March was a difficult month for cryptocurrencies. The price of Bitcoin fell 35% over the month while many altcoins faced even greater reductions. Steem ended the month around the $1.50 level, close to its low point for the recent bear market and a fall of 55% from the month opening price.

The cryptocurrency markets may well now be rebounding but how did the poor price performance in March affect the Steem blockchain user metrics? And which of our Steem platforms fared best in these challenging conditions?

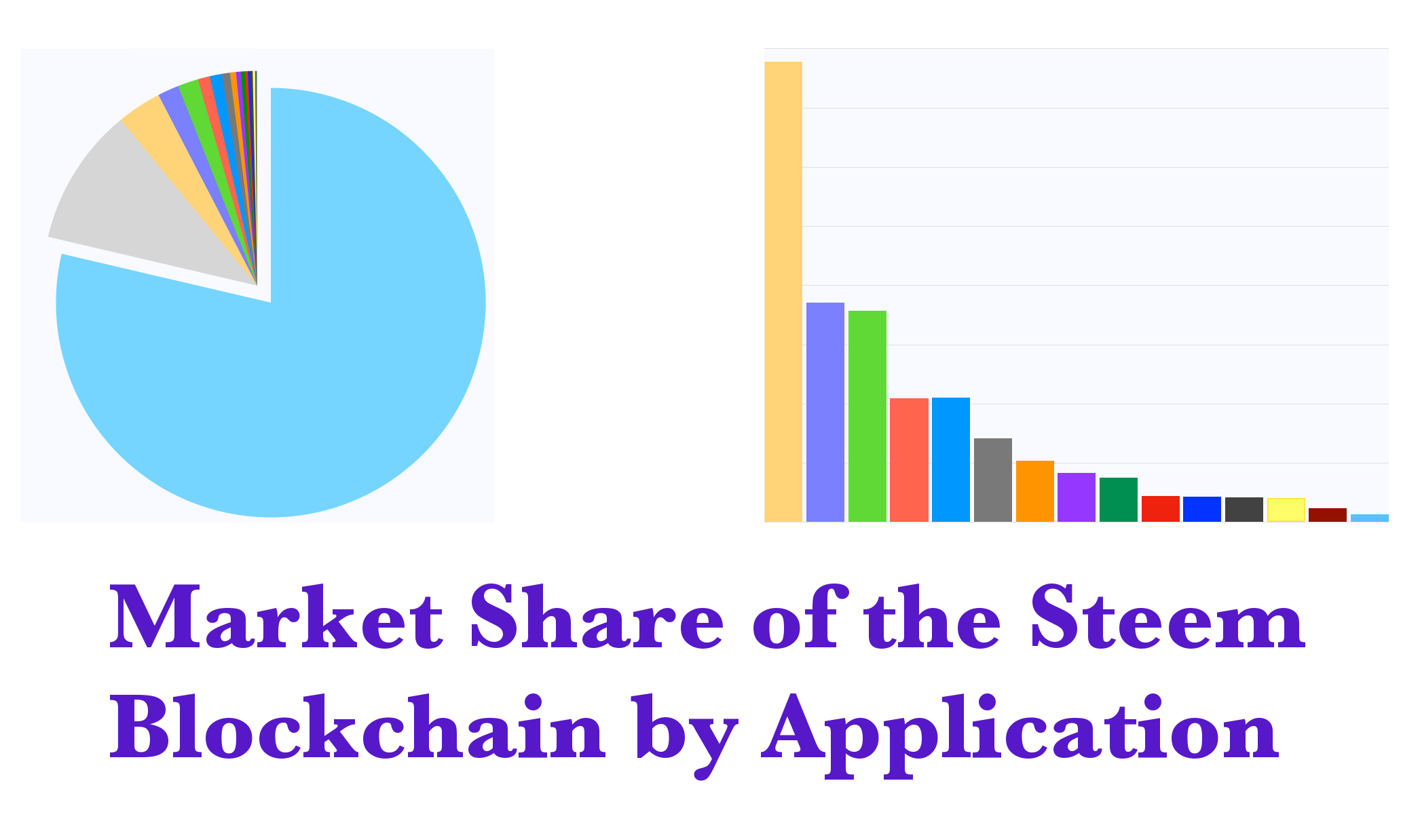

There are now many different applications and platforms that can be used to post on the Steem blockchain. These platforms are a key part of the value proposition of the blockchain and of the underlying Steem currency. The aim of this monthly analysis is to provide an understanding of the growth and market share of these platforms, giving users some easily digestible figures to assess their continuing development.

This analysis covers:

- Background: An overall view of the Steem blockchain user metrics for March 2018 to provide a backdrop for the analyses that follow.

- Breakdown by Market Share: The breakdown and ranking of the key Steem blockchain user metrics by platform for the month of March 2018. Analyses are made for: Regular Posters, Post Numbers and Post Payouts. Comparisons are made to February 2018 showing the changes in ranking and the growth from February to March.

- Conclusions and Trends: A brief consideration of trends and drivers for the next few months.

0 Summary of Findings and Conclusions

I start by presenting the summary of findings for readers who have limited available time. The full details of the analysis are included in the later sections of this article.

Please note that throughout this analysis:

- The figures include only main posts; they do not include comments.

- All payouts considered throughout this article are expressed in the currency as seen on the Steemit interface, i.e. SBD treated as $1.

