, the Petro should be able to use the passport and identity papers in the future and bind the citizens in their financial management with it directly to the state.

Maduro said on Venezuelan television:

As announced yesterday, he wants to be re-elected in an early election on April 22. To date, only his name stands for the vote. According to estimates, this could remain so even against the will of the opposition.

European Central Bank President Mario Draghi outlined during a public debate in the European Parliament that banks could resort to holding positions of Bitcoin themselves. He only referred to BTC futures. A fine but important difference.

In a meeting of the European Parliament on 05.02.2018 was a core topic of the discussions, what influence cryptocurrencies could have on the future monetary system. So far, there has been no trend to show that financial institutions within the European Union are very interested in cryptocurrencies:

In the past, the central banks' attitude towards cryptocurrencies was rather cautious. A few months ago, it was still believed that digital currencies were not a risk to the banking industry. Nevertheless, it is not necessary to deal with this topic more intensively. Since the adaptation into the mainstream u.a. According to Draghi, Bitcoin and co., more and more of the banks could focus more on Bitcoin futures and the resulting growing acceptance in the near future.

Nevertheless, Draghi clearly emphasized that unregulated cryptocurrencies such as Bitcoin are a very risky asset and are extremely volatile and speculative.

There is also an EU regulatory effort in place to address the risks of digital assets to banks and financial institutions:

Although central banks have yet to legislate to regulate cryptocurrency, this seems to be one of the next steps. However, it is unclear to what extent steps have already been taken or will follow in the near future.

Nonetheless, it is remarkable from our point of view that cryptocurrencies are becoming more and more the focus of public debate and have even reached central banks. Another positive aspect is that there is no talk of cryptocurrencies, but only about regulation. In this sense, the European Union seems to be guided by the position of the United States of America.

After the IOTA Marketplace caused a sensation in the public last year, IOTA now wants to launch a new platform called "IOTA Ecosystem". The aim is to bundle the competencies and differences of all players in the industry in one place in order to boost the development of the IOTA Ledger.

IOTA announced on February 7, 2018, a new project to be completed by March 2018 this year. With the "IOTA Ecosystem", IOTA will create a platform that will bring together a wide variety of players in the blockchain industry. Whether developer, startup or hobby crypto supporters, on this decentralized platform, everyone should be welcome, who want to work towards a decentralized future.

The IOTA Ecosystem will take over several functions and contain a whole range of different offers. This includes, among others:

- Educational offerings in the form of videos, tutorials and interactive tools

- Digital libraries of articles and blog posts by experts as well as the provision of developer resources

- Competitions, events and hackathons

The project is financed by the Ecosystem Development Fund (EDF). Donations were collected by all community members to provide a financial basis for the development of this project. The resulting sum is several million euros heavy due to the price increase of IOTA. The capital should be used as support to drive the future development of the project decisively.

The main goal of the IOTA ecosystem is, of course, to accelerate and accelerate the development of the IOTA distributed Ledger protocol:

Democratic decisions in the IOTA ecosystem

The management of the new platform should not take place IOTA-centered, as e.g. at the IOTA Foundation. Instead, all members of the community should be able to influence it. A voting system is being developed that is based on Tangle technology. In the future, it should be possible to hold democratic votes on initiatives and developments as well as on the further course of the project.

It will use a decentralized reputation system that reflects the full transparency and accountability of all participating actors within the ecosystem at all times.

At a Yahoo Finance event, Barry Silbert, CEO of Grayscale, announced that five crypto currency funds will be launched. These will include four funds, each based on a cryptocurrency. There will also be another fund made up of the top 5 cryptocurrencies by market capitalization.

The Barry Silver company first launched the Bitcoin Investment Trust (GBTC) in 2015. The aim was to simplify the acquisition of Bitcoin, especially for institutional investors. By saving the technical steps to buy bitcoins, access to cryptocurrencies should be leveled. The following year, Grayscale also launched an Ethereum Classic investment fund and a Zcash investment fund.

The "Digital Large Cap Fund" will thus be the fourth investment fund of Grayscale. At the start, the fund will be composed of the current top 5 crypto currencies by market capitalization: Bitcoin, Ethereum, Ripple, Litecoin and Bitcoin Cash. (Actually, Litecoin is only 6th behind Cardano at the time of writing.)

The weighting of the investment fund is based on the market capitalization, ie. H. Bitcoin and Ethereum will take the largest share of the fund. A control and new weighting is planned according to silver quarterly. In addition, existing cryptocurrencies can fall out of the fund and new assets can be added.

In the first year, the Digital Large Cap Fund will be available exclusively to SEC-accredited investors. At the end of the first year, Grayscale plans to publicly list the funds. Thus, the original buyers could sell their shares in the public market.

Grayscale's Bitcoin Investment Trust (GBTC) has shown that institutional investors are avoiding the direct purchase of digital coins. Instead, the GBTC traded on the secondary market at a significant premium to the underlying. This shows, in our view, the generally great interest exists. At the same time, there are technical hurdles to the purchase and safe keeping of cryptocurrencies that discourage potential institutional investors from entering the market.

By the end of the first quarter, Grayscale plans to launch four additional cryptocurrency funds based on individual digital currencies.

