Time: 8.18 A.M. / GM+2 / 24 Apr 2018 – Tues.

Bitcoin has again entered a period of consolidation and trading with weak bullish bias to surpass 9K supported by stochastic positivity and EMA50. The tight consolidation will try to push the price twoards the area 9.45K - 9.73K. Note, the price can easily fall from this area.

Malta might be the European Union’s smallest member but they’ve got some big plans for the future. They’re currently creating rules and regulations that will provide clarity for some of the largest names in cryptocurrency. This approach should allow the island to emerge as a central hub for digital currency activity.

Goldman Sachs has made its first hire in its cryptocurrency markets unit, signalling its seriousness in helping clients to invest in digital currencies.

Not everyone is convinced that Bitcoin will dethrone gold, of course. But investors are increasingly choosing Bitcoin Over Gold. Do you think the dominant digital currency will ever be as stable a store of value as the world’s current gold-standard?

In our previous post / 571 / we had forecast the trading range will be between 7.84K and 9.12K. The intraday high was 9.25K and the low was 8.81K.

The price failed to pull back, as 5H expanded into a new bullish candle series, forming a Channel Up ( RSI = 66.656, BBP = 177.8282, MACD = 179.400 ).

1D displays a strong resistance zone between 9.45K - 9.73K.

On 4H we are mostly interested with reverse H&S pattern. As price is coming to neckline, retracement is possible to keep harmony of this pattern.

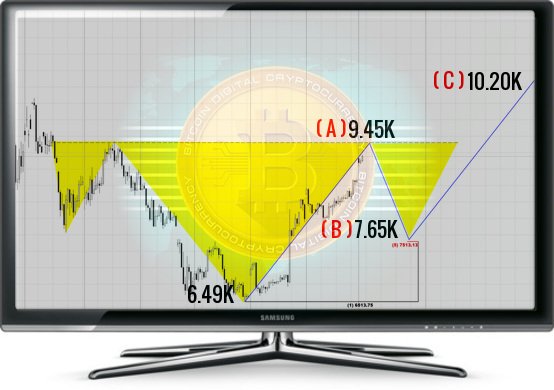

Based on the above, the trend for today is slighty bullish and we expect the below A-B-C move during the upcoming weeks:

( A ) We expect upside action within 1-2 sessions to neckline between 9.45K - 9.73K ( April High ).

( B ) Rejection from current resistance 9.45K - 9.73K and retracement is expected towards 7.30K - 7.64K ( May Low ) to form right arm of our reverse H&S pattern.

( C ) Rise towards the potential target of this reverse H&S stands around 10.17K - 10.40K is expected, followed by 11.78K ( 1W 38.20% Fibonacci ) to focus on the 12.40K ( Early June ).

Support 1: 8643.000 level.

Resistance1 : 9450.000 level.

Support 2: 7610.000 level.

Resistance2 : 9737.000 level.

Expected trading for today:

is between 8643.00 and 9737.00.

Expected trend for today :

Slighty Bullish.

Medium Term:

Bullish.

Long Term:

Bullish.

The low of 2018:

5947.00.

The high of 2018 (BitcoinTrader's Year):

13660.00 level / Expected.

The high of 2019 (Bitcoin Holder's Year):

25000.00 level / Expected.

/ Project by @knircky & @famunger /

You must write a comment to the this post.

investing considerable time and effort up front in

hopes of considerable returns down the road.

I'm so proud of my little blog, and so grateful to all of you

for support to keep it going.