0.1 Background: An overall view of the Steem blockchain user metrics for March 2018

This first analysis provides an overview of the Steem blockchain user metrics for March 2018 to provide a backdrop for the analyses that follow.

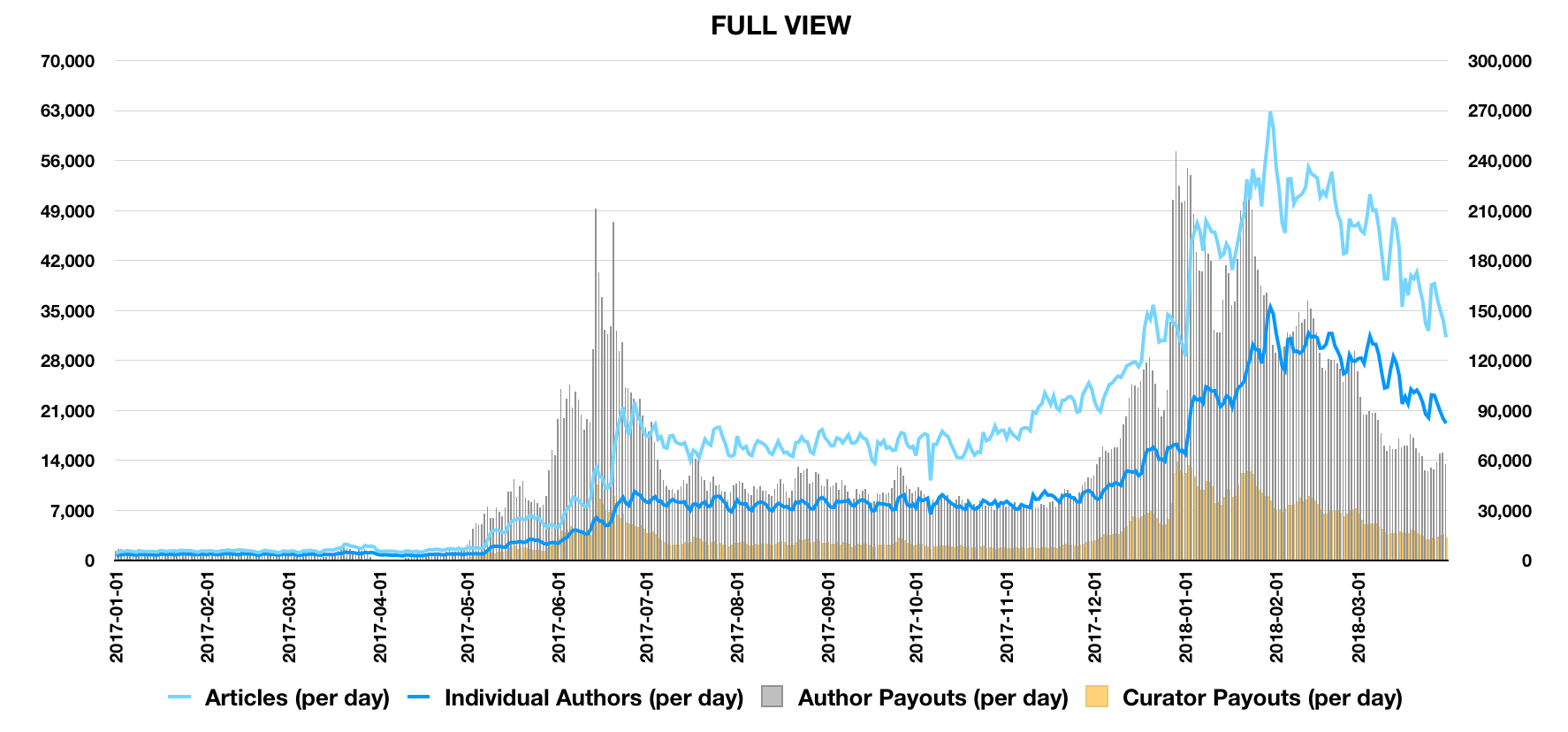

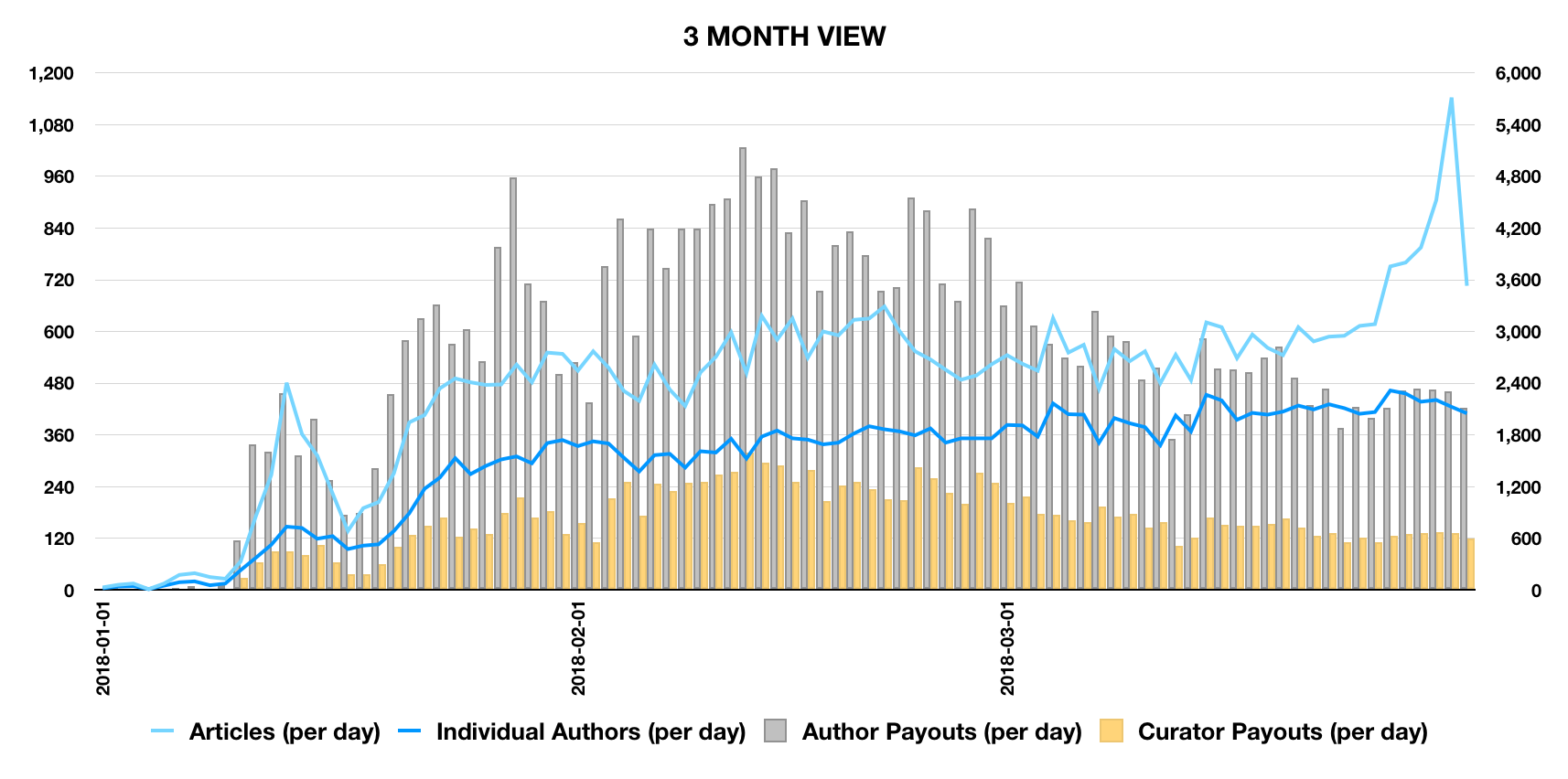

In the graphs below:

- The light blue line is the number of articles per day and the dark blue line is number of distinct authors. These are plotted against the left hand axis.

- The silver columns are author rewards and the gold columns are curator rewards. These are plotted against the right hand axis.

Full View across 2017 and 2018:

