Now that there are two legitimate Bitcoins in the Top Five on coinmarketcap.com, one has to ask... how many legitimate bitcoins can there be? What makes a Bitcoin legitimate anyway? There's no company with a registered brand name. Who gets to use the brand without a qualifier? Can that ever change?

Well, here are some reasons why a form of Bitcoin might be considered "legitimate"

- It uses mostly Satoshi's original code

- It is supported by a group of developers with some lineage back to Satoshi

- It is supported by the companies that have the best mining equipment

- It is supported by the exchanges - they are willing to list it.

- It is supported by merchants and businesses - lots of people accept it.

- It has the largest network effect or market cap

- It's tokens are held by people who can trace them back to an original owner on the original chain

for any of the candidates we are about to discuss?

I claim it's only the last one.

All others can and will change in the next 100 years,

whether incrementally or in a seismic shift.

- There won't be a stick of Satoshi's original code left in 2117.

- There won't be a bit of hardware in common.

- None of the current developers or miners will still be living.

- Exchanges will still be trading anything that's profitable.

- Merchants will be using universal coin translators and won't care what's under the hood.

- The largest network effect and market cap can shift many times in a hundred years - perhaps to something not even called Bitcoin.

But some blockchain will still hold the Bitcoin name. How will that baton pass down to them?

Well, let's make the best case we can for all seven

Slow Bitcoins - There are Three

These three bitcoins are all in the "Slow" category because they use slight variations of Proof of Work (POW) which is inherently far slower than modern solutions. Still, there are those who consider this an essential feature. Both new entries in the slow category claim to be Bitcoin (a) because they honored the existing ownership distribution at the time of the fork, (b) because they made only tiny, incremental changes to the original software, and (c) because their developers used to work on the original bitcoin in some capacity. Of course, lots of altcoin clones can make similar claims to (b) and (c), so it all comes down to (a) honoring original owners faithfully.

Bitcoin Classic (Deceased) This is the original bitcoin that died on August 1, 2017 when various interest groups created alternative software suites and started them running at the now infamous Block 478558. Nobody wanted to keep mining Satoshi's original, so it died. Let's just say it "retired".

Bitcoin Segwit "The king is dead, long live the king!" Apparently all the major exchanges decided to list this fork as the Official Successor - The One that gets to be just Bitcoin (BTC). It will run maybe twice as fast - another 3 to 7 transactions per second. It still takes ten minutes per block and perhaps hours to confirm on busy days - if you don't pay the miners a few dollars extra.

Bitcoin Cash - BTH gets relegated to the role of "cheeky upstart" -- cheeky 4th-place, 5-billion-plus upstart. How illegitimate exactly can that be? It can run twice as fast as "The King". Maybe even as fast as Ethereum on a good day. That's 25 transactions per second for the whole world to share! (A single credit card, say VISA, routinely peaks at over 4000 transactions per second, so these contenders won't be taking over any time soon.) Still, when The King hits its stops (at the current growth rate, just months from now), maybe Bitcoin Cash will take up some slack and grow to #1 in market cap. If another 2x leap forward occurs after that, which one will the exchanges crown King?

Fast Bitcoins - There are Four

Fast Bitcoins conduct their transactions in real time. This is accomplished by running on a private server (Exchange Bitcoin below) or using more advanced decentralization algorithms like Delegated Proof of Stake (DPOS). All three of those BitShares-based DPOS assets shown below have 3 second transaction time and are effortlessly running amid VISA loads already. Further they are scalable to tens or hundreds of thousands of transactions per second and will have unlimited bandwidth when they upgrade to EOS technology next year. They'll all be featured at FastBitcoinUnited.com.

Exchange Bitcoin - This is actually a category of Bitcoin you find on every exchange. These are the "casino chips" that the exchange gives you to trade with on their private server while the bitcoins you have deposited with them sit mostly off-line in a cold wallet. Think of them as "receipts" or "IOUs" for real bitcoins. When you "cash out" the exchange takes back your "chips" and sends you the equivalent in "real" Bitcoin (BTC) - whatever that is by exchange consensus. Since they are redeemable for Bitcoin, they are precisely pegged to the value of Bitcoin.

