Time: 8.37 A.M. / GM+2 / 25 Apr 2018 – Wed.

We have been trading the financial markets ( e-gold ) since Jan 2000, since Feb 2009 we mostly focused on forex and commodities, since June 2016 we started monitoring Bitcoin's behavior, speculating its huge potential and profit margins, based on historical data of Bitcoin and a mix of technical indicators and we are happy to share our daily view as always with you.

Do your own due diligence. No one knows tomorrow's price or circumstance. We intend to portray our thoughts and ideas on the subject which mays be used as a tool for the reader and we do not accept responsibility for being incorrect in our speculations on market trend.

The current bullish wave may show that the industry has already gone through major concerns over regulation around the globe. So, the market start to look healthier and more stable going forward. The local factor which could bring the bitcoin price a relief as tax-related selling ahead of the U.S. tax deadline last week is over.

The bitcoin market is currently engulfed by a feeling of optimism, because the worst has passed and the decrease in trading volumes has cooled the regulators’ interest in the market, and the difficulty in mining is growing, so any positive news is likely to provoke price hikes.

Bitcoin price show nice ride higher toward 9.76K but many participants as expected start to take their profits, the reason why I believe a retracement will be in card soon before the continuation of the current rally.

In our previous post / 572 / we had forecast the trading range will be between 8.643K and 9.737K. The intraday high was 9.760K and the low was 9.178K.

In our previous post / 572 / we wrote :

On 4H we are mostly interested with reverse H&S pattern. As price is coming to neckline, retracement is possible to keep harmony of this pattern.

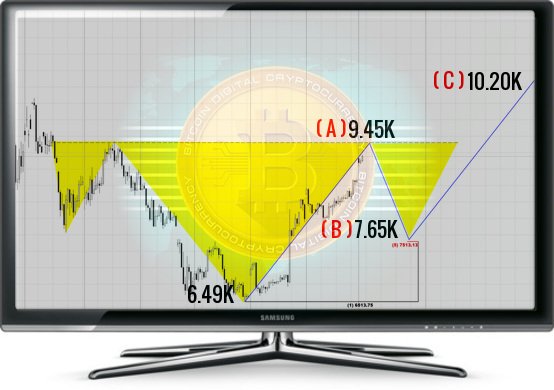

We expect the below A-B-C move during the upcoming weeks: ( A ) We expect upside action within 1-2 sessions to neckline between 9.45K - 9.73K ( April High ). ( B ) Rejection from current resistance 9.45K - 9.73K and retracement is expected towards 7.30K - 7.64K ( May Low ) to form right arm of our reverse H&S pattern. ( C ) Rise towards the potential target of this reverse H&S stands around 10.17K - 10.40K is expected, followed by 11.78K ( 1W 38.20% Fibonacci ) to focus on the 12.40K ( Early June ).

We still believe that, the price tested the high of April and a retracement form 9.76K is expected towards 7.30K - 7.64K ( May Low ).

Note; Clear breaking of 9.911K will cancel our scenario regarding the reverse H&S.

Based on the above, the trend for today is slighty bullish and we still expect as our last post:

Rejection from 9.76K ( April High ) and retracement towards 7.30K - 7.64K ( May Low ) to form right arm of our reverse H&S pattern, followed by a rise towards the potential target of this reverse H&S that stands around 10.17K - 10.40K, followed by 11.78K ( 1W 38.20% Fibonacci ) to focus on the 12.40K ( Early June ).

Support 1: 8643.000 level.

Resistance1 : 9450.000 level.

Support 2: 7610.000 level.

Resistance2 : 9767.000 level.

Expected trading for today:

is between 8643.00 and 9767.00.

Expected trend for today :

Slighty Bullish.

Medium Term:

Bullish.

Long Term:

Bullish.

The low of 2018:

5947.00.

The high of 2018 (BitcoinTrader's Year):

13660.00 level / Expected.

The high of 2019 (Bitcoin Holder's Year):

25000.00 level / Expected.

/ Project by @knircky & @famunger /

You must write a comment to the this post.

investing considerable time and effort up front in

hopes of considerable returns down the road.

I'm so proud of my little blog, and so grateful to all of you

for support to keep it going.