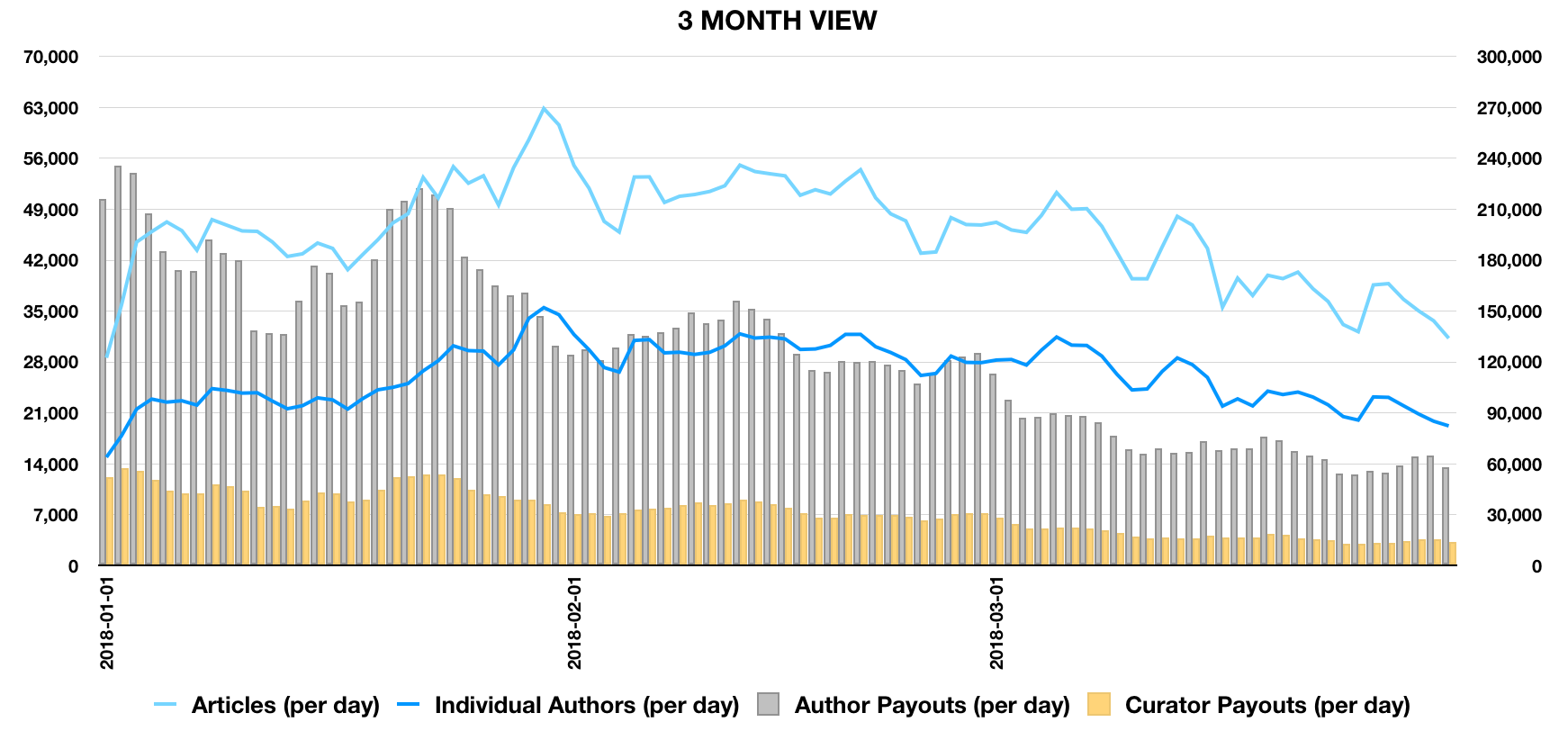

Focus on last three months:

The full view shows how total author and curator payouts have fallen since the turn of 2018, driven down by the fall in the Steem price. The number of individual authors and articles per day have also trended down over the last two months, following the lower reward levels. The relationship between rewards and user activity is clear to see.

Looking at the change in overall Steem blockchain user metrics across March we can see:

- Overall author numbers per day at the end of March were around 25% lower than at the end of February (both sets of figures based on averages over the last week of the month) - a reduction from around the 28,000 level to the 21,000 level.

- Article numbers per day also decreased over the same period - again approximately a 25% reduction - from the 46,000 level to around 35,000.

- Post payouts per day were around 50% lower over the same period (in line with the 55% fall in the Steem price) - a much heavier fall than for the above activity metrics.