BitShares Open.BTC - On the BitShares decentralized exchange this substitution is made explicit. Exchanges that use the BitShares blockchain as a common ledger issue their trading chips as User Issued Assets (UIA) that then trade freely on the blockchain without further exchange involvement until it's time to cash out. This decentralizes everything except the counter party risk associated with the exchange you are trusting to redeem your UIAs in the end. Since they are redeemable for Bitcoin, they are tightly pegged to the value of Bitcoin. Open.BTC is a popular version issued by OpenLedger.info.

BitShares BitBTC - BitBTC is a "smartcoin" Market Pegged Asset (MPA) that eliminates the need to trust an exchange to redeem the coin. Instead they are backed by twice as many BitShares as it currently takes to buy a Bitcoin on the market - all held in counter party risk-free escrow by the BitShares blockchain itself. There are slight fluctuations in price due to supply and demand but a solid floor of 99% of the current price, guaranteed by the blockchain itself.

Fast Bitcoin (FBTC) - This is the third Bitcoin born on the Great Fork of August 1, 2017 with Bitcoin Segwit and Bitcoin Cash. It's was originally called Bitcoin United (BTCX), but after the Great Fork, alas, Bitcoin will never be united again. It represents the biggest change and greatest improvement of all three, boosting Bitcoin performance to unlimited scalability of the BitShares/EOS technologies. Like Bitcoin Cash, every one of them belongs to the original owners at Block 478558 - the only true source of legitimacy. Like its two sister coins born on that day, it is free to trade and seek its own value relative to the others. That value is chiefly the ability to scale to handle all the world's transactions. Thousands today and hundreds of thousands tomorrow as opposed to, well, 28. Currently FBTC exists virtually on the BitShares blockchain waiting for the BitShares holders to vote to fork in the code release it. That's what the "Free the Fast Bitcoins" campaign is all about.

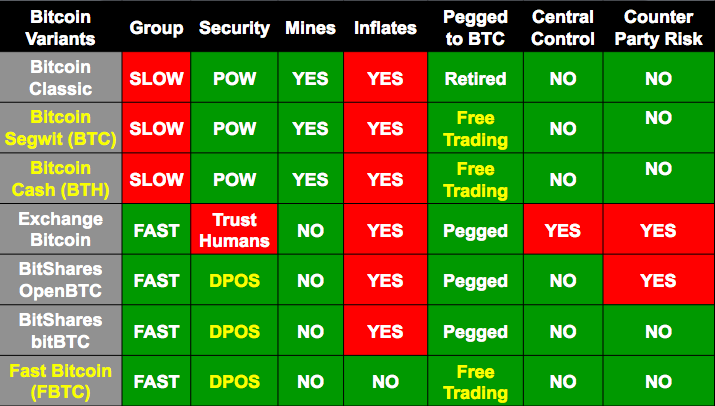

Time to rack and stack them. It's no contest really...

There you have it. Here's a chart summarizing them for your inspection. Each has it's uses, but only one is likely to be extremely undervalued if and when it is approved to start trading - Fast Bitcoin may remain a sleeper for a number of months. It's the one to watch.

The huge gulf between Slow Bitcoin (10 minute blocks, 28 transactions per second) and Fast Bitcoin (3 second blocks and tens of thousands of transactions per second) will be a great test of whether the Bitcoin mantle will ever be passed to technology worthy of Satoshi's original vision. But It's easy to say the one with the biggest market cap will aways hold the coveted heavy weight title "Bitcoin (BTC)".

Well, let's hope that is true!

You laugh? ...I smile.

Check out the BillionHeroCampaign.com website to understand why its targeted 10x industry-wide growth in new mainstream users, all first trained there about the facts shown here, who might not feel the need to use slow bitcoins much. What will 10x growth in industry users do to reshuffle the existing standings in network effect?

We will soon see!

Epilogue

A debate is raging between the names Fast Bitcoin (FBTC) or Light Speed Bitcoin (LSBTC). I've edited in the leader, FBTC, but I'll use whichever name winds up with the most support. Let me know what you think!

Epilogue 2 - Yet another Bitcoin Split

Bitcoin is Splitting once again

Stan Larimer, President

Cryptonomex

The Godfather of BitShares, Fast Bitcoin, and the HERO

Image credits: see embedded links

About the Author -- Stan Larimer

Follow Me On Steemit - The Social Media Platform That Pays

Please Connect To Me On Linkedin!

Greatest Hits

Bitcoin and the Three Laws of Robotics

Engineering Trust with Charles Hoskinson

The Origin of BitShares

The Hero from BitShares Island