Grayscale is a subsidiary of Barry Silbert's Digital Currency Group (DCG), which promotes and invests in cryptocurrency startups. In the list of the richest people in the cryptocurrency world, According to Forbes, Barry Silbert ranks 16th on the crypto kingdoms. The portfolio of DCG includes numerous well-known companies from the cryptocurrency world. These include u.a. BitPay, Bloq, Civic, Coinbase, Coindesk, Etherscan, Korbite, Kraken, Ledger, Ripple, Shapeshipt and ZCash.

Hacks, malware and other malicious software can endanger your own cryptocurrencies or secretly use your own computer resources to mine. Of course, as the value of cryptocurrencies increases, so does the lucrativity of cybercriminals. When it comes to mining malware, the cryptocurrency Monero is often affected. Also currently there is again a new mining worm that spreads on devices with the Android operating system and Monero Mining operates.

The new threat has been discovered by Chinese security researchers at 360Netlab. The exploit, d. H. the malicious program exploits existing vulnerabilities to allocate resources (CPU) and / or gain other access rights to the device. In the ADB.Miner discovered by the Chinese security company, a so-called "open-port exploit" is carried out.

This means that once the ADB.Miner has compromised a device, the local network will be scanned for devices with an open 5555 Internet port. If it finds such devices, it spreads worm-like and tries to copy the malware to other devices with an open port. Finally, it connects to the botnet and actively participates in the monster mining botnet.

However, researchers have not yet been able to find out exactly how the devices got infected. However, according to Chinese researchers, the ports were already open before the devices were infected. One guess is that unknown diagnostic and debugging tools accidentally left this port open.

According to the researchers most of the victims come from China(39%, including Hong Kong and Taiwan) and Korea (39%) over 7,000 devices: smart phones, tablets and TVs are affected.

Monero the darling of mining malware

It has been reported over the last few months that cybercriminals are building botnets to mine the anonymous cryptocurrency Monero.

For example, Proofpoint's IT security researchers have recently discovered the Smominru mining botnet. According to the researchers, this has spread to more than 500,000 Windows computers, and over the period from May 2017 to January 2018, it has raised around 3.6 million US dollars in the cryptocurrency Monero.

Smominru's entry door or seizure was an exploit originally developed by the NSA that hackers captured last year. The exploit, named EternalBlue, became known worldwide through the ransomware attack called WannaCry.

Especially for hackers Monero has its advantages. Since the currency is characterized by unachievable transactions, the developer of the malware can remain undetected. In addition, Monero uses the mining algorithm CryptoNight, which is compatible for CPU as well as GPU mining.

A similar botnet called WannaMine even caused data breaches in several companies because of the overheating of computers as a result of mining, which ultimately led to their destruction. So far, due to the infection with WannaMine around one hundred computers worldwide have failed, and the trend continues to increase. WannaMine and Smominru were unable to be detected by antivirus software at the time of infection. In the case of WannaMine, the visit to a previously prepared website or the opening of a contaminated e-mail was sufficient to take over the PCs.

When dealing with cryptocurrencies, data protection plays an important role. Not only must investors be extremely cautious when managing their coins, they also need to rely on other service providers in this regard. In a recent case from America, a crypto investor is suing T-Mobile for providing access to its cryptocurrency for hackers.

T-Mobile accused

T-Mobile US, Inc., the third largest mobile service provider in the United States, now has to face trial. According to the indictment, the company should have allowed hackers to access the cryptocurrencies of one of their customers. Carlos Tapang of Washington complains because T-Mobile on November 7, 2017 has "allowed the malicious people to gain access" to their mobile account.

According to the suit, it was due to the lax review of this incident. The wrongdoers could transfer the phone number of the plaintiff, without his consent, to a prepaid phone. As a result, they were able to change the password of one of his Bitcoin accounts and thus take all the cryptocurrencies of the account. "T-Mobile was unable to close this vulnerability until the next day," said Tapang. At that time, the hackers had already exchanged 1,000 Omisego (OMG) and 19.6 Bitconnect coins at 2.875 BTC. The captured Bitcoin had a value of $ 20,466.55 at this time and were removed from the account.

Blame T-Mobiles?

Furthermore, the company is responsible for the loss of the coins, as a PIN code should be introduced as a security measure by 7 November. However, this did not happen on time. Also, T-Mobile should have allowed the scammers to access the customer's account without the necessary identity verification. For this purpose, the thieves called the telephone customer service until an employee granted them access to the data.

In addition to losing his Bitconnect coins and OMG tokens, Tapang also suffered "emotional distress" as he could not use his phone and had to spend time and money solving the problem. Therefore, he hopes not only a compensation payment, but also a claim for injunctive relief, which would force T-Mobile to introduce further security measures to avoid such problems in the future.

If these allegations are true, should T-Mobile be completely liable for the customer’s losses? In my opinion YES.

In case you missed my last 5 crypto news posts here are the links:

Your Crypto News on Steemit February 8, 2018

Your Crypto News on Steemit February 7, 2018

Your Crypto News on STEEMIT and DSOUND February 6, 2018

Your Crypto News on Steemit February 2, 2018

Your Crypto News on Steemit February 1, 2018

Image Sources:

- Post header created by myself

- Article images created by myself

I wish you all a great Friday!!!

ⓁⓄⓥⒺ & ⓁⒾⒼⒽⓉ

Best regards

@danyelk

Posted on Utopian.io - Rewarding Open Source Contributors