However there is positive news to be read into these figures:

- The rise of the Steem price over the year-end increased activity substantially and much of this increase has been retained despite the subsequent fall in the cryptocurrency markets. 21,000 daily authors and 35,000 daily articles is 2.5x - 3x the level of activity seen prior to the December markets surge.

- The Steem price has risen substantially from the end of March to today (13 April) - up from $1.50 towards $3 at the time of writing. If the relationship between prices and activity holds we should be in for another surge in interest and metrics across April.

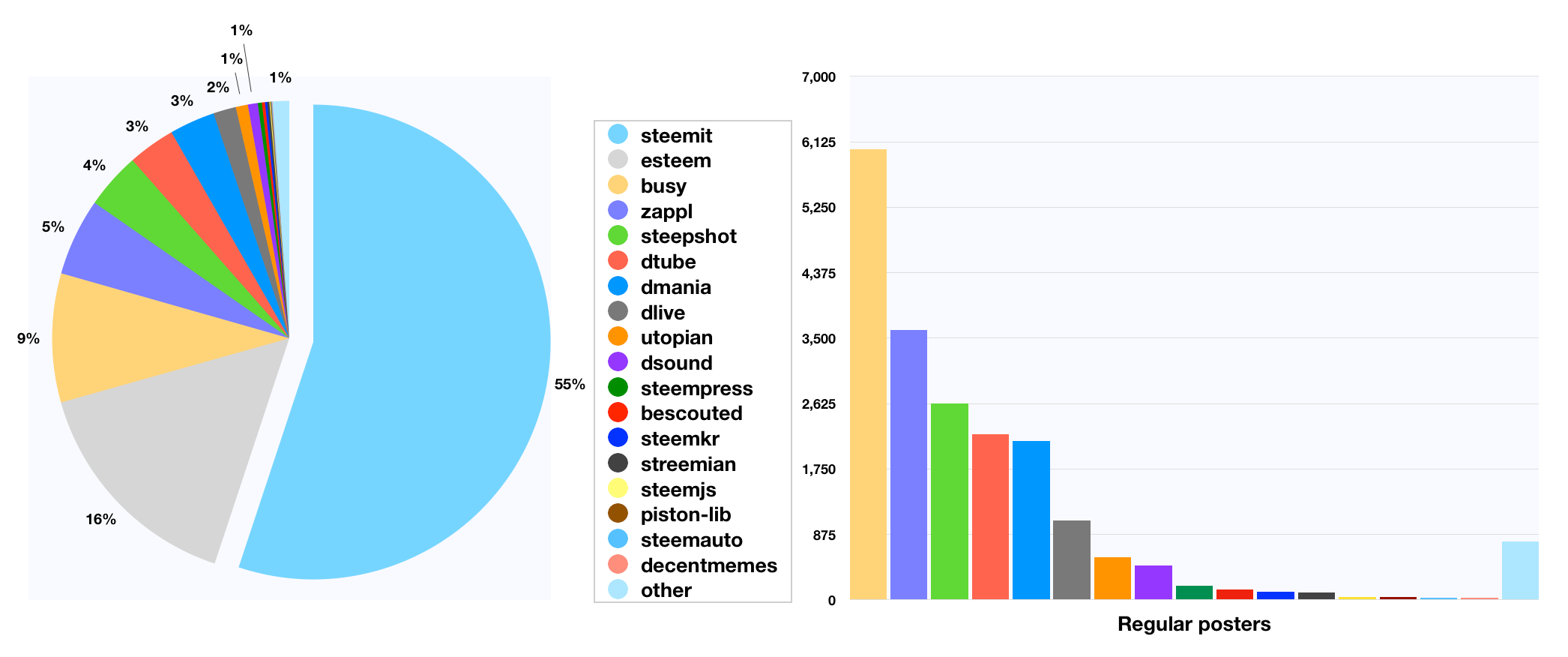

0.2 Breakdown by Market Share: Regular Posters

For the breakdown by market share I start by looking at regular poster numbers. I have defined regular posters as users that have posted four or more articles over the month.

The following table shows the number of regular posters for each application over March. The "Change" column is a comparison to the month of February. The rankings are shown for March, with the February ranking in parentheses.

| Application | Regular posters | Change | Ranking |

|---|---|---|---|

| steemit | 37,812 | -12% | 1 (1) |

| esteem | 10,664 | -8% | 2 (2) |

| busy | 6,025 | +8% | 3 (3) |

| zappl | 3,606 | +24% | 4 (5) |

| steepshot | 2,630 | -4% | 5 (6) |

| dtube | 2,211 | -5% | 6 (7) |

| dmania | 2,125 | -30% | 7 (4) |

| dlive | 1,065 | +29% | 8 (8) |

| utopian | 567 | -31% | 10 (9) |

| dsound | 462 | -37% | 11 (10) |

| steempress | 193 | +53% | 12 (16) |

| bescouted | 142 | -7% | 13 (14) |

| steemkr | 110 | -35% | 14 (12) |

| streemian | 97 | +24% | 15 (17) |

| steemjs | 43 | +30% | 16 (18) |

| piston-lib | 43 | +153% | 16 (19) |

| steemauto | 33 | -76% | 18 (15) |

| decentmemes | 24 | -85% | 19 (13) |

| other | 777 | +50% | 9 (11) |

| Total Result | 68,629 | -9% |

Overall, regular user numbers were down 9% when comparing the two months in full, with steemit.com as the biggest platform down 12% (note that this comparison is over the whole month rather than the last week of each month as was applied for the background section above).

This overall comparison hides some interesting detail for the relative performance of each platform:

- There was no change in the top three positions but busy.org was the only one of the top three to enjoy growth in regular user numbers, up 8%.

- DLive fared best out of the larger platforms, with a bear-market busting 28% increase in regular posters.

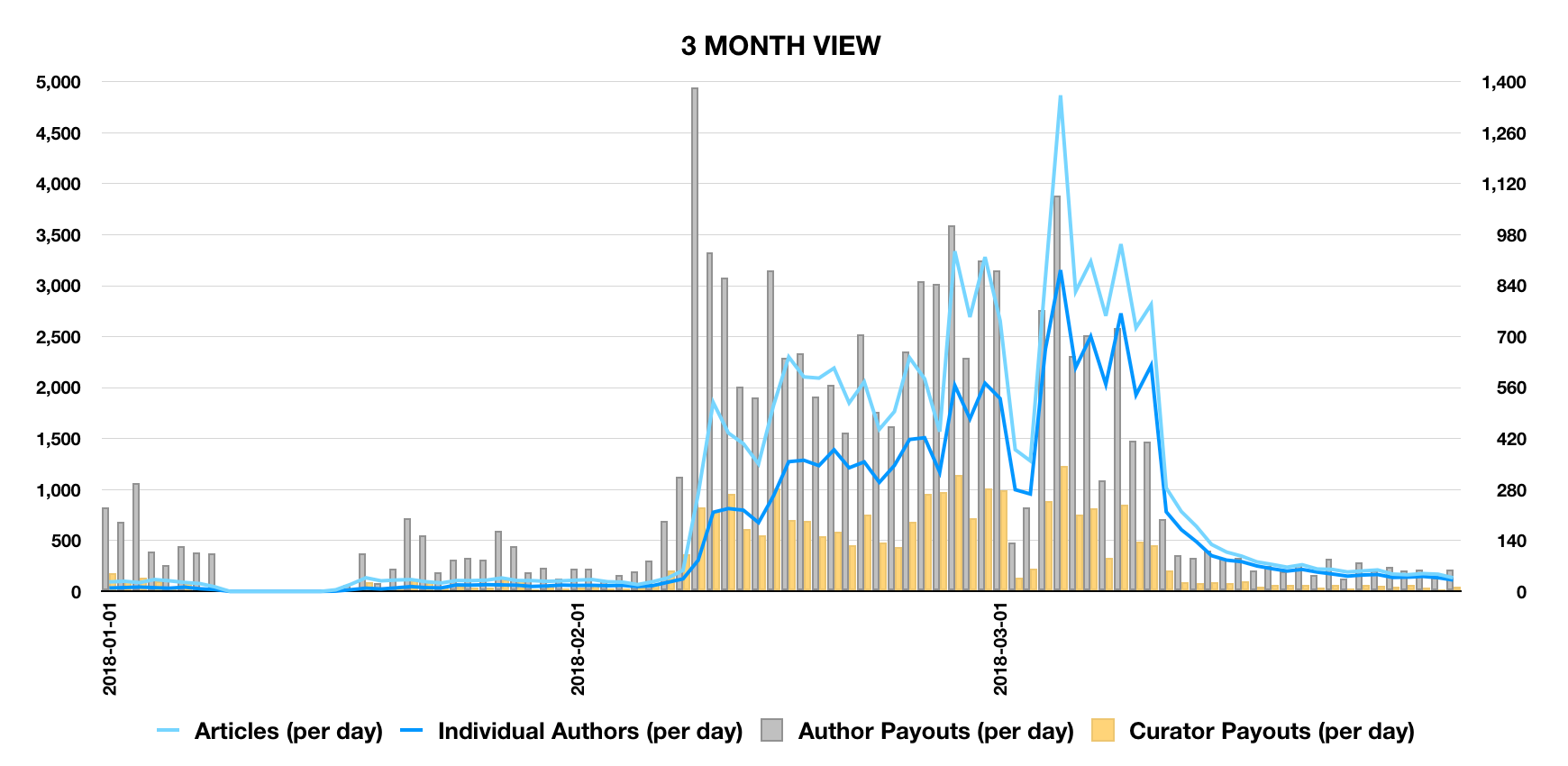

- Zappl also appears to have fared well according to the above table. However whilst Zappl gained in regular users due to activity in the first half of the month there has subsequently been a substantial fall in use. This is illustrated in the chart below:

The fall in activity appears to follow the withdrawal of the delegation from the central steemit team on March 11. Whilst this reduction appears severe, the previous spike of interest shows that there is clearly potential for a short-form platform on the Steem blockchain.

In terms of market share, Steemit now contributes 55% of regular user numbers whilst all other applications combined have now risen to 45% - a small increase from 43% in February and a continuance of the trend up from 25% in December. We will have to wait at least another month for that 50-50 split.

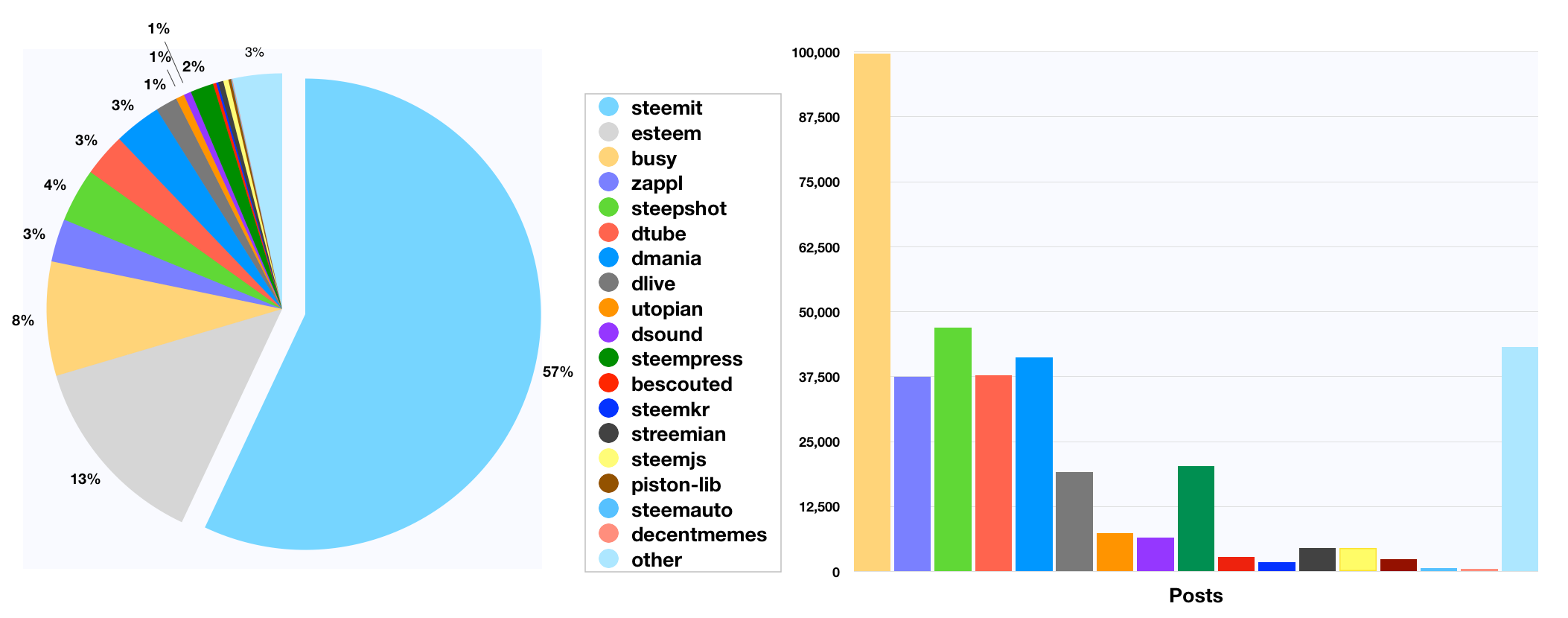

0.3 Breakdown by Market Share: Post Numbers:

The next analysis looks at post numbers (it should be noted that the number of posts does not include comments).

The following table shows the number of posts for each application over March. Again, the "Change" column is a comparison to the month of February.

The order in the table has been maintained from the "Regular Users" table to illustrate how different applications may have different market share rankings depending on which metric is applied (and it should also be noted that the usefulness of the various metrics differs between one application and another).

| Application | Posts | Change | Ranking |

|---|---|---|---|

| steemit | 725,792 | -12% | 1 (1) |

| esteem | 170,811 | -18% | 2 (2) |

| busy | 99,620 | +7% | 3 (3) |

| zappl | 37,506 | -9% | 8 (6) |

| steepshot | 46,888 | -1% | 4 (5) |

| dtube | 37,705 | -0% | 7 (7) |

| dmania | 41,187 | -25% | 6 (4) |

| dlive | 19,078 | +25% | 10 (9) |

| utopian | 7,408 | -39% | 11 (10) |

| dsound | 6,524 | -32% | 12 (11) |

| steempress | 20,296 | +117% | 9 (12) |

| bescouted | 2,810 | -26% | 15 (17) |

| steemkr | 1,786 | -30% | 17 (19) |

| streemian | 4,520 | +7% | 14 (15) |

| steemjs | 4,559 | +0% | 13 (13) |

| piston-lib | 2,350 | -19% | 16 (18) |

| steemauto | 635 | -86% | 18 (14) |

| decentmemes | 531 | -87% | 19 (16) |

| other | 43,233 | +27% | 5 (8) |

| Total Result | 1,273,239 | -10% |

The picture for post numbers is similar to that seen for regular user numbers.

- The order of the top is unchanged: Steemit post numbers fell by 12% from February and eSteem also slipped slightly in the difficult March conditions but busy.org posted growth, up 7%.

- There was positive news from SteemPress which showed some very strong growth in post numbers, racing up to 9th position on the chart. SteemPress is the WordPress plug-in which allows automated posting from any WordPress blog to the Steem blockchain. Another great way to post on the Steem blockchain! You can read more about it here:

@steempress-io - DLive also showed strong growth in the challenging conditions with a 25% rise in post numbers.

There was a particular jump in posting at the end of the month, appearing to coincide with DLive's Sports Campaign promotion.

The market share figure for Steemit is similar to that derived by regular posters at 57%.

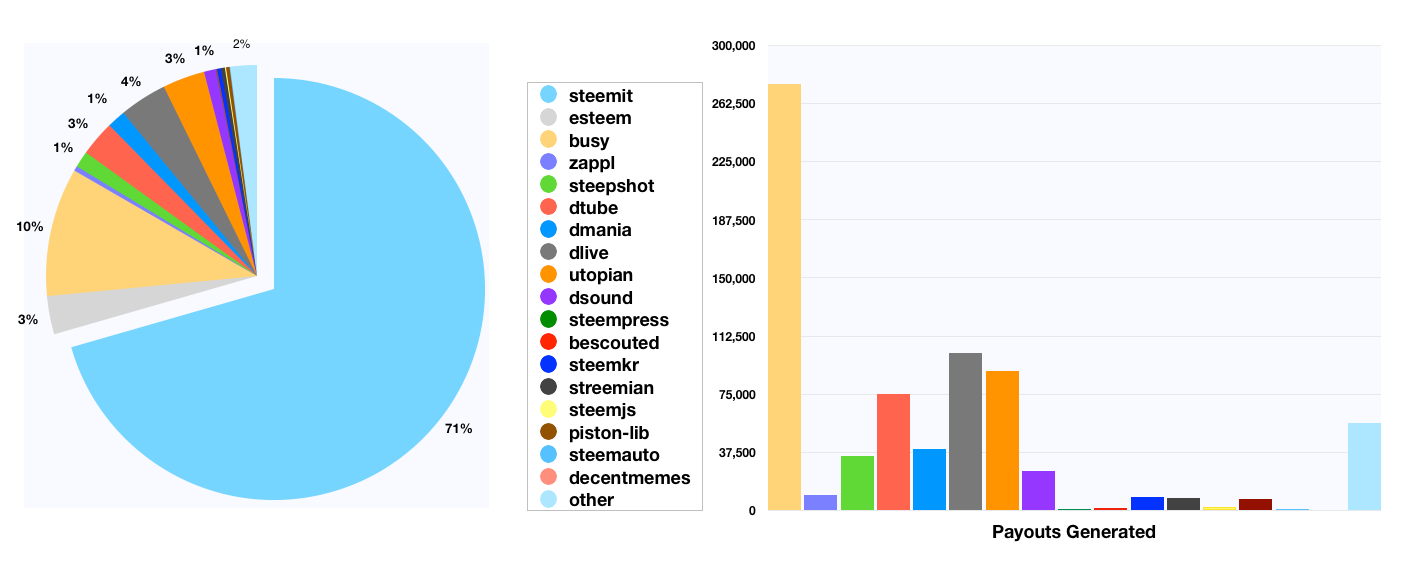

0.4 Breakdown by Market Share: Post Payouts:

Finally, a consideration of post payout numbers.

The following table shows the amount of post payout for each application over March. Again, the "Change" column is a comparison to the month of February.

(Figures have been extracted at 13 April so all post payouts should be final).

| Application | Payouts Generated | Change | Ranking |

|---|---|---|---|

| steemit | 1,966,867 | -39% | 1 (1) |

| esteem | 81,567 | -38% | 5 (5) |

| busy | 274,894 | -22% | 2 (2) |

| zappl | 10,244 | -48% | 11 (11) |

| steepshot | 34,944 | -42% | 9 (9) |

| dtube | 75,481 | -40% | 6 (6) |

| dmania | 39,419 | -52% | 8 (8) |

| dlive | 101,675 | -30% | 3 (4) |

| utopian | 90,188 | -45% | 4 (3) |

| dsound | 25,261 | -46% | 10 (10) |

| steempress | 968 | +17% | 18 (19) |

| bescouted | 1,494 | -47% | 16 (18) |

| steemkr | 8,752 | -50% | 12 (12) |

| streemian | 8,238 | +14% | 13 (15) |

| steemjs | 2,491 | -65% | 15 (16) |

| piston-lib | 7,424 | -10% | 14 (14) |

| steemauto | 1,234 | -88% | 17 (13) |

| decentmemes | 167 | -95% | 19 (17) |

| other | 56,734 | -33% | 7 (7) |

| Total Result | 2,788,041 | -38% |

As would be expected, overall post payouts decreased substantially, down 38% from February, compounding the 35% fall from January to February. These reductions are largely driven by the fall in the Steem price (which mirrored the contraction in the crypto market as a whole).

- All the top 10 platforms showed reductions in payouts across the month.

- Steemit, and busy.org retained their first and second positions, whilst DLive jumped up into third place.

- Utopian fell outside of the top 3 for the first time since I started looking at these figures in November 2017. The reduction in Utopian payouts (45%) exceeds the average fall (38%). This may in part be due to the revision of the Utopian bot upvoting process which is somewhat less efficient than the older approach. However looking forward, the reduction in Utopian beneficiary payments from 25% to 15% and the drive for greater community involvement should see Utopian rise again in April, potentially snatching back the third position.

The market share figure for steemit.com is much higher on a post payout basis than for the other metrics.

0.5 Conclusions and Trends:

- March was a difficult month for cryptocurrencies in general and it was not surprising to see falls in user metrics overall and for most platforms individually.

- However there were some bright spots, in particular the performance of DLive and the emergence of SteemPress as a potential source of new growth for the Steem blockchain.

- Looking forward to the next few months it is likely that user activity and the growth of the overall Steem blockchain community will follow the lead of Steem prices and cryptocurrency markets.

- However a significant boost could also arise from blockchain developments, such as the arrival of SMTs, sparking interest in Steem both from within crypto circles and potentially from wider communities of social network users.

Outline

- 0 Summary of Findings and Conclusions (see above)

- 0.1 Background: An overall view of the Steem blockchain user metrics for February 2018

- 0.2 Breakdown by Market Share: Regular Posters

- 0.3 Breakdown by Market Share: Post Numbers

- 0.4 Breakdown by Market Share: Post Payouts

- 0.5 Conclusions and Trends

- 1 Scope of Analysis

- 2 Tools Used

- 3 Scripts

1 Scope of Analysis

The analysis is based on the data for all user accounts over February and March 2018.

The data has been obtained through SQL queries of SteemSQL, a publicly available Microsoft SQL database built and maintained by @arcange and containing all the Steem blockchain data.

The data has been separated by application by use of the app label information in the json_metadata column of the Comments table. One limitation of this approach is that modifying an article in another application causes the app label information in the json_metadata column to change to that of the modifying platform. However it is expected that this limitation has minimal effect.

The data has been filtered by date using the .created timestamps in the comments table

2 Tools Used

Valentina Studio, a free data management tool, was used to run the SQL queries. The raw data was then verified and analysed and the graphs and charts were produced using Numbers, the Mac spreadsheet tool.

SQL scripts are included at the end of this analysis.

Summary of Findings

Analysis findings have been included in the Summary of Findings at the start of the report.

3 Scripts

I used the following script to obtain the data:

SELECT

Comments.author AS [Author],

IIF(isjson(json_metadata) = 1, IIF(CHARINDEX('/', json_value(json_metadata, '$.app')) > 0, SUBSTRING(json_value(json_metadata, '$.app'), 1, CHARINDEX('/', json_value(json_metadata, '$.app'))-1),json_value(json_metadata, '$.app')), null) as [SummarisedApp],

Count(Comments.author) AS [Posts],

Count(distinct Comments.author) AS [DistinctCommentAuthor],

count(Comments.parent_author) AS [ParentAuthor],

count(distinct Comments.parent_author) AS [DistinctParentAuthor],

sum(CONVERT(REAL,Comments.pending_payout_value)) AS [PendingPayoutValue],

sum(CONVERT(REAL,Comments.curator_payout_value)) AS [CuratorPayoutValue],

sum(CONVERT(REAL,Comments.total_payout_value)) AS [TotalPayoutValue]

FROM

Comments (NOLOCK)

WHERE

YEAR(Comments.created) = 2018 AND

MONTH(Comments.created) = 3 and

depth = 0

GROUP BY

Comments.author,

IIF(isjson(json_metadata) = 1, IIF(CHARINDEX('/', json_value(json_metadata, '$.app')) > 0, SUBSTRING(json_value(json_metadata, '$.app'), 1, CHARINDEX('/', json_value(json_metadata, '$.app'))-1),json_value(json_metadata, '$.app')), null)

A very similar script was used for the extraction of data by day. Briefly the small differences were:

- Replacement of author by comment creation date in both SELECT and GROUP BY clauses.

- Change of dates in WHERE clause to allow full calendar of data to be obtained

That's all for today. Thanks for reading!

Posted on Utopian.io - Rewarding Open Source Contributors